Rethinking Retirement: Why This New Investment Trend Might Not Be For You

Table of Contents

The Allure of Alternative Investments in Retirement Planning

The appeal of alternative investments in retirement planning is undeniable. Many individuals are drawn to the potential for higher returns compared to traditional methods like 401(k)s and IRAs. However, it’s crucial to understand that this higher potential comes with significantly increased risk.

Higher Potential Returns, Higher Potential Risks

Alternative investments encompass a broad range of assets, including cryptocurrency, real estate investment trusts (REITs), peer-to-peer lending, and angel investing. While some have demonstrated impressive growth potential, they often lack the stability and regulation of traditional investments.

- Higher potential returns: The promise of outsized returns is a major draw for investors seeking to accelerate their retirement savings.

- Increased volatility: Many alternative investments are highly susceptible to market fluctuations, leading to significant swings in value.

- Liquidity issues: Selling alternative investments can sometimes be difficult and time-consuming, potentially locking up your capital when you need it most.

- Lack of regulation: Some alternative investments operate in less regulated markets, increasing the risk of fraud or loss.

Example: "While cryptocurrency has seen impressive growth, it's also highly volatile, making it a risky investment for retirement funds which require stability. A sudden market downturn could significantly impact your retirement nest egg."

Understanding Your Risk Tolerance

Before considering alternative retirement investments, it's paramount to assess your individual risk tolerance. This involves understanding your comfort level with potential losses and your time horizon for retirement. A risk profile helps determine the appropriate allocation of assets in your retirement portfolio.

- How comfortable are you with potential losses? Are you willing to accept significant short-term volatility in pursuit of long-term growth?

- What is your time horizon for retirement? Investors with a longer time horizon can typically tolerate more risk than those nearing retirement.

- What is your financial situation? Do you have other sources of income or savings to fall back on in case of losses?

- What are your retirement goals? Understanding your retirement needs will help determine the appropriate level of risk you can take.

Example: "A retiree close to needing their funds will have a much lower risk tolerance than someone decades away from retirement. Someone with a longer timeframe might consider a higher-risk investment with the potential for greater returns."

The Complexity of Managing Alternative Retirement Investments

Alternative investments often demand a higher level of active management and specialized knowledge than traditional investments. This increased complexity can pose significant challenges for many investors.

Increased Management Time and Expertise

Managing alternative investments effectively requires significant time, effort, and expertise. You'll need to dedicate time to researching investment opportunities, monitoring performance, and managing tax implications.

- Research: Thorough due diligence is crucial to identifying promising investments and avoiding scams.

- Monitoring: Regularly monitoring the performance of your investments is essential to ensure they’re meeting your expectations.

- Tax implications: Understanding the tax implications of alternative investments is critical for minimizing your tax burden.

- Professional Advice: Consider seeking expert advice from a financial advisor specializing in alternative investments.

Example: "Investing in real estate requires significantly more time and effort than simply contributing to a traditional 401k. You’ll need to manage property maintenance, tenant relations, and potential legal issues."

Diversification Challenges and Portfolio Balancing

Diversifying a portfolio that includes alternative investments can be significantly more challenging than diversifying a portfolio of traditional assets. This is because alternative investments often lack the same level of liquidity and standardization as stocks and bonds, making it harder to achieve proper diversification and risk mitigation.

- Correlation: Alternative investments might be correlated with each other or with traditional assets in unexpected ways, reducing the overall diversification benefits.

- Liquidity constraints: Difficulty selling alternative investments quickly can hinder your ability to rebalance your portfolio effectively.

- Valuation challenges: Accurately valuing some alternative assets can be difficult, making it harder to assess your overall portfolio risk.

Example: "Over-reliance on a single alternative investment, like cryptocurrency, can leave your retirement fund exposed to significant losses. A diversified portfolio that includes traditional assets helps mitigate this risk."

The Importance of Traditional Retirement Planning

Despite the allure of alternative investments, the stability and predictability of traditional retirement planning methods remain invaluable. These methods, such as 401(k)s, IRAs, and pensions, provide a solid foundation for a secure retirement.

The Stability and Security of Traditional Investments

Traditional retirement plans offer several key advantages:

- Tax advantages: Many traditional plans offer tax benefits, such as tax-deferred growth or tax deductions.

- Employer matching: Many employers offer matching contributions to employee 401(k) plans, effectively boosting your retirement savings.

- Predictable growth: Traditional investments, such as stocks and bonds, tend to offer more predictable growth patterns than alternative investments.

- Regulation: Traditional investments are subject to strict regulations, providing a degree of investor protection.

Example: "A well-diversified portfolio of traditional investments provides a solid foundation for a secure retirement. It offers stability and predictability, which are crucial for long-term financial security."

Professional Financial Advice for Retirement Planning

Seeking professional financial advice is crucial before making any significant investment decisions, particularly when considering alternative retirement investments. A financial advisor can help you develop a personalized retirement plan that aligns with your goals and risk tolerance.

