Understanding The Monday Dip In D-Wave Quantum (QBTS) Stock Price

Table of Contents

Weekend News and Market Sentiment

The period between Friday's closing bell and Monday's opening is ripe for news dissemination and its impact on investor sentiment. This significantly influences the QBTS stock price and contributes to the Monday dip.

Impact of Weekend News Releases

News released over the weekend can dramatically shift investor perception of QBTS and the broader quantum computing market. This includes announcements from D-Wave itself, competitor developments, or broader macroeconomic news.

- Negative News: Negative news such as reports of competitor breakthroughs in quantum computing algorithms, regulatory setbacks for the company, or financial losses reported by similar tech firms can lead to selling pressure on Monday morning. Investors may react swiftly, resulting in a downward price movement.

- Positive News: Conversely, positive news like successful implementations of D-Wave's quantum computers, strategic partnerships with major corporations, or positive industry reports can mitigate or even reverse the Monday dip. However, the speed at which this information is processed and acted upon can still affect the initial opening price.

- Dissemination Speed: The rapid spread of information in today's digital world means news can impact trading even before the market opens. Social media, financial news outlets, and dedicated investment forums contribute to the formation of investor sentiment before the first trades occur.

Psychological Factors

The weekend break from trading allows investors time to reflect on their portfolios and reassess their positions. This can lead to a psychological effect that contributes to Monday's price drop.

- Fear of Losing Out (FLO): The exuberance of a strong trading week might give way to a "fear of losing out" (FLO) on Monday, prompting profit-taking. Investors who may have missed out on gains during the week might wait until the start of the new week to adjust their holdings.

- Risk Aversion: A general risk aversion often accompanies the beginning of the week. Investors may be less inclined to take risks after the weekend break, contributing to selling pressure on Monday for riskier assets like QBTS stock.

- Profit-Taking: Investors who have accumulated gains during the preceding week may decide to secure their profits by selling shares at the beginning of the trading week, creating downward pressure on the price.

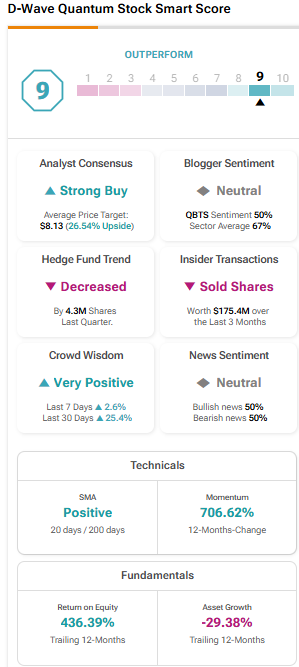

Technical Analysis and Trading Patterns

Technical analysis of QBTS stock charts can reveal patterns and indicators that might partially explain the Monday dip.

Chart Patterns and Indicators

Analyzing historical QBTS price data can highlight recurring chart patterns associated with the Monday dip.

- Resistance Levels: The QBTS price might repeatedly hit resistance levels at the opening on Monday, leading to a price drop.

- Support Levels: Conversely, observing support levels can potentially predict the depth of the Monday dip.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can help identify trends and potential reversal points that may contribute to the Monday dip.

Algorithmic Trading and Programmed Selling

Algorithmic trading plays a significant role in modern stock markets. Pre-programmed sell orders can be a contributing factor to the Monday dip.

- Algorithmic Function: Algorithms frequently execute trades based on pre-defined parameters. These parameters might include time-based triggers, such as selling at the opening bell on Monday, regardless of the prevailing market sentiment.

- Programmed Sell Orders: Some algorithms are designed to liquidate positions at the start of a new week, potentially exacerbating the Monday effect for QBTS stock.

- Influence on QBTS: This automated selling pressure can significantly impact the price in the early hours of trading, creating a downward trend that's self-reinforcing and can last for several hours into the trading day.

Broader Market Influences

The QBTS Monday dip isn't isolated; it's also influenced by broader market trends.

Correlation with the Tech Sector

The performance of QBTS often mirrors that of the broader tech sector. A downturn in the overall technology market on Monday can exacerbate the dip in QBTS stock price.

- Sectoral Correlation: Data analysis of QBTS performance alongside leading technology indices can reveal the degree of correlation, confirming whether general market sentiment plays a role.

- Macroeconomic Factors: Interest rate hikes, inflation concerns, or broader economic slowdowns negatively affecting the tech sector also contribute to the price dip.

Geopolitical and Economic Factors

Global events can greatly impact investor sentiment and risk appetite, affecting QBTS stock price, particularly at the week's start.

- Geopolitical Instability: Uncertainty caused by geopolitical events can lead to risk-off sentiment, prompting investors to sell off assets, including QBTS stock.

- Economic News: Major economic announcements, such as unexpected inflation reports or changes in monetary policy, often lead to market volatility, affecting stocks across all sectors, including quantum computing.

Conclusion

The "Monday dip" in D-Wave Quantum (QBTS) stock price is a complex phenomenon influenced by a confluence of factors. Weekend news, psychological investor behavior, technical chart patterns, algorithmic trading, and broader market conditions all play a role. While the Monday dip presents potential opportunities, understanding these dynamics is crucial for informed investment decisions.

Call to Action: While the Monday dip in D-Wave Quantum (QBTS) stock presents a potential opportunity for shrewd investors, it's crucial to carefully analyze market trends and news before making investment decisions. Continue researching D-Wave Quantum (QBTS) and the quantum computing sector to make informed decisions regarding QBTS stock price and other quantum computing investments. Understanding these contributing factors to the Monday dip in QBTS is key to successful D-Wave Quantum (QBTS) investment strategies.

Featured Posts

-

Tadic Daytonov Sporazum Koliko Politicko Sarajevo Gubi Njegovim Rusenjem

May 20, 2025

Tadic Daytonov Sporazum Koliko Politicko Sarajevo Gubi Njegovim Rusenjem

May 20, 2025 -

Schumacher La Cruda Verdad De Su Regreso A La F1 En 2010

May 20, 2025

Schumacher La Cruda Verdad De Su Regreso A La F1 En 2010

May 20, 2025 -

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025 -

Zayn Under Siege Rollins And Breakkers Wwe Raw Attack

May 20, 2025

Zayn Under Siege Rollins And Breakkers Wwe Raw Attack

May 20, 2025 -

Dusan Tadic In Sueper Lig Yolculugu 100 Mac

May 20, 2025

Dusan Tadic In Sueper Lig Yolculugu 100 Mac

May 20, 2025

Latest Posts

-

Doubters To Believers A Klopp Era Liverpool Fc Review

May 21, 2025

Doubters To Believers A Klopp Era Liverpool Fc Review

May 21, 2025 -

Son Dakika Juergen Klopp Un Gelecegi Hakkinda Guencel Haberler

May 21, 2025

Son Dakika Juergen Klopp Un Gelecegi Hakkinda Guencel Haberler

May 21, 2025 -

Juergen Klopp Nereye Gidiyor Transfer Spekuelasyonlari Ve Analiz

May 21, 2025

Juergen Klopp Nereye Gidiyor Transfer Spekuelasyonlari Ve Analiz

May 21, 2025 -

Cancelled But Not Forgotten Little Britains Gen Z Following

May 21, 2025

Cancelled But Not Forgotten Little Britains Gen Z Following

May 21, 2025 -

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025