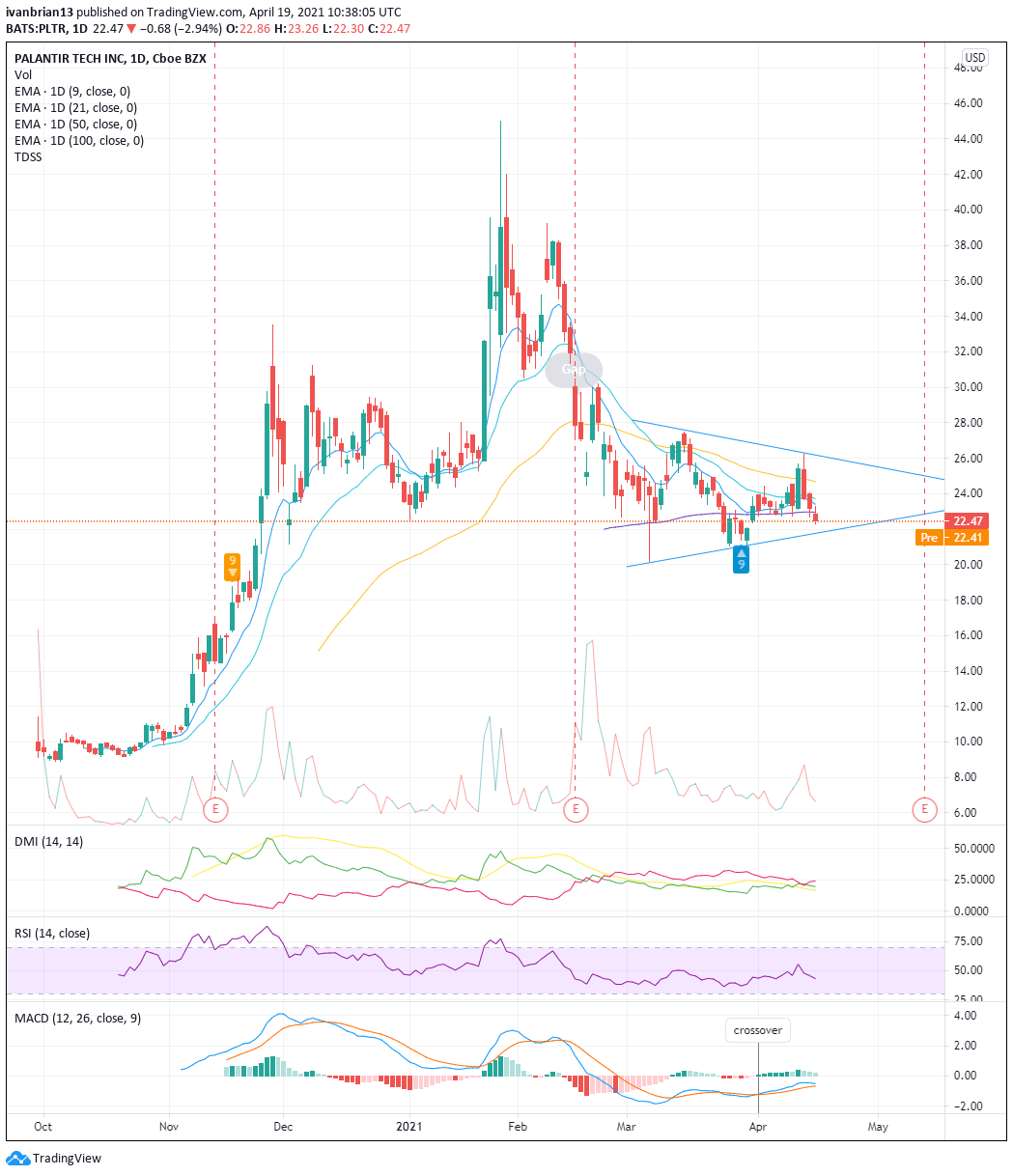

Palantir Stock: A Pre-May 5th Investment Analysis

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's recent quarterly earnings reports reveals key insights into its financial health and future prospects. We'll scrutinize revenue growth, profitability, and cash flow to gauge its overall performance and potential for future growth. Understanding Palantir earnings and revenue growth is critical for any investor.

-

Revenue Growth Rate (YoY and QoQ): Examining the year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth rates helps determine the trajectory of Palantir's top-line performance. Significant increases suggest strong market demand and successful product adoption. Conversely, stagnant or declining growth raises concerns.

-

Profit Margin Analysis: Analyzing Palantir's profit margins—gross, operating, and net—provides crucial insights into its profitability and efficiency. Improving margins indicate enhanced operational efficiency and cost management.

