Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Key Metrics

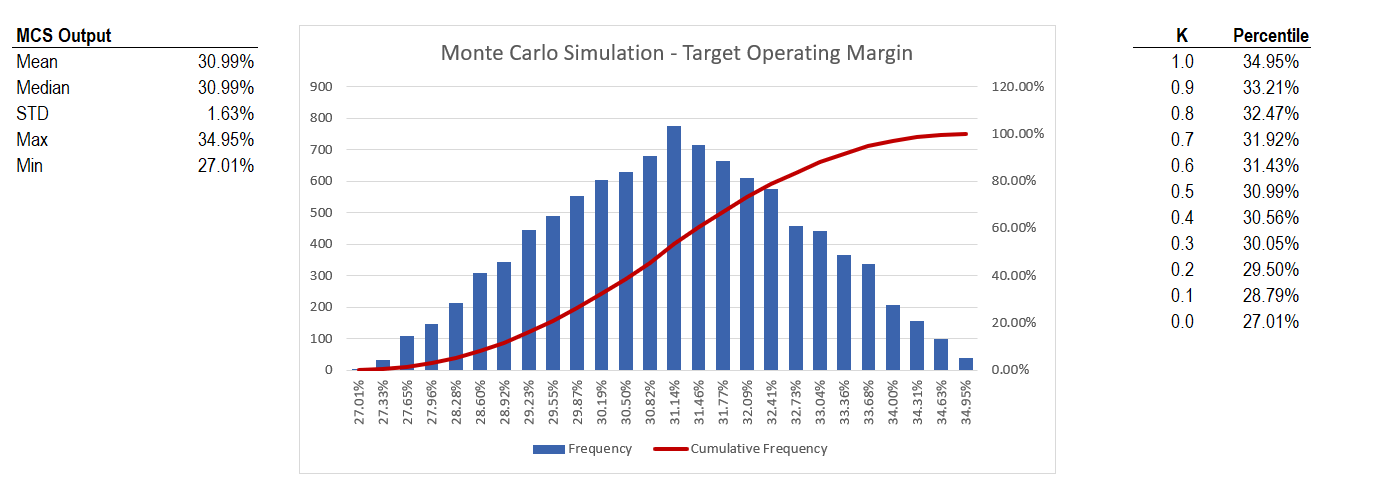

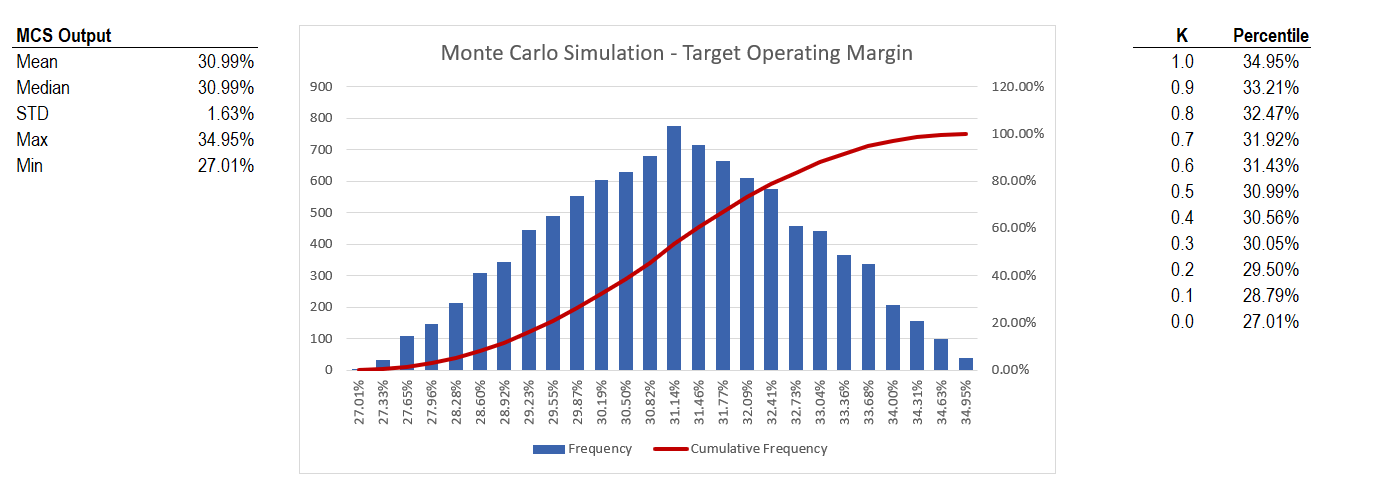

Analyzing Palantir's recent performance requires a close look at key financial metrics. While Palantir has shown significant revenue growth, profitability remains a key area of focus for investors. Examining trends in revenue growth, margins, and customer acquisition is crucial for understanding the company's current financial health.

