Public Sector Pension Reform: Addressing The Taxpayer Burden

Table of Contents

The Growing Fiscal Challenge of Public Sector Pensions

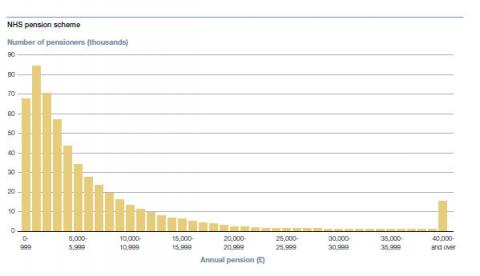

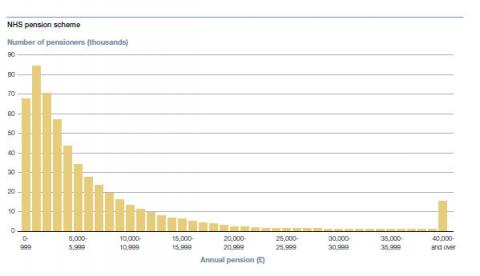

Public sector pension schemes are facing a perfect storm of escalating costs, putting immense pressure on government budgets. The traditional defined benefit model, promising a specific monthly payment upon retirement, is proving increasingly difficult to sustain in the face of several significant factors. These escalating costs are unsustainable in the long run and demand proactive measures.

- Rising Life Expectancy: Increased longevity means retirees are drawing pensions for longer periods, significantly increasing the overall financial burden.

- Generous Benefits and Early Retirement: Many public sector pension plans offer generous benefits and early retirement options, contributing to higher payouts and earlier depletion of funds.

- Underfunding of Pension Plans: Past underfunding of pension plans has left a significant shortfall, creating a large and growing liability for taxpayers.

- Economic Downturns: Periods of economic instability negatively impact investment returns, further exacerbating the funding gap.

- Demographic Shifts: An increasing number of retirees relative to the working-age population intensifies the pressure on the system.

The impact is stark. For example, in [insert specific country/region example], public sector pension liabilities have grown by [insert percentage or specific number] in the last [insert timeframe], leading to [insert specific consequence, e.g., increased tax rates, reduced spending in other areas]. These figures highlight the urgency of addressing this fiscal challenge.

Strategies for Public Sector Pension Reform

Several strategies can be implemented to reform public sector pensions and create a more sustainable system. These reforms require careful consideration of their impact on both current and future retirees and the overall financial health of the public sector.

- Increasing the Retirement Age: Gradually increasing the retirement age, aligning it with improvements in life expectancy, is a common reform strategy. This extends the period over which contributions are made and reduces the duration of benefit payments.

- Reducing Benefits: Adjusting benefit calculations can create a more sustainable system. This might involve reducing the annual Cost of Living Adjustments (COLA) or modifying the benefit formula to a more actuarially sound model.

- Increasing Contribution Rates: A more equitable sharing of the burden between employees and the government through increased contribution rates can help close the funding gap.

- Hybrid Pension Models: Introducing elements of defined contribution plans, where retirement income is based on contributions and investment performance, alongside defined benefit plans can offer a more balanced and sustainable approach.

- Strategic Investment Management: Diversifying investments and employing sophisticated investment strategies can improve long-term returns and enhance the financial health of the pension fund.

Each of these strategies has potential advantages and disadvantages. For instance, increasing the retirement age could negatively impact older workers, while reducing benefits might affect the living standards of retirees. A phased implementation and careful communication are crucial for successful reform. [Insert case study of successful pension reform in another country/region].

Addressing Employee Concerns and Ensuring a Fair Transition

Successful public sector pension reform requires open communication and collaboration with public sector employees. Ignoring their concerns can lead to low morale and decreased productivity.

- Transparency and Open Communication: Regular and transparent communication regarding the need for reform and the proposed changes is essential.

- Phased Implementation: A phased implementation minimizes disruption to current retirees and allows for adjustments based on feedback.

- Targeted Support: Consider the impact on different employee groups, particularly those close to retirement, and provide support for adaptation.

- Protecting Existing Retirees: Ensuring the benefits of existing retirees remain unaffected by the reform is vital for maintaining trust and confidence in the system.

- Employee Engagement: Involving employees in the design and implementation process through consultation and feedback mechanisms is crucial for acceptance and buy-in.

Successful reforms will rely on addressing concerns constructively, emphasizing the long-term benefits for both employees and taxpayers. [Insert example of effective stakeholder engagement in a pension reform initiative].

The Role of Technology in Public Sector Pension Reform

Technology plays a crucial role in improving the efficiency and transparency of public sector pension administration.

- Data Analytics: Using data analytics for improved actuarial modeling and forecasting can lead to more accurate projections and informed decision-making.

- Online Portals: Implementing secure online portals allows employees and retirees to easily access their pension information, increasing transparency and reducing administrative burden.

- Automation: Automating administrative tasks such as contribution processing and benefit payments reduces costs and improves accuracy.

- Cybersecurity: Enhancing cybersecurity measures protects sensitive pension data from breaches and maintains the integrity of the system.

- Digital Communication: Using digital channels for communication improves outreach to beneficiaries and streamlines information dissemination.

Technology can optimize processes, enhance data security, and improve communication. [Insert example of a successful technological implementation in a pension system]. The use of AI and machine learning can further optimize investment strategies and risk management.

