Riot Platforms Stock Near 52-Week Low: What's Happening?

Table of Contents

The Impact of the Crypto Winter on Riot Platforms Stock Price

The current state of the cryptocurrency market, often referred to as "crypto winter," significantly impacts Riot Platforms' stock price. This downturn is largely driven by two primary factors: the decreased Bitcoin price and increased competition within the Bitcoin mining sector.

Decreased Bitcoin Price

The price of Bitcoin is intrinsically linked to the profitability of Bitcoin mining operations, and thus, the value of Riot Platforms stock. A declining Bitcoin price directly reduces the revenue generated from mining, impacting the company's bottom line.

- Bitcoin's hash rate and mining profitability: A higher Bitcoin hash rate (the measure of the computational power dedicated to mining) increases competition, making it harder to profitably mine Bitcoin. As the Bitcoin price drops, the profitability of mining decreases proportionally, affecting Riot Platforms’ revenue.

- Impact of energy costs: The cost of electricity is a major expense for Bitcoin mining operations. Fluctuations in energy prices directly affect the profitability of mining. Higher energy costs reduce profit margins, further impacting Riot Platforms' stock price.

- Bitcoin's recent price decline: Bitcoin’s price has experienced a substantial decline in recent months, significantly impacting the profitability of Bitcoin miners like Riot Platforms. This price drop directly translates to lower revenue and decreased stock valuation.

Increased Competition in the Bitcoin Mining Sector

The Bitcoin mining industry is becoming increasingly competitive. The entry of larger mining operations with greater economies of scale intensifies the pressure on existing players like Riot Platforms.

- Key competitors: Riot Platforms faces competition from other large-scale Bitcoin mining companies, each vying for market share. This competition leads to a reduction in profit margins for all players.

- Impact of larger mining operations: The emergence of larger, more efficient mining operations creates a more challenging environment for Riot Platforms, potentially impacting its ability to maintain its market share and profitability.

- Market saturation and its effects on profit margins: As more miners enter the market, the overall profitability of Bitcoin mining diminishes. This market saturation squeezes profit margins, putting pressure on Riot Platforms' stock price.

Operational Challenges Faced by Riot Platforms

Beyond market forces, Riot Platforms faces various operational challenges impacting its performance and contributing to its stock price decline.

Energy Costs and Supply Chain Issues

Rising energy costs and potential supply chain disruptions pose considerable risks to Riot Platforms' operational efficiency and profitability.

- Specific energy sources and price volatility: Riot Platforms relies heavily on certain energy sources, the prices of which are subject to significant volatility. Increases in these costs directly impact the operational costs of Bitcoin mining.

- Supply chain problems: Potential disruptions to the supply chain, affecting the procurement of mining equipment or essential components, can hinder Riot Platforms' expansion plans and operational capabilities.

- Effect on mining capacity: Both high energy costs and supply chain issues limit Riot Platforms’ ability to increase its mining capacity, further restricting its revenue potential.

Regulatory Uncertainty and Legal Hurdles

The regulatory landscape surrounding Bitcoin mining is constantly evolving, creating uncertainty and potential legal hurdles for companies like Riot Platforms.

- Significant regulatory developments: Changes in regulations related to cryptocurrency mining, taxation, or environmental concerns can impact Riot Platforms' operations and its overall business model.

- Potential legal risks: Legal challenges or lawsuits related to environmental concerns or other aspects of Bitcoin mining operations can negatively affect the company's stock valuation and investor confidence.

Investor Sentiment and Market Analysis

Investor sentiment and market analysis provide further insights into the current state of Riot Platforms stock.

Analyst Ratings and Stock Predictions

Recent analyst ratings and predictions for Riot Platforms stock reflect the prevailing uncertainty in the market.

- Analyst reports and target prices: Analyst reports often reflect a cautious outlook for Riot Platforms stock, with target prices potentially reflecting the current market challenges.

- Overall investor sentiment: Investor sentiment towards Riot Platforms appears to be negative, driven by the combination of market conditions, operational challenges, and the overall cryptocurrency market downturn.

Trading Volume and Volatility

Recent trading volume and volatility in Riot Platforms stock indicate significant market uncertainty.

- Data on trading volume and volatility: High trading volume coupled with significant price fluctuations reflects the uncertainty surrounding Riot Platforms’ future performance.