- Personalized plan: A financial advisor can create a plan tailored to your specific circumstances, including your age, income, expenses, and risk tolerance.

- Asset allocation: They can help you determine the optimal mix of traditional and alternative investments.

- Risk management: They can help you identify and mitigate potential risks associated with your investments.

- Tax optimization: They can help you minimize your tax liability.

Example: "A financial advisor can help you determine the optimal mix of traditional and alternative investments based on your individual circumstances. They can provide valuable insights and guidance to ensure you're on track to achieve your retirement goals."

Conclusion

Rethinking retirement is a crucial step in securing your financial future, but it's vital to approach it with caution and a clear understanding of your risk tolerance and financial goals. While alternative investments offer potential for higher returns, they also carry substantial risks that could jeopardize your retirement security. Traditional retirement planning methods, when properly managed with expert advice, often provide a more stable and predictable path to a comfortable retirement. Before making any significant changes to your retirement strategy, carefully consider the pros and cons of all available options and seek professional advice to ensure you’re making the best decisions for your unique circumstances and your approach to rethinking retirement. Don't hesitate to seek guidance on rethinking your retirement investments—your future self will thank you.

Featured Posts

-

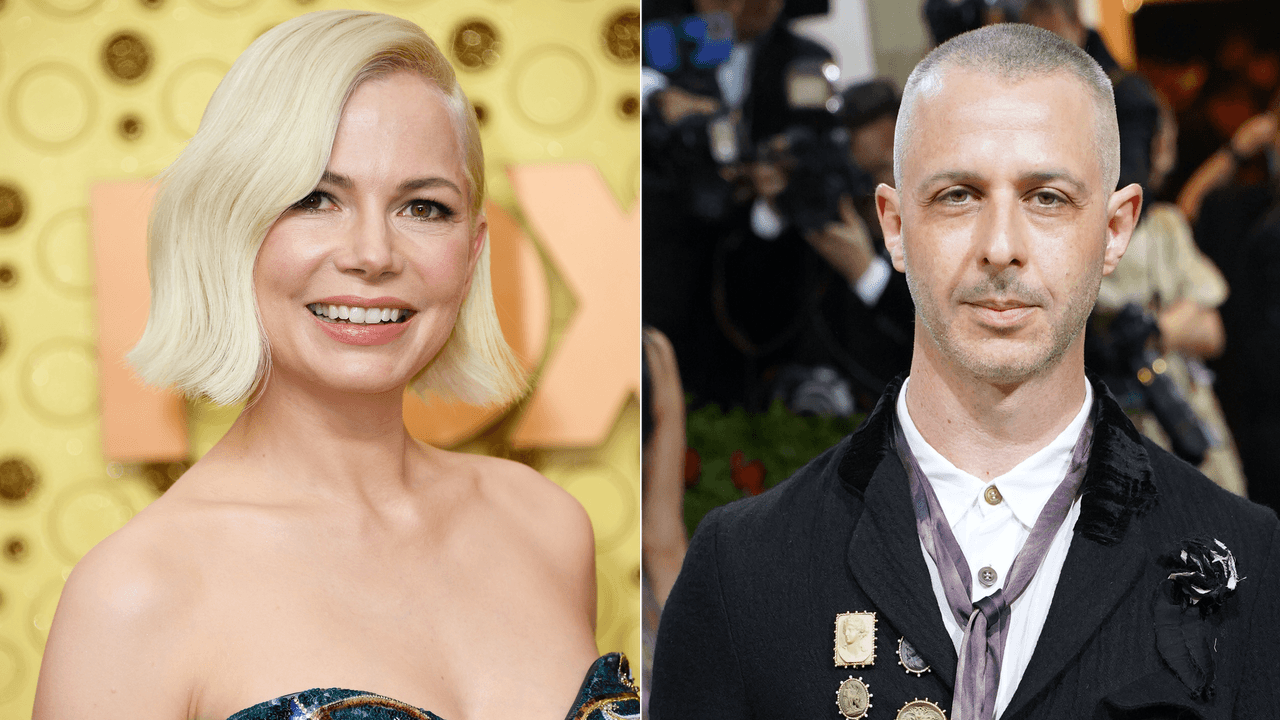

