Bond Market Crisis: Are Investors Missing The Warning Signs?

Table of Contents

Rising Inflation and Interest Rates

The relationship between inflation, interest rates, and bond prices is inverse. Rising inflation typically leads central banks to increase interest rates to cool down the economy. This, in turn, impacts the value of existing bonds. Higher interest rates make newly issued bonds more attractive, pushing down the prices of older bonds with lower yields.

-

Impact of Rising Interest Rates: Rising interest rates directly reduce the value of existing bonds, especially those with longer maturities. Investors seeking higher returns will flock to newer bonds offering better yields, leaving older bonds less desirable. This can lead to significant capital losses for bondholders.

-

Central Bank Challenges: Central banks face a delicate balancing act. They must control inflationary pressures without triggering a recession or a bond market crisis. Aggressive interest rate hikes risk stifling economic growth and potentially leading to a financial crisis.

-

Examples: Several countries are currently grappling with high inflation and its effect on their bond markets. For instance, the aggressive interest rate hikes by the US Federal Reserve have significantly impacted the value of US Treasury bonds, illustrating the real-world implications of inflationary pressures and interest rate hikes. Analyzing the yield curve inversion can provide early warning signals.

(Insert chart showing correlation between inflation, interest rates, and bond yields here)

Geopolitical Risks and Global Uncertainty

Geopolitical events and global uncertainty significantly contribute to bond market volatility. These uncertainties often lead to increased risk aversion among investors, causing a flight to safety and a surge in demand for government bonds perceived as safe-haven assets. However, this increased demand can also be temporary, leading to subsequent market corrections.

-

Investor Sentiment: Geopolitical instability can dramatically shift investor sentiment. Fear and uncertainty can lead to a sell-off in riskier assets, including corporate bonds, while increasing demand for safer government bonds.

-

Historical Examples: The 2008 financial crisis and the various European sovereign debt crises of the 2010s demonstrate how geopolitical tensions and global economic uncertainty can exacerbate existing vulnerabilities in the bond market, leading to a significant market downturn.

-

Current Geopolitical Landscape: The current geopolitical landscape presents several potential risks to the bond market. Ongoing conflicts, trade wars, and political instability in various regions contribute to a heightened sense of uncertainty and potential volatility. The resulting market volatility can severely impact fixed income investments.

Overvaluation in Certain Bond Sectors

Some sectors of the bond market may be exhibiting signs of overvaluation. This is particularly true in government bond markets where historically low interest rates have driven prices to unsustainable levels. This situation presents a significant risk, especially if interest rates rise unexpectedly.

-

Valuation Metrics: Several metrics can be used to assess whether a bond market is overvalued, including price-to-earnings ratios, yield spreads, and duration analysis. A thorough analysis using these bond valuation techniques is critical for informed decision-making.

-

Excessive Risk-Taking: The prolonged period of low interest rates may have encouraged excessive risk-taking in certain bond sectors. Investors may have reached for yield, taking on more credit risk than they should have.

-

Consequences of Correction: If a market correction occurs in these overvalued sectors, the consequences could be significant, including substantial capital losses for investors. The credit risk involved needs careful evaluation.

