Palantir Stock Analysis: Is It A Good Investment Opportunity Now?

Table of Contents

Palantir's Business Model & Revenue Streams

Palantir's revenue streams are multifaceted, presenting both opportunities and challenges. Understanding these is crucial for a comprehensive Palantir stock analysis.

Palantir Government Contracts

Government contracts form a significant pillar of Palantir's revenue and provide a degree of stability. However, reliance on this sector also presents inherent risks.

- Revenue Breakdown: While Palantir is actively expanding its commercial presence, a considerable portion of its revenue still originates from government contracts, particularly within the defense and intelligence sectors. The exact percentage fluctuates, so staying updated on their financial reports is crucial.

- Recent Contract Wins/Losses: Tracking recent contract awards and renewals is vital for assessing the short-term outlook. Significant wins can boost investor confidence, while losses could negatively impact the stock price.

- Risks and Opportunities: Government spending can be cyclical, influenced by political changes and budgetary constraints. This presents a risk factor. Conversely, growing government interest in advanced data analytics for national security and other purposes presents opportunities for continued growth in this sector. Keywords: Palantir government contracts, defense contracts, government spending on data analytics.

Palantir Commercial Market Penetration

Palantir's push into the commercial market is a key indicator of its long-term growth potential. Success here will be crucial for diversifying its revenue streams and reducing reliance on government contracts.

- Key Commercial Clients: Identifying and tracking the growth of Palantir's commercial clientele offers valuable insights. The acquisition of significant clients in diverse industries signifies market acceptance and broader applicability of their data analytics platform.

- Growth in Commercial Revenue: Monitoring the year-over-year growth in commercial revenue is a key metric to gauge Palantir's success in this sector. Rapid growth signifies strong market traction.

- Challenges and Competition: The commercial data analytics market is highly competitive, with established players like Databricks and Snowflake. Analyzing Palantir's competitive advantages and strategies for market share gain is essential for a thorough Palantir stock analysis. Keywords: Palantir commercial clients, data analytics platform, competition in the data analytics market.

Foundry Platform & Future Growth

Palantir's Foundry platform is positioned as a key driver of future growth. Its potential for expansion across various industries makes it a crucial element of any Palantir stock analysis.

- Foundry Capabilities: Foundry's ability to integrate data from diverse sources and provide AI-driven insights is a significant selling point. Understanding its capabilities and how it differentiates from competitors is crucial.

- Adoption Rate: Tracking the adoption rate of Foundry among commercial and government clients is vital for assessing its market acceptance and potential for revenue generation.

- Industry Expansion: Palantir's ability to penetrate new industries with Foundry will directly influence its future growth trajectory. Identifying potential new market segments for this software-as-a-service (SaaS) offering is important. Keywords: Palantir Foundry, data integration platform, AI-driven analytics, software-as-a-service (SaaS).

Financial Performance & Valuation

A thorough Palantir stock analysis requires a deep dive into the company's financial health and valuation.

Revenue Growth & Profitability

Analyzing Palantir's revenue growth trajectory and profitability provides insights into its financial performance and sustainability.

- Year-over-Year Revenue Growth: Consistent, strong year-over-year revenue growth indicates healthy demand for Palantir's products and services.

- Operating Margins & Net Income: Examining operating margins and net income reveals the company's profitability and efficiency in managing costs. Improving margins suggest an enhanced ability to translate revenue into profit.

- Key Financial Ratios: Utilizing key financial ratios, such as the Price-to-Earnings (P/E) ratio, helps gauge the company's valuation relative to its earnings and compare it to industry peers. Keywords: Palantir revenue growth, Palantir profitability, financial performance analysis.

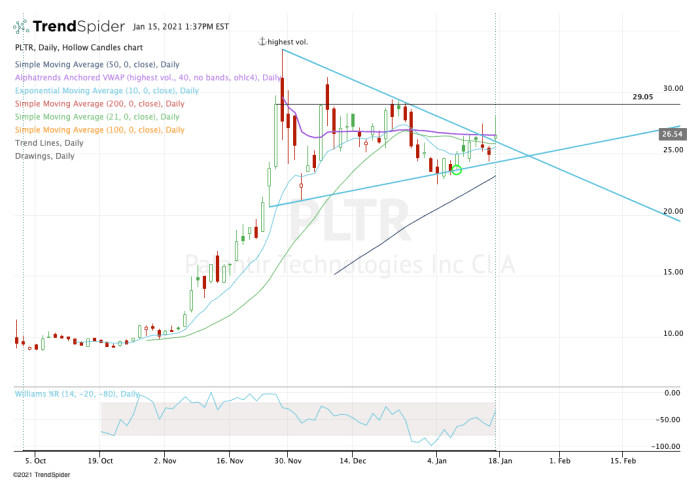

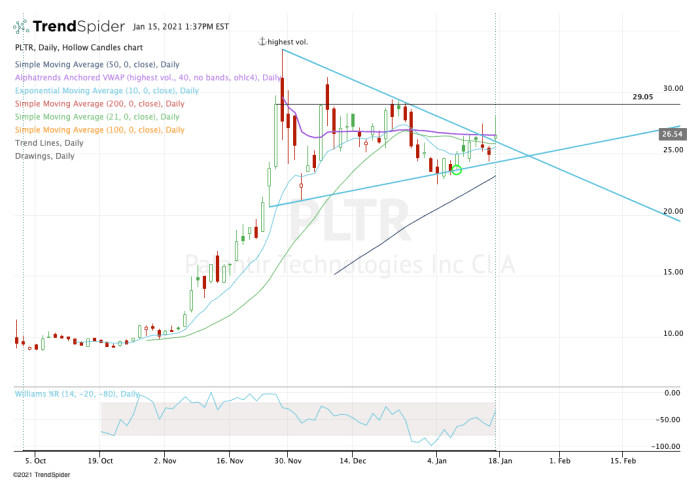

Stock Valuation & Price-to-Sales Ratio

Assessing Palantir's stock valuation relative to its peers and the broader market is crucial for determining its investment attractiveness.