- Revenue Growth: Compare Palantir's revenue growth rate in recent quarters and years. A consistent upward trend indicates strong performance, while a slowdown might signal underlying challenges. Look for comparisons against previous years and industry benchmarks to assess the strength of Palantir's growth trajectory. Analyzing year-over-year and quarter-over-quarter growth rates will paint a clearer picture of the underlying business momentum.

- Margin Analysis: Gross margin and operating margin are critical indicators of profitability. Tracking the trends in these margins is essential. Improving margins suggest increased efficiency and operational leverage, while declining margins may raise concerns about cost management.

- Customer Acquisition and Retention: Palantir's success hinges on attracting and retaining customers. Analyzing the number of new customers acquired and the retention rate of existing clients provides insights into the sustainability of its business model. Are they successfully upselling existing contracts? Is customer churn a concern?

- Contract Wins and Losses: Significant contract wins, particularly large government contracts, can significantly impact Palantir's revenue and outlook. Conversely, any major contract losses could negatively affect investor sentiment. Pay close attention to the types of contracts won and lost, as the mix between government and commercial clients influences overall risk.

- Macroeconomic Impact: The current macroeconomic environment, including inflation and recessionary fears, can significantly impact Palantir's performance. Understanding how these factors influence customer spending and government budgets is critical for assessing potential risks. For example, decreased government spending could severely affect Palantir's revenue.

Upcoming Catalysts and Growth Opportunities

Despite challenges, several factors could boost Palantir's stock price following the May 5th earnings report. These potential catalysts offer reasons for optimism regarding the company's future growth prospects.

- New Product Launches and Updates: The introduction of new products or substantial updates to existing platforms can drive revenue growth and attract new customers. Look for announcements regarding improvements to its core Foundry platform or new offerings tailored to specific market segments.

- Market Expansion: Palantir's expansion into new markets or sectors, both in the commercial and government domains, presents significant growth opportunities. Increased penetration in specific industries or geographical regions could translate to higher revenue and broader market reach.

- Strategic Partnerships and Acquisitions: Strategic partnerships with other technology companies or acquisitions of complementary businesses could enhance Palantir's capabilities and accelerate its growth. Analyzing potential partnerships and their strategic value is crucial for assessing Palantir's future potential.

- Government Spending: Government spending trends, particularly in defense and intelligence, are critical for Palantir's government contracts. Increased government investment in data analytics and cybersecurity could lead to higher contract awards for Palantir.

- Data Analytics Market Potential: The long-term potential of the data analytics market remains substantial. Palantir's position within this rapidly growing market offers significant upside potential. However, intense competition should be considered as a counterpoint.

Potential Risks and Challenges Facing Palantir

While Palantir exhibits considerable potential, various risks and challenges could negatively impact its stock price after the earnings report. Understanding these challenges is crucial for a realistic assessment of the investment opportunity.

- Competition: The data analytics market is highly competitive. Palantir faces competition from established tech giants and emerging startups. Assessing the competitive landscape and Palantir's competitive advantages is important.

- Profitability Concerns: Palantir's path to sustained profitability remains a significant concern for investors. Analyzing the company's cost structure and its ability to achieve profitability is vital.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending priorities or geopolitical events.

- Geopolitical Risks: Geopolitical instability and international relations can directly impact Palantir's business, particularly its government contracts. Understanding these geopolitical risks is crucial.

- Disappointing Earnings: The risk of disappointing earnings results always exists. Unexpectedly weak revenue growth, lower-than-expected margins, or unforeseen challenges could negatively impact investor confidence.

Analyst Sentiment and Price Targets

Analyzing analyst sentiment and price targets offers valuable insights into market expectations for Palantir's future performance. While analyst opinions should not be the sole basis for investment decisions, they offer a valuable perspective on the collective market outlook.

- Average Price Target: The average price target from multiple analysts provides a consensus view of Palantir's potential stock price. Consider this in relation to the current trading price to gauge potential upside or downside.

- Price Target Range: The range of price targets (high and low) highlights the divergence in analyst opinions. A wide range reflects greater uncertainty surrounding Palantir's future performance.

- Analyst Ratings: Analyst ratings (buy, hold, sell) reflect their overall assessment of the investment opportunity. Note the distribution of ratings across different brokerages.

