Understanding Today's Personal Loan Interest Rates

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors is the first step towards securing a competitive rate.

Credit Score: The Cornerstone of Your Interest Rate

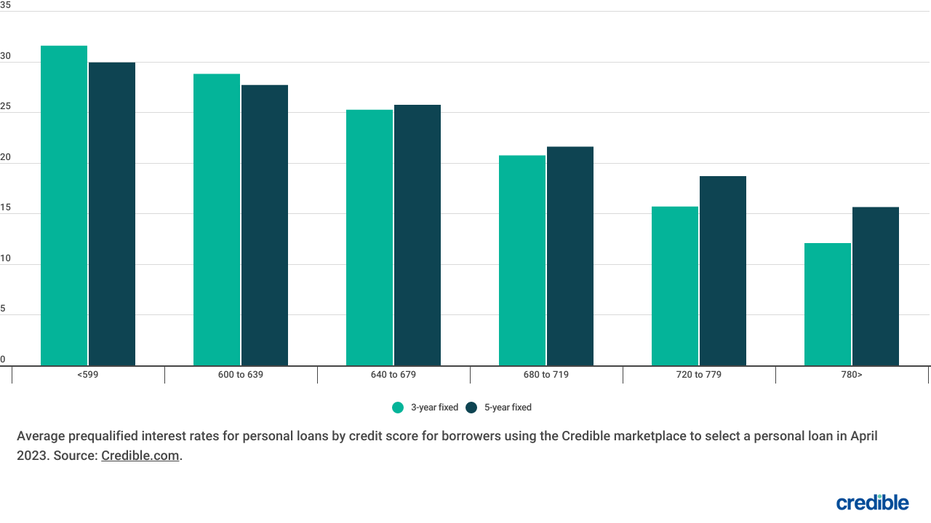

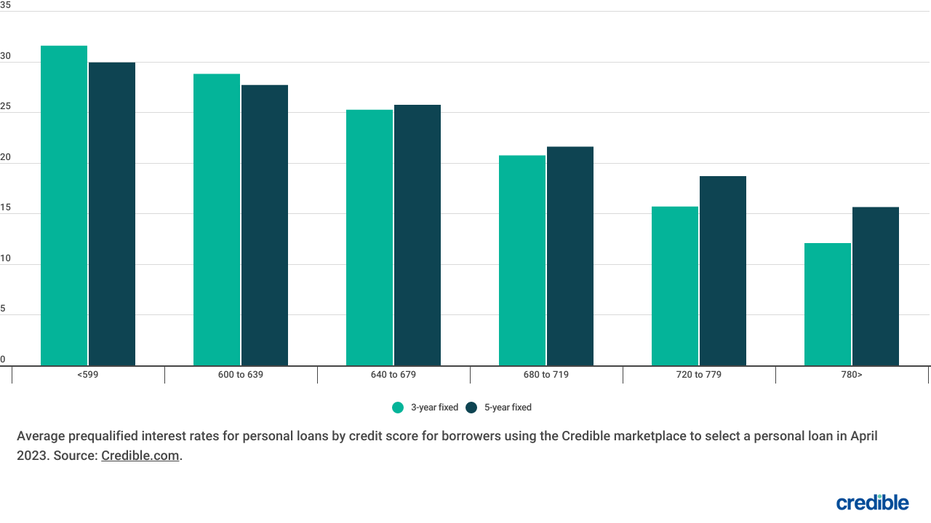

Your credit score is arguably the most important factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan.

- Higher Credit Score = Lower Interest Rate: A higher credit score demonstrates a history of responsible borrowing and repayment, making you a lower-risk borrower. For example, a credit score above 750 typically qualifies you for the lowest interest rates, while a score below 650 may result in significantly higher rates, sometimes exceeding 20%.

- Credit Score Ranges and Interest Rates: While rates vary by lender, here's a general idea:

- 750+: Prime rates (often below 10%)

- 670-749: Above-average rates (10-15%)

- 600-669: High rates (15-25%)

- Below 600: Very high rates (25%+ or loan denial)

- Check Your Credit Score: You can check your credit score for free annually at annualcreditreport.com. Understanding your score is crucial for negotiating better loan terms.

- Improving Your Credit Score: Strategies to improve your credit score include paying bills on time, keeping credit utilization low, and maintaining a diverse credit history.

Loan Amount and Term: Balancing Payments and Total Cost

The amount you borrow and the repayment term (loan length) also influence your interest rate.