-

Cash Flow Generation and its Implications: Strong cash flow generation is vital for a company's long-term sustainability. Analyzing Palantir's cash flow from operations, investing, and financing activities provides a clear picture of its financial health and ability to reinvest in growth initiatives.

-

Analyst Predictions for Future Earnings and Revenue: Consulting analyst reports and forecasts provides an external perspective on Palantir's future financial performance. These predictions, while not guarantees, can offer valuable insights into market expectations.

(Include relevant charts and graphs here visualizing the above data points.)

Key Catalysts Affecting Palantir Stock Price Pre-May 5th

Several factors could significantly influence Palantir's stock price before May 5th. Identifying these potential catalysts allows for a more informed investment decision. Understanding these "Palantir catalysts" is vital for predicting the stock price movement.

-

Upcoming Earnings Reports or Investor Presentations: These events often trigger significant stock price volatility, depending on the company's performance and future outlook. Positive surprises can lead to price increases, while disappointing results can cause declines.

-

Potential Government Contracts or Large Commercial Deals: Securing substantial contracts, particularly with government agencies, can significantly boost Palantir's revenue and market valuation. Announcing such deals can positively impact the Palantir stock price prediction.

-

Technological Advancements and Product Innovations: Introducing new products or significantly improving existing ones can attract new customers and enhance Palantir's competitive position, potentially driving stock price appreciation.

-

Market Sentiment and Overall Economic Conditions: Broader market trends and the overall economic climate can influence investor sentiment toward Palantir and affect its stock price. Economic uncertainty can lead to decreased investor confidence.

Competitive Landscape and Palantir's Market Position

Analyzing Palantir's competitive landscape helps determine its market position and future growth potential. Understanding the "Palantir competitors" and their strategies is key.

-

Major Competitors (e.g., Databricks, Snowflake, other big data analytics companies): Identifying key competitors and their market strategies is crucial for assessing Palantir's competitive advantages and disadvantages.

-

Palantir's Unique Selling Propositions (USPs): Understanding Palantir's strengths, such as its advanced data analytics capabilities and strong government relationships, is critical for evaluating its competitive edge.

-

Market Share Analysis and Growth Potential: Assessing Palantir's current market share and its potential for future growth provides valuable insights into its long-term prospects.

-

Competitive Threats and Opportunities: Identifying potential threats from competitors and emerging market opportunities is essential for understanding the challenges and potential rewards associated with investing in Palantir.

Risk Assessment for Investing in Palantir Stock

Investing in Palantir stock involves several risks. Thorough due diligence is essential before making any investment decisions. Understanding "Palantir risk" is crucial for responsible investment.

-

Market Risk and Overall Economic Uncertainty: Stock prices are inherently volatile and subject to broader market fluctuations. Economic downturns can negatively impact investor sentiment and stock prices.

-

Competitive Pressure and the Risk of Losing Market Share: Intense competition in the data analytics industry poses a risk to Palantir's market share and profitability.

-

Regulatory Risks and Compliance Issues: Operating in a heavily regulated industry exposes Palantir to potential regulatory hurdles and compliance risks.

-

Execution Risk and the Ability to Deliver on Promises: The company's ability to successfully execute its business strategy and deliver on its promises is crucial for its success and stock price performance.

Conclusion

This pre-May 5th Palantir stock analysis highlights both the potential opportunities and inherent risks associated with investing in the company. While Palantir shows promise in its innovative data analytics solutions and strong government relationships, potential investors should carefully consider the competitive landscape and inherent market volatility. Thorough due diligence, including reviewing recent financial reports and analyst predictions, is crucial before making any investment decisions. Remember to analyze Palantir stock thoroughly before investing. Consider consulting with a financial advisor for personalized guidance. Invest in Palantir stock wisely, and consider your own risk tolerance before making any investment decisions.

