Note To Mr. Carney: Why Canadians Avoid 10-Year Mortgages

Table of Contents

The Perceived Risk of Long-Term Commitment

Committing to a single mortgage rate for a decade is a significant undertaking, especially given the inherent volatility of interest rates. This psychological barrier is a major reason why many Canadians shy away from 10-year mortgages. The fear of being locked into an unfavorable rate for an extended period is a significant concern.

- Fear of Missing Out (FOMO): Interest rates fluctuate. What if rates drop significantly after securing a 10-year mortgage? This fear of missing out on lower rates in the future is a powerful deterrent for many potential borrowers.

- Uncertain Future: Life is unpredictable. Major life changes – job loss, unexpected medical expenses, or family growth – can significantly impact financial stability. A 10-year mortgage commitment limits flexibility during such events.

- High-Interest Rate Anxiety: Locking into a high-interest rate environment for a decade is a daunting prospect, particularly in times of economic uncertainty. This concern is amplified by the long-term commitment and the potential for substantial interest payments.

These anxieties related to mortgage rate risk and long-term mortgage commitment contribute significantly to the hesitation surrounding 10-year mortgages in Canada.

Financial Flexibility and the Burden of a Longer Term

Financial flexibility is paramount for many Canadians, and a 10-year mortgage significantly restricts this. The longer term reduces the ability to adapt to changing financial circumstances.

- Refinancing and Penalties: Refinancing or breaking a 10-year mortgage early often involves hefty penalties for early mortgage repayment. This can severely impact finances, especially if circumstances change unexpectedly.

- Income Fluctuations: A 10-year mortgage locks in a fixed payment schedule. If income decreases, meeting these payments can become a significant strain. Shorter-term mortgages allow for greater adjustment based on changing income levels.

- Higher Overall Interest: While potentially securing a lower initial interest rate, the longer term of a 10-year mortgage can lead to higher overall interest paid compared to shorter-term alternatives. This needs careful consideration against potential rate savings.

The Influence of Shorter-Term Mortgage Options and Marketing

The dominance of 5-year mortgages in the Canadian market is partly due to aggressive marketing and lender strategies.

- Lender Incentives: Lenders often prioritize shorter-term mortgages due to the higher turnover and associated fees. This creates a market dynamic that favors shorter-term options.

- Marketing Focus: Marketing campaigns frequently highlight the perceived benefits of shorter-term flexibility, often overlooking the potential long-term savings of 10-year mortgages.

- Lack of Awareness: Many Canadians simply lack awareness of the potential long-term cost savings and stability that a 10-year mortgage can offer. This lack of information contributes to the preference for the more familiar 5-year option.

The Role of Government Policy and Economic Factors

Government policies and broader economic conditions play an indirect but significant role in shaping Canadians' mortgage choices.

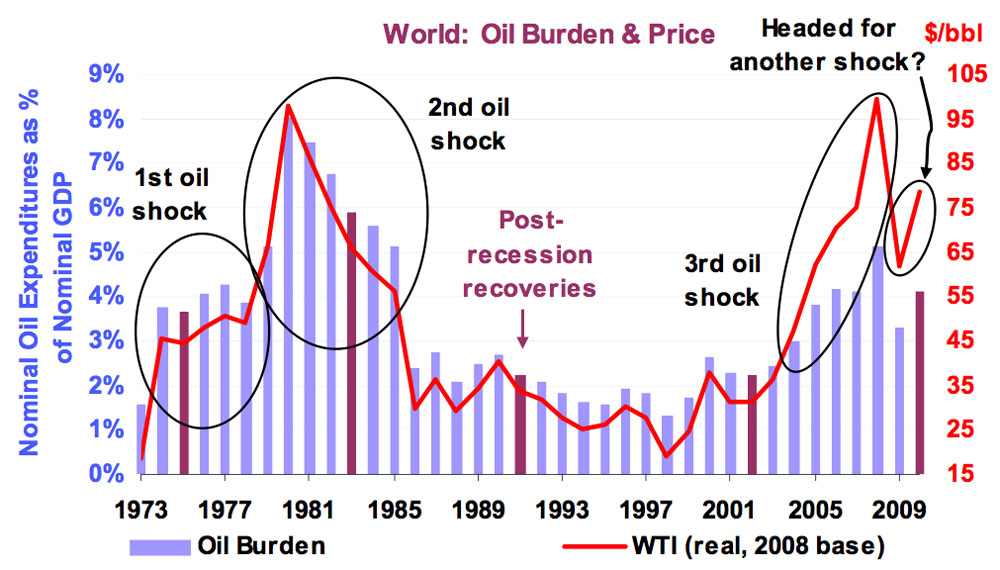

- Bank of Canada Interest Rates: Fluctuations in interest rates set by the Bank of Canada directly impact mortgage rates and consumer confidence, influencing the perceived risk associated with long-term commitments.

- Government Incentives: Government mortgage programs or incentives may indirectly favor shorter-term mortgages, further reinforcing the market trend.

- Economic Uncertainty: Periods of economic uncertainty often lead to greater risk aversion, making consumers more hesitant to commit to long-term financial obligations like 10-year mortgages. This uncertainty further impacts the Canadian housing market.