Michelle Williams On Dying For Sex Co Stars Clasp Comment

May 18, 2025

Michelle Williams On Dying For Sex Co Stars Clasp Comment

May 18, 2025 -

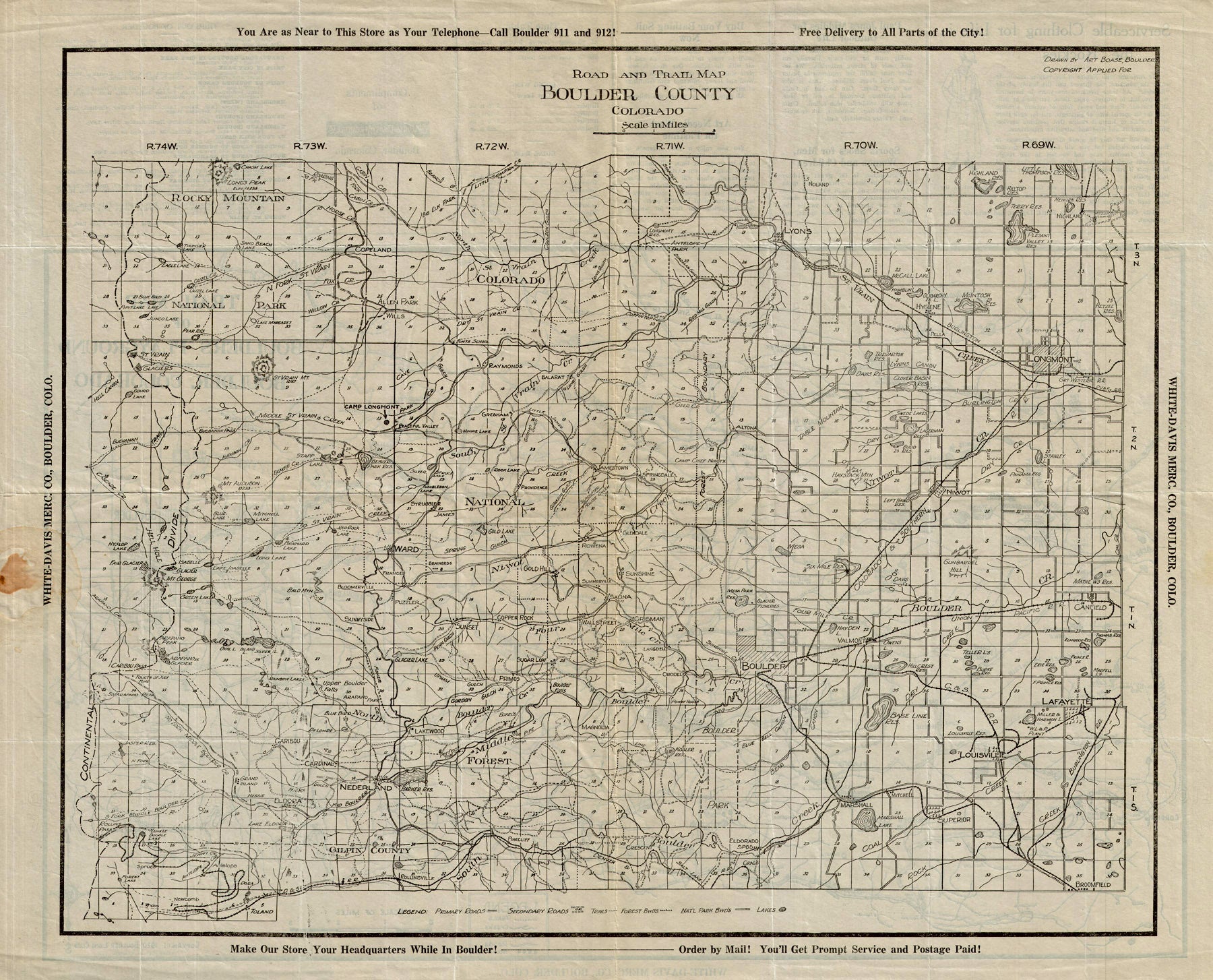

Switzerland Trail A Mining History In Boulder County Colorado

May 18, 2025

Switzerland Trail A Mining History In Boulder County Colorado

May 18, 2025 -

This New Investment And Your Retirement A Cautious Approach

May 18, 2025

This New Investment And Your Retirement A Cautious Approach

May 18, 2025 -

Mikey Madisons Snl Cold Open A Signal Group Chat Spoof

May 18, 2025

Mikey Madisons Snl Cold Open A Signal Group Chat Spoof

May 18, 2025 -

Kardashian And Censori United In Opposition To Kanye West

May 18, 2025

Kardashian And Censori United In Opposition To Kanye West

May 18, 2025

Latest Posts

-

A Former Colleague Paints A Disturbing Picture Of Stephen Miller

May 18, 2025

A Former Colleague Paints A Disturbing Picture Of Stephen Miller

May 18, 2025 -

Analiz Axios Stiven Miller Kak Potentsialniy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025

Analiz Axios Stiven Miller Kak Potentsialniy Sovetnik Trampa Po Natsionalnoy Bezopasnosti

May 18, 2025 -

Axios Novost O Stivena Millere I Ego Potentsialnoy Roli V Administratsii Trampa

May 18, 2025

Axios Novost O Stivena Millere I Ego Potentsialnoy Roli V Administratsii Trampa

May 18, 2025 -

Former Colleague Reveals Stephen Millers Troubling Conduct

May 18, 2025

Former Colleague Reveals Stephen Millers Troubling Conduct

May 18, 2025 -

Stephen Miller A Former Colleague Exposes His Behavior

May 18, 2025

Stephen Miller A Former Colleague Exposes His Behavior

May 18, 2025