Reduced Growth Forces SSE To Cut £3 Billion From Spending

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

The £3 billion reduction in SSE's spending reflects a confluence of factors contributing to a challenging financial landscape for the energy industry. Several key issues have forced the company to reassess its investment strategy and prioritize projects with higher returns.

-

Increased Inflation and Rising Interest Rates: Soaring inflation and increased interest rates have significantly impacted the viability of many energy projects. The increased cost of borrowing makes financing large-scale initiatives, such as renewable energy projects, considerably more expensive, reducing their overall return on investment (ROI). This necessitates a stricter evaluation of all investment opportunities.

-

Reduced Consumer Demand: The ongoing cost of living crisis has led to a reduction in consumer energy demand. Higher energy prices have forced households and businesses to curb their consumption, impacting revenue projections for energy companies like SSE. This reduced demand makes it harder to justify large capital expenditures (CAPEX).

-

Uncertainty in the Energy Market: Geopolitical factors, such as the ongoing war in Ukraine, have created significant volatility in global energy markets. Fluctuating energy prices make accurate long-term forecasting incredibly difficult, increasing the risk associated with large-scale investments. The uncertainty surrounding future energy prices directly influences investment decisions.

-

Stringent Regulatory Changes: Changes in energy regulations and policies add another layer of complexity to investment planning. New environmental standards and stricter emission controls can increase the cost and complexity of projects, requiring thorough assessments of their compliance and long-term viability. These regulatory hurdles can significantly impact profitability.

-

Reassessment of Investment Portfolio: SSE's decision reflects a strategic reassessment of its investment portfolio. The company is now focusing on projects with higher ROI and reduced risk, prioritizing efficiency and profitability over ambitious, long-term growth strategies. This shift in focus is a direct response to the current economic realities.

Impact of the Spending Cuts on SSE's Operations

The £3 billion spending cut will undoubtedly have significant repercussions on SSE's operations and its future trajectory. The company will likely experience:

-

Potential Delays or Cancellations of Renewable Energy Projects: The most immediate impact could be delays or cancellations of planned renewable energy projects, such as wind farms and solar farms. These projects typically require substantial upfront investment and are highly sensitive to changes in financing costs and market conditions.

-

Impact on Network Infrastructure Upgrades and Maintenance: Deferred maintenance and upgrades to the network infrastructure could compromise the reliability and efficiency of the energy supply. Reduced investment in infrastructure modernization poses a potential risk to the long-term stability of the energy grid.

-

Possible Job Losses: Cost-cutting measures often translate into job losses. While SSE has not yet announced specific numbers, it is likely that job losses across various departments will be necessary to align the company’s operational costs with its reduced budget.

-

Focus on Operational Efficiency: SSE will likely implement measures to improve operational efficiency, aiming to minimize costs without compromising the quality of service provided to customers. This could involve streamlining processes, optimizing energy production, and implementing cost-saving technologies.

-

Shift Towards Less Capital-Intensive Projects: The company is expected to shift its focus toward projects requiring less capital investment and offering quicker returns. This could mean a temporary slowdown in large-scale renewable energy projects in favour of smaller, more immediately profitable ventures.

Potential Long-Term Consequences for SSE and the Energy Sector

The long-term consequences of SSE's £3 billion spending cut extend beyond the company itself, influencing the wider energy sector and the UK's energy transition goals.

-

Impact on SSE's Long-Term Growth and Market Share: The reduction in investment could hinder SSE's long-term growth and potentially impact its market share. Competitors who can secure financing and continue investing may gain a competitive advantage.

-

Implications for the UK's Renewable Energy Targets: The delay or cancellation of renewable energy projects could affect the UK's commitment to achieving its ambitious renewable energy targets and its overall carbon reduction goals. This reduction in investment could slow down the much-needed transition to a greener energy system.

-

Effect on Investor Confidence and Credit Rating: The spending cuts could negatively impact investor confidence in SSE and potentially lead to a downgrade in the company's credit rating. This, in turn, could make it more difficult and expensive to secure future financing.

-

Increased Competition and Strategic Partnerships: The challenging market conditions could lead to increased competition among energy providers, potentially encouraging strategic alliances, mergers, or acquisitions to enhance competitiveness and share resources.