Conclusion: Rethinking 10-Year Mortgages in Canada

Canadians' hesitation towards 10-year mortgages stems from a combination of perceived risk, limited financial flexibility, and market influences. The fear of fluctuating interest rates, the potential for unforeseen life changes, and the lack of awareness about long-term savings contribute significantly to this reluctance.

However, 10-year mortgages can offer significant benefits, such as potentially lower interest rates and long-term financial stability, especially for those with stable incomes and long-term financial goals. Before dismissing 10-year mortgages, carefully weigh the pros and cons based on your individual financial situation. Consult a financial advisor to determine if a 10-year mortgage is the right fit for your long-term financial goals. Explore 10-year mortgage options with a reputable lender to see if this could be the right choice for you.

Featured Posts

-

Soaring Fuel Prices The Impact Of Oil Supply Shocks On Airlines

May 04, 2025

Soaring Fuel Prices The Impact Of Oil Supply Shocks On Airlines

May 04, 2025 -

Is Reform Uk Doomed Ex Deputys Departure Signals Potential Party Split

May 04, 2025

Is Reform Uk Doomed Ex Deputys Departure Signals Potential Party Split

May 04, 2025 -

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025 -

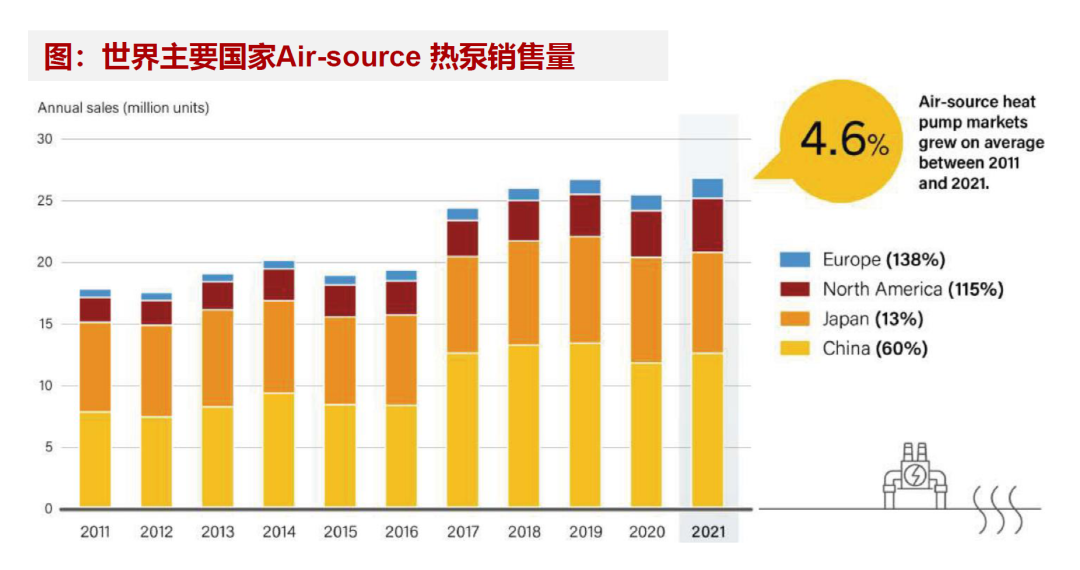

Utrecht Wastewater Plant Netherlands Largest Heat Pump Launched

May 04, 2025

Utrecht Wastewater Plant Netherlands Largest Heat Pump Launched

May 04, 2025 -

Hong Kongs Fx Peg Us Dollar Intervention After Two Year Pause

May 04, 2025

Hong Kongs Fx Peg Us Dollar Intervention After Two Year Pause

May 04, 2025

Latest Posts

-

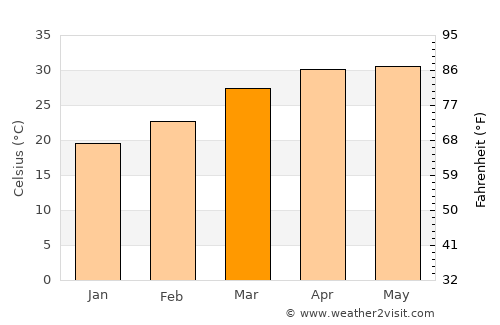

Holi Weather Forecast For West Bengal Expect High Tide And Heat

May 04, 2025

Holi Weather Forecast For West Bengal Expect High Tide And Heat

May 04, 2025 -

Me T Department Predicts High Tide And Temperature In West Bengal For Holi

May 04, 2025

Me T Department Predicts High Tide And Temperature In West Bengal For Holi

May 04, 2025 -

West Bengal Holi Weather High Tide And Temperature Forecast

May 04, 2025

West Bengal Holi Weather High Tide And Temperature Forecast

May 04, 2025 -

Wb Weather Update Holi Brings High Tide And Temperature Warnings

May 04, 2025

Wb Weather Update Holi Brings High Tide And Temperature Warnings

May 04, 2025 -

Rising Temperatures In Kolkata March Weather Update And Outlook

May 04, 2025

Rising Temperatures In Kolkata March Weather Update And Outlook

May 04, 2025