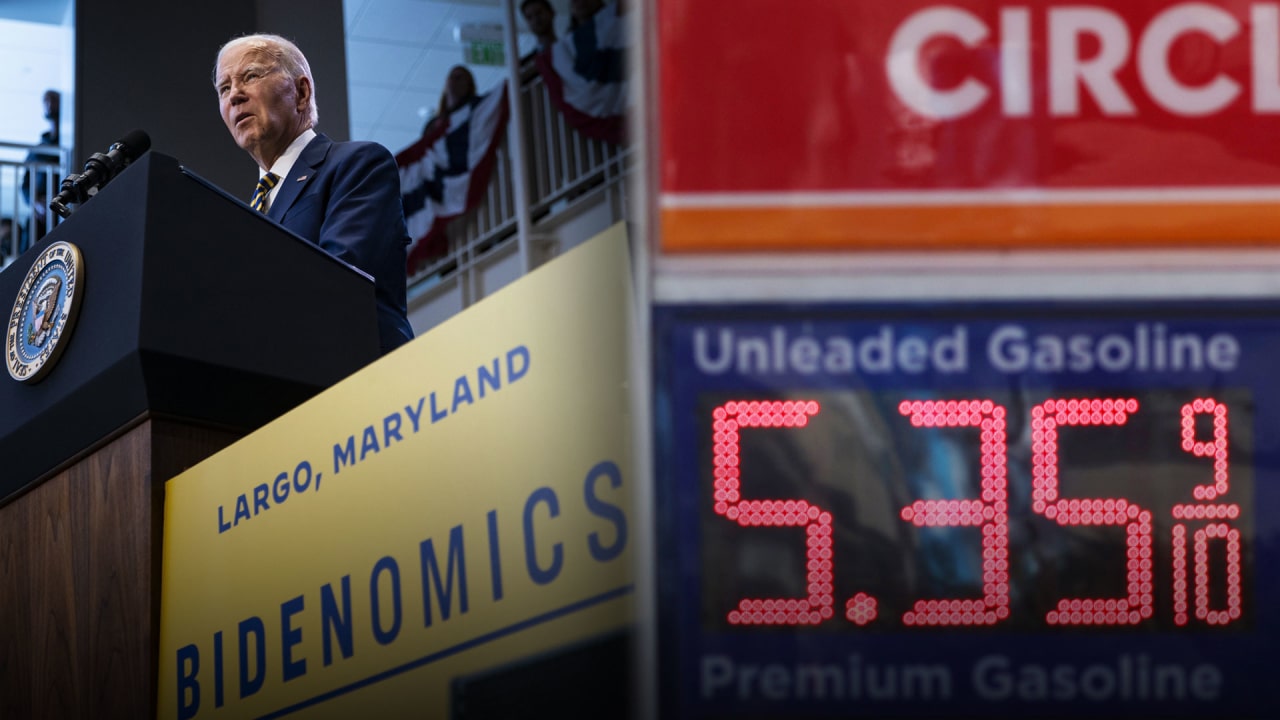

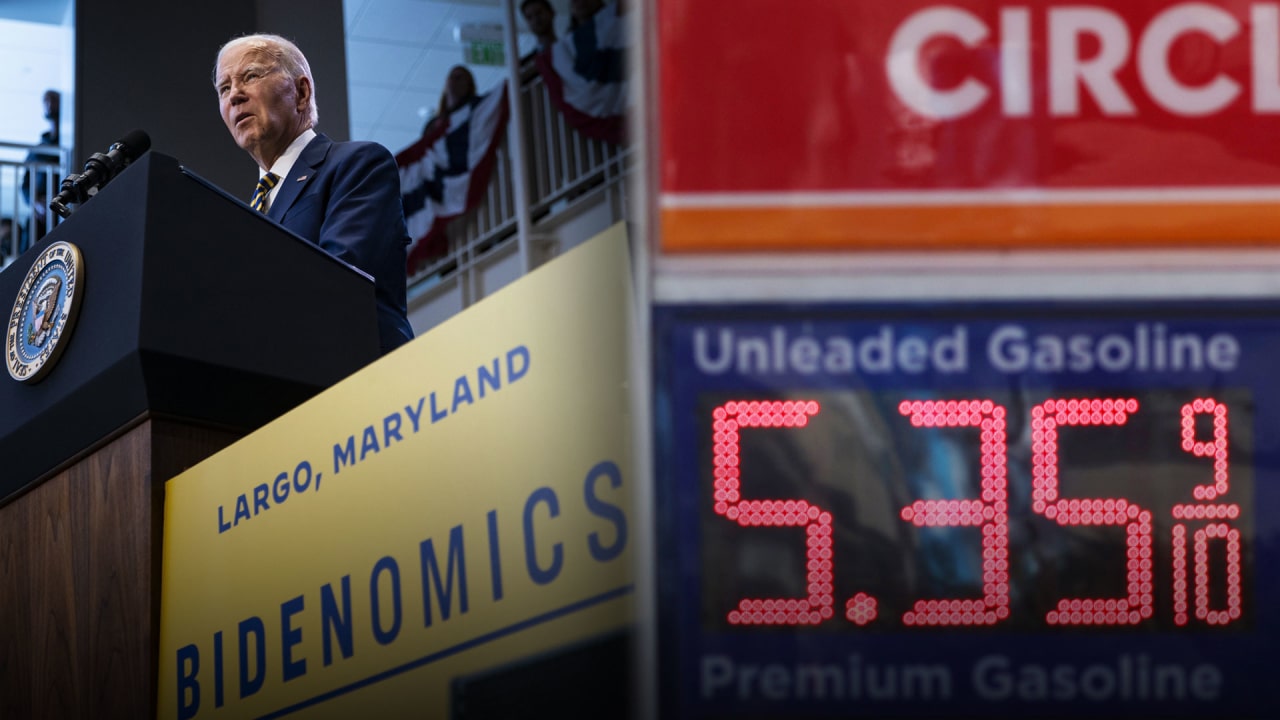

Is Joe Biden Responsible For The Slowing Economy? A Critical Analysis

Table of Contents

H2: Inflation and the Biden Administration's Response

H3: The Inflation Surge

The sharp rise in inflation during President Biden's term is undeniable. The Consumer Price Index (CPI) and Producer Price Index (PPI) surged significantly, exceeding levels not seen in decades. This inflation wasn't solely a US phenomenon; global factors played a crucial role.

-

Specific inflation rates and comparison to previous administrations: While inflation began its upward trend before Biden's inauguration, the pace accelerated significantly during his presidency. Comparing year-over-year inflation rates under Biden to those under previous administrations provides valuable context. For example, comparing the CPI increase in 2022 to the average annual CPI increase under the Trump administration reveals a significant difference, highlighting the severity of the recent surge.

-

Discussion of the Consumer Price Index (CPI) and Producer Price Index (PPI): Analyzing both the CPI (measuring consumer prices) and the PPI (measuring producer prices) gives a comprehensive view of inflationary pressures throughout the supply chain. The PPI's rise often precedes a rise in the CPI, indicating the transmission of cost increases from producers to consumers.

-

Analysis of the impact of inflation on different income groups: Inflation disproportionately affects low-income households, as a larger percentage of their income is spent on necessities like food and energy, which experienced particularly sharp price increases. This creates economic inequality and social hardship.

H3: Biden's Economic Policies and Their Impact on Inflation

The American Rescue Plan (ARP), a large stimulus package passed early in Biden's presidency, has been a central point of debate regarding its contribution to inflation. Proponents argue the ARP was necessary to mitigate the economic fallout from the COVID-19 pandemic. Critics, however, contend that its size and scope fueled inflationary pressures by injecting excessive demand into an already strained economy.

-

Breakdown of spending allocations in key bills: A detailed breakdown of the ARP's spending, showing allocations to various sectors (e.g., direct payments, state and local aid, vaccine distribution), helps analyze its potential impact on aggregate demand.

-

Economic models predicting the impact of these bills on inflation: Various macroeconomic models attempt to quantify the contribution of fiscal stimulus like the ARP to inflation. Examining the range of predictions from these models, and understanding their underlying assumptions, is crucial for a balanced perspective.