-

Long-Term Sustainability of the Energy Sector: Reduced investment across the energy sector could jeopardize the long-term sustainability of the industry, impacting innovation, infrastructure development, and the broader energy transition.

Conclusion

SSE's decision to slash £3 billion from its spending underscores the significant challenges facing the energy sector due to reduced growth, increased inflation, and market volatility. These spending cuts will have far-reaching consequences, potentially delaying crucial renewable energy projects and impacting job security. The long-term implications for SSE and the wider UK energy sector remain uncertain, raising concerns about the nation's energy security and its transition to a low-carbon future. Stay informed about the evolving situation and the implications of this major spending reduction. Follow our updates on SSE and the energy sector for insights into the future of energy investment and the impact of reduced growth on major energy providers. Understand the implications of spending cuts and their effect on the energy market.

Featured Posts

-

Al Roker And Today Show Co Host In Public Dispute Following Private Conversation

May 24, 2025

Al Roker And Today Show Co Host In Public Dispute Following Private Conversation

May 24, 2025 -

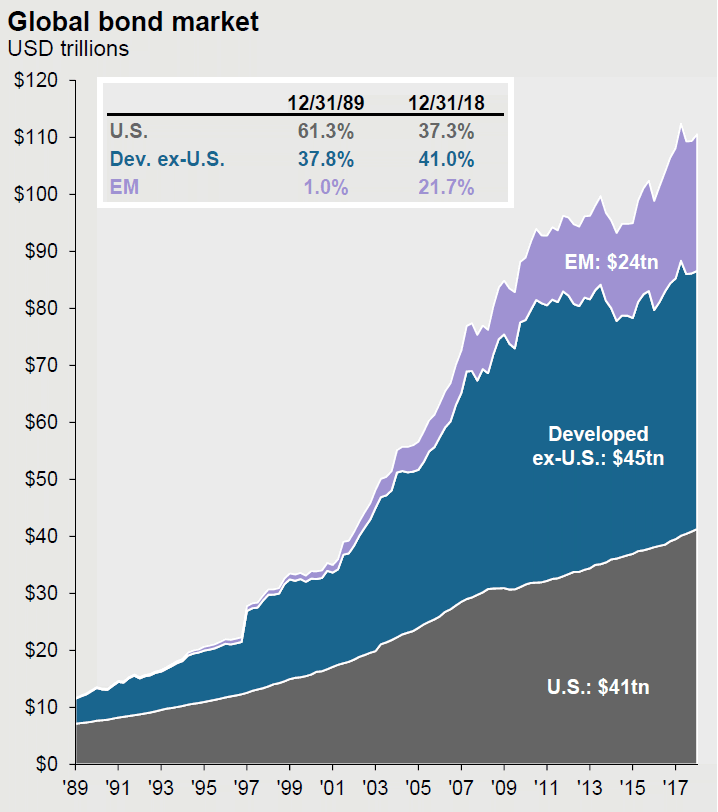

Global Bond Market Instability A Posthaste Analysis Of Emerging Risks