- Changes in Sentiment: Monitor recent changes in analyst sentiment. An upward revision in price targets or a shift from "hold" to "buy" ratings suggests increased optimism.

Conclusion

This pre-earnings analysis of Palantir stock provides a balanced view, examining both the potential upsides (new products, market expansion) and downsides (competition, profitability concerns) before the May 5th earnings release. Weighing these factors is crucial for making an informed investment decision. Remember that past performance is not indicative of future results.

Call to Action: While this analysis offers valuable insights into whether you should buy Palantir stock before May 5th, thorough due diligence and consideration of your individual risk tolerance are paramount. Do your own research and consider consulting a financial advisor before making any investment decisions regarding Palantir stock or any other security. Continue to monitor Palantir's performance and news surrounding the company after the earnings announcement. Remember that this is not financial advice, and investing in Palantir stock involves inherent risks.

Featured Posts

-

Uk Set To Implement Stricter Immigration Rules English Language Test Mandatory

May 09, 2025

Uk Set To Implement Stricter Immigration Rules English Language Test Mandatory

May 09, 2025 -

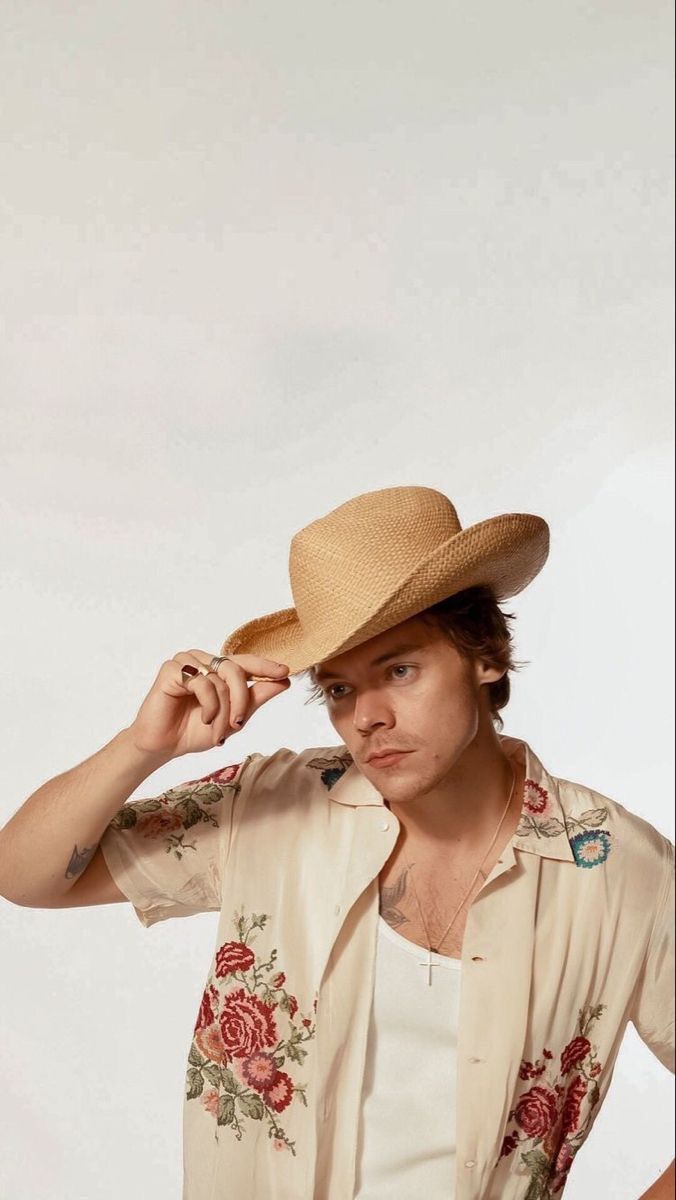

Harry Styles Reacts To A Failed Snl Impression

May 09, 2025

Harry Styles Reacts To A Failed Snl Impression

May 09, 2025 -

Wave Of Car Break Ins Hits Elizabeth City Apartments

May 09, 2025

Wave Of Car Break Ins Hits Elizabeth City Apartments

May 09, 2025 -

Gear Up For The Celtics Finals Push Find Authentic Merchandise At Fanatics

May 09, 2025

Gear Up For The Celtics Finals Push Find Authentic Merchandise At Fanatics

May 09, 2025 -

Is Daily Fox News Appearance By Us Attorney General A Distraction

May 09, 2025

Is Daily Fox News Appearance By Us Attorney General A Distraction

May 09, 2025