Oil Prices Today: Market News And Analysis (May 16)

Table of Contents

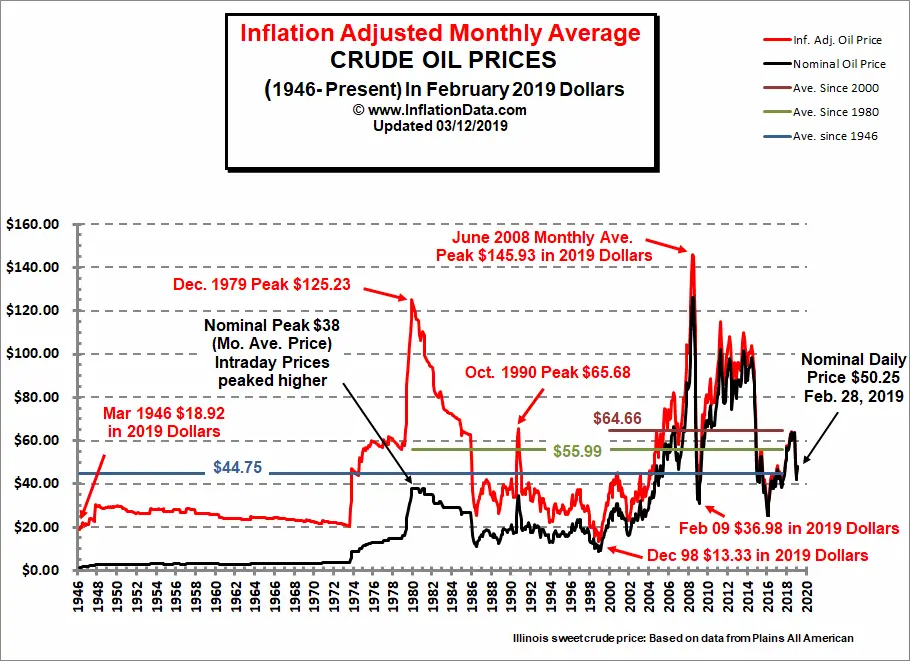

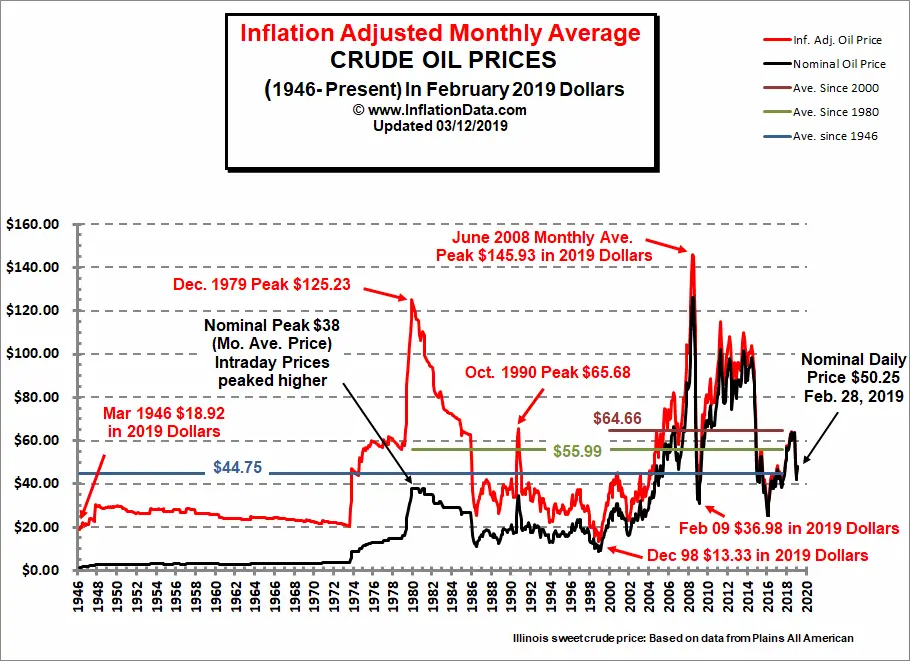

Global Crude Oil Prices: Benchmark Movements and Trends

Brent Crude Oil

Brent crude, a global benchmark for oil pricing, experienced significant fluctuations on May 16th. Analyzing the price movements reveals key insights into the market's dynamics.

- Opening Price: $76.50 per barrel

- Closing Price: $77.25 per barrel

- Intraday High: $77.50 per barrel

- Intraday Low: $76.00 per barrel

- Percentage Change: +0.98% compared to the previous day's closing price.

This positive movement can be partly attributed to increased demand from Europe, driven by a recovering post-pandemic economy and ongoing concerns about Russian supply disruptions. Geopolitical tensions in the Middle East also contributed to the price increase, as fears of potential supply disruptions remain a significant factor influencing Brent prices. Support levels were observed around $75.50, while resistance levels were tested near $78.00.

WTI Crude Oil

West Texas Intermediate (WTI) crude oil, the benchmark for US oil, showed a similar upward trend on May 16th, though the magnitude of the increase was slightly less pronounced than that seen in Brent.

- Opening Price: $73.00 per barrel

- Closing Price: $73.70 per barrel

- Intraday High: $74.00 per barrel

- Intraday Low: $72.80 per barrel

- Percentage Change: +0.96% compared to the previous day's closing price.

The relatively lower price increase compared to Brent can be attributed to increased US shale oil production and relatively high storage levels, which exert downward pressure on WTI prices. However, the overall upward trend reflects the impact of global factors affecting the broader oil market.

