Personal Loan Rates Today: How To Secure The Lowest Rate

Table of Contents

Understanding Personal Loan Rates Today

Personal loan rates represent the cost of borrowing money. They're expressed as a percentage of the loan amount and determine the interest you'll pay over the loan term. A key term to understand is APR (Annual Percentage Rate). The APR represents the annual cost of borrowing, including interest and any fees. It's crucial to compare APRs when shopping for loans, as this gives you a true picture of the overall cost.

You'll typically encounter two types of interest rates: fixed and variable. Fixed interest rates remain constant throughout the loan term, providing predictable monthly payments. Variable interest rates fluctuate based on market conditions, meaning your monthly payments could change.

- Factors Affecting Personal Loan Rates:

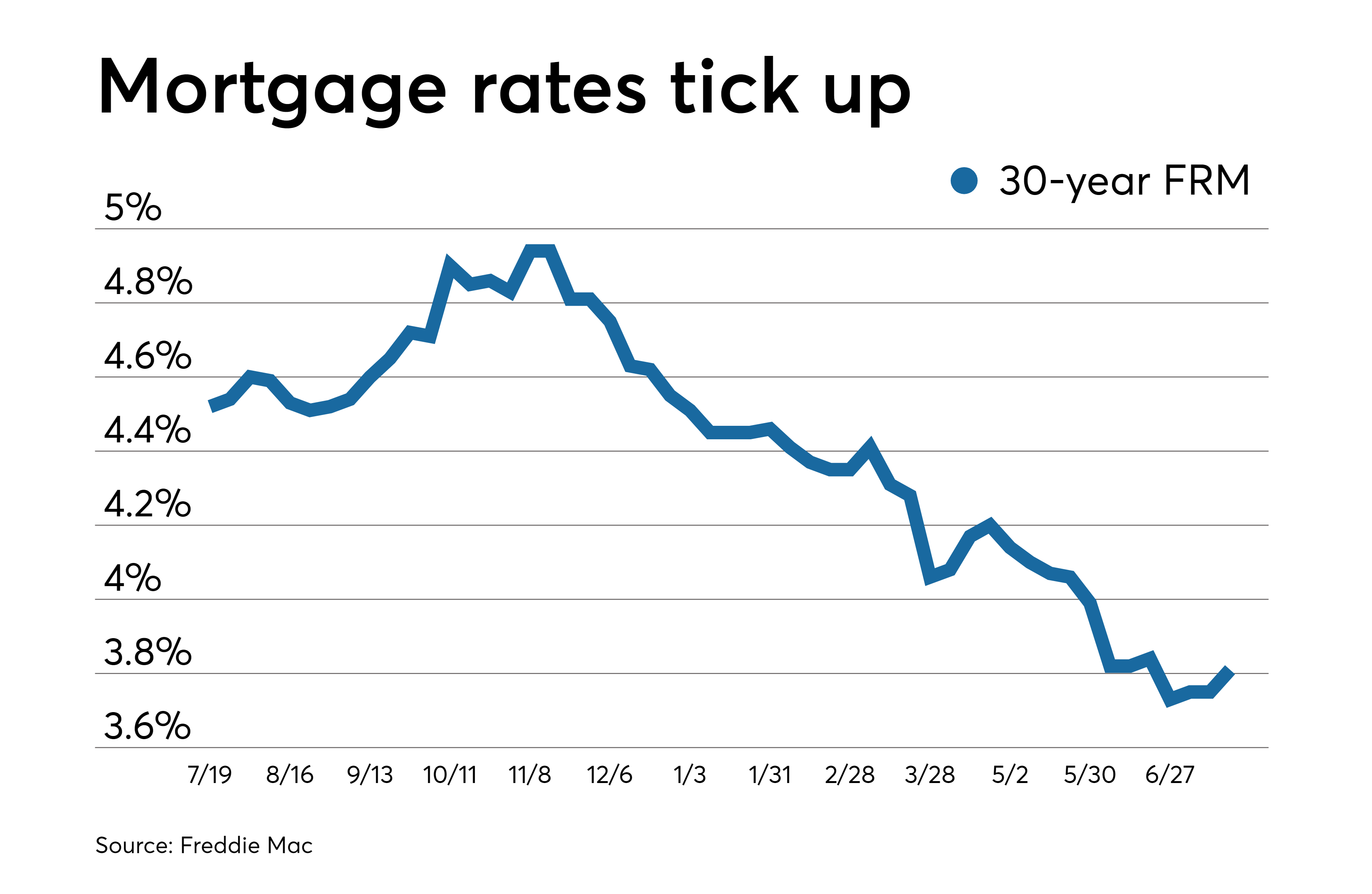

- Credit Score: Your credit score is the most significant factor. A higher score (700+) typically qualifies you for lower rates.

