PIF Blocks PwC From Advisory Work: One-Year Ban

Table of Contents

The PIF's Decision and its Rationale

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is a critical component of the nation's Vision 2030 plan, aiming to diversify its economy away from oil dependence. Its vast assets and ambitious investment strategies make it a highly sought-after client for global consulting firms. The PIF's decision to impose a one-year ban on PwC from undertaking advisory work is therefore a highly significant development.

While the precise reasons behind the ban haven't been fully disclosed publicly, official statements suggest a serious breach of trust and professional standards. Potential contributing factors include:

- Violation of contractual obligations: PwC may have failed to adhere to the terms and conditions outlined in its contracts with the PIF.

- Conflicts of interest: The firm might have engaged in activities that created a conflict of interest, potentially compromising the integrity of its advice to the PIF.

- Failure to meet professional standards: PwC's performance may have fallen short of the expected professional standards and ethical conduct required by the PIF.

- Breach of confidentiality: A potential leak of confidential information related to the PIF's operations could be a contributing factor.

[Insert links to relevant news articles and official statements here]

Impact on PwC and its Operations

The PIF's decision to block PwC has substantial implications for the consulting giant. The financial impact is potentially severe, considering the significant revenue stream generated from PIF-related projects. This loss of revenue could affect PwC's overall financial performance and profitability.

Beyond financial implications, the ban severely damages PwC's reputation and brand image. The loss of a prestigious client like the PIF casts a shadow of doubt on the firm's ability to maintain the highest ethical standards and professional conduct. This reputational damage can affect future business prospects and relationships with other potential clients.

Specific impacts on PwC include:

- Loss of revenue from PIF-related projects: This represents a substantial financial blow to the firm.

- Damage to reputation and trust: This erodes client confidence and could lead to the loss of other contracts.

- Potential loss of future contracts: The ban sets a negative precedent and might discourage future collaborations with other sovereign wealth funds.

- Impact on employee morale and client relationships: The uncertainty and negative publicity can impact employee morale and strain relationships with other clients.

Wider Implications for the Global Advisory Sector

The “PIF Blocks PwC” situation carries significant ramifications for the global advisory sector. Other consulting firms operating in Saudi Arabia and globally will be acutely aware of the heightened scrutiny facing the industry. This incident highlights the increasing importance of ethical conduct, transparency, and regulatory compliance for all consulting firms working with sovereign wealth funds.

The implications extend to:

- Increased competition among remaining advisory firms: The exit of PwC creates an opportunity for its competitors to acquire PIF’s business.

- Potential for stricter regulations and oversight: This event could trigger a review of existing regulations and lead to stricter oversight of the advisory sector.

- Shift in how sovereign wealth funds select advisors: Sovereign wealth funds may adopt more rigorous due diligence processes when selecting advisors.

- Increased focus on ethical conduct and transparency: The industry will likely see a greater emphasis on ethical conduct and transparent practices.

Reactions and Responses to the PIF's Ban

Both the PIF and PwC have issued official statements addressing the ban, though details remain limited. [Insert summaries of official statements here]. Industry experts and analysts have offered varying perspectives, some suggesting this is an isolated incident, while others see it as a sign of increasing scrutiny of the advisory sector. Potential legal challenges or appeals remain a possibility.

Reactions to the ban include:

- PwC's official statement: [Insert a summary of PwC’s response].

- PIF's clarification on the ban: [Insert a summary of PIF’s explanation].

- Industry expert commentary: [Summarize key opinions from industry experts].

- Market analysis of the impact: [Include analysis from financial news sources].

Conclusion: Understanding the PIF's Block on PwC Advisory Work

The "PIF Blocks PwC" situation underscores the critical importance of ethical conduct, transparency, and robust risk management within the global advisory sector. The PIF's decision to impose a one-year ban on PwC highlights the potential consequences of failing to meet these standards when dealing with major sovereign wealth funds. The impact on PwC, both financially and reputationally, is substantial, and the wider implications for the industry suggest a shift towards increased regulatory scrutiny and a greater emphasis on ethical practices. The long-term consequences of this event remain to be seen, but it serves as a stark reminder for all firms operating in this space. To stay informed about further developments regarding the PIF Blocks PwC situation and its impact on the global advisory landscape, subscribe to our newsletter, follow reputable financial news sources, and continue researching this evolving story.

