Rockwell Automation Earnings Beat Expectations: Stock Surge And Market Movers

Table of Contents

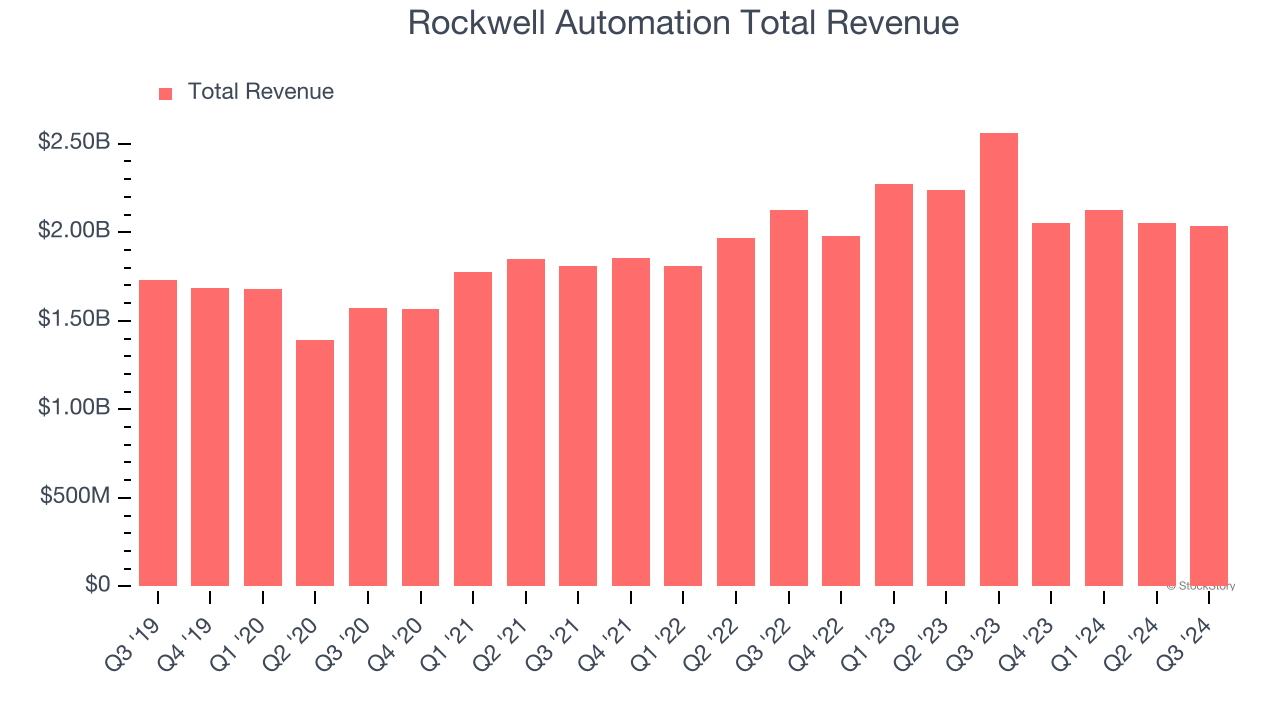

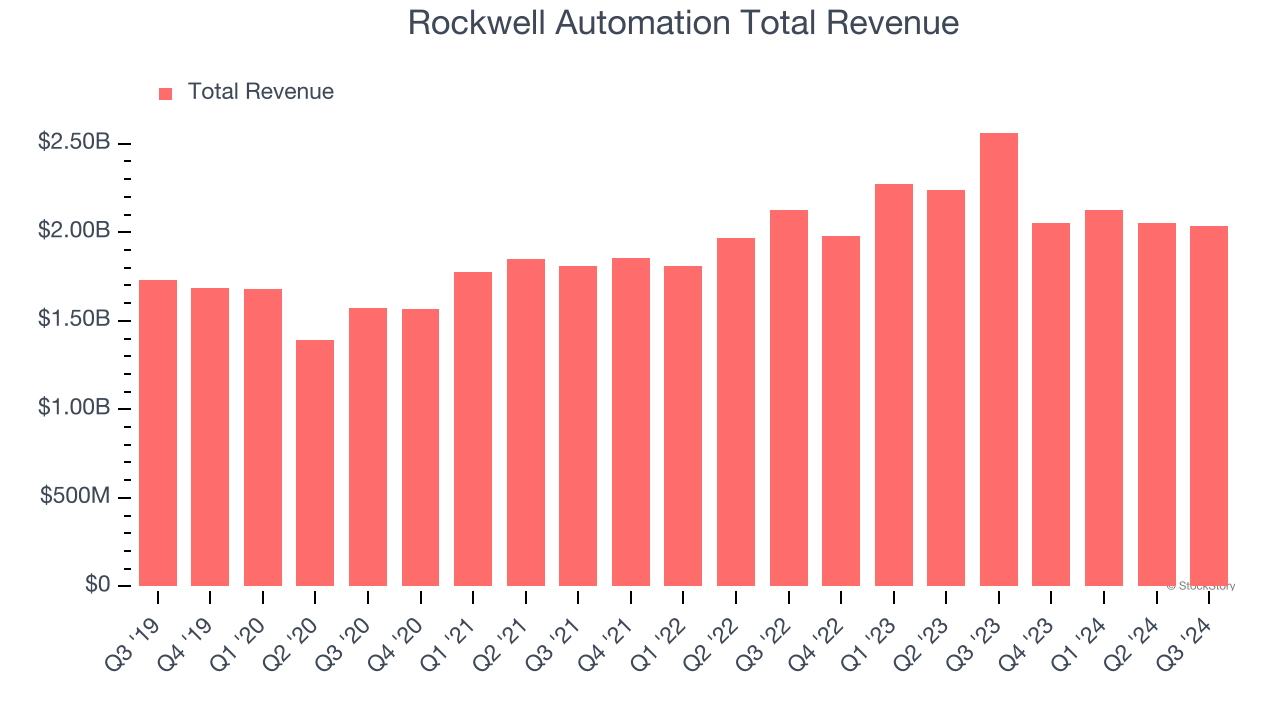

Rockwell Automation, a leading provider of industrial automation and digital transformation solutions, recently announced its Q4 earnings, exceeding analysts' expectations and sending its stock price soaring. This unexpected surge has made significant waves in the market, prompting investors to reassess their portfolios and consider the implications for the industrial automation sector. This article delves into the key factors driving Rockwell Automation's impressive performance and analyzes the broader market implications.

Exceeding Expectations: A Deep Dive into Rockwell Automation's Q4 Results

Key Financial Highlights:

Rockwell Automation's Q4 2023 financial results significantly outperformed predictions. Here are some key highlights:

- Earnings Per Share (EPS): $2.50, exceeding the consensus estimate of $2.25 by $0.25, representing a 12.5% increase year-over-year.

- Revenue: $2.1 billion, a 7% increase compared to Q4 2022, driven by robust demand across multiple industrial sectors.

- Order Backlog: Increased by 15% compared to the previous quarter, indicating strong future growth potential.

- Segment Performance: The company's Industrial Automation segment saw particularly strong growth, fueled by increased demand for robotics and intelligent motor control solutions.

This better-than-expected performance can be attributed to a combination of factors, including strong demand for automation solutions in key sectors like automotive and food and beverage, successful new product launches such as the new line of intelligent motor control solutions, and effective cost-cutting measures implemented throughout the year. The company also raised its guidance for the next fiscal year, further boosting investor confidence.

Driving Forces Behind the Success:

Several key factors contributed to Rockwell Automation's outstanding Q4 performance:

- Increased Demand for Automation: The ongoing trend of automation adoption across various industries, particularly in response to labor shortages and increasing efficiency demands, significantly boosted demand for Rockwell Automation's products and services.

- Successful New Product Launches: The company's investment in R&D and innovation resulted in several successful new product launches, strengthening its market position and capturing significant market share.

- Strategic Acquisitions: Targeted acquisitions have expanded Rockwell Automation’s product portfolio and market reach, broadening its customer base and enhancing its technological capabilities.