- Current Stock Price & Market Capitalization: Monitoring the current stock price and market capitalization provides a snapshot of investor sentiment and the company's overall value.

- Price-to-Sales Ratio (P/S): The P/S ratio is a useful valuation metric for high-growth companies like Palantir, providing a comparison to industry peers.

- Competitor Valuation: Comparing Palantir's valuation metrics (P/S, P/E, etc.) to its competitors gives context to its relative valuation and potential future performance. Keywords: Palantir stock price, market capitalization, price-to-sales ratio, stock valuation.

Risk Assessment & Future Outlook

A realistic Palantir stock analysis must incorporate a thorough assessment of potential risks and the long-term outlook.

Competition & Market Saturation

The competitive landscape and potential for market saturation pose significant risks to Palantir's future growth.

- Major Competitors: Identifying and analyzing the strategies of key competitors, such as Databricks and Snowflake, is vital for understanding Palantir's competitive position.

- Increased Competition: The data analytics market is dynamic, and new entrants or increased competition from existing players could impact Palantir's market share.

- Market Share Analysis: Analyzing Palantir's market share and its potential for growth within the broader data analytics market provides a clearer picture of its long-term prospects. Keywords: Palantir competitors, data analytics competition, market saturation.

Geopolitical Risks & Regulatory Challenges

Geopolitical factors and regulatory hurdles can significantly influence Palantir's operations and financial performance.

- Government Contract Dependence: Palantir's reliance on government contracts exposes it to the risks associated with political changes, budgetary constraints, and shifts in government priorities.

- Regulatory Changes: Changes in data privacy regulations or other relevant legislation could impact Palantir's operations and ability to acquire new clients.

- International Expansion Challenges: Expanding into new international markets can present unique challenges related to regulatory compliance, cultural differences, and geopolitical risks. Keywords: Palantir geopolitical risk, regulatory compliance, international expansion.

Long-Term Growth Potential

Despite the risks, Palantir possesses significant long-term growth potential fueled by technological innovation and market expansion.

- New Market Expansion: Palantir's ability to expand into new markets and industries will be critical to its long-term growth.

- Technological Innovation: Continued investment in research and development and the development of new data analytics capabilities will be essential for maintaining a competitive edge.

- Long-Term Revenue Projections: Analyzing long-term revenue projections based on realistic growth scenarios provides a framework for evaluating the long-term investment potential of Palantir stock. Keywords: Palantir growth potential, future outlook, long-term investment.

Conclusion: Is Palantir Stock Right for You?

This Palantir stock analysis reveals a company with significant potential but also considerable risks. Its strong presence in the government sector provides a degree of stability, while its push into the commercial market offers substantial growth opportunities. However, intense competition, geopolitical uncertainties, and regulatory hurdles present challenges. The success of its Foundry platform will be crucial for future growth. Palantir's valuation and financial performance require close monitoring.

Ultimately, the question of whether Palantir stock is right for you depends on your individual risk tolerance, investment timeline, and financial goals. Conduct your own thorough Palantir stock analysis, consider your personal investment strategy before investing in Palantir, and learn more about Palantir's future prospects before making a decision about Palantir stock. Remember, this is not financial advice; consult a qualified financial advisor before making any investment decisions.

Featured Posts

-

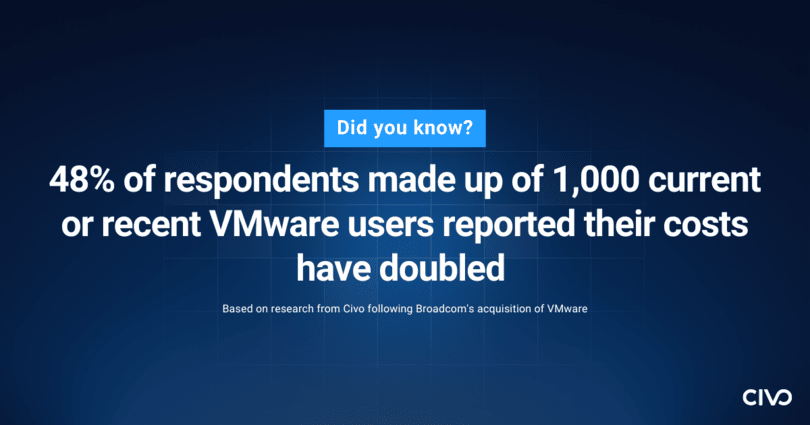

1 050 V Mware Price Increase Proposed By Broadcom At And Ts Concerns

May 10, 2025

1 050 V Mware Price Increase Proposed By Broadcom At And Ts Concerns

May 10, 2025 -

Wynne Evans Speaks Out A Post Strictly Come Dancing Career Announcement

May 10, 2025

Wynne Evans Speaks Out A Post Strictly Come Dancing Career Announcement

May 10, 2025 -

Imf To Review Pakistans 1 3 Billion Loan Package Amidst India Tensions

May 10, 2025

Imf To Review Pakistans 1 3 Billion Loan Package Amidst India Tensions

May 10, 2025 -

Europa League Preview Brobbeys Power A Key Factor

May 10, 2025

Europa League Preview Brobbeys Power A Key Factor

May 10, 2025 -

Federal Charges Millions Stolen Via Compromised Executive Office365 Accounts

May 10, 2025

Federal Charges Millions Stolen Via Compromised Executive Office365 Accounts

May 10, 2025