Retail Sales Slump: Could This Force Bank Of Canada To Cut Rates?

Table of Contents

Keywords: Retail sales slump, Bank of Canada, interest rate cuts, Canadian economy, inflation, economic slowdown, monetary policy, consumer spending, GDP growth, economic recession, supply chain disruptions.

The Canadian economy is facing a significant challenge: a recent and substantial slump in retail sales. This unexpected downturn has ignited a critical debate: will the Bank of Canada (BoC) respond by cutting interest rates? This article delves into the severity of the retail sales decline, its impact on the broader economy, and the potential for a shift in the BoC's monetary policy.

The Severity of the Retail Sales Slump

Analyzing the Recent Data

Statistics Canada's latest report reveals a concerning [insert specific percentage]% drop in retail sales for [insert month/quarter]. This represents a significant deviation from the projected growth and marks [insert comparison to previous periods, e.g., the steepest decline in X years]. The decline isn't uniform across all sectors.

- Specific sectors most affected: Durable goods, such as furniture and appliances, experienced a particularly sharp decline, suggesting consumers are delaying major purchases. Non-durable goods, while less affected, also saw a noticeable decrease.

- Geographical variations in sales decline: The slump isn't evenly distributed across the country. [Insert details about regional variations, citing Statistics Canada data]. Provinces heavily reliant on specific sectors (e.g., resource-based economies) might be experiencing more pronounced effects.

- Comparison to previous years and expected growth: Compared to the same period last year, retail sales are down by [insert percentage]%, significantly underperforming expectations. Economists had predicted growth of around [insert percentage]%.

- Unexpected factors contributing to the drop: The unexpected drop could be attributed to a combination of factors, such as increased interest rates impacting consumer borrowing power, persistent inflation eroding purchasing power, and lingering anxieties about a potential recession.

This substantial drop in retail sales paints a worrying picture for the Canadian economy, signaling a potential weakening in consumer demand.

Impact on the Canadian Economy

Consumer Confidence and Spending

The retail sales slump is a clear indicator of weakening consumer confidence and reduced spending. This has far-reaching implications for the overall economy.

- Link between retail sales and overall consumer spending: Retail sales account for a significant portion of overall consumer spending, which in turn is a major driver of GDP growth. A decline in retail sales directly translates to a reduction in overall economic activity.

- Impact on GDP growth: The slump could significantly reduce GDP growth, potentially pushing the economy closer to a recession. The ripple effect could be substantial, impacting future economic forecasts.

- Potential for a ripple effect across other sectors: Reduced consumer spending in the retail sector will likely lead to decreased demand in other sectors, such as manufacturing, transportation, and warehousing, potentially leading to job losses and reduced investment.

- Mention job losses and potential increase in unemployment: Businesses struggling with reduced sales may resort to layoffs, leading to increased unemployment and further impacting consumer spending, creating a negative feedback loop.

The ongoing retail sales slump poses a serious threat to the health and stability of the Canadian economy, potentially impacting millions of Canadians.

The Bank of Canada's Response

Current Monetary Policy and Inflation

The Bank of Canada's current monetary policy focuses on managing inflation, which remains a significant concern. The BoC's mandate is to maintain price stability and full employment.

- Explain the Bank of Canada's mandate: The BoC aims to keep inflation within its target range (typically 1-3%). Interest rate adjustments are a key tool used to achieve this goal.

- Discuss the current inflation rate and its trajectory: While inflation has eased somewhat, it remains above the BoC's target. This complicates the decision on whether to cut interest rates, as doing so could risk further fueling inflation.

- Analyze the potential trade-offs between combating inflation and stimulating economic growth: The BoC faces a difficult choice: cutting rates to stimulate the economy could worsen inflation, while maintaining high rates could prolong the economic slowdown.

- Review past instances where the Bank of Canada adjusted interest rates in response to economic downturns: The BoC's history provides some insight, but each economic situation is unique. Past responses might not perfectly predict its actions in this instance.

Given the complexities, the probability of interest rate cuts remains uncertain. The BoC might opt for a wait-and-see approach to assess the full impact of the retail sales slump before making any significant policy changes.

Alternative Economic Factors at Play

Global Economic Conditions and their Impact

The Canadian economy is not isolated from global economic headwinds. Several external factors are influencing the current retail sales slump.

- Impact of global inflation and recessionary fears: Global inflation and the risk of a global recession are significant factors dampening consumer and business confidence worldwide, impacting Canadian spending.

- Influence of the exchange rate on import/export prices: Fluctuations in the Canadian dollar impact the prices of imported goods, influencing consumer spending and business profitability.

- Effects of supply chain disruptions: Lingering supply chain disruptions continue to impact the availability and cost of goods, adding to inflationary pressures and reducing consumer purchasing power.