- Reasons for fluctuations: News events, announcements from the company, and broader market trends all contribute to the volatility observed in Riot Platforms stock.

Conclusion

The decline of Riot Platforms stock to near its 52-week low is a result of several interconnected factors. The "crypto winter," characterized by a decreased Bitcoin price and increased competition, significantly impacts profitability. Operational challenges, including rising energy costs, supply chain issues, and regulatory uncertainty, further exacerbate the situation. Negative investor sentiment and high trading volatility reflect the current market uncertainty. While Riot Platforms stock is currently near its 52-week low, understanding these underlying factors is crucial for investors. Continue researching Riot Platforms stock price, analyzing Riot Platforms investment opportunities, and staying updated on market trends to make informed investment decisions regarding Riot Platforms future.

Featured Posts

-

Fans Inappropriate Kiss On Christina Aguilera Sparks Outrage

May 02, 2025

Fans Inappropriate Kiss On Christina Aguilera Sparks Outrage

May 02, 2025 -

England Stages Late Comeback To Defeat France

May 02, 2025

England Stages Late Comeback To Defeat France

May 02, 2025 -

Fortnite Cowboy Bebop Collaboration Free Rewards Available For A Short Time

May 02, 2025

Fortnite Cowboy Bebop Collaboration Free Rewards Available For A Short Time

May 02, 2025 -

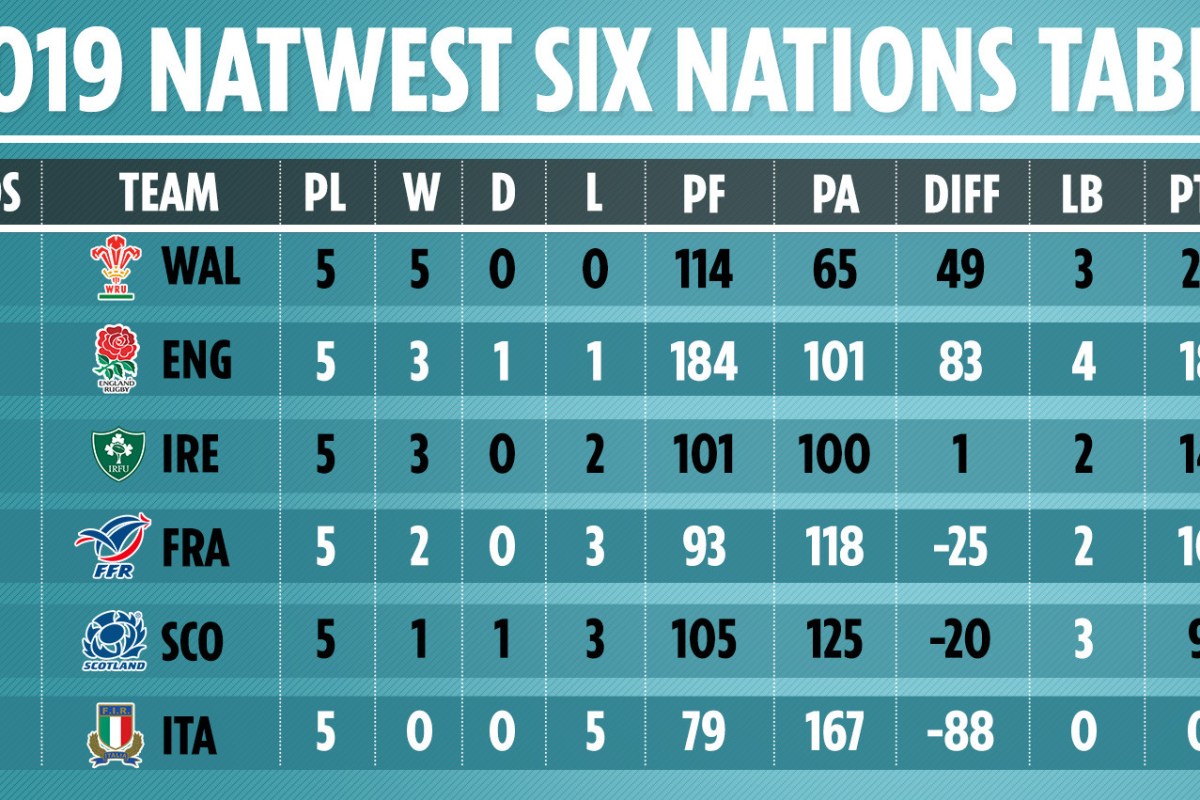

Six Nations Results French Dominance Englands Win Scotland And Irelands Poor Performances

