Palantir Stock Before May 5th: Is It A Smart Investment?

Table of Contents

Palantir Technologies (PLTR) stock has experienced considerable volatility, leaving many investors questioning its viability. With May 5th approaching, the question on everyone's mind is: is Palantir a smart investment? This comprehensive analysis delves into key factors influencing Palantir's stock price, helping you determine whether to buy, sell, or hold PLTR before this date. We'll examine recent performance, future prospects, and potential risks associated with investing in this data analytics giant.

Palantir's Recent Performance and Financial Health

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings report offered a mixed bag. While the company demonstrated continued revenue growth, surpassing analyst expectations in some areas, profitability remained a key focus.

- Revenue Growth: Palantir reported a [insert actual percentage]% increase in revenue compared to Q4 2021. While this demonstrates positive growth, it's crucial to compare this figure to previous quarters and the company's projected growth trajectory.

- Net Income: [Insert actual net income figure] reflects [positive or negative] performance. This figure should be analyzed in conjunction with operating expenses and the overall financial health of the company.

- Operating Margin: The operating margin stood at [insert actual percentage]%, indicating [positive or negative] progress towards profitability. Consistent improvement in this key performance indicator (KPI) is crucial for long-term investor confidence.

- Business Model Changes: Palantir has been actively diversifying its revenue streams, expanding beyond its traditional government contracts into the commercial sector. The success of this strategy is vital for sustainable growth and reduced reliance on government funding.

Stock Price Volatility and Market Sentiment

Palantir's stock price has exhibited considerable volatility in recent months. This volatility is influenced by various factors:

- Price Fluctuations: In the past few months, PLTR has seen highs of [insert high price] and lows of [insert low price]. This significant price swing underscores the inherent risk associated with investing in Palantir.

- Market Correlation: Palantir's stock price is, to some degree, correlated with the overall performance of the technology sector and the broader market. Negative market sentiment often impacts high-growth technology stocks like PLTR disproportionately.

- Trading Volume and Short Interest: High trading volume and short interest indicate significant investor activity and potential for sharp price movements. Monitoring these indicators is crucial for understanding market sentiment towards Palantir.

Future Growth Prospects and Market Opportunities

Government Contracts and Commercial Partnerships

Palantir's growth trajectory hinges on its ability to secure and expand both government contracts and commercial partnerships.

- Government Clients: Palantir's existing relationships with numerous government agencies across various countries represent a significant revenue stream. The pipeline of potential future contracts is a key factor to consider.

- Commercial Partnerships: Palantir is making inroads into the commercial sector, partnering with companies in diverse industries. The success of these partnerships will be crucial in diversifying its revenue streams.

- Market Size: The market for data analytics and artificial intelligence (AI) solutions is vast and rapidly expanding, offering significant growth potential for companies like Palantir.

Technological Innovation and Competitive Landscape

Palantir's commitment to technological innovation and its competitive position are crucial elements to consider.

- Technological Advancements: Palantir is continuously developing and refining its data analytics platform, incorporating cutting-edge AI and machine learning capabilities. This ongoing innovation is essential for maintaining its competitive edge.

- Competitive Landscape: The data analytics market is highly competitive. Palantir faces competition from established tech giants and agile startups. Its ability to differentiate its offerings and maintain market share is crucial for long-term success.

- Challenges and Threats: Competition, regulatory changes, and the potential for technological disruption pose challenges to Palantir's growth. Investors must consider these factors when assessing its long-term prospects.