These global factors are intertwined with the domestic retail sales slump, creating a complex economic environment that requires careful consideration by the Bank of Canada.

Conclusion

The recent retail sales slump is a serious issue for the Canadian economy. Its severity, coupled with its impact on consumer confidence and broader economic activity, presents a significant challenge. While the Bank of Canada faces a difficult choice regarding interest rate adjustments, the potential for cuts remains a possibility, depending on the evolving economic situation and the BoC's assessment of the risks involved. The interaction between domestic and global economic factors adds layers of complexity to the decision-making process.

The retail sales slump presents a critical challenge to the Canadian economy. Stay informed on the Bank of Canada's decisions regarding interest rates and their potential implications for your financial planning. Continue following our updates on the retail sales slump and its economic effects. Monitor this developing situation closely to understand how it might affect you.

Featured Posts

-

Hollywood Shut Down Actors And Writers On Strike What It Means For The Industry

Apr 29, 2025

Hollywood Shut Down Actors And Writers On Strike What It Means For The Industry

Apr 29, 2025 -

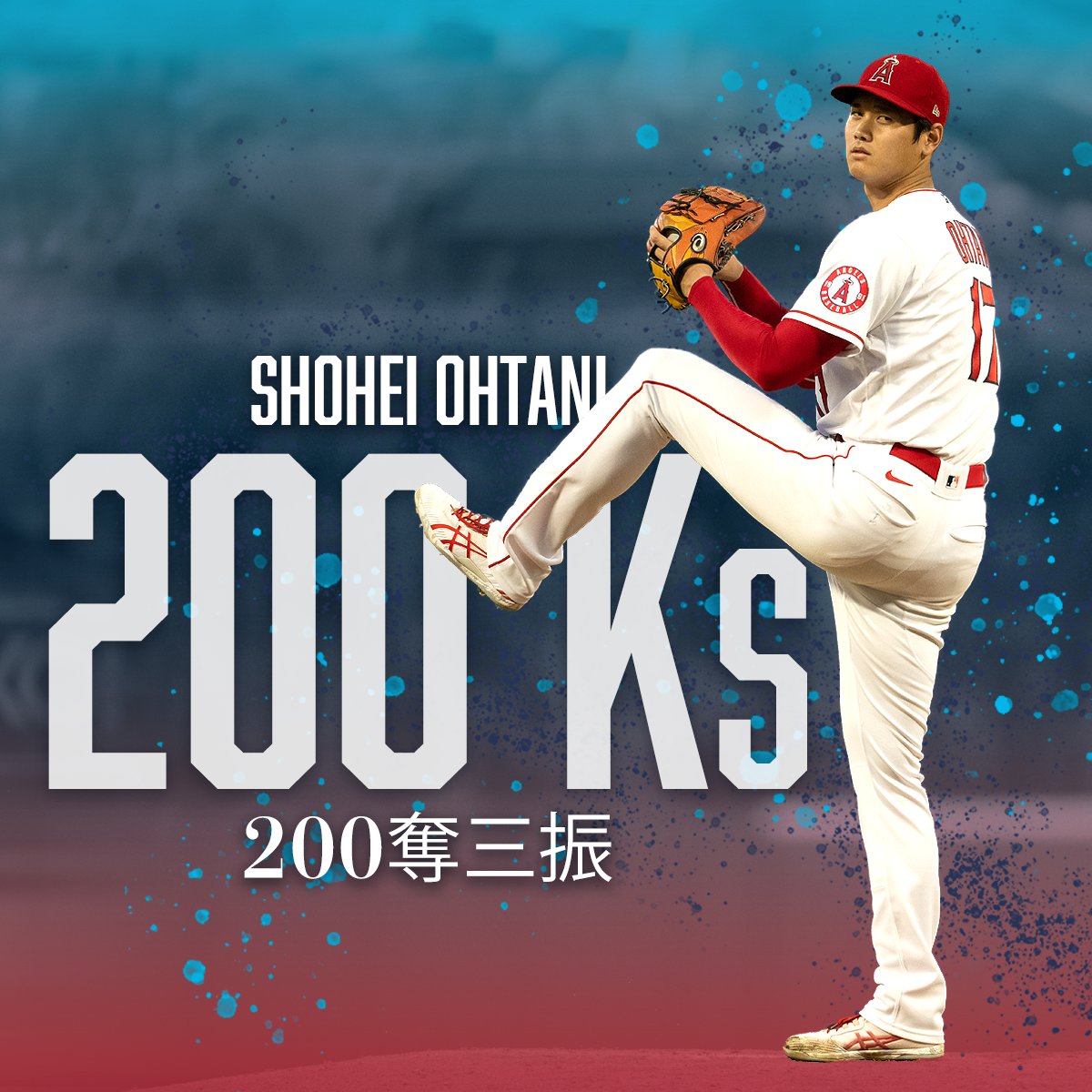

Mlb

Apr 29, 2025

Mlb

Apr 29, 2025 -

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025 -

Chat Gpt Creator Open Ai Faces Ftc Investigation Key Questions And Concerns

Apr 29, 2025

Chat Gpt Creator Open Ai Faces Ftc Investigation Key Questions And Concerns

Apr 29, 2025 -

Did Trumps China Tariffs Hurt The Us Economy A Look At Inflation And Supply Chains

