This New Investment And Your Retirement: A Cautious Approach

Table of Contents

Understanding Your Risk Tolerance Before Investing for Retirement

Before diving into any new investment strategy, understanding your risk tolerance is paramount, especially when it comes to securing your retirement. Risk tolerance is your comfort level with the possibility of losing some or all of your investment. A crucial aspect of retirement planning involves a careful assessment of your risk tolerance.

- Assessing your current financial situation and retirement goals: Are you close to retirement, or do you have many years before you plan to stop working? Your timeframe significantly impacts your risk tolerance. A longer time horizon allows for greater risk-taking as there's more time to recover from potential losses.

- Determining your comfort level with potential investment losses: How much fluctuation in your investment value can you handle without significant stress? Are you willing to accept potential short-term losses for the possibility of higher long-term gains?

- Understanding the difference between high-risk, moderate-risk, and low-risk investments: High-risk investments like individual stocks offer the potential for high returns but also carry the risk of substantial losses. Moderate-risk investments such as balanced mutual funds offer a blend of growth and stability. Low-risk investments like government bonds prioritize capital preservation over high returns.

- Considering your time horizon until retirement: The closer you are to retirement, the lower your risk tolerance should generally be. You need to prioritize preserving your capital to ensure a secure retirement income.

Several online risk tolerance questionnaires can help determine your risk profile. Understanding your risk tolerance guides your investment choices and helps prevent impulsive decisions that could jeopardize your retirement savings.

Analyzing Index Funds: Due Diligence is Key

Index funds, which track a specific market index like the S&P 500, offer a diversified and relatively low-cost way to invest in the stock market. However, due diligence remains crucial before incorporating them into your retirement portfolio.

- Researching the investment's past performance and potential future returns: While past performance doesn't guarantee future results, analyzing historical data provides insights into the fund's consistency and potential volatility. Consider long-term trends rather than short-term fluctuations.

- Understanding the associated fees and expenses: Index funds generally have lower expense ratios than actively managed funds, but it's crucial to compare fees across different funds to select the most cost-effective option. High fees can significantly eat into your returns over time.

- Evaluating the investment's liquidity (how easily it can be converted to cash): Index funds are generally highly liquid, meaning you can readily buy or sell shares. This is important for accessing your funds if needed, although frequent trading can incur transaction costs.

- Seeking advice from a qualified financial advisor: A financial advisor can provide personalized guidance based on your specific circumstances, risk tolerance, and retirement goals. They can help you determine the appropriate allocation of index funds within your overall investment strategy.

Thorough research and professional advice are essential to ensure that index funds align with your retirement objectives and risk profile.

Diversification: Spreading Your Retirement Investments

Diversification is a cornerstone of sound retirement planning. It involves spreading your investments across different asset classes to reduce risk and potentially enhance returns.

- Understanding the benefits of diversifying your investment portfolio: Diversification helps to cushion the impact of poor performance in one asset class by offsetting it with potentially better performance in another.

- Exploring different asset classes (stocks, bonds, real estate, etc.): A well-diversified portfolio includes a mix of stocks (representing ownership in companies), bonds (representing loans to governments or corporations), and potentially other asset classes like real estate or commodities.

- Determining the appropriate asset allocation for your risk tolerance and retirement goals: Your asset allocation should reflect your risk tolerance and time horizon. Younger investors with a longer time horizon can generally tolerate a higher allocation to stocks, while those nearing retirement might prefer a more conservative approach with a higher allocation to bonds.

- Avoiding over-concentration in any single investment: Over-reliance on a single investment, even a seemingly safe one, exposes your portfolio to significant risk if that investment underperforms.

A diversified portfolio helps to mitigate risk and increase the likelihood of achieving your long-term retirement goals.

The Role of Index Funds in a Diversified Portfolio

Index funds play a valuable role in a diversified retirement portfolio. Their low cost and broad diversification make them an excellent foundation for building a well-rounded investment strategy. They offer exposure to a wide range of companies, reducing the risk associated with individual stock picking. The proportion of your portfolio allocated to index funds will depend on your overall risk tolerance and investment objectives, as determined in consultation with a financial advisor. They can form the core of your equity holdings, complemented by other asset classes to create a balanced portfolio.

