Riot Platforms (RIOT) Stock: A Deep Dive Into Recent Performance

Table of Contents

Recent RIOT Stock Price Trends and Volatility

RIOT stock price has experienced significant fluctuations recently, mirroring the inherent volatility of the cryptocurrency market and the Bitcoin mining industry. Analyzing the RIOT stock chart reveals periods of sharp increases and decreases, often closely correlated with the price of Bitcoin. Several factors contribute to this volatility:

-

Bitcoin Price Movements: The price of Bitcoin is the most significant driver of RIOT's stock price. When Bitcoin's price rises, RIOT's revenue and profitability increase, leading to higher stock valuations. Conversely, a Bitcoin price drop negatively impacts RIOT's financial performance and stock price. Analyzing the RIOT price history alongside the Bitcoin price reveals a strong correlation. Tools visualizing the Bitcoin price impact on RIOT are readily available online.

-

Energy Costs: Bitcoin mining is energy-intensive. Fluctuations in energy prices directly affect the profitability of Riot Platforms and, consequently, its stock price. Higher energy costs reduce margins, impacting the RIOT stock price negatively.

-

Regulatory Changes: Government regulations concerning cryptocurrency mining can significantly impact the industry. Changes in regulatory frameworks, both domestically and internationally, can create uncertainty and volatility in the RIOT stock price.

-

Mining Difficulty: The difficulty of mining Bitcoin adjusts automatically to maintain a consistent block generation rate. Increased mining difficulty means higher energy consumption per Bitcoin mined, impacting profitability. This factor plays a crucial role in understanding RIOT stock volatility.

Financial Performance and Key Metrics

Analyzing RIOT's financial statements, including quarterly and annual reports, is essential to understanding its performance. Key metrics to consider include:

-

Revenue: RIOT's revenue is directly tied to Bitcoin's price and the amount of Bitcoin mined. Examining RIOT revenue trends provides insights into the company's operational efficiency.

-

Mining Capacity (Hashrate): Hashrate measures the computational power of Riot Platforms' mining operations. Higher hashrate generally translates to greater Bitcoin mining capacity and higher revenue potential. The RIOT hashrate is a key indicator of its competitive position within the Bitcoin mining industry.

-

Operating Margins: Analyzing RIOT's operating margins reveals its profitability relative to its operating costs. Changes in energy prices and mining difficulty significantly affect operating margins.

-

Net Income/Loss: The net income or loss provides an overall picture of RIOT's financial health. Comparing RIOT's profitability to competitors like Marathon Digital Holdings (MARA) and Core Scientific (CORZ) offers valuable context. Understanding RIOT profitability requires considering the impact of Bitcoin's price and operational efficiencies. Accessing RIOT financial statements allows for detailed analysis.

Impact of Bitcoin Price on RIOT Stock

The relationship between the Bitcoin price and RIOT's stock price is undeniable. A rise in the Bitcoin price directly translates into higher revenue for Riot Platforms as the value of their mined Bitcoins increases. Conversely, a drop in the Bitcoin price negatively impacts profitability, leading to a decline in the RIOT stock price. Analyzing historical data clearly demonstrates this strong correlation. Understanding Bitcoin price prediction models can offer insights, but it's crucial to remember that the cryptocurrency market is highly volatile. Effective cryptocurrency market analysis requires careful consideration of various factors.

Future Outlook and Investment Considerations

The long-term prospects of Riot Platforms depend on several factors, including Bitcoin's future price, the company's expansion plans, technological advancements in mining efficiency, and the sustainability of Bitcoin mining itself. Analyzing RIOT stock forecast requires assessing these variables.

-

Expansion Plans: RIOT's plans to expand its mining capacity will influence its future revenue potential.

-

Technological Advancements: Improvements in mining technology could enhance efficiency and lower operational costs, positively impacting profitability.

-

Sustainability: The environmental impact of Bitcoin mining is a growing concern, and regulations addressing energy consumption could influence RIOT's operations and stock price.

Investors should carefully consider the RIOT investment risks before investing. These include the volatility of Bitcoin's price, regulatory uncertainty, and the inherent risks associated with the cryptocurrency industry. Understanding the RIOT future prospects requires considering a range of possibilities.

Conclusion: Is RIOT Stock a Good Investment?

Our analysis of Riot Platforms (RIOT) stock reveals a company deeply intertwined with the performance of Bitcoin. RIOT stock price volatility is heavily influenced by the price of Bitcoin, energy costs, regulatory developments, and mining difficulty. While RIOT's financial performance shows potential, investing in RIOT carries substantial risk due to the inherent volatility of the cryptocurrency market. Before making any investment decisions regarding Riot Platforms (RIOT) stock, conduct thorough research and consider your risk tolerance. Consult with a financial advisor to help you create an effective RIOT investment strategy tailored to your personal circumstances. Explore additional resources for a more comprehensive understanding of RIOT stock analysis and the cryptocurrency mining industry. Remember, understanding RIOT stock and making informed investment decisions is critical in the ever-evolving landscape of cryptocurrency mining.

Featured Posts

-

Best In Klas Nrc Health Leads In Healthcare Experience Management

May 02, 2025

Best In Klas Nrc Health Leads In Healthcare Experience Management

May 02, 2025 -

Dublin Concert Loyle Carner At The 3 Arena

May 02, 2025

Dublin Concert Loyle Carner At The 3 Arena

May 02, 2025 -

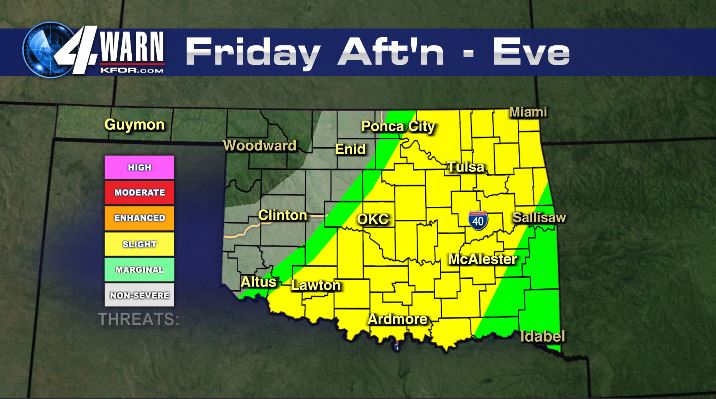

When To Expect Strong Winds Oklahoma Severe Weather Timeline

May 02, 2025

When To Expect Strong Winds Oklahoma Severe Weather Timeline

May 02, 2025 -

The China Factor Assessing Risks And Opportunities For International Auto Brands

May 02, 2025

The China Factor Assessing Risks And Opportunities For International Auto Brands

May 02, 2025 -

Frances Dominant Six Nations Victory Sends Message To Ireland

May 02, 2025

Frances Dominant Six Nations Victory Sends Message To Ireland

May 02, 2025

Latest Posts

-

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025 -

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025