Everything You Need To Know About Finance Loans: Application Process, Interest Rates, And More

Table of Contents

Understanding Different Types of Finance Loans

Finance loans come in various forms, each designed for specific purposes and carrying unique characteristics. Choosing the right type of loan depends heavily on your individual needs and financial situation. Let's explore some common types:

- Personal loans: These unsecured loans offer flexibility for various needs, from debt consolidation to home improvements. However, they typically come with higher interest rates than secured loans due to the higher risk for lenders. Keywords: personal loan, unsecured loan, debt consolidation, home improvement loan.

- Auto loans: Specifically designed for purchasing vehicles, auto loans use the car itself as collateral. This secured nature often leads to lower interest rates compared to personal loans. Keywords: auto loan, car loan, secured loan, vehicle financing.

- Mortgage loans: These significant loans finance the purchase of a home or other real estate. They are long-term loans with potentially lower monthly payments but high overall costs. Keywords: mortgage loan, home loan, real estate loan, home financing.

- Business loans: Vital for entrepreneurs and small business owners, business loans can fund operations, expansion, or equipment purchases. The approval process often involves a detailed business plan and financial projections. Keywords: business loan, small business loan, commercial loan, SBA loan, business financing.

- Student loans: Designed to finance higher education, student loans often have government-backed options with favorable interest rates and repayment plans. Keywords: student loan, education loan, federal student loan, private student loan.

The Finance Loan Application Process: A Step-by-Step Guide

Securing a finance loan involves a multi-step process. Understanding each step can significantly improve your chances of approval and help you navigate the process smoothly.

- Step 1: Check your credit score: A higher credit score is crucial for loan approval and securing better interest rates. Knowing your credit score beforehand allows you to address any negative factors. Keywords: credit score, credit report, credit history, credit check.

- Step 2: Shop around for lenders: Compare loan offers from different lenders to find the best terms, interest rates, and fees. Keywords: lender comparison, loan comparison, best loan rates, interest rate comparison.

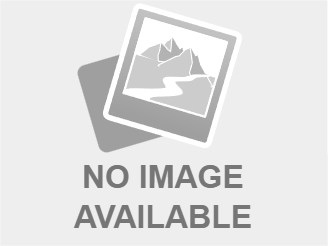

- Step 3: Gather required documents: Lenders typically require proof of income, identification, and sometimes proof of address. Having these documents ready expedites the application process. Keywords: required documents, loan application, income verification, identification, proof of address.

- Step 4: Complete the application: Fill out the loan application accurately and completely. Any omissions or inaccuracies can delay the process or lead to rejection. Keywords: loan application form, online loan application, loan application process.

- Step 5: Await approval: Once submitted, the lender will review your application and inform you of their decision. This can take several days or weeks. Keywords: loan approval, loan decision, loan processing.

Decoding Interest Rates and APR

Understanding interest rates and APR (Annual Percentage Rate) is fundamental to making informed borrowing decisions.

