Palantir Technologies Stock: Should You Invest Before May 5th? Expert Analysis

Table of Contents

Palantir Technologies' Recent Performance and Q1 2024 Earnings Report

Palantir Technologies' recent performance provides a crucial lens through which to view the potential of a Palantir investment. Analyzing their Q1 2024 earnings report and subsequent market reaction is vital for any prospective investor considering PLTR stock.

Analyzing Key Financial Metrics

The Q1 2024 earnings report (replace with actual data when available) will reveal crucial financial metrics. We'll look closely at:

- Revenue Growth Percentage: A significant increase compared to the previous quarter and year-over-year would be a positive sign for Palantir Technologies stock.

- Net Income/Loss: Profitability is a key indicator of financial health. A positive net income would boost investor confidence in PLTR stock.

- Earnings Per Share (EPS): EPS reflects the profitability on a per-share basis and is closely watched by investors.

- Comparison to Analyst Predictions: How did the actual results compare to analyst expectations? Beating expectations could lead to a positive market reaction.

Market Reaction to Earnings

The market's response to Palantir's Q1 2024 earnings report will be a significant factor affecting the PLTR stock price before May 5th.

- Stock Price Fluctuations Post-Earnings: Did the stock price rise or fall immediately following the release of the earnings report? This is a direct reflection of investor sentiment.

- Investor Sentiment Analysis: Examining news articles, social media discussions, and expert opinions will reveal the overall sentiment surrounding the earnings announcement. Was it positive, negative, or neutral?

- News Headlines and Expert Opinions: Major financial news outlets often provide immediate analyses and predictions following earnings releases. Their opinions will help gauge the market's overall perception of the Palantir investment opportunity.

Impact of Geopolitical Factors

Global events significantly impact Palantir's business, particularly its government contracts.

- The War in Ukraine (and other geopolitical events): The ongoing conflict in Ukraine and other geopolitical tensions could significantly influence government spending on defense and intelligence technologies. Increased demand could benefit Palantir.

- Influence on Government Contracts: Palantir's revenue heavily relies on government contracts. Geopolitical stability (or instability) directly affects the procurement processes and budgets of these entities.

- Subsequent Impact on Palantir's Performance: Changes in government spending directly influence Palantir's revenue and profitability, making geopolitical analysis a critical component of any Palantir investment strategy.

Future Projections and Growth Potential for Palantir Technologies

To assess a Palantir investment, evaluating future projections and growth potential is crucial.

Long-Term Growth Strategy

Palantir's long-term strategy hinges on several factors:

- AI Initiatives: Palantir's focus on artificial intelligence and machine learning is a key driver of future growth. Their progress in this area will be vital to their success.

- Government Contracts Pipeline: Securing new government contracts is crucial for Palantir's continued revenue stream. A strong pipeline indicates future growth potential.

- Commercial Market Penetration Strategies: Expanding into the commercial market is key for diversification and reducing reliance on government contracts. Success in this area would significantly reduce the risk associated with a Palantir investment.

Competitive Landscape and Market Share

Analyzing Palantir's position within the big data analytics and AI market is essential:

- Key Competitors: Identify and analyze major competitors like AWS, Microsoft Azure, and Google Cloud.

- Strengths and Weaknesses: Compare Palantir's strengths and weaknesses against its competitors. Areas where Palantir excels (e.g., data integration, AI capabilities) are crucial for success.

- Market Share and Potential for Growth: Assess Palantir's current market share and its potential for future growth within the expanding big data and AI market.

Technological Innovation and Future Product Roadmap

Palantir's R&D efforts are crucial for maintaining a competitive edge:

- AI, Machine Learning, and Cloud Computing: Palantir's continued investment in these technologies is crucial for future growth.

- Planned Product Releases: Any upcoming product launches will significantly influence Palantir's market position and investor sentiment.

- Potential to Drive Growth: The success of new technologies and product releases will directly impact Palantir's future performance and, consequently, its stock price.

Risks and Potential Downsides of Investing in Palantir Technologies Stock Before May 5th

Understanding the potential risks is as important as analyzing the growth potential.

Valuation and Stock Price Volatility

The valuation of PLTR stock and its volatility are significant considerations:

- P/E Ratio and Other Valuation Metrics: Analyze Palantir's P/E ratio and other relevant metrics to assess if the stock is currently overvalued or undervalued.