Featured Posts

-

Wypozyczylem Porsche Cayenne Gts Coupe Warto Bylo

Apr 29, 2025

Wypozyczylem Porsche Cayenne Gts Coupe Warto Bylo

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025 -

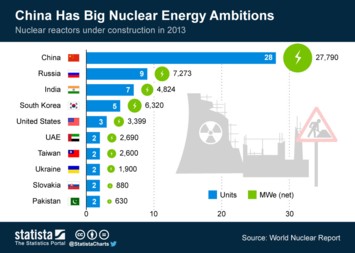

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025 -

Attorney General Targets Minnesota Over Transgender Athlete Ban Compliance Deadline Looms

Apr 29, 2025

Attorney General Targets Minnesota Over Transgender Athlete Ban Compliance Deadline Looms

Apr 29, 2025 -

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025

Latest Posts

-

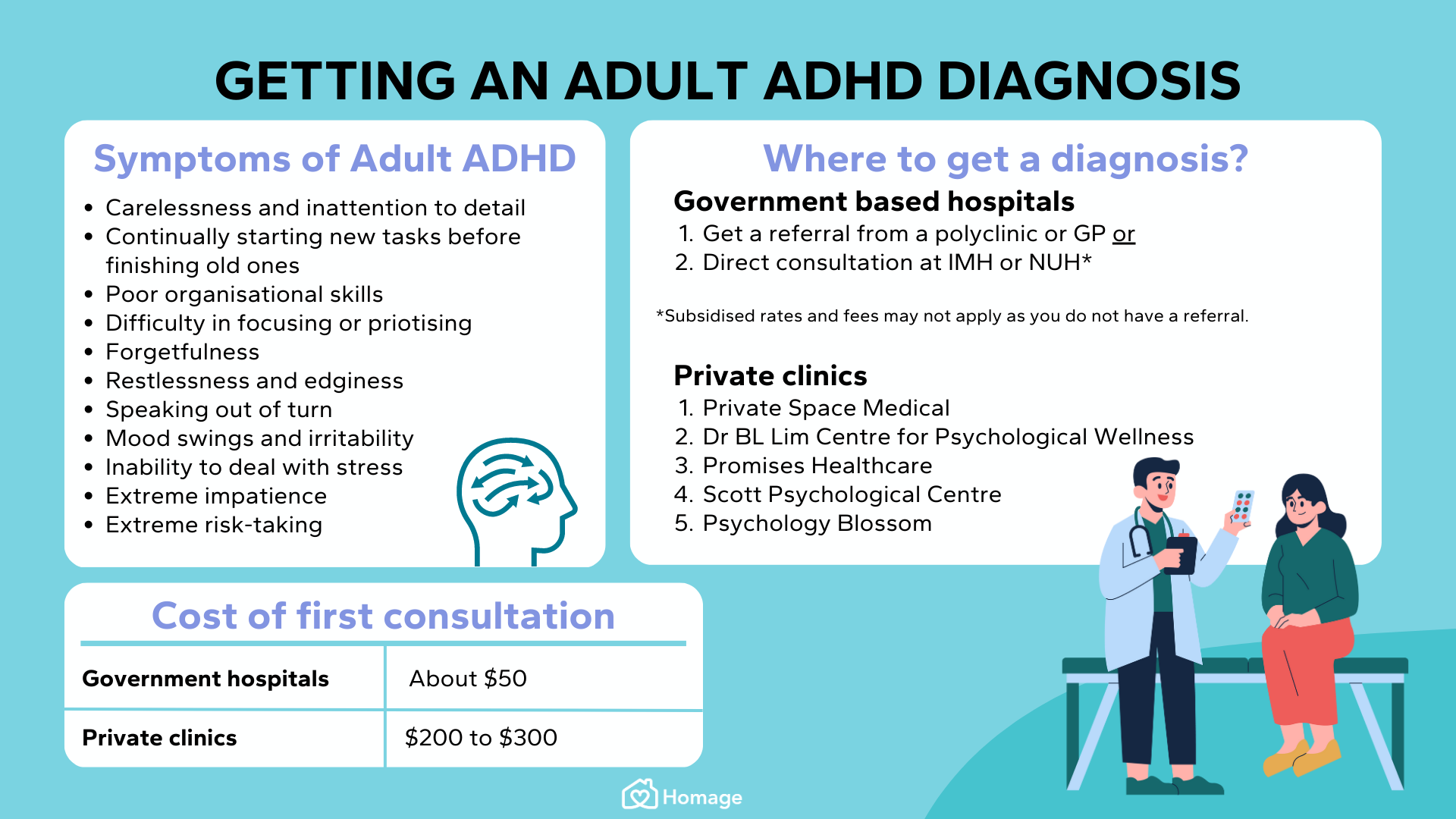

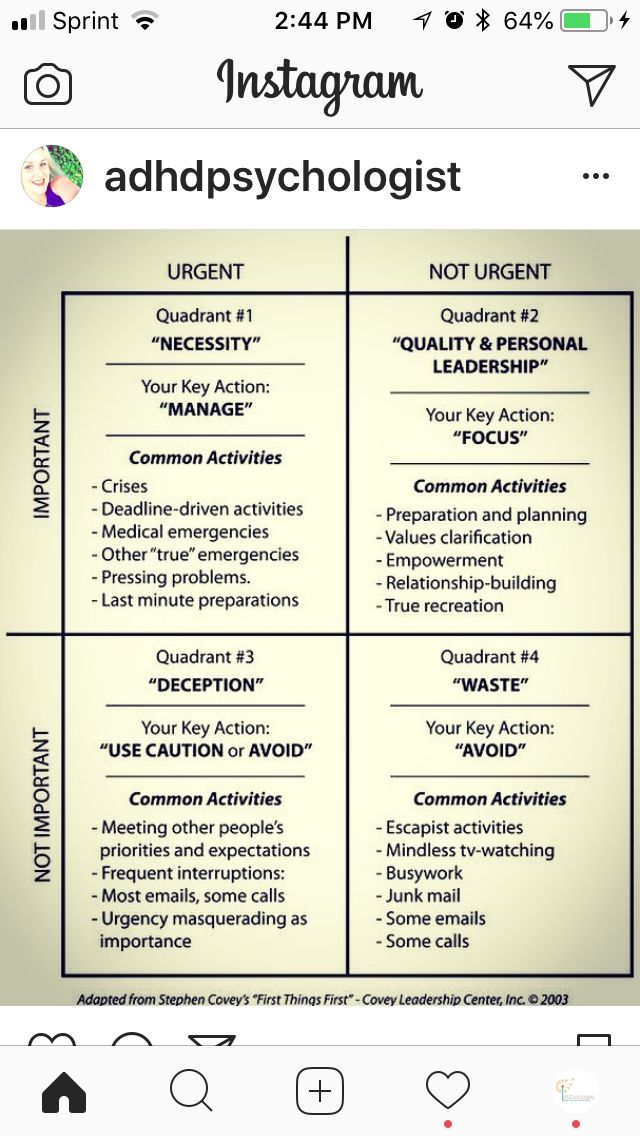

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025 -

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025

Suspecting Adult Adhd A Practical Guide To Next Steps

Apr 29, 2025 -

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025

Adult Adhd Understanding Your Diagnosis And Moving Forward

Apr 29, 2025 -

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025

Improve Focus Naturally Effective Natural Approaches To Adhd

Apr 29, 2025 -

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025