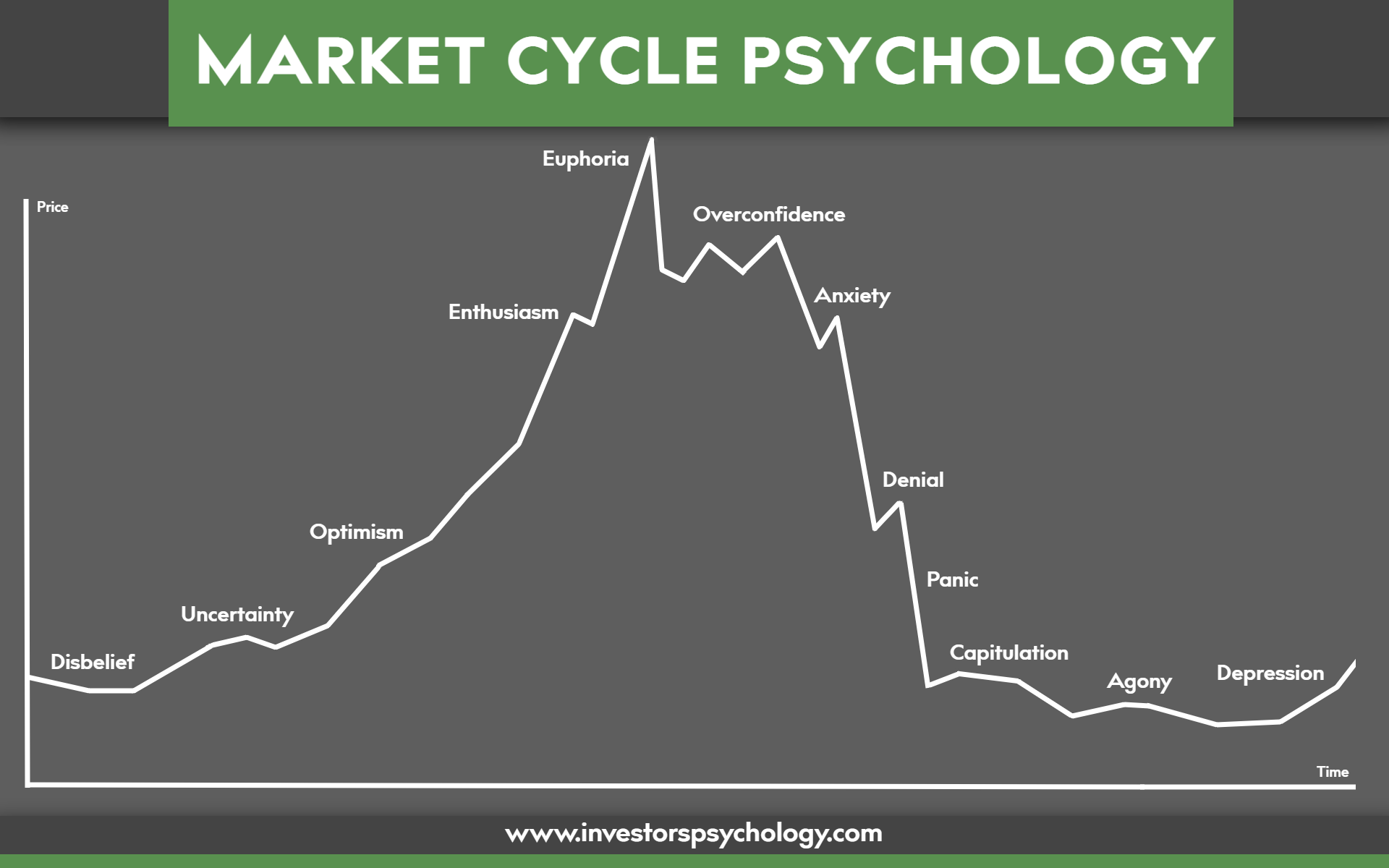

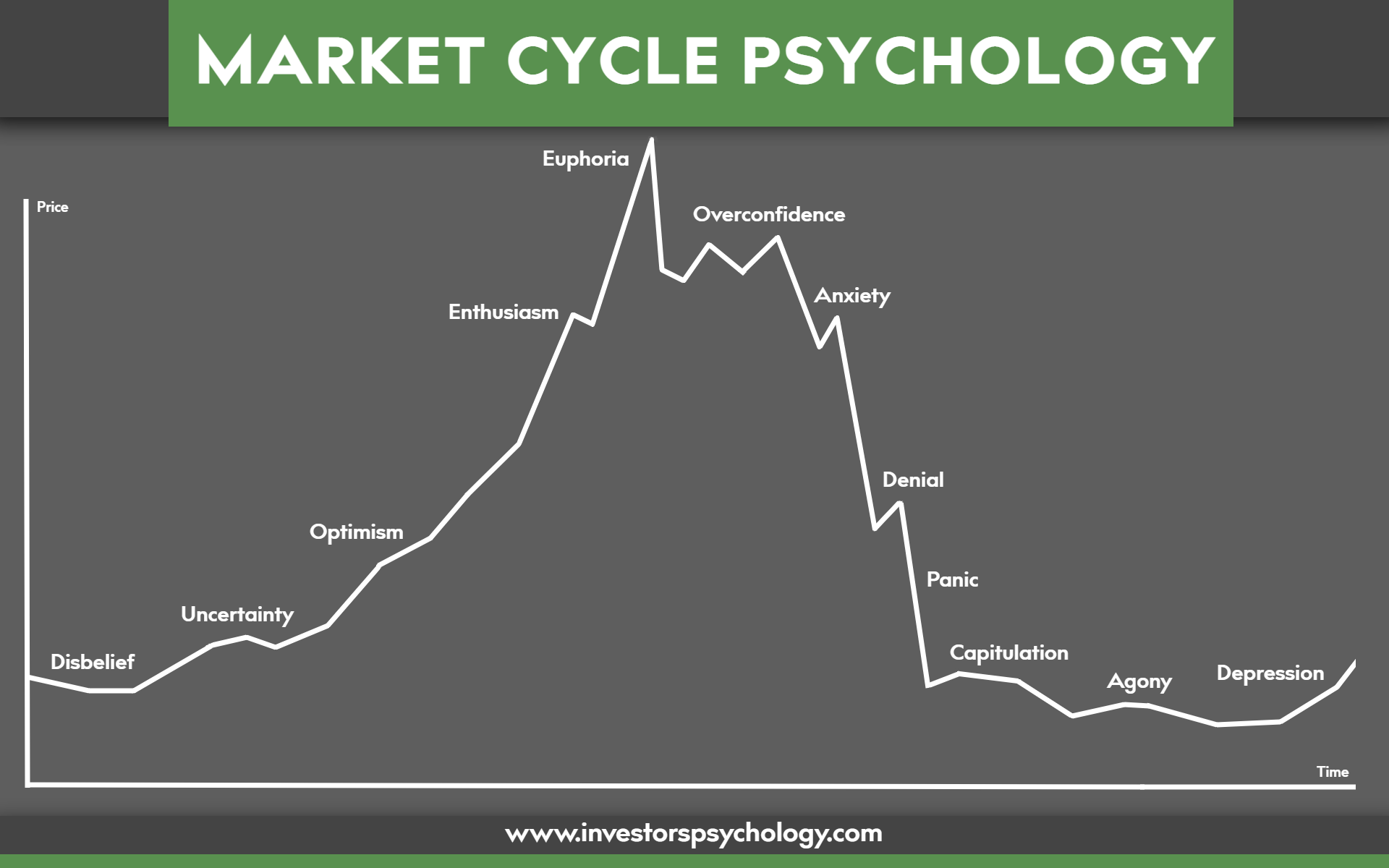

Ignoring the Warning Signs: Investor Complacency

Despite the clear warning signs, there's a risk of investor complacency. The "this time is different" mentality – a dangerous belief that past market corrections won't repeat – can lead to significant underestimation of risks. This can lead to a severe bond market crisis.

-

Herd Behavior: Herd behavior, where investors follow the crowd without conducting their own due diligence, can amplify market bubbles and exacerbate downturns. Ignoring fundamental analysis creates a dangerous vulnerability.

-

Importance of Diversification: Diversification is crucial for mitigating risk. Spreading investments across different bond sectors, maturities, and issuers can help to reduce overall portfolio volatility. Risk management strategies must always be a priority.

-

Risk Management: Proactive risk management is critical in navigating a potentially volatile bond market. This includes regularly assessing portfolio risk exposure, using appropriate hedging strategies, and maintaining sufficient liquidity.

Conclusion: Navigating the Potential Bond Market Crisis

Several warning signs point towards a potential bond market crisis: rising inflation and interest rates, heightened geopolitical risks, and potential overvaluation in certain bond sectors. Investor complacency further exacerbates the situation. To avoid a bond market crisis, or at least mitigate its impact, vigilance and proactive risk management are crucial.