- Loan Amount: Larger loan amounts often carry slightly higher interest rates due to the increased risk for the lender.

- Loan Term: Longer loan terms (e.g., 60 months) typically result in lower monthly payments but higher total interest paid over the life of the loan. Shorter terms (e.g., 36 months) mean higher monthly payments but significantly less interest paid overall. Consider your budget and financial goals when choosing a term. For example, a $10,000 loan over 5 years might have a lower monthly payment than a 3-year loan, but you’ll pay substantially more in interest over the longer term.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying interest rates and terms.

- Banks: Often offer competitive rates, especially for borrowers with excellent credit. However, they might have stricter lending criteria.

- Credit Unions: Membership-based institutions that frequently offer lower rates and more personalized service than banks. However, membership requirements may apply.

- Online Lenders: Provide convenience and speed, sometimes with competitive rates, but carefully review fees and terms before committing.

Current Economic Conditions: The Impact of Inflation and the Prime Rate

Prevailing economic conditions directly affect personal loan interest rates.

- Inflation: Rising inflation typically leads to higher interest rates as lenders adjust to compensate for the decreased purchasing power of money.

- Prime Rate: The prime rate, a benchmark interest rate set by the Federal Reserve, influences the rates offered by many lenders. A rise in the prime rate usually translates to higher personal loan interest rates. Consult reliable sources like the Federal Reserve website for the current prime rate and economic indicators.

Finding the Best Personal Loan Interest Rates

Securing the best personal loan interest rate requires careful planning and comparison shopping.

Shop Around: Compare Offers from Multiple Lenders

Don't settle for the first offer you receive.

- Compare Rates and Fees: Use online comparison tools and visit multiple lenders to compare interest rates, fees, and loan terms.

- Loan Aggregators: Websites and apps that allow you to compare offers from multiple lenders simultaneously can save you valuable time and effort.

Negotiate: Don't Be Afraid to Ask

In some cases, you can negotiate a lower interest rate.

- Highlight Your Strengths: Emphasize a strong credit score, stable income, and a substantial down payment to leverage your bargaining power.

- Compare Offers: Present competing offers from other lenders to encourage a better rate.

Check for Fees: Hidden Costs Can Impact Your Overall Cost

Be aware of additional fees that can significantly increase the overall cost of your loan.

- Origination Fees: Fees charged by lenders to process your loan application.

- Prepayment Penalties: Penalties for paying off the loan early. Read the fine print carefully!

Understanding APR (Annual Percentage Rate)

The APR is a crucial figure representing the true cost of your loan.

APR vs. Interest Rate: The Complete Picture

The stated interest rate is only part of the story.

- APR Includes Fees: The APR incorporates the interest rate plus all other loan fees, providing a more accurate representation of the total cost of borrowing.

Calculating Total Loan Cost: See the Big Picture

Using the APR, you can easily calculate the total cost of your loan.

- Online Loan Calculators: Many online loan calculators can help you determine the total cost, including principal, interest, and fees, based on the APR and loan terms.

Conclusion

Understanding today's personal loan interest rates involves considering your credit score, loan amount, term, lender type, and current economic conditions. By shopping around, comparing offers, and negotiating effectively, you can significantly reduce your borrowing costs. Remember to carefully review all fees and understand the APR to make an informed decision. Start comparing personal loan interest rates today and secure the best financial deal for your needs! Find the best personal loan rates and low interest personal loans by doing your research and comparing options.

Featured Posts

-

Rayan Cherki News From A German Source

May 28, 2025

Rayan Cherki News From A German Source

May 28, 2025 -

Jawa Tengah Diguyur Hujan Peringatan Cuaca 23 April 2024

May 28, 2025

Jawa Tengah Diguyur Hujan Peringatan Cuaca 23 April 2024

May 28, 2025 -

The Impact Of Climate Change On Rainfall Patterns In Western Massachusetts

May 28, 2025

The Impact Of Climate Change On Rainfall Patterns In Western Massachusetts

May 28, 2025 -

Sir Rod Stewart To Receive Prestigious Lifetime Achievement Award

May 28, 2025

Sir Rod Stewart To Receive Prestigious Lifetime Achievement Award

May 28, 2025 -

Nl West 2024 Dodgers And Padres Perfect Starts

May 28, 2025

Nl West 2024 Dodgers And Padres Perfect Starts

May 28, 2025