Resilient Investments Boost China Life's Profits

Table of Contents

Strategic Asset Allocation Drives Profitability

China Life's profitability is significantly linked to its sophisticated asset allocation strategy. A carefully diversified portfolio, encompassing fixed income, equities, and alternative investments, has proven crucial in mitigating the risks inherent in market volatility. This strategic approach allows for consistent returns even during periods of economic uncertainty.

-

Portfolio Diversification: China Life's success stems from its avoidance of over-reliance on any single asset class. For example, while a precise breakdown is commercially sensitive, it's understood they maintain a balanced allocation between fixed-income securities (e.g., government bonds, corporate bonds) offering stability, and equities (both domestic and international) providing growth potential. A portion is also dedicated to alternative investments, such as infrastructure projects and private equity, which offer diversification and potentially higher returns. This multifaceted approach ensures that losses in one area are offset by gains in others.

-

Strategic Shift to Lower-Risk Assets: In response to market fluctuations, China Life has adeptly shifted a portion of its portfolio towards higher-yielding, lower-risk assets. This tactical adjustment has further enhanced the resilience of its investment strategy and contributed to increased returns.

-

Effective Risk Management: The company employs sophisticated risk management techniques, including stress testing and scenario analysis, to proactively identify and mitigate potential threats. This proactive approach minimizes losses during periods of market uncertainty and protects the overall portfolio's value.

Focus on Long-Term, Sustainable Investments

China Life's commitment to long-term, sustainable investments is another key factor behind its profit growth. This strategy aligns with global trends toward Environmental, Social, and Governance (ESG) investing.

-

ESG Integration: China Life is increasingly integrating ESG factors into its investment decision-making process. This involves evaluating the environmental, social, and governance performance of potential investments, ensuring alignment with sustainable development goals.

-

Infrastructure and Long-Term Growth: The company invests heavily in infrastructure projects and other sectors poised for long-term growth, generating stable, predictable returns over extended periods. This long-term perspective contrasts with short-term, speculative investments and creates a more resilient portfolio.

-

Responsible Investing: China Life's emphasis on responsible investing not only contributes to positive social impact but also enhances its reputation and attracts investors who prioritize sustainability. This strengthens their competitive advantage and promotes long-term value creation.

Strong Performance in the Chinese Market

China Life's success is inextricably linked to its deep understanding and strong performance within the rapidly evolving Chinese insurance market.

-

Market Share and Growth: China Life holds a significant market share in the booming Chinese insurance sector, benefiting from the country's rising middle class and increasing demand for insurance products.

-

Economic Policy Impact: The company has effectively leveraged China's economic policies and initiatives to optimize its investment strategies, capitalizing on growth opportunities within the domestic market.

-

Regulatory Environment: Navigating the regulatory landscape effectively is crucial, and China Life's expertise in this area allows them to make strategic investment decisions within the legal and regulatory framework.

-

Competitive Advantage: The company's established brand recognition, extensive distribution network, and strong customer relationships provide a significant competitive advantage in the Chinese market.

Technological Innovation and Efficiency Improvements

China Life's adoption of innovative technologies has significantly enhanced operational efficiency and contributed to profit growth.

-

Fintech Integration: The company has embraced fintech solutions to streamline investment processes, improve risk management, and enhance decision-making. This includes utilizing advanced analytics, machine learning, and AI for portfolio optimization and fraud detection.

-

Digital Transformation: China Life's ongoing digital transformation initiatives have resulted in substantial cost reductions and improved operational efficiency across various aspects of its business.

-

Technological Advancements: The implementation of advanced technologies, such as blockchain for secure transactions and big data analytics for improved risk assessment, has modernized operations and further enhanced profitability.

Conclusion

China Life's remarkable profit growth underscores the power of a resilient investment strategy. By strategically allocating assets, focusing on long-term sustainable investments, capitalizing on opportunities within the Chinese market, and embracing technological innovation, the company has not only navigated economic challenges but also achieved substantial profitability. This demonstrates a blueprint for success in the dynamic world of insurance and investment.

Call to Action: Learn more about building your own resilient investment portfolio. Explore the innovative strategies employed by industry leaders like China Life to achieve sustainable and profitable growth. Invest wisely and build a resilient portfolio for long-term success – contact us today to learn more about resilient investment strategies.

Featured Posts

-

Passengers Stranded In Kogi Train Breakdown Causes Delays

May 01, 2025

Passengers Stranded In Kogi Train Breakdown Causes Delays

May 01, 2025 -

Canadas Next Prime Minister Top Economic Challenges

May 01, 2025

Canadas Next Prime Minister Top Economic Challenges

May 01, 2025 -

Household Plastic Chemicals A Potential Threat To Cardiovascular Health Study Finds

May 01, 2025

Household Plastic Chemicals A Potential Threat To Cardiovascular Health Study Finds

May 01, 2025 -

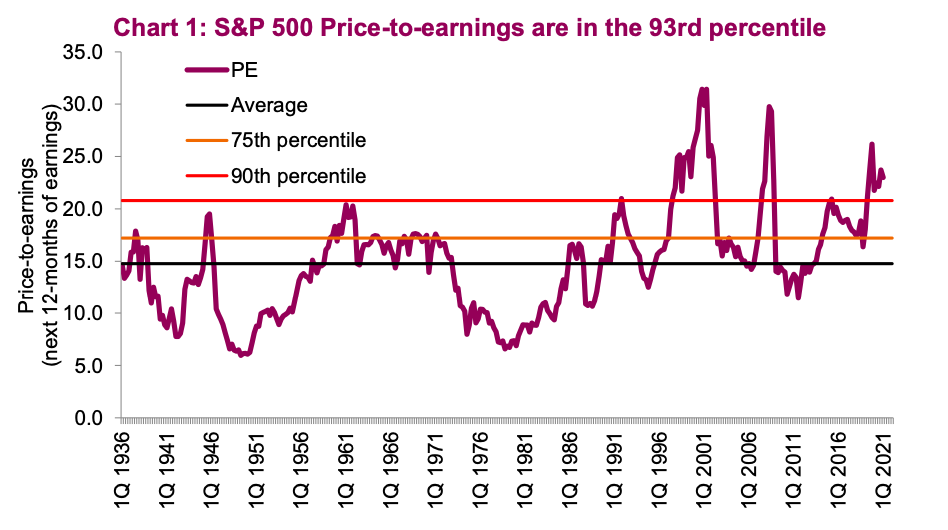

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Cap Nhat Ket Qua Chung Cuoc Lan Thu Vii

May 01, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Cap Nhat Ket Qua Chung Cuoc Lan Thu Vii

May 01, 2025

Latest Posts

-

Flaminia Un Passo In Avanti Decisivo In Classifica

May 01, 2025

Flaminia Un Passo In Avanti Decisivo In Classifica

May 01, 2025 -

Alqlq Ytsaed Arqam Jwanka W Mstqbl Nady Alnsr

May 01, 2025

Alqlq Ytsaed Arqam Jwanka W Mstqbl Nady Alnsr

May 01, 2025 -

Sorpasso Flaminia Recupero Posizioni In Classifica

May 01, 2025

Sorpasso Flaminia Recupero Posizioni In Classifica

May 01, 2025 -

Paul Skenes Pitches Well But Offense Falters In Loss

May 01, 2025

Paul Skenes Pitches Well But Offense Falters In Loss

May 01, 2025 -

La Flaminia Scalda I Motori Dal Quinto Al Secondo Posto

May 01, 2025

La Flaminia Scalda I Motori Dal Quinto Al Secondo Posto

May 01, 2025