Conclusion

Successfully navigating retirement planning requires a cautious approach to investments. Thoroughly understanding your risk tolerance, conducting due diligence on any new investment, and creating a diversified portfolio are all critical steps. Integrating index funds should be done thoughtfully and strategically, considering their place within your overall retirement strategy.

Before making any significant changes to your retirement investment strategy, consult with a qualified financial advisor to determine if index funds align with your individual goals and risk tolerance. Remember, a cautious approach to retirement investment planning is crucial for securing your financial future.

Featured Posts

-

Angels Star Faces Difficult Offseason Amidst Family Health Crisis

May 18, 2025

Angels Star Faces Difficult Offseason Amidst Family Health Crisis

May 18, 2025 -

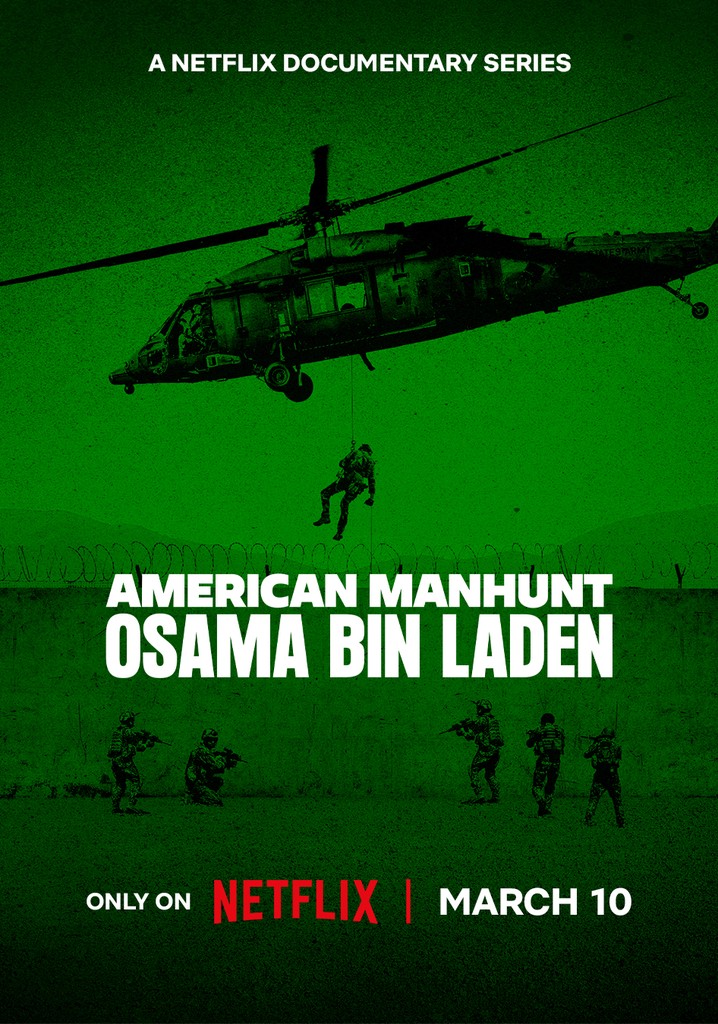

American Manhunt Osama Bin Laden Documentary Delayed Netflix Premiere Date

May 18, 2025

American Manhunt Osama Bin Laden Documentary Delayed Netflix Premiere Date

May 18, 2025 -

Photos Cassie Ventura And Alex Fines Mob Land Premiere Debut

May 18, 2025

Photos Cassie Ventura And Alex Fines Mob Land Premiere Debut