Price Volatility and Forecasting

Oil prices remain volatile, influenced by macroeconomic uncertainty and the potential for unexpected supply disruptions. Forecasting future prices involves a high degree of uncertainty, with various analysts offering differing perspectives.

- Potential Price Range (Short-Term): $75 - $80 per barrel for Brent, $70 - $75 for WTI.

- Key Risks: Geopolitical instability, unexpected supply chain disruptions, and changes in OPEC+ production quotas.

- Potential Opportunities: A sustained increase in global demand or a significant reduction in supply could lead to higher prices.

Key Market Drivers Influencing Oil Prices Today

OPEC+ Decisions and Production Quotas

The recent OPEC+ decision to maintain production cuts continues to be a major driver of oil prices today. This decision reflects the cartel's strategy to support oil prices by managing supply.

- Production Quota: The current production quota aims to balance supply and demand, preventing a significant price crash.

- Member Disagreements: While the decision was broadly agreed upon, some member countries have expressed differing views regarding the optimal production levels.

- Implications: The production cuts create a tighter supply environment, potentially pushing prices higher in the short term.

Geopolitical Events and Energy Security

Geopolitical events continue to play a significant role in influencing oil prices. Ongoing conflicts and political instability in various regions create uncertainty surrounding oil supply chains.

- Impact of Sanctions: Sanctions imposed on certain oil-producing countries restrict supply, leading to price increases.

- Supply Chain Disruptions: Conflicts and political unrest can disrupt oil transportation routes, impacting global supply.

- Energy Security Concerns: Countries are increasingly prioritizing energy security, leading to diversification of supply sources and investment in domestic energy production.

Economic Indicators and Global Demand

Macroeconomic indicators, such as GDP growth, inflation, and interest rates, significantly impact global oil demand and therefore prices.

- GDP Growth: Strong economic growth in major economies increases energy consumption, boosting oil demand.

- Inflation: High inflation can reduce consumer spending, potentially impacting demand for oil.

- Interest Rates: Higher interest rates can slow economic growth and decrease oil demand.

Market Sentiment and Investor Behavior

Analyst Opinions and Trading Signals

Analyst opinions on future oil price movements are diverse, reflecting the inherent uncertainties in the market. Technical analysis plays a significant role in shaping investor behavior and trading strategies.

- Bullish Sentiment: Some analysts anticipate further price increases due to supply constraints and robust demand.

- Bearish Sentiment: Others caution against overestimating demand and highlight the risks of a potential economic slowdown.

- Technical Indicators: Technical indicators such as moving averages and RSI are used to identify potential support and resistance levels and gauge momentum.

Speculative Trading and Futures Markets

Speculative trading in the futures market contributes to short-term price volatility. Futures contracts reflect market expectations regarding future oil prices.

- Price Discovery: Futures markets play a crucial role in price discovery, reflecting the collective wisdom of market participants.

- Risk Management: Futures contracts allow businesses to hedge against price fluctuations and manage their risk exposure.

- Speculative Bubbles: Excessive speculation can lead to price bubbles and significant market corrections.

Conclusion: Staying Informed on Oil Prices Today and Beyond

Understanding "oil prices today" requires careful analysis of global supply and demand dynamics, geopolitical events, and investor sentiment. While the recent upward trend reflects a combination of factors, including OPEC+ decisions and geopolitical uncertainties, the market remains highly volatile. Tracking these factors is essential for investors, businesses, and policymakers to make informed decisions. For continued analysis and insights into oil price movements, subscribe to our newsletter for daily updates and in-depth market analysis. Stay informed on oil price today and beyond to navigate the complexities of the energy market successfully.

Featured Posts

-

Saoydiki Aravia I Ekthamvotiki Ypodoxi Toy Proedroy Tramp

May 17, 2025

Saoydiki Aravia I Ekthamvotiki Ypodoxi Toy Proedroy Tramp

May 17, 2025 -

Financial Planning For Homeownership With Existing Student Loans

May 17, 2025

Financial Planning For Homeownership With Existing Student Loans

May 17, 2025 -

Investitsii Ferrexpo Pod Ugrozoy Zayavlenie Zhevogo O Prekraschenii Finansirovaniya V Ukraine

May 17, 2025

Investitsii Ferrexpo Pod Ugrozoy Zayavlenie Zhevogo O Prekraschenii Finansirovaniya V Ukraine

May 17, 2025 -

37 Point Loss Prompts Thibodeau To Call For More Resolve From Knicks

May 17, 2025

37 Point Loss Prompts Thibodeau To Call For More Resolve From Knicks

May 17, 2025 -

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Apo Tin Megaloprepi Teleti

May 17, 2025

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Apo Tin Megaloprepi Teleti

May 17, 2025

Latest Posts

-

Will Jalen Brunson Watch Cm Punk Vs Seth Rollins On Next Weeks Raw

May 17, 2025

Will Jalen Brunson Watch Cm Punk Vs Seth Rollins On Next Weeks Raw

May 17, 2025 -

The Trump Family An Overview Of Its Members And Relationships

May 17, 2025

The Trump Family An Overview Of Its Members And Relationships

May 17, 2025 -

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025 -

Understanding The Trump Family A Genealogy Of The Trump Dynasty

May 17, 2025

Understanding The Trump Family A Genealogy Of The Trump Dynasty

May 17, 2025 -

Donald Tramp Ta Yogo Mati Khto Bula Meri Enn Maklaud

May 17, 2025

Donald Tramp Ta Yogo Mati Khto Bula Meri Enn Maklaud

May 17, 2025