Making The Decision: To Refinance Federal Student Loans Or Not

Table of Contents

Understanding Federal Student Loan Benefits

Before diving into the allure of refinancing, it's crucial to understand the significant benefits associated with federal student loans. Losing these benefits could outweigh any potential savings from refinancing.

Government Protections

Federal student loans offer vital protections that private loans typically don't. These include:

- Income-Driven Repayment (IDR) Plans: IDR plans adjust your monthly payment based on your income and family size, making repayment more manageable. Losing this option through refinancing could lead to significantly higher monthly payments.

- Deferment and Forbearance: These options allow you to temporarily postpone or reduce your payments during periods of financial hardship. Refinancing eliminates these crucial safety nets.

- Loan Forgiveness Programs: Programs like Public Service Loan Forgiveness (PSLF) can forgive your remaining debt after a period of qualifying employment in public service. Refinancing usually disqualifies you from these programs.

Losing these benefits could have serious long-term financial consequences. Carefully consider the potential drawbacks before proceeding with refinancing.

Interest Rates and Loan Terms

Federal student loan interest rates vary depending on the loan type and when it was disbursed. Understanding these rates is crucial for comparing them to potential refinancing offers.

- Fixed vs. Variable Rates: Federal loans often have fixed interest rates, providing predictability. Private refinancing loans can offer fixed or variable rates. Variable rates can be initially lower but can increase over time, potentially negating any initial savings.

- Repayment Periods: Federal loans typically offer various repayment periods, affecting your monthly payment amount and total interest paid. Shorter repayment periods lead to higher monthly payments but lower total interest. Longer periods result in lower monthly payments but higher overall interest costs.

The Allure of Private Student Loan Refinancing

Private student loan refinancing offers several attractive features that may entice borrowers to switch from federal loans.

Lower Interest Rates

Private lenders often advertise lower interest rates than those currently offered on federal student loans. This can translate into substantial savings over the life of the loan.

- Potential Savings: For example, refinancing a $50,000 loan from a 6% interest rate to a 4% interest rate could save thousands of dollars in interest payments over the repayment term.

- Rate Comparison: It's crucial to compare rates from multiple private lenders to find the best offer. Don’t just settle for the first offer you receive.

Streamlined Repayment

Refinancing can simplify your repayment process by consolidating multiple federal loans into a single monthly payment.

- Simplified Payments: Managing one payment is much easier than tracking several, reducing the risk of missed payments and late fees.

- Shorter Repayment Term: Refinancing may offer the option of a shorter repayment term, allowing you to pay off your debt faster.

Potential Drawbacks of Refinancing

While the potential for lower interest rates and simplified repayment is appealing, it's essential to acknowledge the significant risks. The biggest risk is losing the protections afforded by federal student loans.

- Loss of Federal Benefits: As mentioned, refinancing means losing access to IDR plans, deferment, forbearance, and loan forgiveness programs. This is a critical consideration.

- Variable Rate Risk: If you choose a variable-rate loan, your interest rate can increase over time, leading to higher monthly payments and increased total interest paid.

When Refinancing Federal Student Loans Makes Sense

Refinancing federal student loans isn't always the best option. It makes sense only under specific circumstances.

Strong Credit Score & Income

Private lenders assess your creditworthiness before offering refinancing. A strong credit score and stable income are vital for securing favorable terms.

- Credit Score Requirements: Most lenders require a credit score of at least 670 to qualify for the best rates. A lower score may lead to a higher interest rate or loan denial.

- Income Verification: Lenders verify your income to assess your ability to repay the loan. Sufficient income is essential for approval.

Clear Financial Goals

Refinancing should align with your financial goals. Do you prioritize lower monthly payments or paying off your debt faster?

- Budget Analysis: Conduct a thorough budget analysis to determine if a lower monthly payment is feasible, even if it means a longer repayment period.

- Projected Savings: Calculate the potential savings over the life of the loan to determine if refinancing justifies the loss of federal benefits.

Comparison Shopping

Before committing to refinancing, compare offers from multiple private lenders.

- Online Comparison Tools: Use reputable online tools to compare rates, fees, and terms.

- Lender Reviews: Check reviews and ratings of lenders to ensure you're working with a reputable institution.

Conclusion

Deciding whether to refinance federal student loans requires careful consideration. While refinancing offers the potential for lower interest rates and streamlined repayment, it comes at the cost of valuable federal protections. Before making a decision on refinancing federal student loans, carefully weigh the pros and cons. Understand the potential loss of federal benefits and compare offers from multiple lenders. Only refinance if it aligns with your long-term financial goals and improves your overall financial situation. Consider seeking advice from a financial advisor to ensure you make the best choice for your unique circumstances. Refinance federal student loans wisely, and always prioritize your financial well-being.

