Post-Record High: Frankfurt Stock Market And The DAX's Opening

Table of Contents

Factors Influencing the DAX's Post-Record High Opening

The opening of the DAX after a record high is influenced by a complex interplay of factors. These factors can be broadly categorized into global economic conditions, company-specific news, and overall investor sentiment. Predicting the market's immediate reaction requires careful consideration of these interacting forces within the Frankfurt Stock Exchange.

-

Global Economic Indicators: Global inflation rates, interest rate decisions by central banks (like the European Central Bank), and overall GDP growth significantly impact investor confidence and risk appetite. High inflation, for example, often leads to increased interest rates, potentially dampening economic growth and causing a sell-off in the stock market, impacting the DAX.

-

Geopolitical Risks: Geopolitical events, such as international conflicts or trade disputes, introduce uncertainty into the market. These events can trigger significant volatility in the DAX, irrespective of the previous record high. The Frankfurt Stock Exchange is not immune to global political instability.

-

Company Earnings Reports: The financial performance of major companies listed on the DAX significantly affects the index's performance. Strong earnings reports generally boost investor confidence, while disappointing results can lead to share price declines. Analyzing these reports is crucial for understanding the DAX's post-record high behavior.

-

Investor Sentiment: The prevailing mood among investors – whether bullish (optimistic) or bearish (pessimistic) – plays a crucial role in shaping market movements. After a record high, investor sentiment can quickly shift, leading to either continued upward momentum or a correction. Monitoring investor sentiment through various indicators is essential.

Analyzing the DAX's Initial Movements After the Record High

Analyzing the DAX's initial movements following the record high is critical. Did the index open higher, indicating continued bullish momentum? Or did it open lower, suggesting profit-taking or concerns about the sustainability of the record high? Trading volume also provides valuable insights.

-

Charting the Opening Movement: A detailed chart showing the DAX's opening price, initial price fluctuations, and intraday highs and lows during the first hour of trading provides immediate visual evidence of market reaction.

-

Trading Volume Analysis: High trading volume during the opening indicates significant investor activity and strong conviction in either buying or selling. Low volume could suggest indecision and a potential for sideways movement.

-

Historical Comparison: Comparing the DAX's post-record high opening to similar instances in the past can help identify potential patterns and predict future behavior. Analyzing historical data can reveal trends and inform expectations.

Key Sectors Driving the DAX's Post-Record High Performance

The DAX is a broad market index, and its performance is driven by the performance of its constituent sectors. Understanding which sectors contributed most to the post-record high movement provides a nuanced perspective on the market's overall health.

-

Sector-Specific Performance: Analyzing the performance of major sectors within the DAX, including automotive, technology, financials, and healthcare, reveals which sectors outperformed or underperformed expectations.

-

Company-Specific Impacts: Pinpointing specific companies within these sectors that experienced significant price changes helps identify contributing factors. Individual company news can drastically affect the DAX.

-

Sectoral Outperformance/Underperformance: Explaining why certain sectors outperformed or underperformed provides a clearer understanding of market dynamics and investor preferences. Understanding market forces is crucial.

Predicting Future Trends for the Frankfurt Stock Market and the DAX

Predicting future market trends is inherently challenging, yet analyzing current market conditions and historical data allows for informed speculation. While no prediction is guaranteed, considering both short-term and long-term outlooks helps investors manage expectations.

-

Short-Term Outlook (Next Few Weeks/Months): Based on the initial post-record high performance and the prevailing economic factors, a short-term forecast can be established. This would consider the immediate effects of any recent announcements or events.

-

Long-Term Outlook (Next Year or Longer): A long-term perspective would account for sustained economic trends, technological advancements, and geopolitical shifts impacting the DAX.

-

Risks and Uncertainties: Highlighting potential risks and uncertainties, such as unexpected economic downturns or geopolitical instability, is crucial for realistic predictions. Transparency is essential.