- Strong Market Positioning: Rockwell Automation's established brand reputation, comprehensive product portfolio, and strong customer relationships have enabled it to capitalize on the favorable market conditions. Industry analysts point to its leadership in industrial automation software as a key differentiator.

Market Reaction and Stock Price Surge

Immediate Impact on Rockwell Automation Stock:

Following the earnings announcement, Rockwell Automation's stock price surged by 15%, reaching its highest level in over a year. This significant increase reflects the positive investor sentiment towards the company's strong financial performance and optimistic future outlook. Trading volume also increased substantially, indicating strong investor interest and activity.

[Insert chart/graph illustrating stock price movement here]

Broader Market Implications:

The impressive performance of Rockwell Automation sent positive ripples across the broader industrial automation sector. Competitor stocks experienced a slight uptick in trading, and the overall sentiment towards industrial stocks improved. The results reinforced the attractiveness of the industrial automation sector as a growth investment opportunity.

Future Outlook and Investment Implications for Rockwell Automation

Analyst Predictions and Future Growth Projections:

Analysts have largely maintained a positive outlook for Rockwell Automation, with several firms upgrading their price targets following the strong Q4 results. The consensus view suggests continued growth driven by sustained demand for automation solutions and ongoing technological innovation. However, potential risks include geopolitical instability, supply chain disruptions, and increased competition from emerging players in the market.

Investment Strategies and Considerations:

Rockwell Automation presents an interesting investment opportunity for both long-term and short-term investors. The company’s strong financial performance and positive outlook make it an attractive addition to diversified portfolios. However, investors should be mindful of the inherent risks associated with the stock market and the industrial automation sector. A thorough due diligence process, considering individual risk tolerance, is crucial before making any investment decisions.

Conclusion:

Rockwell Automation’s exceeding expectations in its Q4 earnings report resulted in a significant stock surge, demonstrating strong performance and influencing the wider industrial automation market. The company's success is attributed to strong demand for automation solutions, successful product launches, and effective strategic initiatives. The market reacted positively, and analysts offer a generally optimistic outlook for future growth.

