PFC Takes Action: EoW Transfer Blocked Due To Gensol's False Documents

Table of Contents

The Blocked EoW Transfer: Understanding the Context

An EoW (End-of-Warranty) transfer, in the context of PFC and Gensol's dealings, refers to the transfer of ownership or responsibility for an asset after its warranty period has expired. This often involves significant financial transactions and requires meticulous documentation to ensure compliance and transparency. For PFC, a vital financial institution in India, such transfers are subject to rigorous scrutiny.

- Typical EoW Transfer Process: The usual process involves a thorough review of all relevant documentation, including warranty certificates, maintenance records, and financial statements, by PFC before approving the transfer. This process is designed to mitigate risk and protect the interests of all stakeholders.

- Financial Implications: This specific EoW transfer involved a substantial sum, the exact figure remaining undisclosed for confidentiality reasons. The blocking of the transfer represents a significant financial setback for Gensol and potentially impacts the project's timeline.

- Project Involved: While the precise details of the project or asset are confidential, it is understood to be a significant infrastructure project where PFC had a substantial financial stake. This underscores the seriousness of the situation and the potential systemic repercussions.

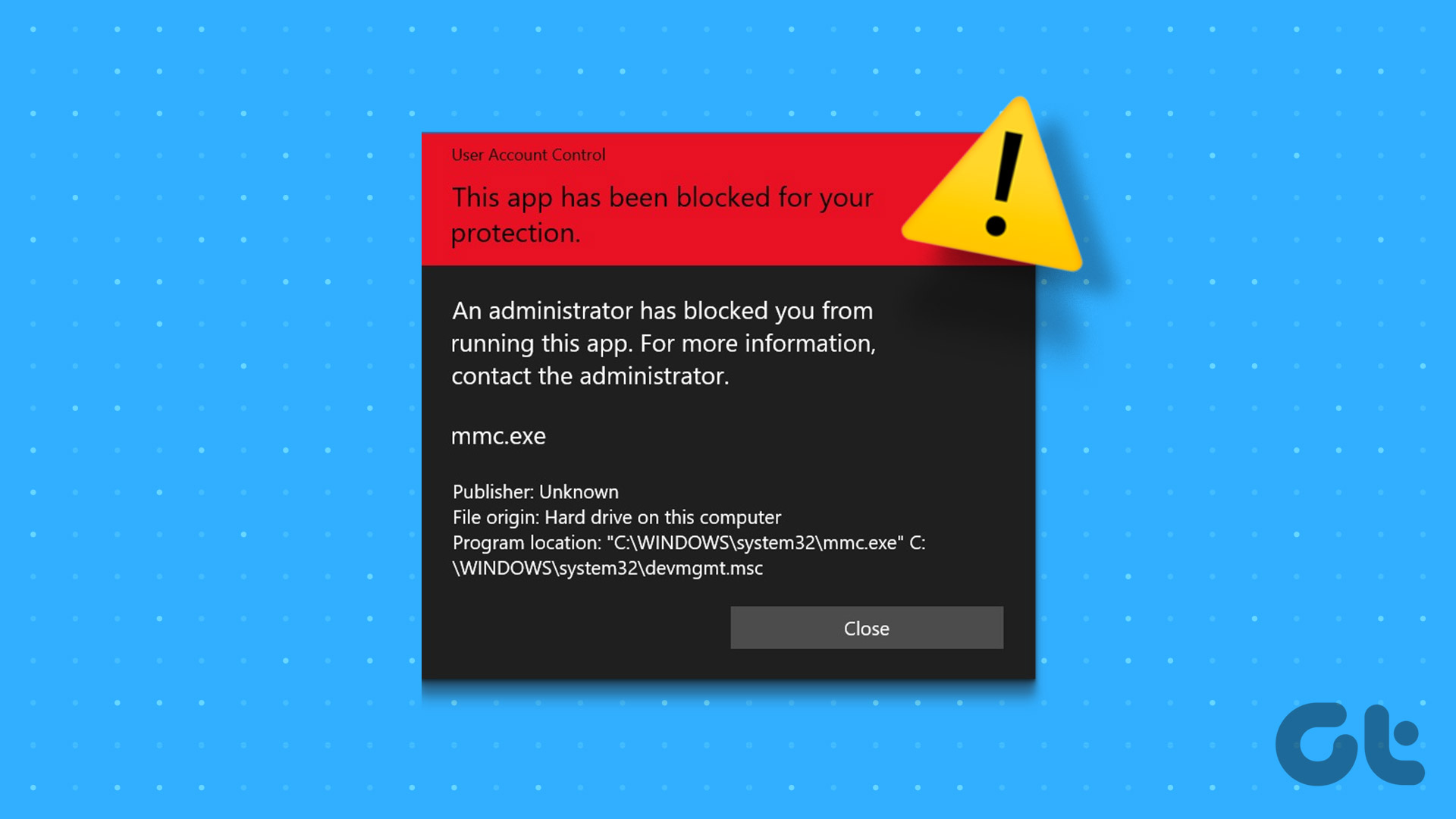

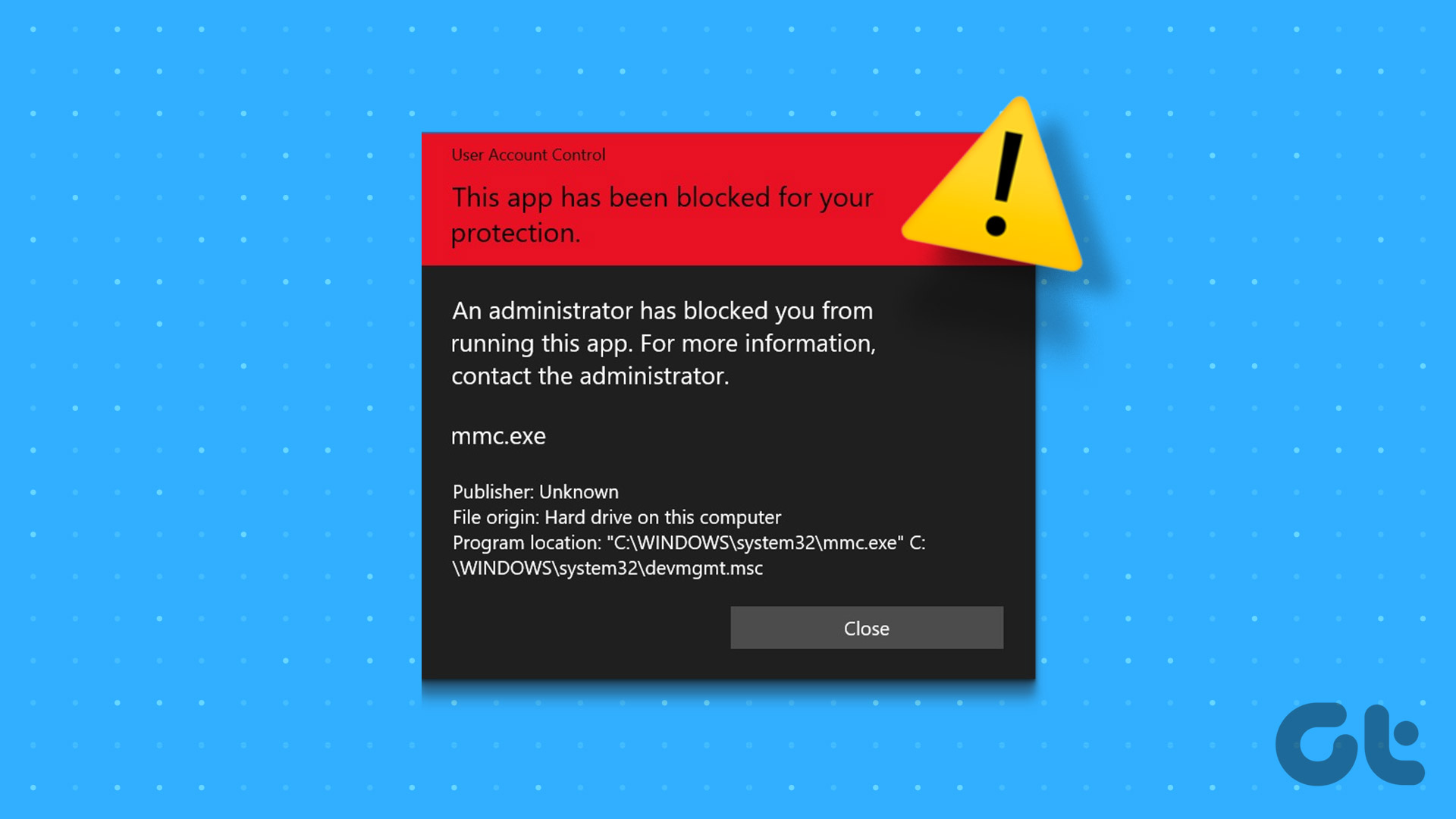

Gensol's False Documents: Nature of the Fraud

The investigation revealed that Gensol submitted several fraudulent documents as part of their EoW transfer application. These falsified documents were critical to the PFC's assessment of the asset's condition and viability.