Apr 29, 2025

Did Trumps China Tariffs Hurt The Us Economy A Look At Inflation And Supply Chains

Apr 29, 2025

Latest Posts

-

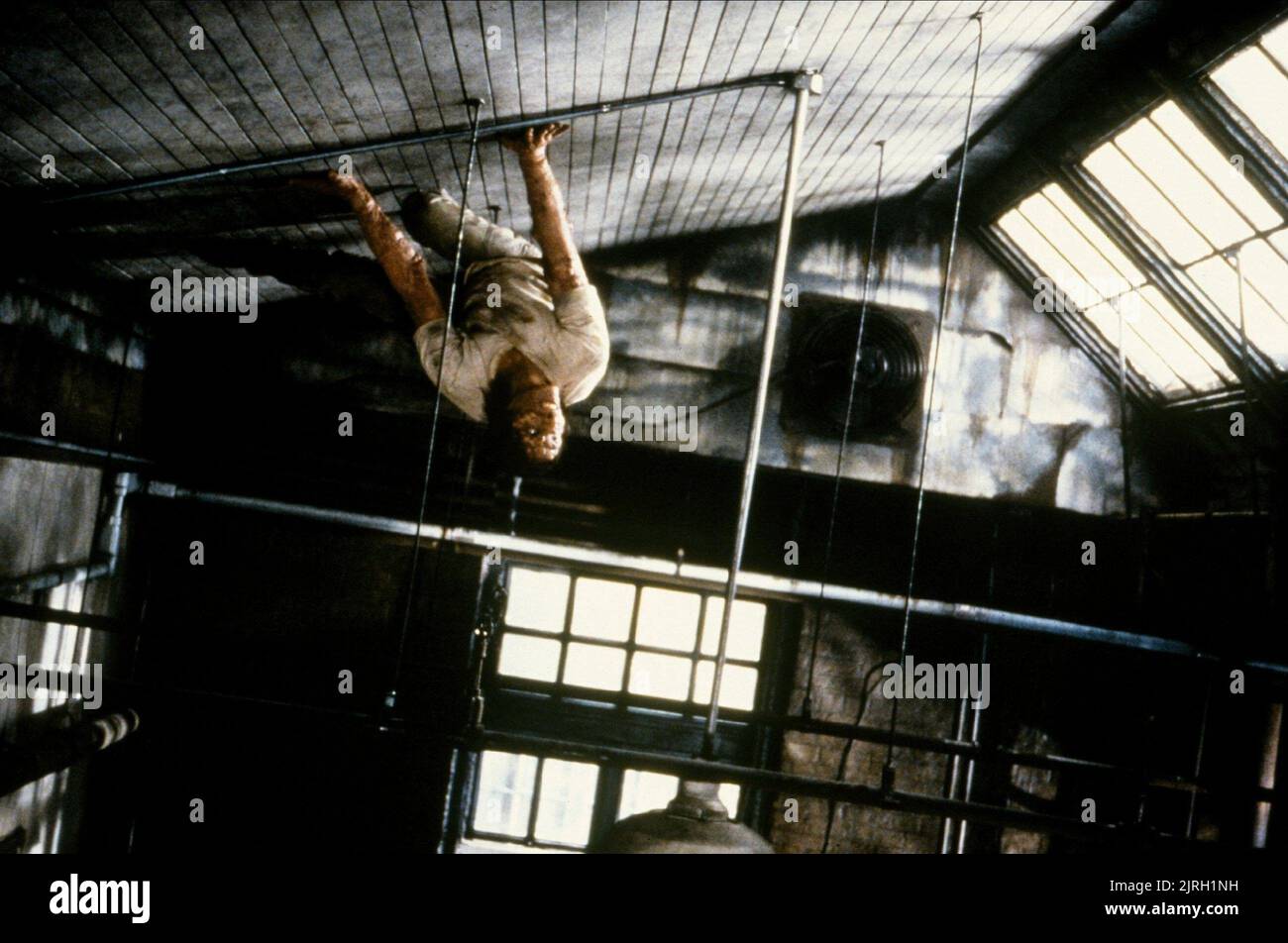

Re Examining The Fly Jeff Goldblums Performance And The Academys Oversight

Apr 29, 2025

Re Examining The Fly Jeff Goldblums Performance And The Academys Oversight

Apr 29, 2025 -

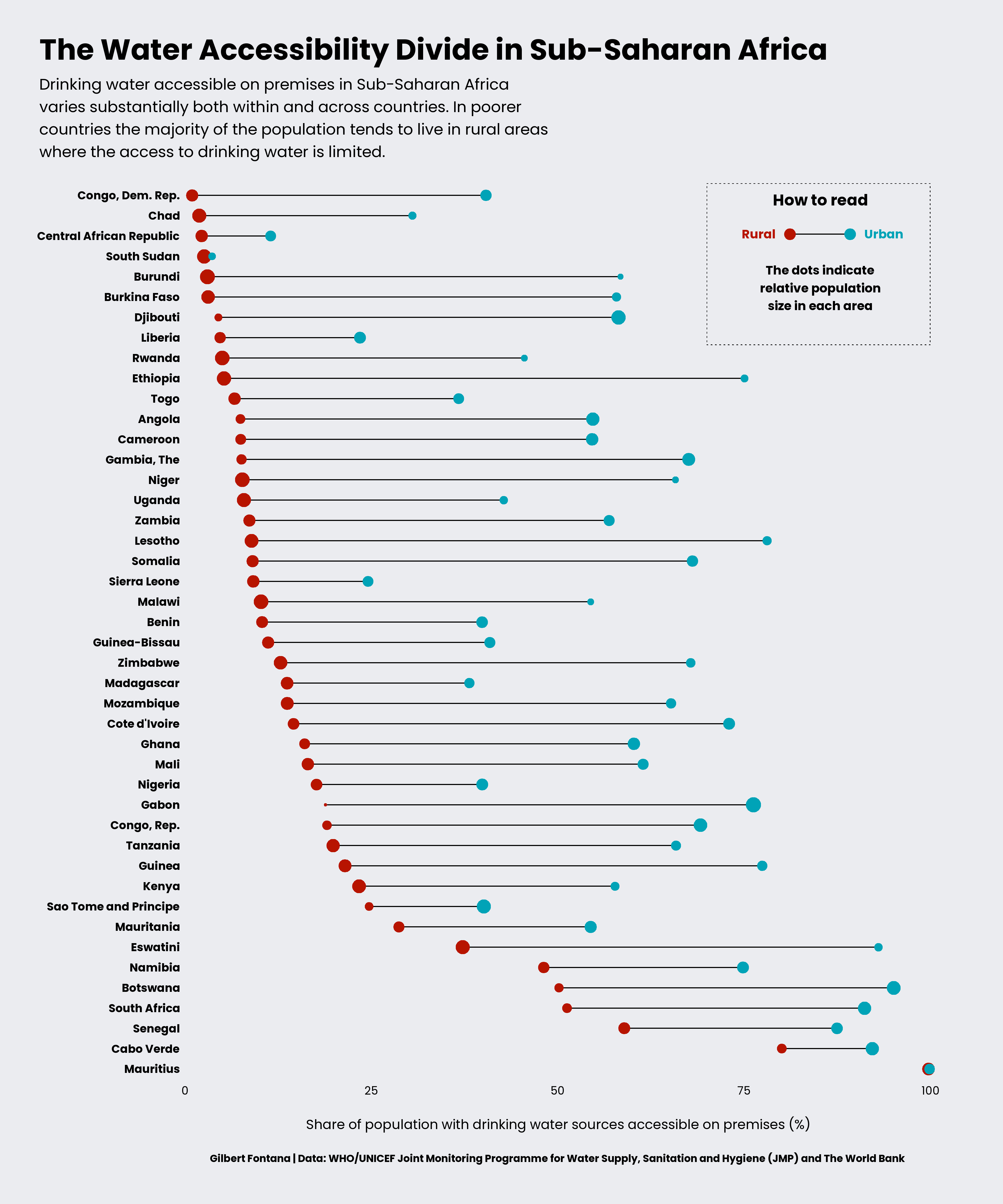

Sub Saharan Africa Faces Pw Cs Exit Exploring The Reasons And Future Outlook

Apr 29, 2025

Sub Saharan Africa Faces Pw Cs Exit Exploring The Reasons And Future Outlook

Apr 29, 2025 -

Getting To Know Emilie Livingston Jeff Goldblums Wife And Their Children

Apr 29, 2025

Getting To Know Emilie Livingston Jeff Goldblums Wife And Their Children

Apr 29, 2025 -

Jeff Goldblum The Flys Underrated Masterpiece And A Missed Oscar Opportunity

Apr 29, 2025

Jeff Goldblum The Flys Underrated Masterpiece And A Missed Oscar Opportunity

Apr 29, 2025 -

Who Is Emilie Livingston Jeff Goldblums Wife And Family

Apr 29, 2025

Who Is Emilie Livingston Jeff Goldblums Wife And Family

Apr 29, 2025