Real Estate Market Crisis: Home Sales At Record Lows

Table of Contents

Soaring Interest Rates: A Major Culprit in the Housing Market Slowdown

Rising interest rates are a primary driver of the current housing market slowdown. The direct correlation between interest rate hikes and reduced affordability for potential homebuyers is undeniable. The Federal Reserve's aggressive interest rate increases, aimed at curbing inflation, have drastically increased mortgage rates. This translates to significantly higher monthly mortgage payments, effectively pricing many potential buyers out of the market.

For example, a 30-year fixed-rate mortgage at 3% interest would have monthly payments significantly lower than the same mortgage at 7%. This difference, even on modest-priced homes, can be substantial.

- Higher monthly payments deter potential buyers. The increased financial burden associated with higher interest rates makes homeownership unattainable for many.

- Reduced purchasing power shrinks the pool of qualified buyers. Higher mortgage rates decrease the amount a buyer can borrow, reducing the price range of homes they can afford.

- Increased borrowing costs impact investor activity. Investors, sensitive to interest rate fluctuations, are scaling back their purchases, further impacting market demand.

The combination of these factors, fueled by significant interest rate hikes, is creating a considerable challenge in the current real estate market, contributing significantly to the crisis of record low home sales. Keywords: Interest rate hikes, mortgage rates, affordability crisis, housing market slowdown.

Inflation and Economic Uncertainty: Chilling the Real Estate Market

Beyond interest rates, inflation and economic uncertainty are significantly chilling the real estate market. High inflation erodes consumer confidence and reduces disposable income, making large purchases like homes less feasible. The fear of an impending recession further discourages buyers from making significant financial commitments.

- Fear of recession discourages major purchases like homes. Uncertainty about job security and future economic stability makes potential buyers hesitant to commit to long-term financial obligations.

- Inflation erodes savings and reduces disposable income. The rising cost of living leaves less money available for a down payment and ongoing housing expenses.

- Uncertainty about job security affects buying decisions. The fear of job loss in an uncertain economic climate discourages potential homebuyers from making such a significant investment.

This combination of economic headwinds is fostering market volatility and contributing to the current real estate market crisis characterized by record low home sales. Keywords: Inflation, economic uncertainty, consumer confidence, recession fears, market volatility.

Limited Inventory and High Home Prices: A Supply-Demand Imbalance

The current real estate market crisis is further exacerbated by a significant supply-demand imbalance. A persistent shortage of homes on the market, combined with high home prices, creates a challenging environment for potential buyers. This shortage is driven by several factors, including elevated construction costs and limited land availability.

- High demand and low supply drive up prices. The limited number of homes available for sale intensifies competition, pushing prices upward and making homes less accessible.

- Construction costs remain elevated, hindering new builds. The high cost of materials and labor makes new home construction less profitable, slowing down the pace of new housing supply.

- Lack of affordable housing options exacerbates the problem. The shortage is particularly acute in the affordable housing segment, leaving many potential buyers with limited options.

This imbalance contributes to the overall real estate market crisis and the resulting record low home sales, creating a significant challenge for both buyers and sellers. Keywords: Housing shortage, low inventory, high home prices, supply and demand imbalance, new construction.

Potential Long-Term Impacts of the Real Estate Market Crisis

The prolonged period of low home sales carries significant potential long-term consequences for the broader economy. The impact extends beyond the housing sector itself, affecting related industries and potentially leading to a broader economic downturn.

- Job losses in related industries. A slowdown in the housing market leads to reduced demand for building materials, construction services, and other related goods and services, resulting in job losses.

- Potential for a broader economic downturn. The housing market's significant contribution to the overall economy means a prolonged slump could have ripple effects across various sectors.

- Impact on local and national tax revenue. Lower home sales translate into reduced property taxes and related revenue streams for local and national governments.

These potential long-term implications highlight the severity of the current real estate market crisis and the need for proactive measures to address the underlying challenges. Keywords: Economic impact, long-term consequences, housing market downturn, related industries.

Conclusion: Navigating the Real Estate Market Crisis: A Path Forward

The current real estate market crisis, characterized by record low home sales, is a complex issue stemming from a confluence of factors: soaring interest rates, inflation and economic uncertainty, and a limited inventory of homes at high prices. These challenges have created a difficult environment for both buyers and sellers, with potential long-term consequences for the broader economy.

Understanding the current real estate market crisis is crucial. Stay informed on the latest trends and consult with a real estate expert to navigate this challenging market. Proactive planning and informed decision-making are essential for navigating this period of market volatility and uncertainty. Don't hesitate to seek professional advice to understand the implications of this real estate market crisis on your specific circumstances.

Featured Posts

-

The Elon Musk Reckoning Examining His Current Predicament

May 31, 2025

The Elon Musk Reckoning Examining His Current Predicament

May 31, 2025 -

Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025

Duncan Bannatynes Support For Moroccan Childrens Charity

May 31, 2025 -

Fast Track Approval For Sanofis Chlamydia Vaccine Candidate A Significant Step Forward

May 31, 2025

Fast Track Approval For Sanofis Chlamydia Vaccine Candidate A Significant Step Forward

May 31, 2025 -

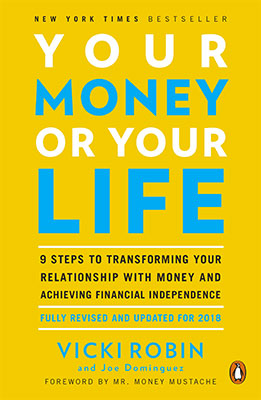

Podcast Transforming Your Relationship With Money

May 31, 2025

Podcast Transforming Your Relationship With Money

May 31, 2025 -

What Is The Good Life Defining Your Ideal Lifestyle

May 31, 2025

What Is The Good Life Defining Your Ideal Lifestyle

May 31, 2025