UltraTech Cement Decline Weighs On Market Gains: Sensex, Nifty Close Higher

Table of Contents

UltraTech Cement's Share Price Drop: Causes and Analysis

UltraTech Cement's share price fell by X% today, a significant drop that warrants closer examination. Several factors could have contributed to this decline.

- Quarterly Earnings Results: While official reports are pending, preliminary indications suggest [insert speculation about potential underperformance in quarterly earnings – e.g., lower-than-expected profits, reduced sales volume]. Negative surprises in key performance indicators (KPIs) like EBITDA and net profit margins can significantly impact investor confidence.

- Industry-Wide Trends: The cement sector is facing [mention current challenges, e.g., rising input costs like fuel and raw materials, weakening demand due to slowdown in construction activity, increased competition]. These industry headwinds could be impacting UltraTech Cement's profitability and future projections.

- Company-Specific News: Any recent announcements from UltraTech Cement itself, such as changes in management, regulatory hurdles, or unexpected operational challenges, could also have influenced investor sentiment negatively. [Add specifics if available, linking to relevant news sources].

- Geopolitical Factors and Macroeconomic Indicators: Broader economic conditions, both domestic and global, play a crucial role. Factors such as rising interest rates, inflation, or geopolitical instability can impact investor risk appetite and lead to sell-offs, even in fundamentally strong companies like UltraTech Cement.

[Insert a relevant chart or graph showing UltraTech Cement's share price movement for the day, clearly labeled and sourced.]

Impact on Market Indices Despite Overall Positive Sentiment

Despite the significant "UltraTech Cement Decline," the Sensex and Nifty closed higher, demonstrating the resilience of the broader market and the diverse factors at play. UltraTech Cement, while a major player, doesn't hold a dominant enough position in the indices to single-handedly dictate their overall movement.

The positive closure of Sensex and Nifty can be attributed to:

- Strong Performance in Other Key Sectors: Robust performance in sectors like IT and banking, which carry significant weight in the indices, offset the negative impact from UltraTech Cement's decline. [Cite specific examples, if available, with data to support positive performance in other sectors].

- Positive Global Market Trends: Positive sentiment in global markets, perhaps driven by positive economic data or easing geopolitical concerns, could have buoyed investor confidence, leading to increased buying in the Indian market despite the UltraTech Cement dip.

- Investor Sentiment and Market Confidence: Overall, investor sentiment and confidence in the long-term growth prospects of the Indian economy might have been strong enough to absorb the negative impact from the UltraTech Cement decline.

Investor Reactions and Future Outlook for UltraTech Cement

The "UltraTech Cement Decline" resulted in [insert data on trading volume – e.g., increased trading volume, indicating higher volatility]. Investor sentiment towards UltraTech Cement appears to be [describe cautiously based on available data – e.g., cautious, negative, uncertain].

The short-term outlook for UltraTech Cement's share price remains uncertain, depending heavily on forthcoming announcements regarding quarterly earnings and the company's response to the current challenges. However, the long-term prospects are likely to depend on the company's ability to navigate industry headwinds and implement strategies to improve profitability. [Mention analyst predictions and expert opinions if available, linking to reputable sources]. The cement sector's future depends heavily on infrastructure development plans and the overall economic growth of India.

Conclusion: Understanding the UltraTech Cement Decline and its Market Implications

The "UltraTech Cement Decline" serves as a reminder that individual stock movements don't always dictate the direction of broader market indices. While UltraTech Cement experienced a significant drop, the positive performance of other sectors and overall market sentiment led to a higher close for the Sensex and Nifty. The impact of the UltraTech Cement decline on overall market sentiment was ultimately limited. The future performance of UltraTech Cement and the broader cement sector will hinge on several factors, including company-specific performance, industry trends, and macroeconomic conditions.

Stay updated on the latest developments regarding the "UltraTech Cement Decline" and other market trends by subscribing to our newsletter for continuous market analysis and insightful commentary on UltraTech Cement and similar stocks. Don't miss out – subscribe today!

Featured Posts

-

The High Price Of Childcare One Mans 3 000 Babysitter Bill And 3 600 Daycare Bill

May 09, 2025

The High Price Of Childcare One Mans 3 000 Babysitter Bill And 3 600 Daycare Bill

May 09, 2025 -

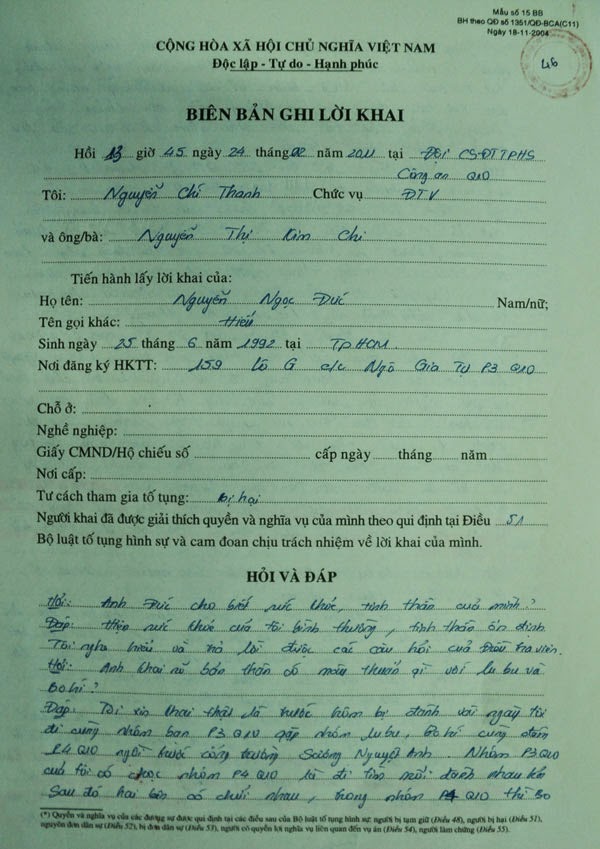

Loi Khai Gay Soc Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025

Loi Khai Gay Soc Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025 -

Characters Ectomobile And Connections Arctic Comic Con 2025 Photo Highlights

May 09, 2025

Characters Ectomobile And Connections Arctic Comic Con 2025 Photo Highlights

May 09, 2025 -

Wall Street Predicts 110 Surge The Billionaire Backed Black Rock Etf

May 09, 2025

Wall Street Predicts 110 Surge The Billionaire Backed Black Rock Etf

May 09, 2025 -

Palantir Stock Should You Invest Before May 5th Wall Streets Verdict

May 09, 2025

Palantir Stock Should You Invest Before May 5th Wall Streets Verdict

May 09, 2025