Featured Posts

-

Perkins Tells Brunson To Ditch Podcast

May 17, 2025

Perkins Tells Brunson To Ditch Podcast

May 17, 2025 -

United States Crypto Casino Comparison Jack Bit Vs The Competition

May 17, 2025

United States Crypto Casino Comparison Jack Bit Vs The Competition

May 17, 2025 -

Ubers April Surge Understanding The Double Digit Rally

May 17, 2025

Ubers April Surge Understanding The Double Digit Rally

May 17, 2025 -

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 17, 2025

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 17, 2025 -

Former Mariners Infielder Criticizes Seattles Quiet Offseason

May 17, 2025

Former Mariners Infielder Criticizes Seattles Quiet Offseason

May 17, 2025

Latest Posts

-

Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Skin Bundle Price

May 17, 2025

Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Skin Bundle Price

May 17, 2025 -

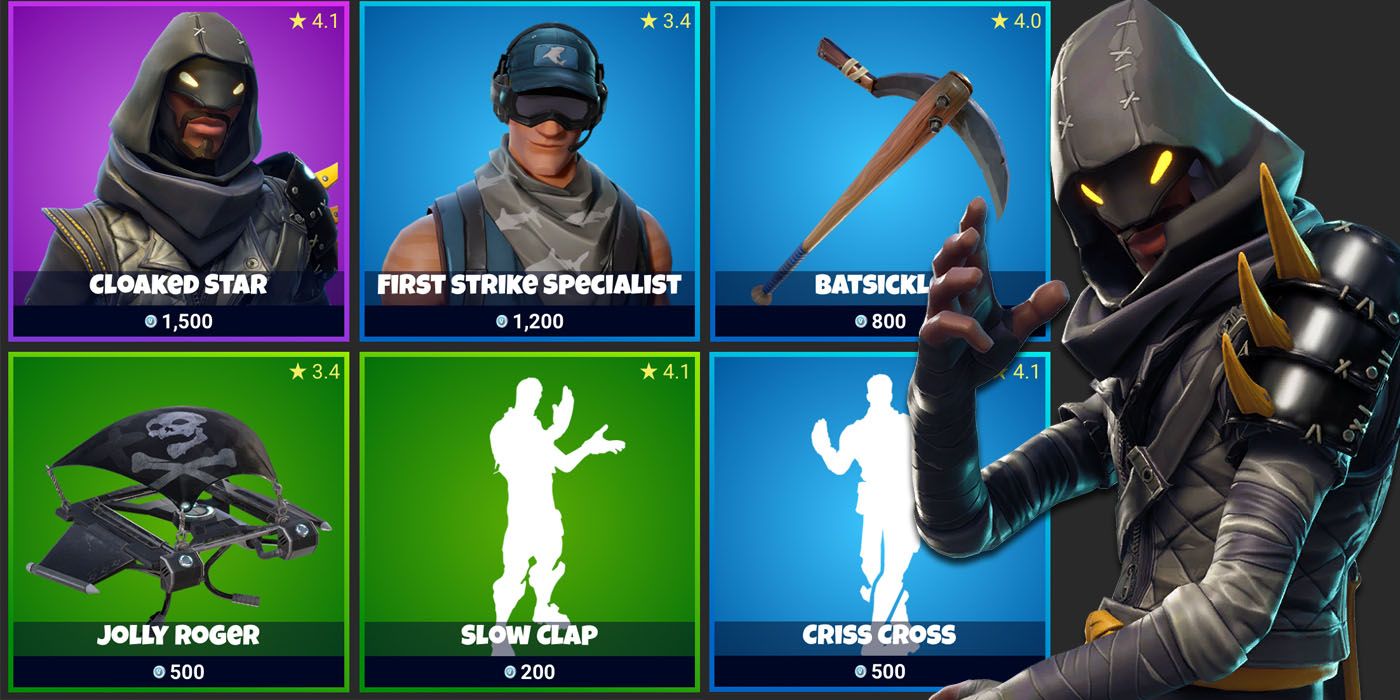

Fortnite Item Shop New Update Receives Heavy Criticism

May 17, 2025

Fortnite Item Shop New Update Receives Heavy Criticism

May 17, 2025 -

How Much Does The Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

How Much Does The Fortnite Cowboy Bebop Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Latest Fortnite Shop Update Sparks Player Outrage

May 17, 2025

Latest Fortnite Shop Update Sparks Player Outrage

May 17, 2025 -

Fortnites Item Shop Update A Disappointment For Fans

May 17, 2025

Fortnites Item Shop Update A Disappointment For Fans

May 17, 2025