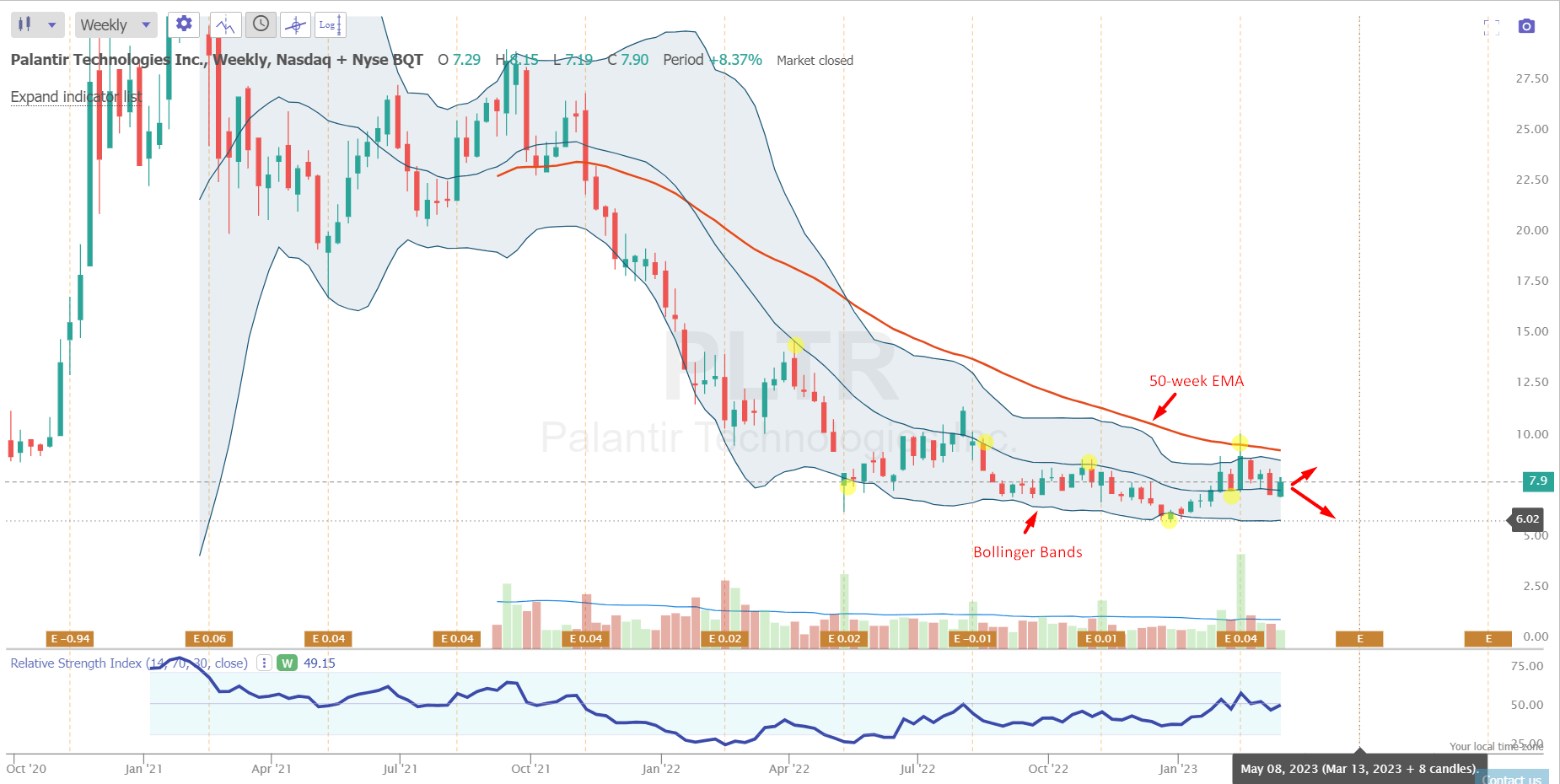

- Historical Price Charts Showing Volatility: Examine historical price charts to understand the extent of the stock's price fluctuations. High volatility indicates greater risk.

- Explanations for Price Swings: Identify the factors that have historically caused significant price swings in PLTR stock.

Dependence on Government Contracts

Palantir's reliance on government contracts presents a risk:

- Percentage of Revenue from Government Sources: A high percentage indicates significant vulnerability to changes in government spending.

- Potential Risks of Contract Delays or Cancellations: Delays or cancellations of major contracts could severely impact Palantir's revenue and profitability.

- Diversification Strategies: Analyze Palantir's efforts to diversify its revenue streams and reduce reliance on government contracts.

Competition and Market Saturation

Increased competition and market saturation pose a threat:

- Potential New Competitors: Identify potential new entrants into the big data analytics and AI market.

- Competitive Pressures: Assess the competitive pressures Palantir faces and its ability to maintain its market share.

- Impact on Palantir's Market Share: Determine the potential for market saturation to erode Palantir's market share and profitability.

