Palantir Stock Prediction: Two Potential Investments For Superior Returns In 3 Years

Table of Contents

Investment Strategy 1: Long-Term Growth Based on Palantir's Expanding Government Contracts

Palantir's government contracts represent a significant portion of its revenue and provide a foundation for long-term growth. A robust Palantir stock prediction must account for this key aspect.

Analyzing Palantir's Government Sector Performance:

Palantir boasts a strong presence in government agencies worldwide, providing crucial data analytics and intelligence solutions. This sector's stability offers a degree of predictability, vital for a solid Palantir stock prediction.

- Existing Contracts: Palantir holds substantial contracts with various US government agencies, including the Department of Defense and intelligence communities. These contracts provide a consistent revenue stream.

- Projected Growth: The increasing demand for advanced data analytics within the government sector points towards significant growth opportunities for Palantir in the coming years. Government spending on technology modernization continues to rise.

- Key Metrics: Palantir's government revenue growth has shown consistent upward trends, and their contract win rate demonstrates their competitive edge in this sector. Further analysis of these metrics is crucial for any informed Palantir stock prediction. (Data sources should be cited here, for example, Palantir's quarterly earnings reports and SEC filings).

Mitigation of Risks in Government Contracts:

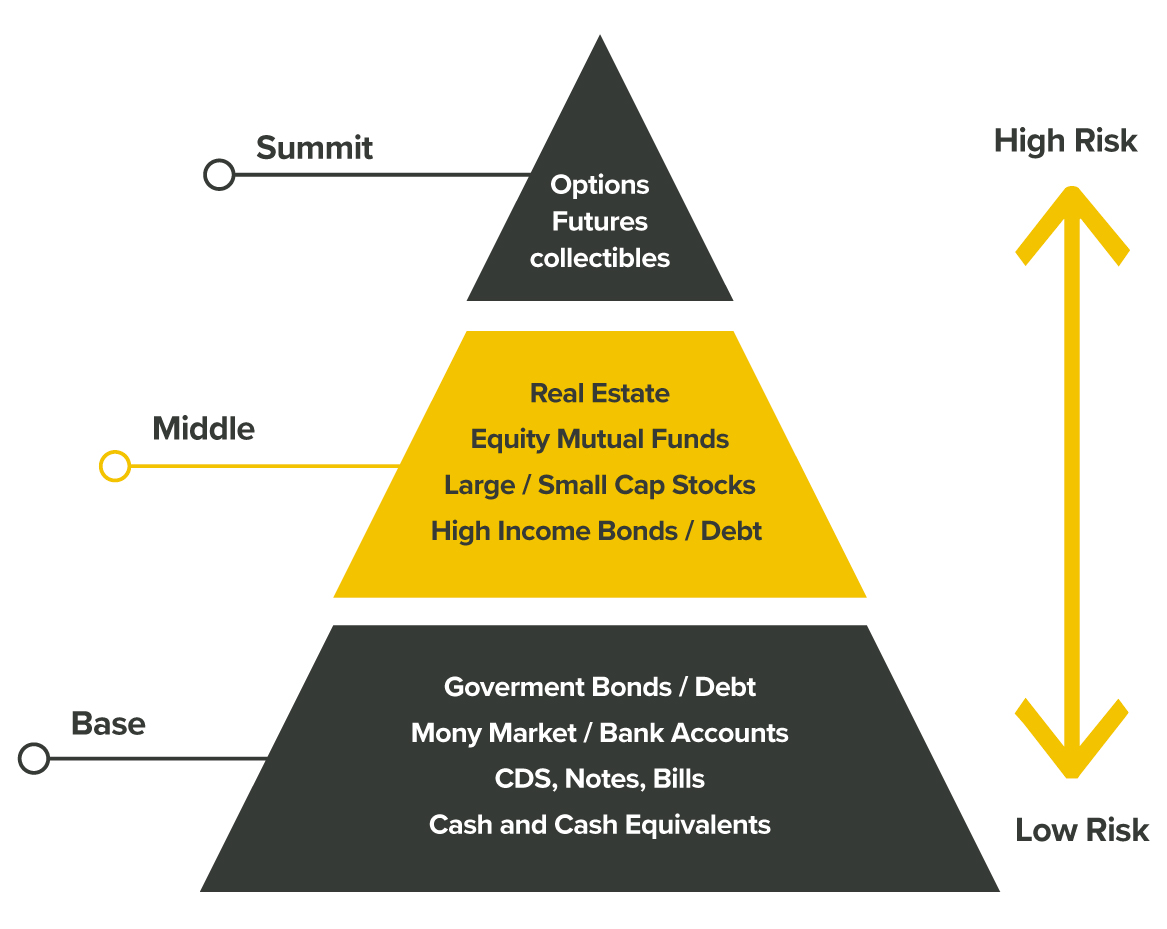

While government contracts offer stability, potential risks must be acknowledged. A comprehensive Palantir stock prediction must include risk management strategies.

- Budget Cuts: Government budget fluctuations can impact contract renewal and future procurements.

- Changing Political Landscapes: Shifts in political priorities could affect funding for certain programs.

- Risk Mitigation: Diversification within the government sector (working with multiple agencies and countries) and focusing on contracts with longer durations can mitigate these risks. Effective risk management is essential for optimizing your Palantir stock portfolio. This requires understanding the dynamics of government spending and political risk.

Investment Strategy 2: Capitalizing on Palantir's Growing Commercial Market Share

While the government sector provides a solid foundation, Palantir's commercial sector holds enormous growth potential. A sophisticated Palantir stock prediction necessitates a thorough understanding of this market segment.

Exploring Palantir's Commercial Market Penetration:

Palantir's expansion into the commercial sector is gaining momentum. This presents a significant opportunity for superior returns, shaping a positive Palantir stock prediction.

- Industry Wins: Palantir has secured notable partnerships and contracts with leading companies across various sectors, including finance, healthcare, and energy.

