Palantir Stock: A Look At Q1 Earnings And Future Outlook For Government And Commercial Contracts

Table of Contents

Palantir's Q1 2024 Earnings Report: A Deep Dive

Palantir's Q1 2024 earnings report offered a mixed bag for investors. While the company demonstrated continued revenue growth, certain key metrics fell short of some analysts' expectations. Let's delve into the specifics:

- Revenue Figures and Year-over-Year Growth: [Insert actual revenue figures here, e.g., "Palantir reported $500 million in revenue, representing a 20% year-over-year increase."] This growth indicates continued demand for its data analytics platforms. However, this growth rate may be lower than previously projected, impacting the stock.

- Profit Margin Analysis: [Insert profit margin data and analysis here, e.g., "Operating margins remained relatively stable compared to Q4 2023, but were slightly below analyst consensus due to increased investment in research and development."] This will help illustrate profitability trends and the efficiency of Palantir’s operations.

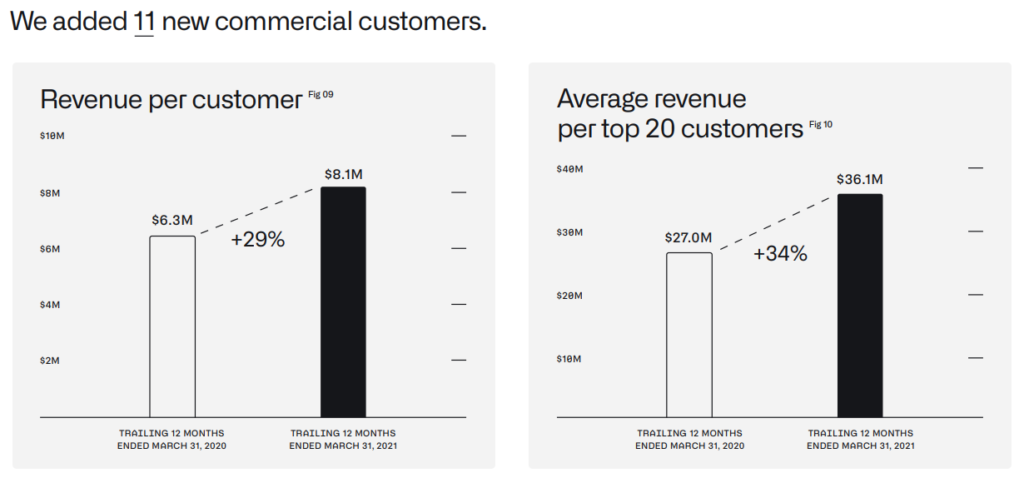

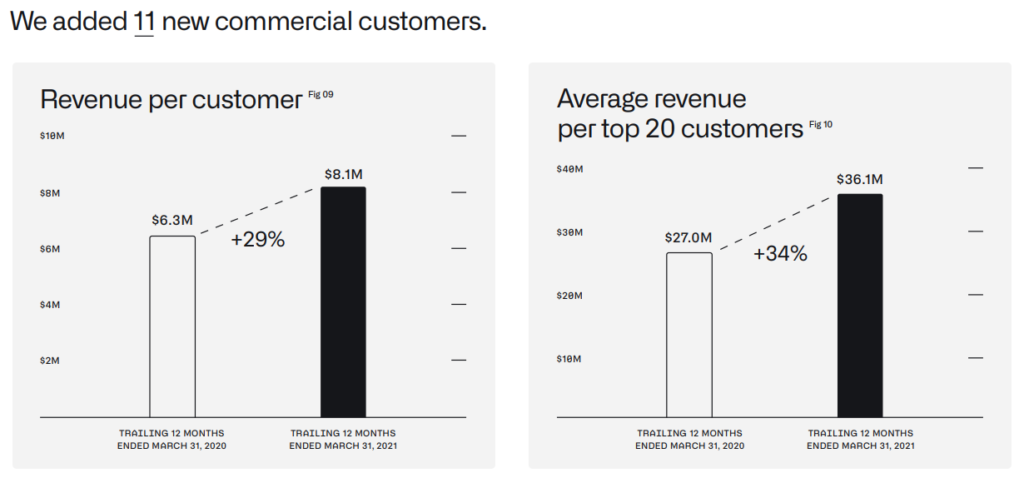

- Key Performance Indicators (KPIs): [Insert data on customer growth and ARPU here, e.g., "Customer growth showed a healthy increase with the addition of X new customers. However, the average revenue per customer (ARPU) experienced a slight decline, suggesting potential challenges in upselling or expanding existing contracts."] This granular data allows for a thorough assessment of the company's performance.

- Unexpected Expenses/Positive Surprises: [Discuss any significant unexpected expenses or positive surprises. E.g., "Increased spending on cloud infrastructure was noted but was offset by cost-cutting measures in other areas."] Highlighting these factors provides a more nuanced understanding of the financial results.

