Analysis: Ripple (XRP) And Its Potential To Reach $3.40

Table of Contents

Recent volatility in the cryptocurrency market has left many investors wondering about the future of various digital assets. One coin sparking considerable debate is Ripple (XRP), with some predicting a potential surge to $3.40. This analysis delves into the factors that could contribute to such a significant price increase, exploring Ripple's current market position, technological advancements, the regulatory landscape, and the potential for increased adoption. Our goal is to provide a comprehensive overview of XRP's potential to reach the ambitious $3.40 price target.

2. Main Points:

2.1. Current Market Conditions and XRP's Position:

-

XRP Price Analysis: As of [Insert Current Date], XRP is trading at $[Insert Current Price]. Over the past [Time Period - e.g., month, quarter], the price has experienced [Describe Price Trend - e.g., significant volatility, a steady increase, a gradual decline]. Its market capitalization currently stands at $[Insert Current Market Cap], placing it among the [e.g., top 10] cryptocurrencies by market rank. [Include a relevant chart showcasing price trends].

-

Market Sentiment: Current investor sentiment towards XRP is mixed. While [mention positive news or events impacting sentiment, e.g., positive court rulings, increased institutional interest], concerns remain regarding the ongoing SEC lawsuit and broader regulatory uncertainty. Social media sentiment analysis reveals [mention overall sentiment - e.g., a cautiously optimistic outlook, a predominantly bearish sentiment]. Trading volume has [describe trading volume - e.g., increased recently, remained relatively stable, decreased significantly].

-

Comparison to other Cryptocurrencies: Compared to Bitcoin (BTC) and Ethereum (ETH), XRP exhibits [describe relative performance - e.g., higher volatility, lower market capitalization, faster transaction speeds]. Its potential for growth depends on several factors, including increased adoption by financial institutions and positive regulatory developments, which could significantly impact its relative performance against its larger-cap counterparts.

-

Key Indicators: Technical indicators such as the Relative Strength Index (RSI) and moving averages suggest [Analyze technical indicators and their implications for potential price movement. Be cautious about making definitive predictions].

2.2. Ripple's Technological Advancements and Adoption:

-

xRapid and On-Demand Liquidity: Ripple's xRapid and On-Demand Liquidity solutions offer faster and cheaper cross-border payments, potentially disrupting the traditional banking system. These solutions utilize XRP to facilitate instant settlements, reducing reliance on correspondent banks and minimizing delays. The widespread adoption of these solutions could significantly boost demand for XRP.

-

Partnerships and Integrations: Ripple has forged partnerships with numerous banks and financial institutions globally, including [mention key partners]. These partnerships demonstrate a growing acceptance of XRP's utility in cross-border payments, fostering further adoption and potentially driving price appreciation. Successful implementations of XRP in these partnerships will be crucial to fuel future growth.

-

Scalability and Transaction Speed: XRP boasts significantly higher transaction speeds and lower fees compared to Bitcoin and Ethereum. This scalability advantage makes it well-suited for handling high-volume transactions, a key factor in its appeal to financial institutions seeking efficient payment solutions.

-

Developer Ecosystem and Community Growth: The XRP Ledger's developer community is actively contributing to its growth and development. The number of projects built on the XRP Ledger is [mention number and growth trend], indicating a vibrant and expanding ecosystem that further supports XRP's long-term potential.

2.3. Regulatory Landscape and Legal Battles:

-

SEC Lawsuit Update: The ongoing SEC lawsuit against Ripple remains a significant factor influencing XRP's price. The outcome of the case could have a substantial impact on XRP's future, potentially leading to either a significant price surge or a considerable decline depending on the ruling. [Provide a balanced overview of potential scenarios and their likely impacts on the price.]

-

Regulatory Clarity and its Impact: Clear regulatory frameworks are essential for the widespread adoption of cryptocurrencies. Positive regulatory developments for XRP, such as clear guidelines on its classification, could significantly boost investor confidence and drive price appreciation.

-

Global Regulatory Trends: Regulatory landscapes vary across different jurisdictions. Positive regulatory shifts in key markets could positively influence XRP's adoption and price. Conversely, negative regulatory actions could dampen investor enthusiasm and hinder price growth.

-

Potential for Positive Regulatory Developments: There's a possibility of a favorable outcome in the SEC lawsuit or the emergence of clear, supportive regulations in key jurisdictions, both of which could significantly boost XRP's price.

2.4. Factors Contributing to a Potential $3.40 Price Target:

-

Increased Market Adoption: Widespread adoption by financial institutions and a surge in individual investor interest could create substantial demand, pushing XRP's price higher. Reaching a $3.40 price would require a massive increase in market capitalization, necessitating significant adoption.