Conclusion

Public sector pension reform is a critical undertaking demanding careful planning, transparency, and proactive stakeholder engagement. Addressing the taxpayer burden necessitates a multi-pronged approach, balancing the needs of current and future retirees with the long-term financial sustainability of government budgets. By implementing well-considered strategies and leveraging technology, governments can create more sustainable and equitable public sector pension systems. The successful implementation of comprehensive public sector pension reform is vital for ensuring the long-term financial health of the public sector and the taxpayers who support it. Let's work together to achieve effective public sector pension reform.

Featured Posts

-

Family Appeals For Information On Missing Paralympian Sam Ruddock

Apr 29, 2025

Family Appeals For Information On Missing Paralympian Sam Ruddock

Apr 29, 2025 -

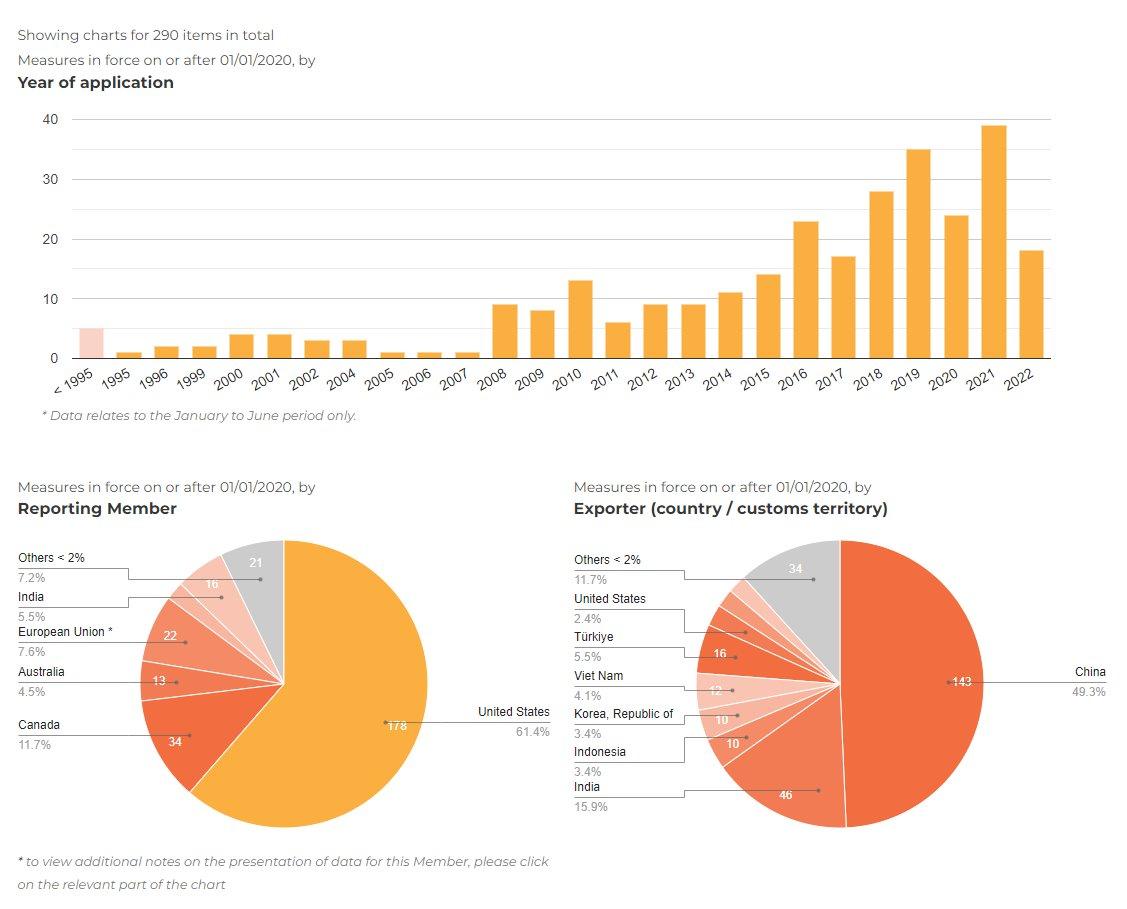

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty Through Cost Reduction

Apr 29, 2025 -

67 Dead In D C Helicopter Crash Focus On Pilots Actions And Training

Apr 29, 2025

67 Dead In D C Helicopter Crash Focus On Pilots Actions And Training

Apr 29, 2025 -

The Hidden Cost Of Temu Unpacking The Impact Of Trumps Tariffs

Apr 29, 2025

The Hidden Cost Of Temu Unpacking The Impact Of Trumps Tariffs

Apr 29, 2025 -

Adhd Or Tik Tok Trends Understanding The Difference

Apr 29, 2025

Adhd Or Tik Tok Trends Understanding The Difference

Apr 29, 2025

Latest Posts

-

Ru Pauls Drag Race Live Las Vegas 1000th Show Global Broadcast

Apr 30, 2025

Ru Pauls Drag Race Live Las Vegas 1000th Show Global Broadcast

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Preview Of The Wicked Challenge

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Preview Of The Wicked Challenge

Apr 30, 2025 -

Surprise Nba Legend Is Godfather To Ru Pauls Drag Race Star

Apr 30, 2025

Surprise Nba Legend Is Godfather To Ru Pauls Drag Race Star

Apr 30, 2025 -

Wickedness Unleashed Ru Pauls Drag Race Season 17 Episode 8 Preview

Apr 30, 2025

Wickedness Unleashed Ru Pauls Drag Race Season 17 Episode 8 Preview

Apr 30, 2025 -

Nba Star Revealed As Godfather To Ru Pauls Drag Race Contestant

Apr 30, 2025

Nba Star Revealed As Godfather To Ru Pauls Drag Race Contestant

Apr 30, 2025