May 24, 2025

Global Bond Market Instability A Posthaste Analysis Of Emerging Risks

May 24, 2025 -

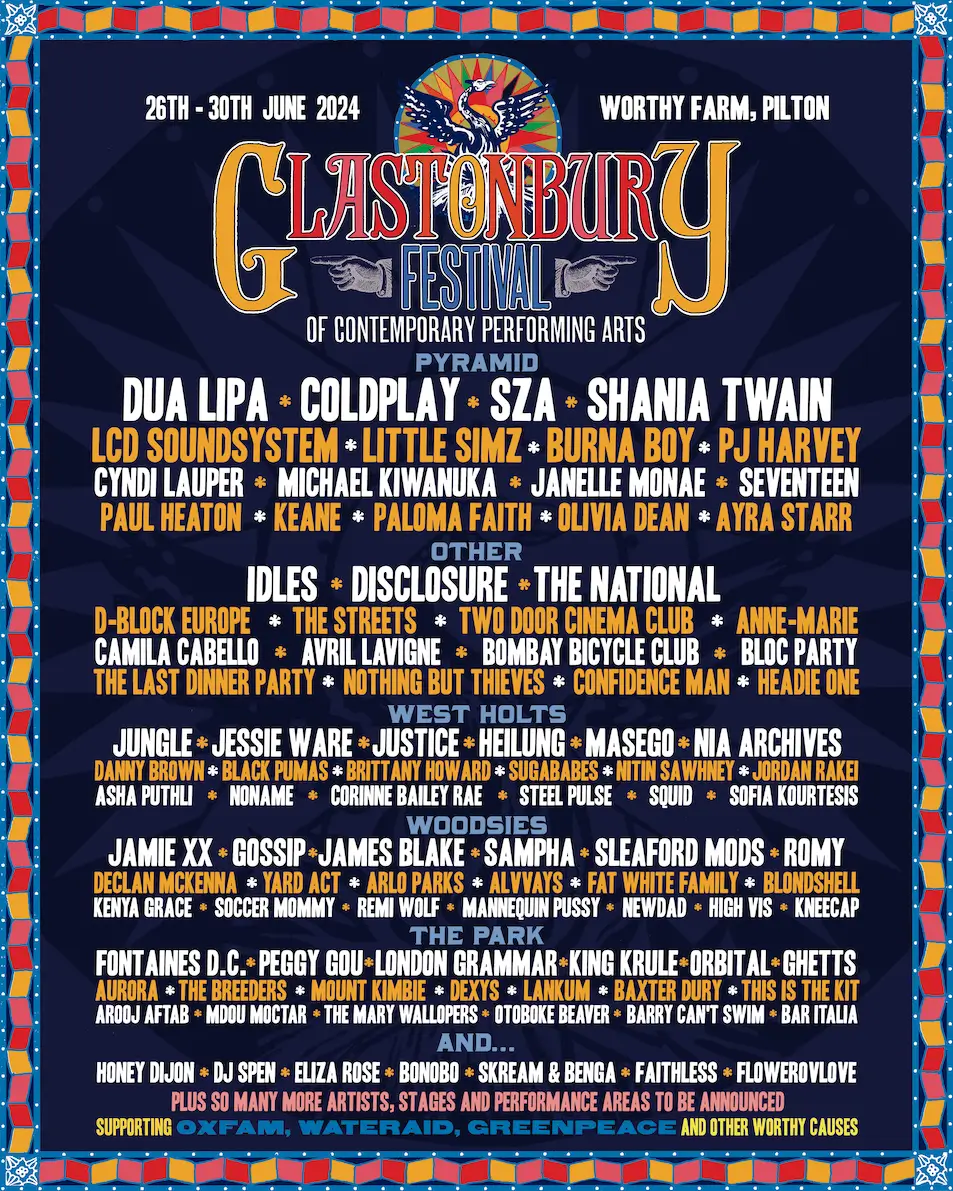

Glastonbury 2025 Full Lineup Announcement Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Full Lineup Announcement Olivia Rodrigo The 1975 And More

May 24, 2025 -

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 24, 2025

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 24, 2025 -

Costi Daziari Stati Uniti Come Influenzano I Prezzi Della Moda

May 24, 2025

Costi Daziari Stati Uniti Come Influenzano I Prezzi Della Moda

May 24, 2025

Latest Posts

-

Sheinelle Jones Missing From Today Show Colleagues Address Speculation

May 24, 2025

Sheinelle Jones Missing From Today Show Colleagues Address Speculation

May 24, 2025 -

Today Show Features Sheinelle Jones Navigating Daily Routine During Absence

May 24, 2025

Today Show Features Sheinelle Jones Navigating Daily Routine During Absence

May 24, 2025 -

Concerns Grow Over Sheinelle Jones Absence From The Today Show

May 24, 2025

Concerns Grow Over Sheinelle Jones Absence From The Today Show

May 24, 2025 -

Sheinelle Jones Absence Colleagues Speak Out

May 24, 2025

Sheinelle Jones Absence Colleagues Speak Out

May 24, 2025 -

Sheinelle Jones Return To The Today Show A Health Update

May 24, 2025

Sheinelle Jones Return To The Today Show A Health Update

May 24, 2025