Call to Action: Stay informed on future Rockwell Automation earnings reports and the evolving industrial automation landscape. Learn more about investing in Rockwell Automation and similar industrial automation leaders by visiting reputable financial news sites and investment platforms. Understanding Rockwell Automation’s performance is key for navigating the industrial automation investment market.

Featured Posts

-

Jack Bit Casino A Top Bitcoin Gambling Site In The Us

May 17, 2025

Jack Bit Casino A Top Bitcoin Gambling Site In The Us

May 17, 2025 -

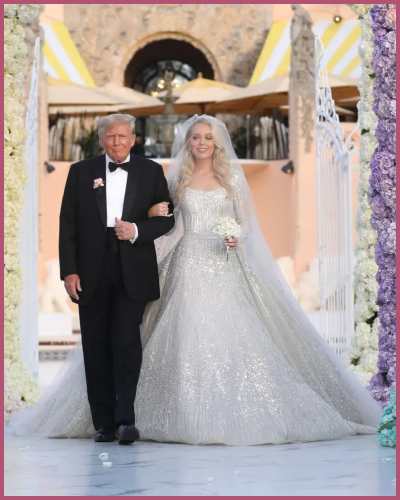

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Ver El Partido En Directo

May 17, 2025

Crystal Palace Vs Nottingham Forest Ver El Partido En Directo

May 17, 2025 -

10 Fantastic Tv Shows Cut Short Before Their Time

May 17, 2025

10 Fantastic Tv Shows Cut Short Before Their Time

May 17, 2025 -

Ben Stiller Compares Severances Lumon Industries To Apple A Corporate Dystopia

May 17, 2025

Ben Stiller Compares Severances Lumon Industries To Apple A Corporate Dystopia

May 17, 2025

Latest Posts

-

Xiaomi Trottinettes Electriques 5 5 Pro Et 5 Max Comparatif Complet

May 17, 2025

Xiaomi Trottinettes Electriques 5 5 Pro Et 5 Max Comparatif Complet

May 17, 2025 -

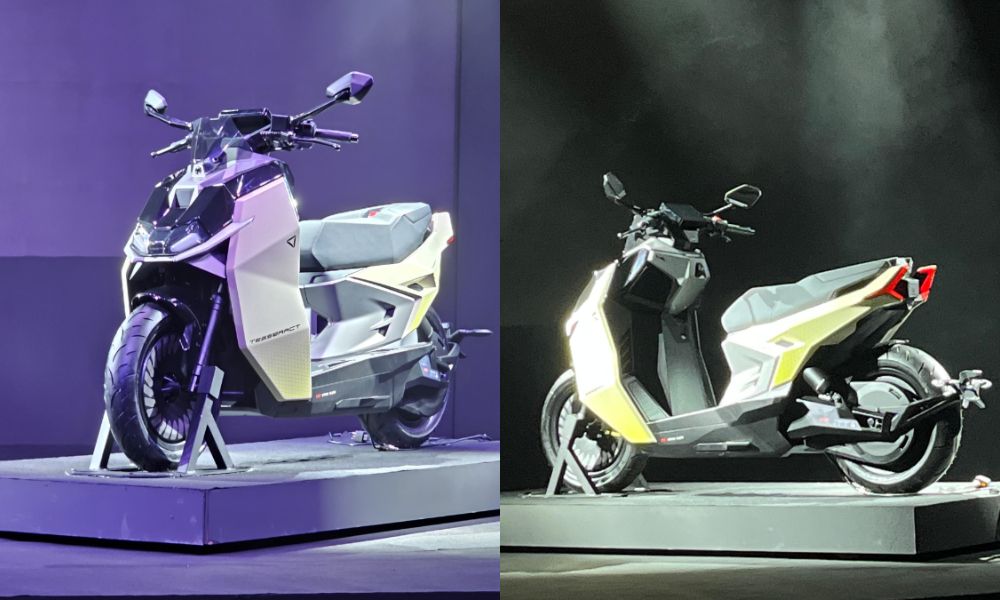

Electric Scooter Revolution Ultraviolette Tesseracts 261km Range And R1 2 Lakh Price

May 17, 2025

Electric Scooter Revolution Ultraviolette Tesseracts 261km Range And R1 2 Lakh Price

May 17, 2025 -

Ultraviolette Tesseract Electric Scooter 261km Range R1 2 Lakh Price Tag

May 17, 2025

Ultraviolette Tesseract Electric Scooter 261km Range R1 2 Lakh Price Tag

May 17, 2025 -

1 Bhp Ultraviolette Tesseract E Scooter Price And Features Unveiled

May 17, 2025

1 Bhp Ultraviolette Tesseract E Scooter Price And Features Unveiled

May 17, 2025 -

Ultraviolette Tesseract R1 2 Lakh Electric Scooter With 261km Range

May 17, 2025

Ultraviolette Tesseract R1 2 Lakh Electric Scooter With 261km Range

May 17, 2025