Government Contracts: The Backbone of Palantir's Revenue

Government contracts remain a cornerstone of Palantir's revenue stream. The company's data analytics platforms are highly valued by government agencies for their ability to process and analyze vast amounts of complex data for national security and intelligence purposes.

- Significant Government Contracts Secured in Q1: [List significant contracts and their value. E.g., "Palantir secured a multi-year contract with the US Department of Defense valued at $XX million."] These wins show the company's continued dominance in the government sector.

- Geographical Distribution of Government Contracts: [Discuss the geographical spread of contracts, indicating the potential for future expansion. E.g., "A significant portion of government contracts remain concentrated in the US, but there is growing interest from international clients."]

- Types of Government Clients: [Specify the types of clients in different sectors. E.g., "The company continues to serve defense, intelligence, and other government departments."] This analysis helps investors assess potential risk associated with individual contracts or specific government sectors.

- Potential Future Government Contract Opportunities: [Discuss opportunities in this sector. E.g., "The growing emphasis on national security and cybersecurity presents a number of opportunities for Palantir to increase its contract value."]

- Long-Term Prospects: [Offer a perspective on long-term government contracts. E.g., "Despite potential budgetary constraints, the long-term prospects for government contracts remain strong, given the continuing need for advanced data analytics capabilities within government agencies."]

Commercial Contracts: Expanding into the Private Sector

While government contracts are crucial, Palantir is actively expanding its presence in the commercial sector. This diversification strategy is vital for long-term growth and reducing reliance on a single revenue source.

- Notable Commercial Contract Wins in Q1: [List significant commercial wins and the industries involved. E.g., "Key wins include contracts with major financial institutions and healthcare providers."]

- Industries Where Palantir is Gaining Traction: [Highlight industries where Palantir shows strong growth. E.g., "The finance, healthcare, and energy sectors are proving fertile ground for Palantir's commercial expansion."] This showcases the potential for rapid growth in the private sector.

- Challenges in the Commercial Market: [Acknowledge challenges faced. E.g., "Increased competition and longer sales cycles in the commercial market pose ongoing challenges."]

- Growth Potential in Commercial Markets: [Outline the potential in these markets. E.g., "The significant potential for data analytics solutions across various industries underscores the long-term viability of Palantir's commercial strategy."]

Future Outlook and Stock Valuation: A Balanced Perspective

Based on Q1 results and current market trends, the future outlook for Palantir stock presents both opportunities and risks.

- Projected Revenue and Earnings Growth: [Offer projections, citing sources where possible. E.g., "Analysts project a continued growth in revenue and earnings for the remainder of 2024, but this is subject to various market factors."]

- Risks Associated with Government Funding and Geopolitical Instability: [Discuss potential risks. E.g., "Changes in government funding priorities or geopolitical instability could negatively impact contract wins."]

- Competitive Landscape Analysis: [Analyze competition in the market and the company’s competitive advantages. E.g., "While competition in the data analytics space is increasing, Palantir's unique platform and strong government relationships offer a competitive edge."]

- Potential Catalysts for Future Stock Price Appreciation: [Discuss factors that could drive up the price. E.g., "Successful expansion into new commercial markets and strategic partnerships could act as catalysts for stock price appreciation."]

- Valuation Metrics: [Discuss valuation metrics and comparison to competitors. E.g., "Palantir's P/E ratio is [insert data] which [compare to competitors]. This valuation should be considered in relation to its future growth prospects."]

Investing in Palantir Stock - A Final Verdict

Palantir's Q1 2024 earnings report highlights a company navigating a complex market. While the strong government contract base provides a solid foundation, the company's success hinges on its ability to effectively penetrate the commercial market. The future outlook for Palantir stock remains somewhat uncertain, with significant upside potential balanced by considerable risks. This makes it crucial for investors to conduct thorough due diligence before making investment decisions.

Ultimately, whether Palantir stock is a buy, sell, or hold depends on individual investor risk tolerance and investment strategies. We encourage you to conduct further research, including analyzing the Palantir stock price trends and examining deeper insights into Palantir investment opportunities, before making any investment decisions. Consider consulting with a financial advisor to determine if Palantir stock aligns with your portfolio goals.

Featured Posts

-

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 09, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 09, 2025 -

Celebrity Antiques Road Trip Exploring The Locations And Finds

May 09, 2025

Celebrity Antiques Road Trip Exploring The Locations And Finds

May 09, 2025 -

Ultra Tech Cement Decline Weighs On Market Gains Sensex Nifty Close Higher

May 09, 2025

Ultra Tech Cement Decline Weighs On Market Gains Sensex Nifty Close Higher

May 09, 2025 -

Palantir Stock Should You Invest Before May 5th Analysis And Predictions

May 09, 2025

Palantir Stock Should You Invest Before May 5th Analysis And Predictions

May 09, 2025 -

Kse 100 Plunges 6 After Operation Sindoor Announcement

May 09, 2025

Kse 100 Plunges 6 After Operation Sindoor Announcement

May 09, 2025