-

Positive Regulatory Outcomes: A favorable resolution to the SEC lawsuit and clear, supportive regulatory frameworks would significantly improve market sentiment, potentially leading to a substantial price increase.

-

Technological Breakthroughs: Further technological advancements in the XRP Ledger or innovative applications of XRP could boost its value proposition and drive increased adoption.

-

Increased Institutional Investment: Increased institutional investment in XRP, similar to what has been observed with Bitcoin and Ethereum, could significantly boost its price.

3. Conclusion: Investing in XRP's Potential – Is $3.40 Achievable?

Reaching a $3.40 price for XRP is ambitious and hinges on several factors, including a positive resolution to the SEC lawsuit, increased market adoption, and favorable regulatory developments. While the potential for significant gains exists, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments, including price volatility and regulatory uncertainty. This analysis suggests that while a price of $3.40 is possible, it's dependent on several converging positive factors. Conduct your own thorough research and understand these risks before investing in Ripple (XRP) or any other cryptocurrency. For further information on XRP and its potential, refer to [Link to a reputable source, e.g., Ripple's website, a trusted financial news source]. Remember to make informed decisions based on your own risk tolerance and investment strategy.

Featured Posts

-

Predicting The Nba Playoffs Warriors Vs Rockets Best Bets And Odds

May 07, 2025

Predicting The Nba Playoffs Warriors Vs Rockets Best Bets And Odds

May 07, 2025 -

Playoff Stars How Mitchell And Brunson Are Proving Their Worth

May 07, 2025

Playoff Stars How Mitchell And Brunson Are Proving Their Worth

May 07, 2025 -

Evaluating Skypes Vision Where It Succeeded And Where It Fell Short

May 07, 2025

Evaluating Skypes Vision Where It Succeeded And Where It Fell Short

May 07, 2025 -

Round 2 Cavs Tickets Sale Starts Tuesday

May 07, 2025

Round 2 Cavs Tickets Sale Starts Tuesday

May 07, 2025 -

Konklawe Tajemnice Wyborow Papieskich Premiera Ksiazki W Warszawie

May 07, 2025

Konklawe Tajemnice Wyborow Papieskich Premiera Ksiazki W Warszawie

May 07, 2025

Latest Posts

-

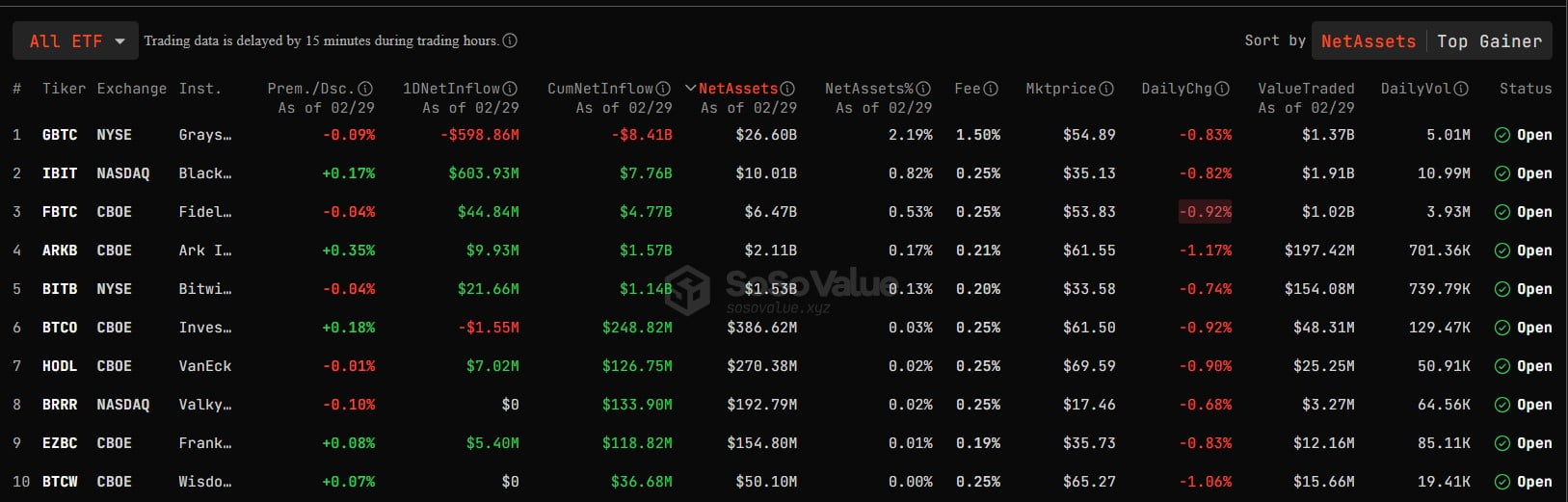

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025