Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

Understanding Federal Student Loan Refinancing

Refinancing federal student loans means replacing your existing federal loans with a new private loan from a private lender. This process involves consolidating your multiple federal student loans into a single, new private loan with potentially different terms and interest rates. Understanding key terms is vital:

- Interest Rate: The percentage charged on the remaining loan balance. A lower interest rate means lower overall loan costs.

- Loan Term: The length of time you have to repay the loan. Longer terms result in lower monthly payments but higher total interest paid.

- Principal: The original amount of the loan, excluding interest.

- Private Lender: A private financial institution (bank, credit union, or online lender) offering refinancing options, unlike the federal government.

Here's what refinancing entails:

- Replaces your existing federal loans with a new private loan.

- Potentially lowers your monthly payments.

- May offer a lower interest rate than your current federal loans.

- Crucially: Loses federal loan benefits (e.g., income-driven repayment plans, loan forgiveness programs).

Benefits of Refinancing Federal Student Loans

Refinancing your federal student loans can offer several significant advantages:

Lower Monthly Payments

Refinancing can result in lower monthly payments through two main avenues: a longer loan term or a lower interest rate. For example, extending your repayment period from 10 years to 15 years will reduce your monthly payment, though you'll pay more interest overall. Similarly, a lower interest rate directly translates to a lower monthly payment for the same loan term.

- Example: A $50,000 loan at 7% interest over 10 years has a monthly payment of approximately $570. Refinancing to a 15-year term at the same interest rate lowers the monthly payment to around $400.

Lower Interest Rates

Securing a lower interest rate through refinancing can lead to substantial savings over the life of your loan. Even a small reduction in your interest rate can translate to thousands of dollars saved.

- Example: A $30,000 loan at 7% interest over 10 years costs approximately $38,000 in total. Refinancing to 5% interest over the same term reduces the total cost to approximately $34,000, saving $4,000.

Simplified Repayment

Consolidating multiple federal student loans into a single private loan simplifies repayment. Managing one monthly payment is easier than tracking multiple loans with varying due dates and interest rates.

- Easier budgeting and tracking of payments.

- Reduced risk of missed payments due to simpler organization.

- Improved financial clarity and stress reduction.

Drawbacks of Refinancing Federal Student Loans

While refinancing can offer benefits, it's essential to be aware of the potential downsides:

Loss of Federal Loan Benefits

The most significant drawback is the loss of federal student loan benefits. This includes:

- Income-driven repayment plans (IDR): These plans base monthly payments on your income and family size.

- Deferment and forbearance options: Temporary pauses in payments during financial hardship.

- Public Service Loan Forgiveness (PSLF): Potential for loan forgiveness after 10 years of qualifying public service.

- Other federal loan forgiveness programs.

Higher Interest Rates (Potential)

While refinancing often aims for lower interest rates, it's not guaranteed. Your eligibility for a lower rate depends heavily on your credit score and financial situation. A poor credit score could lead to a higher interest rate than your current federal loans.

- Pre-qualification is crucial to avoid surprises.

- Shop around and compare rates from multiple lenders.

Risk of Default

Defaulting on a private student loan can have severe consequences, including damage to your credit score, wage garnishment, and legal action. Responsible borrowing is essential.

- Understand your repayment ability before refinancing.

- Create a realistic budget to ensure timely payments.

Who Should Consider Refinancing Federal Student Loans?

Refinancing is most advantageous for borrowers with:

- Excellent or good credit scores (typically 700 or higher).

- Stable income and employment history.

- A thorough understanding of the risks involved.

Refinancing might be beneficial if you:

- Have high interest rates on your federal loans.

- Have multiple federal student loans to consolidate.

Refinancing is generally not recommended if:

- You have a low credit score.

- Your income is unstable.

- You rely on federal loan benefits like IDR or PSLF.

How to Find the Best Refinancing Option

Finding the best refinancing option involves careful research and comparison:

- Compare interest rates and loan terms: Obtain quotes from multiple private lenders.

- Consider factors beyond interest rates: Look at fees (origination fees, prepayment penalties), customer service reviews, and lender reputation.

- Use reputable online tools: Many websites offer loan comparison tools to simplify the process.

To find the best refinance option:

- Check your credit score before applying.

- Compare offers from at least three lenders.

- Read reviews and check lender reputations.

- Carefully review the loan terms and conditions before signing.