May 18, 2025 -

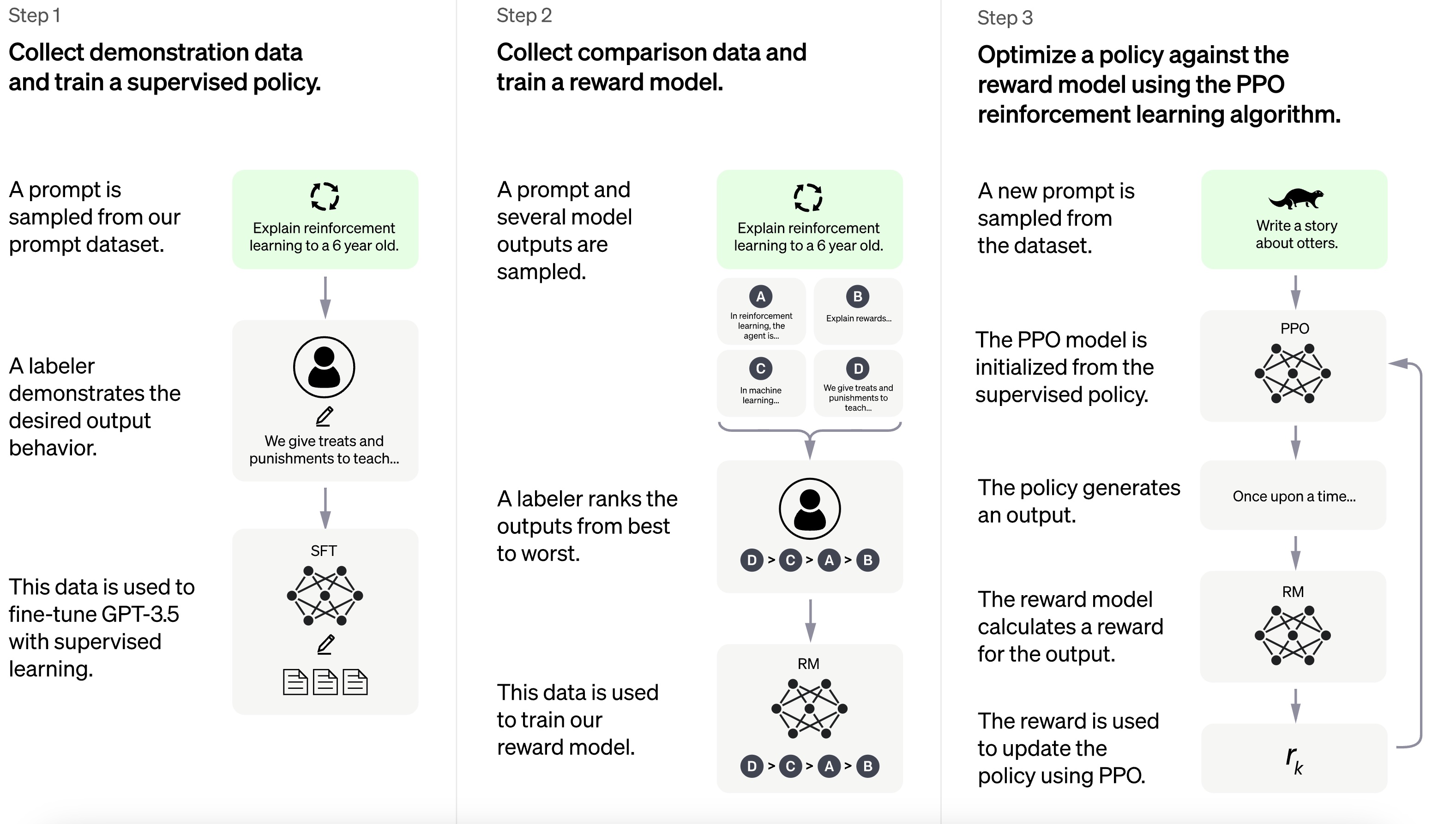

Ai Coding Agent Integrated Into Chat Gpt Features And Implications

May 18, 2025

Ai Coding Agent Integrated Into Chat Gpt Features And Implications

May 18, 2025 -

Five Game Win Streak For Dodgers Gonsolins Impressive Return To The Mound

May 18, 2025

Five Game Win Streak For Dodgers Gonsolins Impressive Return To The Mound

May 18, 2025

Latest Posts

-

The Stephen Miller Nsa Nomination Implications And Analysis

May 18, 2025

The Stephen Miller Nsa Nomination Implications And Analysis

May 18, 2025 -

Stephen Miller And The Nsa Understanding The Potential Appointment

May 18, 2025

Stephen Miller And The Nsa Understanding The Potential Appointment

May 18, 2025 -

Stephen Millers Potential Appointment As National Security Advisor

May 18, 2025

Stephen Millers Potential Appointment As National Security Advisor

May 18, 2025 -

Jersey Mikes Subs Galesburg Location Details Revealed

May 18, 2025

Jersey Mikes Subs Galesburg Location Details Revealed

May 18, 2025 -

Could Stephen Miller Become The Next Nsa Director Under Trump

May 18, 2025

Could Stephen Miller Become The Next Nsa Director Under Trump

May 18, 2025