Palantir Stock Prediction: Identifying Two Superior Alternatives For 2026

Table of Contents

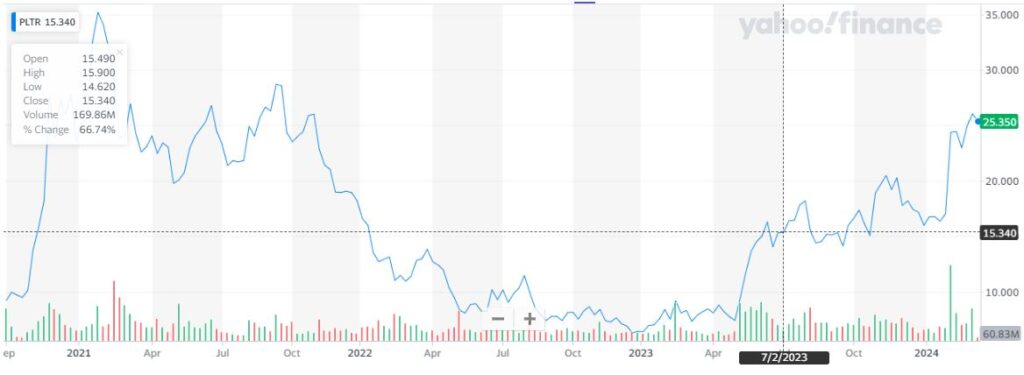

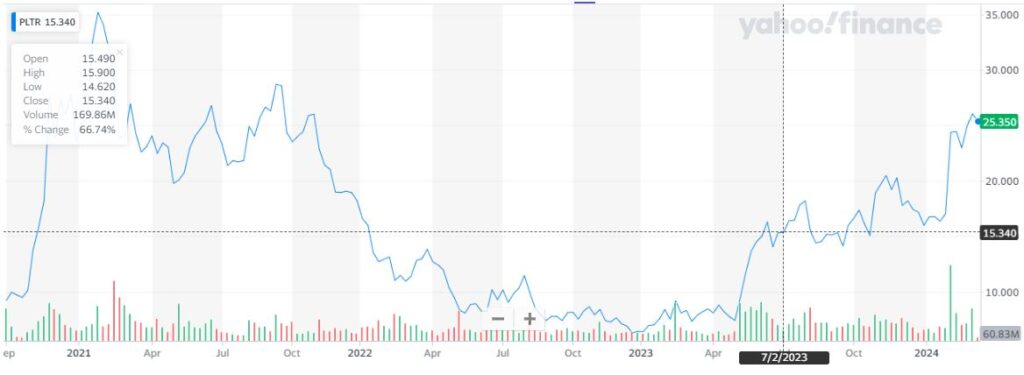

Assessing the Risks and Uncertainties of Palantir Stock

While Palantir boasts impressive technology, several factors cast shadows on its long-term stock performance. A thorough Palantir stock forecast needs to account for these crucial risks.

Valuation Concerns: Is Palantir Overvalued?

Palantir's current valuation is a significant concern for many investors. Some analysts believe the stock is overpriced, potentially leading to future price corrections.

- High P/E Ratio Compared to Industry Peers: Palantir's price-to-earnings ratio (P/E) is often higher than its competitors, suggesting a potentially inflated valuation. This high P/E ratio reflects investor optimism, but it also increases the risk of a significant drop if earnings don't meet expectations.

- Dependence on Government Contracts: A considerable portion of Palantir's revenue comes from government contracts. This reliance introduces vulnerability to changes in government spending, budget cuts, and shifting political priorities. A decrease in government contracts could severely impact Palantir's revenue and, consequently, its stock price.

- Slow Revenue Growth Compared to Expectations: While Palantir's revenue is growing, it hasn't always met initial market expectations. This inconsistency in growth can lead to investor uncertainty and potential stock price volatility.

Competitive Landscape: Navigating a Crowded Market

The big data and analytics market is incredibly competitive. Palantir faces pressure from established tech giants and nimble startups constantly innovating.

- Competition from Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform: These industry behemoths offer powerful cloud-based analytics solutions, putting pressure on Palantir's market share. Their extensive resources and established client bases pose a significant challenge.

- The Rise of Open-Source Data Analytics Tools: The increasing popularity of open-source alternatives provides cost-effective solutions for companies, further intensifying the competition and potentially reducing Palantir's market appeal. These tools often offer similar functionalities at a fraction of the cost.