- Loan Amount: Larger loan amounts often come with slightly higher rates.

- Loan Term: Shorter loan terms usually mean higher monthly payments but lower overall interest paid. Longer terms result in lower monthly payments but higher total interest.

- Lender Type: Different lenders (banks, credit unions, online lenders) offer varying rates based on their risk assessments and business models.

- Current Average Personal Loan Rates: As of October 26, 2023, average personal loan rates range from 7% to 25%, depending on the factors listed above. However, these are averages, and your individual rate will vary. Check reputable financial websites for updated rate information.

- Impact of a High Credit Score: A high credit score significantly improves your chances of securing the lowest personal loan rates. Lenders view borrowers with excellent credit as less risky.

Improving Your Credit Score for Better Rates

Your credit score plays a pivotal role in determining the personal loan rates you qualify for. A higher score translates directly into lower interest rates and better loan terms. Improving your credit score takes time and effort, but the rewards are substantial.

- Actionable Steps to Improve Your Credit Score:

- Pay Bills on Time: This is the single most important factor. Late payments severely damage your credit.

- Keep Credit Utilization Low: Aim to keep your credit card balances below 30% of your total credit limit.

- Monitor Your Credit Report for Errors: Check your credit report regularly (you can get a free copy annually from AnnualCreditReport.com) and dispute any inaccuracies.

- Avoid Opening Multiple New Accounts in a Short Period: Opening several new accounts in a short time can negatively impact your credit score.

- Consider a Secured Credit Card: If you have limited or poor credit, a secured credit card can help you build credit responsibly.

By diligently following these steps, you can significantly improve your creditworthiness and unlock access to more favorable personal loan rates.

Shopping Around for the Best Personal Loan Rates

Once you've worked on improving your credit, it's time to shop around for the best personal loan rates. Don't settle for the first offer you receive. Comparing offers from multiple lenders is crucial for securing the most competitive rate.

- Various Types of Lenders:

- Banks: Traditional banks often offer competitive rates, especially for borrowers with excellent credit.

- Credit Unions: Credit unions are member-owned and often offer lower rates and more personalized service.

- Online Lenders: Online lenders are known for their convenience and potentially faster approval processes. However, always carefully review their terms and conditions.

- Tips for Comparing Loan Offers:

- Use Online Comparison Tools: Several websites allow you to compare loan offers from multiple lenders simultaneously.

- Check Lender Reviews and Ratings: Research the reputation of lenders before applying.

- Pay Attention to Fees and Charges: Beware of origination fees, prepayment penalties, and other hidden charges.

- Consider the Lender's Customer Service Reputation: Good customer service is crucial, particularly if you encounter any issues during the loan process.

Negotiating a Lower Personal Loan Rate

While shopping around helps, don't be afraid to negotiate. Sometimes, lenders are willing to lower their initial offer, especially if you have a strong financial profile and can demonstrate responsible borrowing habits.

- How to Negotiate:

- Be Prepared to Discuss Your Financial Situation: Show the lender you are financially stable and capable of repaying the loan.

- Highlight Your Good Credit History and Responsible Borrowing: Emphasize your positive credit history and consistent payment record.

- Politely Ask for a Rate Reduction Based on Your Qualifications: Be confident and polite when asking for a better rate.

- Consider Refinancing if You Find a Better Rate Later: If your circumstances change, or you find a better rate after securing a loan, consider refinancing to potentially reduce your monthly payments.

Conclusion

Securing the lowest personal loan rates requires understanding the factors influencing rates, improving your credit score, diligently shopping around, and strategically negotiating with lenders. By following the steps outlined in this article, you can significantly increase your chances of obtaining a loan with the most favorable terms. Don't delay—start comparing personal loan rates today to secure your best offer! Find the best personal loan rates now and begin your application process. [Link to a reputable loan comparison website]

Featured Posts

-

Wes Andersons The Phoenician Scheme A Cannes Film Festival Review

May 28, 2025

Wes Andersons The Phoenician Scheme A Cannes Film Festival Review

May 28, 2025 -

Cuaca Bandung Besok 22 4 Perkiraan Hujan Pukul 1 Siang

May 28, 2025

Cuaca Bandung Besok 22 4 Perkiraan Hujan Pukul 1 Siang

May 28, 2025 -

Understanding Todays Personal Loan Interest Rates

May 28, 2025

Understanding Todays Personal Loan Interest Rates

May 28, 2025 -

The Creative Void Examining The Lack Of Depth In Wes Andersons Recent Release

May 28, 2025

The Creative Void Examining The Lack Of Depth In Wes Andersons Recent Release

May 28, 2025 -

Torpedo Bats The New Favorite Of Marlins An Examination Of Fishing Trends

May 28, 2025

Torpedo Bats The New Favorite Of Marlins An Examination Of Fishing Trends

May 28, 2025