May 02, 2025

Six Nations Results French Dominance Englands Win Scotland And Irelands Poor Performances

May 02, 2025 -

Winter Storm Warning Tulsa Road Crews On High Alert

May 02, 2025

Winter Storm Warning Tulsa Road Crews On High Alert

May 02, 2025

Latest Posts

-

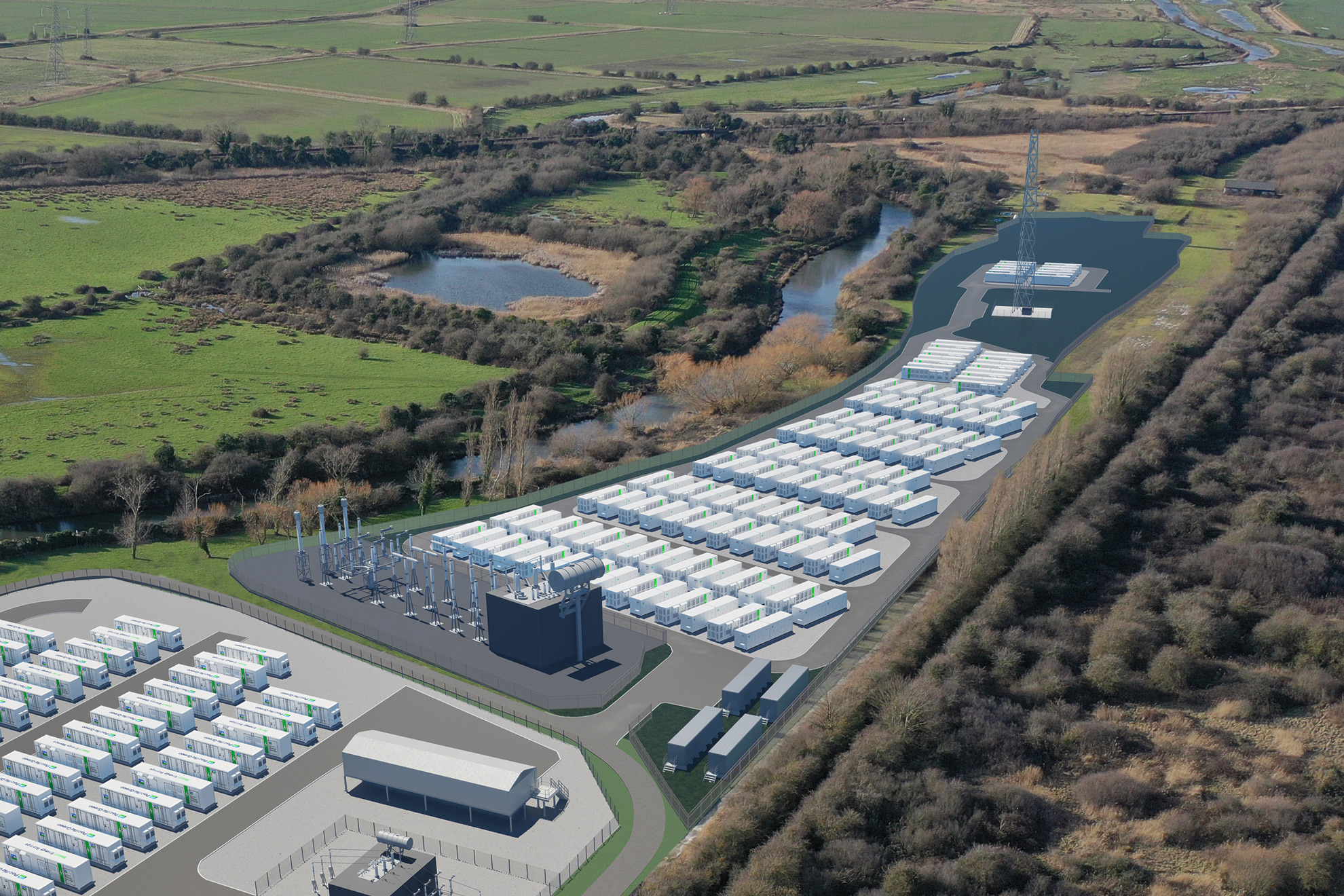

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025 -

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025