-

Expert opinions on the effectiveness of the administration's anti-inflation measures: Analyzing the opinions of economists and policymakers on the effectiveness of the Biden administration's response to inflation, including its effectiveness in addressing supply chain bottlenecks and reducing energy prices, is vital for a comprehensive understanding.

H2: The Role of Fiscal and Monetary Policy

H3: Fiscal Policy Decisions

The Biden administration's fiscal policies, encompassing tax policies, government spending, and budget deficits, significantly impact economic growth and inflation.

-

Details of tax changes and their influence on economic activity: Changes to corporate tax rates and individual income tax brackets can stimulate or dampen economic activity, affecting inflation through changes in aggregate demand.

-

Government spending programs and their effectiveness: Government spending on infrastructure, clean energy, and social programs can boost economic growth, but also potentially contribute to inflationary pressures if it outpaces the economy's productive capacity.

-

Analysis of the national debt and its implications: The increasing national debt raises concerns about future economic stability and the potential for higher interest rates, further impacting inflation and economic growth.

H3: The Federal Reserve's Actions

The Federal Reserve (the Fed) plays a crucial role in managing the US economy. Its response to inflation, primarily through interest rate hikes, has significant consequences.

-

Timeline of interest rate increases: Charting the Fed's interest rate increases throughout 2022 and 2023 provides a clear picture of the monetary policy response to inflation.

-

Impact of interest rate hikes on borrowing costs and investment: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing investment and economic growth.

-

Potential for a recession induced by monetary policy tightening: Aggressive interest rate hikes risk triggering a recession by significantly dampening economic activity. The delicate balance between curbing inflation and avoiding a recession is a major challenge for the Fed.

H2: External Factors Influencing the Economy

H3: Global Economic Conditions

Global events significantly influence the US economy. The war in Ukraine, supply chain disruptions, and the global energy crisis all played a role in the current economic slowdown.

-

Specific examples of global events and their effects: Analyzing the impact of the war in Ukraine on energy prices and supply chains, for instance, demonstrates the interconnectedness of the global economy.

-

Analysis of the interconnectedness of the global economy: The US economy is deeply intertwined with the global economy; external shocks have significant domestic repercussions.

-

Evidence of the influence of these factors independent of domestic policy: It's crucial to isolate the impact of external factors on the US economy to understand the true extent of the influence of domestic policies on the current economic slowdown.

3. Conclusion

Determining whether President Biden is solely responsible for the slowing economy is overly simplistic. While his administration's policies, particularly the large stimulus packages and fiscal spending, likely contributed to inflationary pressures, attributing the entire economic slowdown to his actions ignores significant external factors and the complex interplay of fiscal and monetary policies. The inflation surge, while partly influenced by domestic policies, was also fueled by global supply chain disruptions, the war in Ukraine, and other international events. The Federal Reserve's actions in raising interest rates, while aimed at curbing inflation, also carry the risk of inducing a recession.

This analysis provides a critical overview of the economic landscape under President Biden's administration. Further research and ongoing monitoring of economic indicators are vital to understanding the full impact of current policies and the evolving economic situation. To stay informed on this crucial topic, continue exploring the complexities of the relationship between the Biden administration and the slowing economy.

Featured Posts

-

Gaza Freedom Flotilla Attacked Off Malta Watch Now

May 03, 2025

Gaza Freedom Flotilla Attacked Off Malta Watch Now

May 03, 2025 -

New Music Loyle Carner Releases All I Need And In My Mind

May 03, 2025

New Music Loyle Carner Releases All I Need And In My Mind

May 03, 2025 -

Afghan Migrant Threatens To Kill Nigel Farage On Journey To Uk

May 03, 2025

Afghan Migrant Threatens To Kill Nigel Farage On Journey To Uk

May 03, 2025 -

Le Gabon Temoin De La Fin Annoncee De La Francafrique Par Macron

May 03, 2025

Le Gabon Temoin De La Fin Annoncee De La Francafrique Par Macron

May 03, 2025 -

Farage Faces Backlash Criticism Mounts Over Zelenskyy Remarks

May 03, 2025

Farage Faces Backlash Criticism Mounts Over Zelenskyy Remarks

May 03, 2025