Don't be caught unaware. Proactively manage your bond investments and prepare for potential volatility in the bond market. Consult a financial advisor to assess your risk exposure and develop a robust investment strategy for safeguarding your bond investments and implementing effective bond market risk mitigation techniques. Understanding and addressing these risks is critical for navigating the complexities of the bond market and avoiding significant losses.

Featured Posts

-

Bali Belly Causes Symptoms And Effective Treatments

May 28, 2025

Bali Belly Causes Symptoms And Effective Treatments

May 28, 2025 -

Aggressive Campaign Tactics Used Against Bethlehem Mayoral And Council Candidates

May 28, 2025

Aggressive Campaign Tactics Used Against Bethlehem Mayoral And Council Candidates

May 28, 2025 -

Cristiano Ronaldo Nun Marka Degeri Gelecek Tahminleri Ve Etki Analizi

May 28, 2025

Cristiano Ronaldo Nun Marka Degeri Gelecek Tahminleri Ve Etki Analizi

May 28, 2025 -

Irish Euro Millions Jackpot Two Players Win Big Locations Announced

May 28, 2025

Irish Euro Millions Jackpot Two Players Win Big Locations Announced

May 28, 2025 -

Blake Lively Justin Baldoni Legal Saga Expands A List Involvement Shakes Hollywood

May 28, 2025

Blake Lively Justin Baldoni Legal Saga Expands A List Involvement Shakes Hollywood

May 28, 2025