Conclusion

Refinancing federal student loans can be a smart financial move for some borrowers, offering the potential for lower monthly payments and interest rates. However, it's crucial to carefully weigh the benefits against the loss of federal loan protections. Before deciding whether to refinance your federal student loans, thoroughly research lenders, compare rates and terms, and assess your financial situation to ensure it aligns with the risks involved. Make an informed decision about whether refinancing federal student loans is the right path for you. Start exploring your refinancing options today!

Featured Posts

-

Putin Dhe Presidenti I Emirateve Te Bashkuara Arabe Zhvillojne Bisedim Telefonik Cfare U Diskutua

May 17, 2025

Putin Dhe Presidenti I Emirateve Te Bashkuara Arabe Zhvillojne Bisedim Telefonik Cfare U Diskutua

May 17, 2025 -

Principal Financial Group Stock A 13 Analyst Review

May 17, 2025

Principal Financial Group Stock A 13 Analyst Review

May 17, 2025 -

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 17, 2025

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 17, 2025 -

A Fortnite Refund Case Potential Precursor To Cosmetic Policy Updates

May 17, 2025

A Fortnite Refund Case Potential Precursor To Cosmetic Policy Updates

May 17, 2025 -

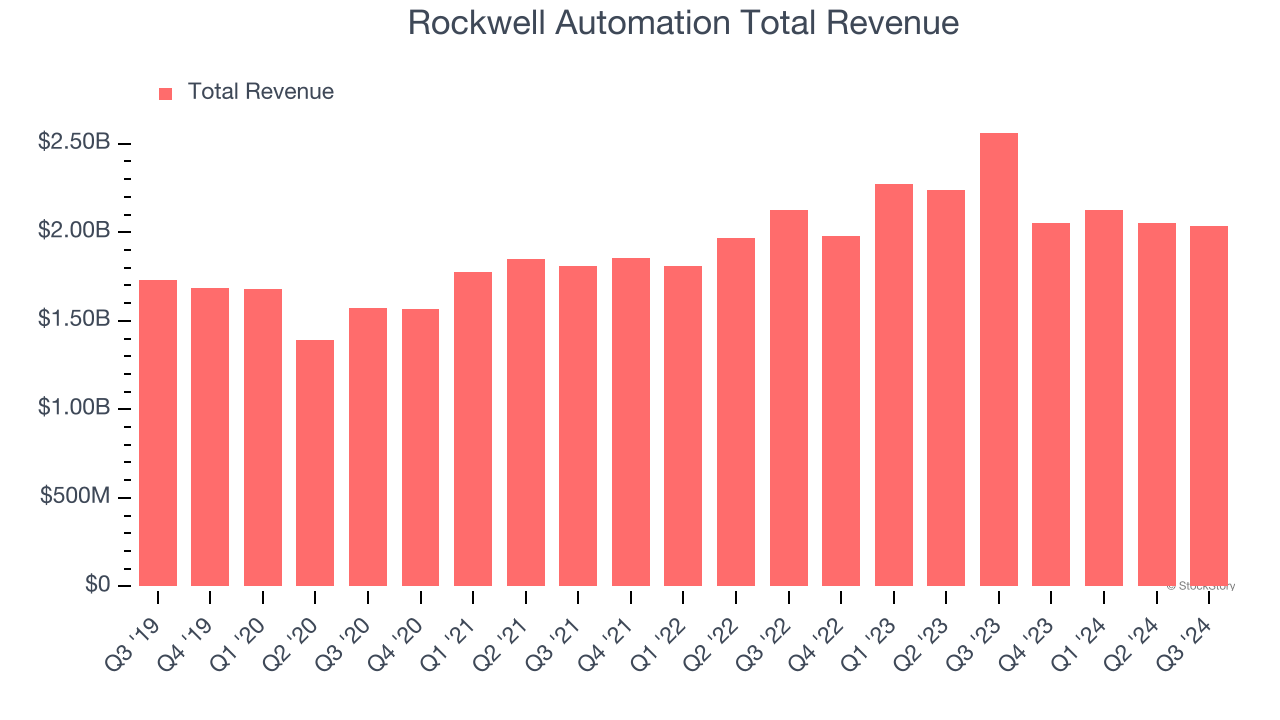

Rockwell Automation Earnings Beat Expectations Stock Surge And Market Movers

May 17, 2025

Rockwell Automation Earnings Beat Expectations Stock Surge And Market Movers

May 17, 2025

Latest Posts

-

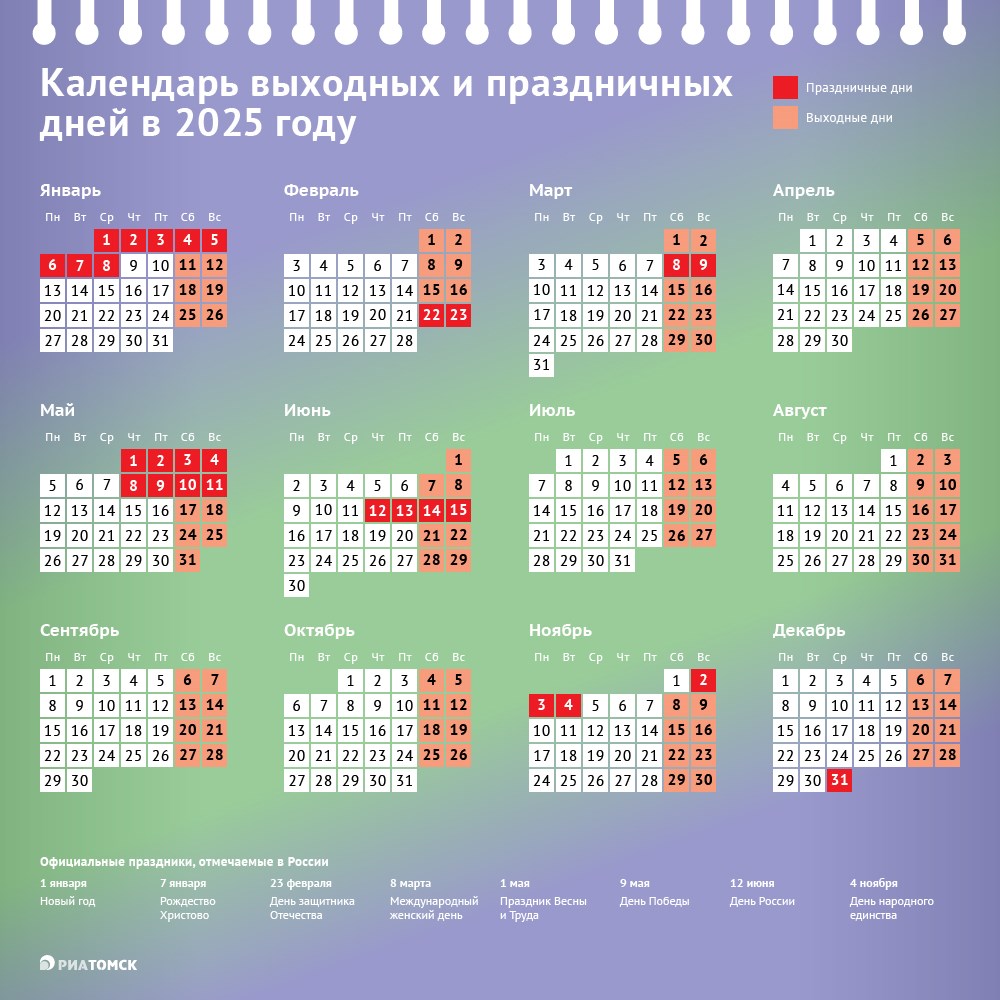

Zhizn I Rabota V Dubae Perspektivy Dlya Rossiyan V 2025 Godu

May 17, 2025

Zhizn I Rabota V Dubae Perspektivy Dlya Rossiyan V 2025 Godu

May 17, 2025 -

New York Knicks Suffer 37 Point Rout Thibodeau Calls For Improved Resolve

May 17, 2025

New York Knicks Suffer 37 Point Rout Thibodeau Calls For Improved Resolve

May 17, 2025 -

New Emirates Id Card Fee For Newborn Babies In Uae March 2025

May 17, 2025

New Emirates Id Card Fee For Newborn Babies In Uae March 2025

May 17, 2025 -

Rossiyane V Dubae Trudoustroystvo I Adaptatsiya V 2025 Godu

May 17, 2025

Rossiyane V Dubae Trudoustroystvo I Adaptatsiya V 2025 Godu

May 17, 2025 -

37 Point Loss Prompts Thibodeau To Demand More From The Knicks

May 17, 2025

37 Point Loss Prompts Thibodeau To Demand More From The Knicks

May 17, 2025