- Examples of Falsified Documentation: The fraudulent documents included falsified permits, misrepresented operational certificates, and potentially manipulated financial statements designed to inflate the asset's value or mask underlying problems.

- Impact on Project Viability: The false documents could have significantly misled PFC regarding the true state of the asset, potentially jeopardizing its operational viability and causing further financial losses.

- Evidence of Fraud: While specific details remain confidential due to ongoing investigations, PFC's internal audit uncovered inconsistencies and discrepancies that led to the discovery of the fraudulent documentation. Further evidence may emerge during any subsequent legal proceedings.

PFC's Investigation and Response

PFC initiated a thorough investigation upon discovering inconsistencies in the documentation submitted by Gensol. The response was swift and decisive, reflecting PFC's commitment to maintaining transparency and ethical business practices.

- Internal Investigation Process: PFC's internal audit team conducted a comprehensive review of all submitted documents, cross-referencing information with independent sources to verify authenticity.

- External Audits/Investigations: While not initially confirmed, the possibility of engaging external forensic accounting experts to aid in the investigation cannot be ruled out.

- Timeline of Events: The timeline, from initial suspicion to the blocking of the EoW transfer, remains undisclosed, however, it's evident that PFC acted swiftly to safeguard its interests and maintain its reputation for due diligence.

Implications for Gensol and Future Projects

The consequences for Gensol are severe, potentially impacting their financial stability and future opportunities. The submission of fraudulent documents carries significant legal and reputational risks.

- Potential Legal Actions: PFC may initiate legal action against Gensol, potentially leading to financial penalties, legal fees, and reputational damage.

- Impact on Credit Rating and Funding: This incident will negatively impact Gensol's credit rating, making it more difficult to secure future funding and potentially jeopardizing existing contracts.

- Loss of Contracts and Partnerships: The reputational damage associated with this incident could lead to a loss of future contracts and partnerships, significantly impacting Gensol’s business prospects.

Lessons Learned and Best Practices for Due Diligence

This case serves as a stark reminder of the critical importance of rigorous due diligence in all financial transactions, particularly those involving large sums and complex assets.

- Importance of Thorough Document Verification: Independent verification of all supporting documents is crucial, going beyond simple visual inspection and involving external verification services where appropriate.

- Utilizing Third-Party Verification Services: Engaging reputable third-party verification services to validate documentation can significantly mitigate the risk of fraud.

- Establishing Robust Internal Controls: Companies need robust internal controls to prevent and detect fraudulent activities, ensuring transparent documentation and record-keeping procedures.

Conclusion

The PFC's decisive action in blocking the EoW transfer due to Gensol's submission of false documents underscores the critical need for stringent due diligence in all financial transactions. This case serves as a stark warning to other companies about the serious consequences of fraudulent practices. The implications for Gensol highlight the significant risks associated with submitting fraudulent documentation to PFC.

Call to Action: Learn from this case and strengthen your due diligence procedures to prevent similar instances of fraud in your EoW transfers and other PFC-related dealings. Ensure the integrity of your documentation to maintain a strong and transparent relationship with the PFC. Contact us to learn more about best practices for preventing fraudulent documentation in your EoW transfers and other large-scale financial transactions.

Featured Posts

-

Power Finance Corporation Dividend Update March 12th Announcement

Apr 27, 2025

Power Finance Corporation Dividend Update March 12th Announcement

Apr 27, 2025 -

Fin Del Camino Para Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Fin Del Camino Para Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

How Ariana Grande Maintains Her Look Professional Hair And Tattoo Experts

Apr 27, 2025

How Ariana Grande Maintains Her Look Professional Hair And Tattoo Experts

Apr 27, 2025 -

Abu Dhabi Open Bencics Path To The Final

Apr 27, 2025

Abu Dhabi Open Bencics Path To The Final

Apr 27, 2025 -

La Wta Lidera Licencia De Maternidad Remunerada De Un Ano Para Tenistas

Apr 27, 2025

La Wta Lidera Licencia De Maternidad Remunerada De Un Ano Para Tenistas

Apr 27, 2025

Latest Posts

-

Analysis Teslas Price Adjustments And Pre Tariff Inventory In Canada

Apr 27, 2025

Analysis Teslas Price Adjustments And Pre Tariff Inventory In Canada

Apr 27, 2025 -

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025

Understanding Teslas Canadian Price Increase And Inventory Strategy

Apr 27, 2025 -

Teslas Canadian Price Hike A Strategic Move To Clear Pre Tariff Stock

Apr 27, 2025

Teslas Canadian Price Hike A Strategic Move To Clear Pre Tariff Stock

Apr 27, 2025 -

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push Explained

Apr 27, 2025 -

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025