- Competitive Advantages: Palantir’s powerful data analytics platform, combined with its advanced artificial intelligence capabilities, provides a distinct competitive edge.

- Key Metrics: Tracking market share gains, customer acquisition costs, and revenue growth within the commercial sector is crucial. These metrics provide valuable insights for any Palantir stock prediction. (Again, cite reliable data sources).

Assessing the Competitive Landscape:

The commercial data analytics market is competitive. A robust Palantir stock prediction needs to consider the competitive landscape.

- Key Competitors: Identify Palantir’s main competitors and analyze their strengths and weaknesses (e.g., market share, technological capabilities).

- Competitive Advantages: Palantir's focus on complex data integration and its strong platform differentiates it from competitors. Its ability to leverage data analytics and artificial intelligence is a key competitive advantage.

- Market Dynamics: Understanding the factors driving market competition, such as technological advancements and evolving customer needs, is critical for making an informed Palantir stock prediction.

Conclusion: Making Informed Decisions on Your Palantir Stock Prediction

Investing in Palantir requires a careful assessment of both its government and commercial sectors. Both strategies, focusing on long-term growth within government contracts and capitalizing on commercial market expansion, offer potential for superior returns over the next three years. However, a realistic Palantir stock prediction must also acknowledge the inherent risks. Thorough research, understanding market dynamics, and effective risk management are paramount for making a sound Palantir stock investment.

Before making any investment decisions related to Palantir stock prediction, conduct thorough due diligence. Consider consulting with a qualified financial advisor to optimize your Palantir stock portfolio and tailor your investment strategy to your risk tolerance. Remember, an informed Palantir stock prediction is the foundation of any successful investment strategy.

Featured Posts

-

Rhlt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 09, 2025

Rhlt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 09, 2025 -

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 09, 2025

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 09, 2025 -

Prognoz Pogody Na Konets Aprelya 2025 Goda Perm I Permskiy Kray

May 09, 2025

Prognoz Pogody Na Konets Aprelya 2025 Goda Perm I Permskiy Kray

May 09, 2025 -

Palantir Stock Prediction Two Potential Investments For Superior Returns In 3 Years

May 09, 2025

Palantir Stock Prediction Two Potential Investments For Superior Returns In 3 Years

May 09, 2025 -

Predicting The Bayern Munich Vs Fc St Pauli Encounter

May 09, 2025

Predicting The Bayern Munich Vs Fc St Pauli Encounter

May 09, 2025