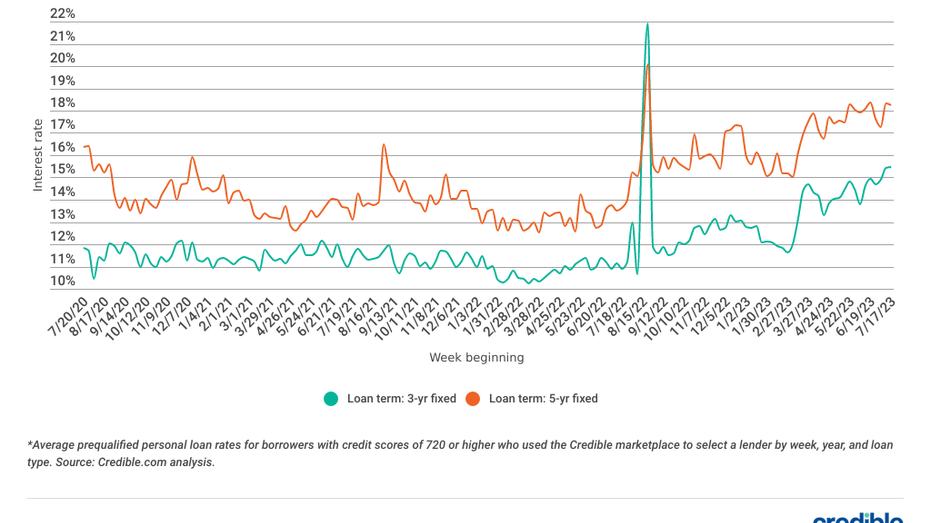

- Interest rate: The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. Keywords: interest rate, loan interest, interest calculation.

- APR (Annual Percentage Rate): The APR reflects the total cost of the loan, including interest and other fees. It provides a more comprehensive picture of the loan's true cost. Keywords: APR, annual percentage rate, total loan cost.

- Factors affecting interest rates: Several factors influence interest rates, including your credit score, the loan amount, and the loan term. A higher credit score generally results in lower interest rates. Keywords: interest rate factors, credit score impact, loan amount impact, loan term impact, fixed interest rate, variable interest rate.

Managing Your Finance Loan Effectively

Responsible borrowing and effective repayment strategies are essential for avoiding financial difficulties.

- Create a realistic budget: Incorporate your loan repayment into your monthly budget to ensure timely payments and prevent debt accumulation. Keywords: loan repayment, budgeting, debt management, financial planning.

- Explore different repayment options: Understand the various repayment options available, such as fixed payments or variable payments, to choose the best fit for your financial situation. Keywords: loan repayment options, amortization schedule, loan repayment plan.

- Stay informed about your loan: Regularly monitor your loan account and statement to ensure accurate payments and identify any potential issues. Keywords: loan statement, loan account, loan monitoring.

Finding the Best Finance Loan for Your Needs

Choosing the right finance loan requires careful comparison of offers from different lenders.

- Compare loan offers: Use online comparison tools or directly contact lenders to compare interest rates, fees, and loan terms. Keywords: loan comparison, lender comparison, best loan rates, loan fees, loan terms.

- Consider the total cost: Don't just focus on the interest rate; consider all associated fees to determine the overall cost of the loan. Keywords: total loan cost, loan fees, hidden fees.

- Choose a reputable lender: Select a lender with a strong reputation for fair practices and customer service. Keywords: reputable lender, reliable lender, trustworthy lender.

Conclusion

This guide provided a comprehensive overview of finance loans, covering various types, the application process, interest rates, and effective management strategies. Understanding these aspects is key to securing the best financing options for your needs. Successfully navigating the world of finance loans requires careful planning, research, and responsible financial management.

Ready to explore finance loan options? Start your research today and find the perfect finance loan to achieve your financial goals. Learn more about different types of finance loans and find the best rates now!

Featured Posts

-

Nine Points 99th Minute Ajaxs Devastating Title Collapse

May 28, 2025

Nine Points 99th Minute Ajaxs Devastating Title Collapse

May 28, 2025 -

Jackman Vs Reynolds A Friendly Feud And One Unsolved Gripe

May 28, 2025

Jackman Vs Reynolds A Friendly Feud And One Unsolved Gripe

May 28, 2025 -

Test Et Avis Samsung Galaxy S25 512 Go Un Bon Plan A Saisir

May 28, 2025

Test Et Avis Samsung Galaxy S25 512 Go Un Bon Plan A Saisir

May 28, 2025 -

Kemenangan 3 1 Atas Sparta Rotterdam Antar Psv Jadi Kampiun Liga Belanda

May 28, 2025

Kemenangan 3 1 Atas Sparta Rotterdam Antar Psv Jadi Kampiun Liga Belanda

May 28, 2025 -

Social Housing Rent Freeze Whos Affected

May 28, 2025

Social Housing Rent Freeze Whos Affected

May 28, 2025