Risks and Considerations Before Investing in Palantir Stock

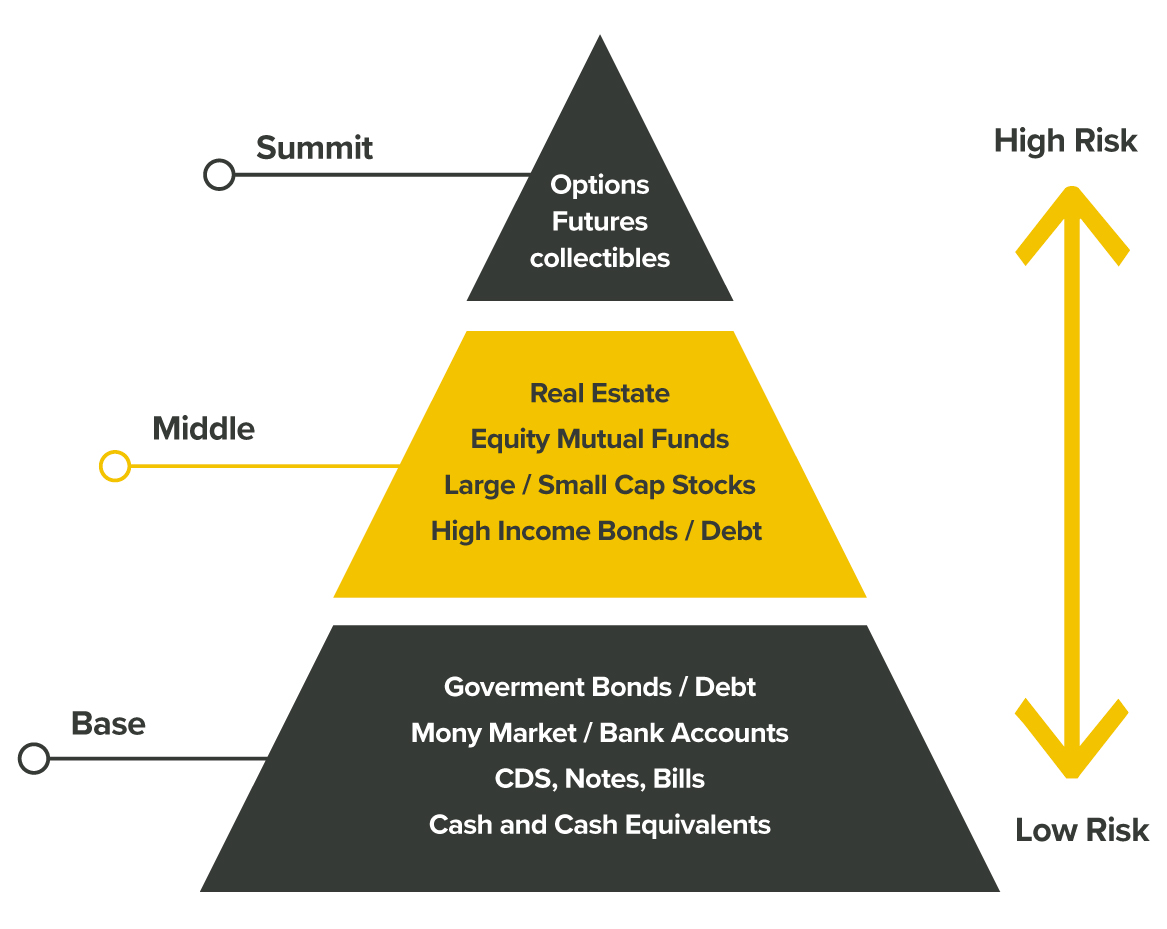

Valuation and Stock Price Risk

Palantir's valuation compared to its peers and historical performance is crucial to assess potential future price movements.

- Valuation Metrics: Key valuation metrics such as the P/E ratio and market capitalization provide insights into Palantir's relative valuation. It's important to compare these metrics to those of its competitors.

- High Growth Stock Risk: High growth stocks, like Palantir, are inherently more volatile than established companies. Investors must accept a higher degree of risk in exchange for the potential for higher returns.

- Investment Risk Disclaimer: Investing in the stock market always involves risk. There's no guarantee of profit, and you could lose some or all of your investment.

Geopolitical and Regulatory Risks

Geopolitical events and regulatory changes can significantly impact Palantir's business.

- International Operations: Palantir operates globally, making it susceptible to geopolitical risks and regulatory changes in different countries.

- Data Privacy and Security Regulations: The data analytics industry is subject to increasingly stringent data privacy and security regulations. Compliance with these regulations is crucial for Palantir.

- Overall Risk Profile: Palantir operates in a high-risk, high-reward environment. Investors need to assess their risk tolerance before investing in the company.

Conclusion

This analysis of Palantir stock before May 5th presents a complex picture. Palantir's substantial growth potential, driven by government contracts and technological innovation, is undeniable. However, investors must acknowledge the inherent volatility and valuation risks associated with this high-growth company.

Call to Action: The decision to invest in Palantir stock before May 5th is ultimately a personal one. Conduct thorough due diligence, carefully evaluate your risk tolerance, and consult with a qualified financial advisor before making any investment decisions. Remember to always perform your own research before investing in Palantir.

Featured Posts

-

Wall Street Predicts 110 Surge The Billionaire Backed Black Rock Etf

May 09, 2025

Wall Street Predicts 110 Surge The Billionaire Backed Black Rock Etf

May 09, 2025 -

Psg Dominon Formacionin E Gjysmefinaleve Te Liges Se Kampioneve

May 09, 2025

Psg Dominon Formacionin E Gjysmefinaleve Te Liges Se Kampioneve

May 09, 2025 -

Barys San Jyrman Msyrt Nhw Alttwyj Bdwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Msyrt Nhw Alttwyj Bdwry Abtal Awrwba

May 09, 2025 -

Palantir Stock Prediction Two Potential Investments For Superior Returns In 3 Years

May 09, 2025

Palantir Stock Prediction Two Potential Investments For Superior Returns In 3 Years

May 09, 2025 -

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025