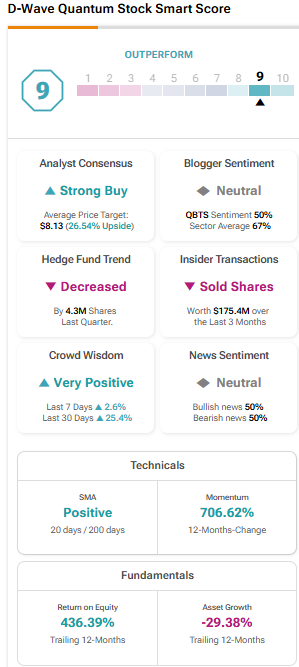

QBTS Earnings Announcement: Implications For Investors

Table of Contents

Key Financial Highlights of the QBTS Earnings Report

QBTS (QuickBooks Technology Solutions - replace with actual company name and industry if different), reported [Insert Quarter/Year] earnings that showcase [Overall positive or negative performance summary, e.g., robust growth or a period of readjustment]. Let's delve into the specific financial metrics:

-

Revenue: [Amount] (YoY change: [+/-]% ). This represents a [positive/negative] shift compared to the same period last year, primarily driven by [mention key factors driving revenue change, e.g., increased market share, successful product launches, or economic headwinds].

-

EPS (Earnings Per Share): [Amount] (YoY change: [+/-]% ). The change in EPS reflects [explain factors influencing EPS, e.g., cost-cutting measures, increased revenue, or higher operating expenses].

-

Net Income: [Amount] (YoY change: [+/-]% ). A [positive/negative] change in net income, attributable to [explain key factors, e.g., improved profitability, increased sales, or one-time charges].

-

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): [Amount] (YoY change: [+/-]% ). This metric offers insight into the company's operating performance, independent of financing and accounting decisions.

-

Operating Margin: [Percentage] (YoY change: [+/-]% ). Changes in the operating margin indicate shifts in the efficiency of the company's operations.

Analysis of QBTS's Performance Against Expectations

Comparing the reported earnings to analyst expectations reveals whether QBTS met, beat, or missed the mark. Analyst consensus predicted [state the analyst expectation for key metrics like EPS and Revenue]. QBTS's actual results [state whether results beat, met, or missed expectations, e.g., exceeded expectations across the board, slightly missed expectations on revenue, etc.].

Key factors contributing to this performance include:

-

Market Conditions: The overall [industry name] market experienced [describe the market conditions, e.g., strong growth, significant contraction, increased competition]. This significantly impacted QBTS's [mention specific impact on revenue, sales etc.].

-

Company Strategy: QBTS's strategic initiatives, such as [mention key strategies, e.g., new product launches, market expansion, cost-cutting measures], played a [positive/negative] role in the overall performance.

-

Operational Efficiency: Improvements/deterioration in operational efficiency led to [positive/negative] effects on profitability.

-

One-Time Events: [Mention any significant one-time events, e.g., acquisitions, write-downs, or legal settlements] that influenced the reported earnings.

Implications for QBTS Stock and Future Outlook

The QBTS earnings announcement is likely to have a significant impact on the QBTS stock price. Based on the reported results, we can anticipate [predict potential stock price movement, e.g., a short-term price increase, a period of consolidation, or a potential decline].

The future outlook for QBTS depends on several factors:

-

Stock Price Increase/Decrease Predictions: [Explain the reasoning behind your prediction, referencing the financial highlights and market analysis.]

-

Potential for Dividend Changes: [Discuss the possibility of dividend increases or decreases based on the company's profitability and financial health.]

-

Long-Term Growth Prospects: Considering the current market trends and QBTS's strategic direction, the long-term growth potential appears [positive/negative/uncertain]. The company's guidance for [mention upcoming quarters/years] suggests [explain the company’s outlook based on their official statement].

Risk Factors and Considerations for Investors

Investing in QBTS, like any investment, carries inherent risks. Before making any investment decisions, it's crucial to consider the following:

-

Market Volatility: The overall market's instability can significantly impact QBTS's stock price.

-

Competition: Intense competition within the [industry name] sector presents a challenge to QBTS's market share and profitability.

-

Regulatory Changes: Changes in regulations could significantly affect QBTS's operations and profitability.

-

Economic Factors: Macroeconomic factors, such as inflation and recessionary pressures, can influence investor sentiment and QBTS's performance. A thorough risk assessment and due diligence are essential before making an investment.

Conclusion: Making Informed Decisions Based on the QBTS Earnings Announcement

The QBTS earnings announcement provides valuable insights into the company's recent performance and future outlook. Understanding the key financial highlights, comparing them to expectations, and analyzing potential risks is critical for making informed investment decisions. Remember to conduct thorough research and consider your personal risk tolerance before investing in QBTS. Stay informed about future QBTS earnings announcements and market trends to make well-informed investment decisions regarding QBTS financial reports and understand QBTS earnings more effectively.

Featured Posts

-

Understanding The Monday Dip In D Wave Quantum Qbts Stock Price

May 20, 2025

Understanding The Monday Dip In D Wave Quantum Qbts Stock Price

May 20, 2025 -

Tri Godine Sukoba Tadi I Reaktsi A Na Napad Na Detsu U Bi Kh

May 20, 2025

Tri Godine Sukoba Tadi I Reaktsi A Na Napad Na Detsu U Bi Kh

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 20 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 20 2025

May 20, 2025 -

Hmrc Child Benefit Alerts What To Do When You Receive A Message

May 20, 2025

Hmrc Child Benefit Alerts What To Do When You Receive A Message

May 20, 2025 -

Explore Local History Burnham And Highbridge Photo Archive Grand Opening

May 20, 2025

Explore Local History Burnham And Highbridge Photo Archive Grand Opening

May 20, 2025

Latest Posts

-

Efimereyontes Iatroi Patras Savvatokyriako 10 11 Maioy 2024

May 20, 2025

Efimereyontes Iatroi Patras Savvatokyriako 10 11 Maioy 2024

May 20, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Rodoy Plirofories And Programmatismos

May 20, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Rodoy Plirofories And Programmatismos

May 20, 2025 -

Patra Lista Efimereyonton Giatron 10 And 11 Maioy

May 20, 2025

Patra Lista Efimereyonton Giatron 10 And 11 Maioy

May 20, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Mia Moysiki Bradia

May 20, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Mia Moysiki Bradia

May 20, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025