Conclusion

Investing in Palantir Technologies stock (PLTR) before May 5th requires a careful assessment of its recent performance, future projections, and potential risks. While Palantir shows promising growth potential in AI and big data analytics, its reliance on government contracts and the competitive landscape present significant considerations. The impact of the Q1 2024 earnings report and the market's reaction will heavily influence the stock price in the short term. The geopolitical climate also plays a significant role.

Call to Action: Make informed decisions about your Palantir investment strategy by further researching the company's financials, market trends, and considering your own risk tolerance. This analysis is for informational purposes only and does not constitute financial advice. Remember to conduct thorough due diligence before investing in Palantir Technologies stock or any other security.

Featured Posts

-

Transgender Mouse Research Examining Us Government Funding

May 10, 2025

Transgender Mouse Research Examining Us Government Funding

May 10, 2025 -

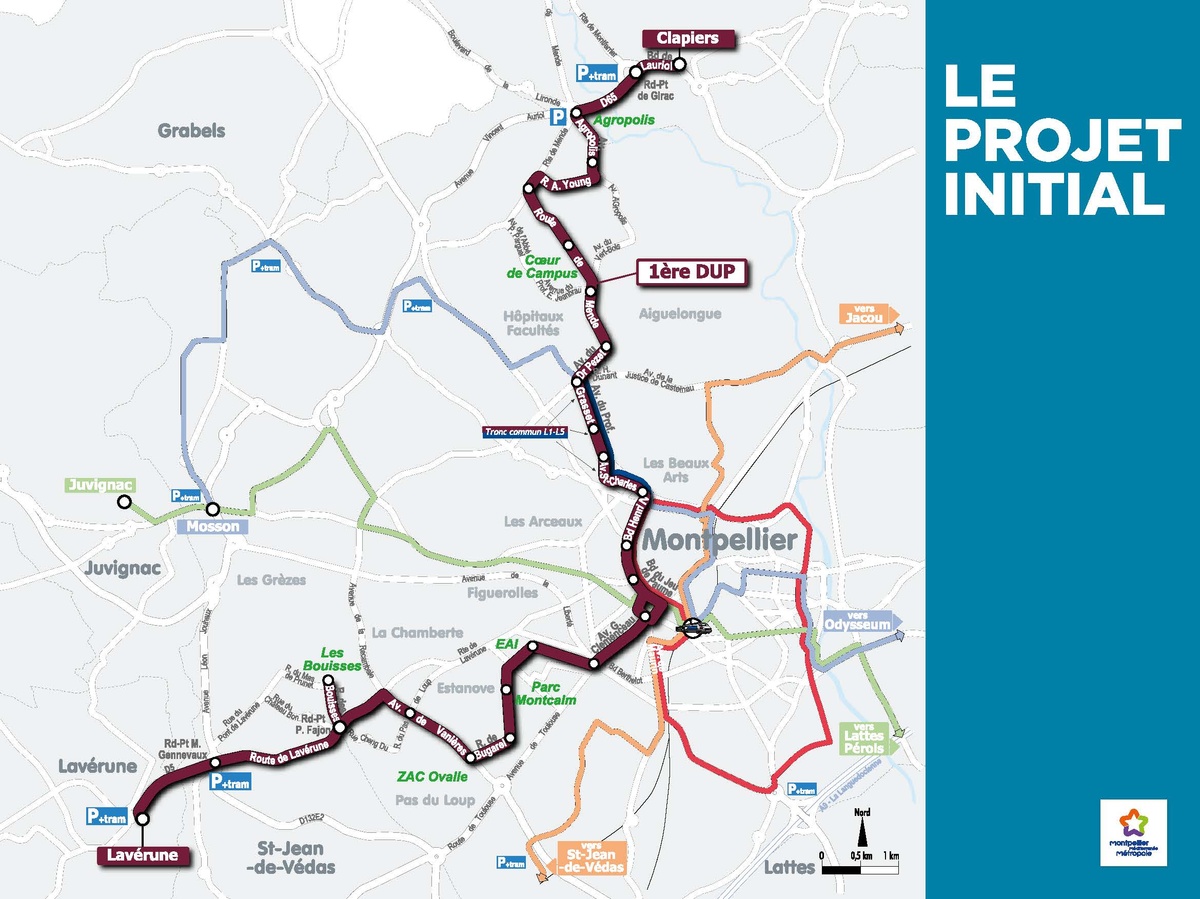

Conseil Metropolitain De Dijon Concertation Sur La Ligne 3 De Tram Lancee

May 10, 2025

Conseil Metropolitain De Dijon Concertation Sur La Ligne 3 De Tram Lancee

May 10, 2025 -

Behind The Scenes Of Celebrity Antiques Road Trip An Insiders Look

May 10, 2025

Behind The Scenes Of Celebrity Antiques Road Trip An Insiders Look

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 10, 2025 -

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 10, 2025

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 10, 2025