Conclusion: Understanding the DAX's Opening After Record Highs – Next Steps for Investors

The DAX's opening after a record high is a complex event influenced by numerous factors. Analyzing the market's immediate reaction, understanding the contributing sectors, and considering potential risks are crucial for investors. Continuous monitoring of the Frankfurt Stock Market and the DAX is essential for making informed investment decisions. To effectively navigate the dynamic landscape of the German stock market, actively monitor the DAX, track the Frankfurt Stock Exchange, and understand the DAX Index movements. Stay informed to make smart investment choices.

Featured Posts

-

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025 -

Could Kyle Walker Peters Join Crystal Palace On A Free

May 24, 2025

Could Kyle Walker Peters Join Crystal Palace On A Free

May 24, 2025 -

Prepustanie V Nemecku Ake Firmy Rusia Pracovne Miesta A Co To Znamena Pre Ekonomiku

May 24, 2025

Prepustanie V Nemecku Ake Firmy Rusia Pracovne Miesta A Co To Znamena Pre Ekonomiku

May 24, 2025 -

8 Stock Market Jump On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

Latest Posts

-

17 Famous Faces Careers Shattered By Scandal

May 24, 2025

17 Famous Faces Careers Shattered By Scandal

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Overnight

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Overnight

May 24, 2025 -

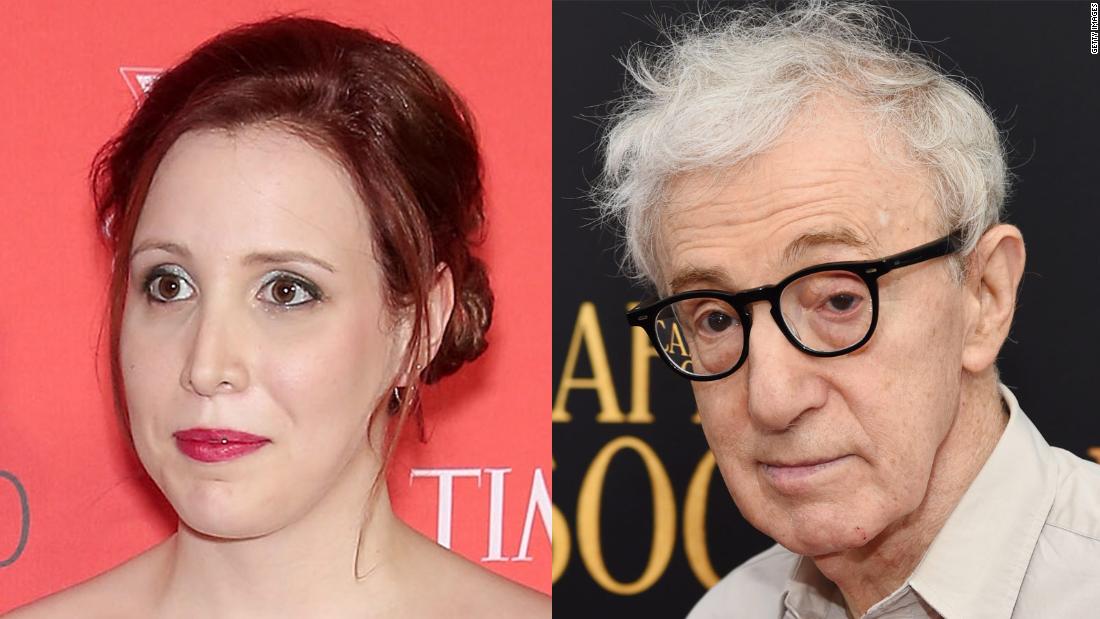

The Sean Penn Dylan Farrow Woody Allen Controversy Examining The Claims

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy Examining The Claims

May 24, 2025 -

From A List To Blacklisted 17 Celebrities Who Ruined Their Careers

May 24, 2025

From A List To Blacklisted 17 Celebrities Who Ruined Their Careers

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 24, 2025