Featured Posts

-

Is Now The Right Time To Invest In Palantir Technologies Stock

May 09, 2025

Is Now The Right Time To Invest In Palantir Technologies Stock

May 09, 2025 -

Varm Vinter Forer Til Stengte Skibakker

May 09, 2025

Varm Vinter Forer Til Stengte Skibakker

May 09, 2025 -

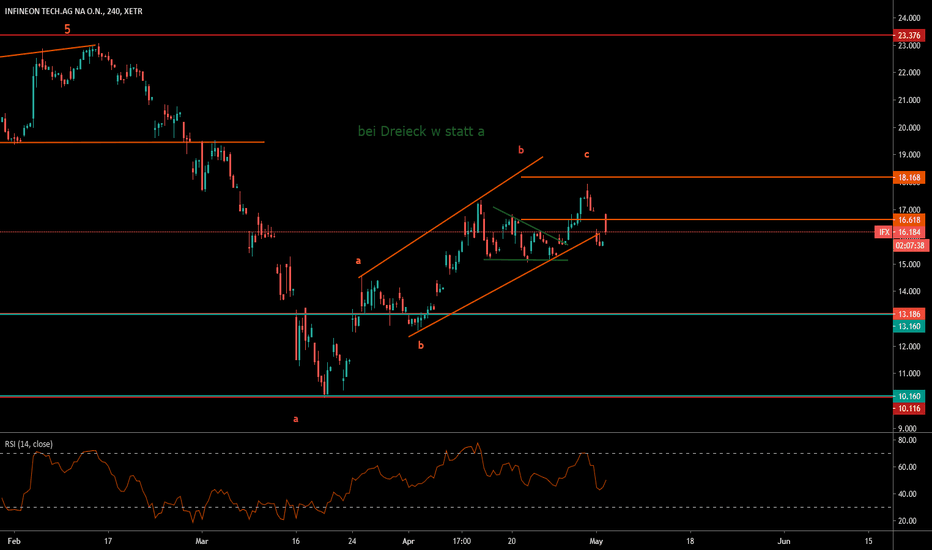

Infineon Ifx Q Quarter Earnings Lower Sales Guidance Due To Tariff Concerns

May 09, 2025

Infineon Ifx Q Quarter Earnings Lower Sales Guidance Due To Tariff Concerns

May 09, 2025 -

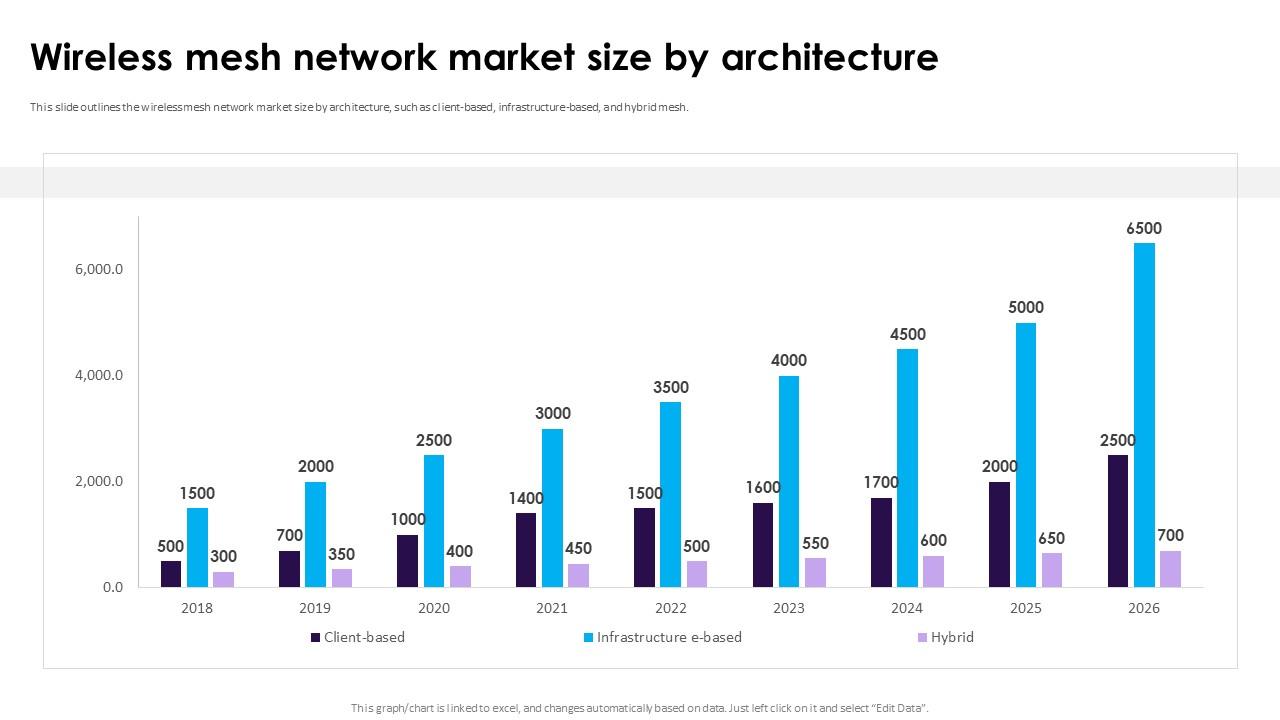

8 Cagr Projected For Wireless Mesh Networks Market Size

May 09, 2025

8 Cagr Projected For Wireless Mesh Networks Market Size

May 09, 2025 -

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Raspisanie I Pryamaya Translyatsiya

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Raspisanie I Pryamaya Translyatsiya

May 09, 2025