Geopolitical Risks: International Instability and its Impact

Palantir's reliance on government contracts exposes it to the unpredictable nature of international relations and geopolitical instability.

- Potential Budget Cuts: Changes in government priorities or economic downturns can lead to significant budget cuts, impacting the demand for Palantir's services and potentially leading to contract cancellations.

- Changes in Government Regulations: New regulations or policy shifts could impact Palantir's ability to operate effectively and secure future contracts, leading to revenue uncertainty.

- International Relations Impacting Contracts: Geopolitical tensions or conflicts can disrupt international collaborations and impact the execution of existing contracts, negatively affecting Palantir's revenue stream.

Introducing Superior Alternatives for 2026: Two Promising Tech Stocks

Considering the risks associated with Palantir, let's explore two promising technology stocks that offer potentially superior investment opportunities for 2026.

Alternative 1: CrowdStrike Holdings, Inc. (CRWD) – Cybersecurity

CrowdStrike is a leading cybersecurity company providing endpoint protection, threat intelligence, and incident response services. It represents a superior alternative to Palantir due to several key factors:

- Strong Financial Performance Indicators: CrowdStrike demonstrates consistent revenue growth, high profit margins, and a strong return on equity, suggesting a healthier financial foundation than Palantir.

- Innovative Technology and Business Model: CrowdStrike's cloud-native platform offers a scalable and flexible solution, giving it a competitive edge in the rapidly evolving cybersecurity landscape. Its subscription-based model ensures recurring revenue streams.

- Strong Management Team: CrowdStrike has a seasoned and highly respected management team with a proven track record of success in the technology industry.

- Lower Valuation Compared to Palantir (Potentially): Depending on market conditions, CrowdStrike might present a more attractive valuation than Palantir, offering better risk-adjusted returns.

Alternative 2: Datadog (DDOG) – Monitoring and Analytics

Datadog provides a cloud-based monitoring and analytics platform for IT infrastructure and applications. This makes it a compelling Palantir alternative due to its:

- Diversified Revenue Streams: Datadog caters to a wide range of clients across various industries, reducing its dependence on any single sector and mitigating risk.

- Strong Market Position: Datadog enjoys a strong market position in the rapidly growing observability market, with a large and expanding customer base.

- Potential for Expansion into New Markets: Datadog's platform is versatile and can be applied to various new markets, offering significant growth potential.

- Robust Intellectual Property Portfolio: Datadog's technology is protected by a robust intellectual property portfolio, providing a competitive advantage and reducing the risk of imitation.

Conclusion

This article analyzed a Palantir stock prediction for 2026, highlighting significant risks associated with investing in the company. While Palantir possesses innovative technology, its high valuation, intense competition, and reliance on government contracts present substantial challenges. We've presented two alternative technology stocks, CrowdStrike (CRWD) and Datadog (DDOG), which offer potentially superior risk-adjusted returns based on their stronger financials, diversified revenue streams, and less volatile market exposure.

Call to Action: Before investing in Palantir stock or any other technology stock, conduct thorough due diligence. Consider diversifying your portfolio and exploring superior alternatives like CrowdStrike and Datadog for a potentially more profitable and stable investment strategy. Remember to carefully research a Palantir stock prediction and alternative options before committing your capital. Thoroughly analyze the risks and rewards associated with any investment before making a decision.

Featured Posts

-

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025 -

Dijon Proces Pour Violences Conjugales Le Boxeur Bilel Latreche Attendu En Aout

May 09, 2025

Dijon Proces Pour Violences Conjugales Le Boxeur Bilel Latreche Attendu En Aout

May 09, 2025 -

Municipales A Dijon 2026 Le Programme Ecologiste

May 09, 2025

Municipales A Dijon 2026 Le Programme Ecologiste

May 09, 2025 -

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev 9 Maya Prichiny I Posledstviya

May 09, 2025

Otkaz Makrona Starmera Mertsa I Tuska Ot Poezdki V Kiev 9 Maya Prichiny I Posledstviya

May 09, 2025 -

Predicting The Bayern Munich Vs Inter Milan Champions League Encounter

May 09, 2025

Predicting The Bayern Munich Vs Inter Milan Champions League Encounter

May 09, 2025