Hong Kong's FX Peg: US Dollar Intervention After Two-Year Pause

Table of Contents

Understanding Hong Kong's Currency Peg

The Mechanics of the Linked Exchange Rate

Hong Kong's currency peg operates under a linked exchange rate system, maintaining the Hong Kong dollar (HKD) within a narrow band against the US dollar (USD). This system is managed by the HKMA, acting as a currency board. The HKMA maintains the peg through buying and selling US dollars, ensuring the HKD stays within the predefined range.

- Currency Board: The HKMA's role is critical; it acts as a currency board, maintaining sufficient US dollar reserves to meet any demand for conversion.

- Buying and Selling USD: To maintain the peg, the HKMA buys HKD and sells USD when the HKD strengthens, and vice versa, preventing excessive fluctuations.

- Interest Rate Impact: This intervention directly impacts interest rates. To manage the exchange rate, the HKMA adjusts its interest rate target, influencing borrowing costs in Hong Kong. This mechanism closely ties Hong Kong's monetary policy to that of the United States.

- Monetary Base: The monetary base in Hong Kong is largely determined by the amount of US dollar reserves held by the HKMA, limiting the degree of monetary policy independence.

Historical Context of Interventions

The HKMA has intervened in the past to defend the Hong Kong dollar's peg, demonstrating its commitment to maintaining the linked exchange rate.

- Asian Financial Crisis (1997-98): This crisis severely tested the peg. The HKMA's aggressive intervention, including massive purchases of HKD, successfully defended the currency and its linked exchange rate mechanism.

- Other Instances: Several other instances of market speculation and volatility have prompted HKMA intervention, highlighting its ongoing commitment to maintaining the peg's stability. These actions reinforce the stability and credibility of the Hong Kong dollar.

- Market Speculation: The history of interventions demonstrates the HKMA's preparedness to counter market speculation that threatens the Hong Kong dollar peg.

Reasons for the Recent US Dollar Intervention

Market Pressures and Speculative Attacks

The recent intervention wasn't without reason. Several factors contributed to the pressure on the HKD's peg.

- Speculative Attacks: Market speculation, driven by shifts in global sentiment and economic forecasts, can create pressure to weaken the HKD.

- Capital Flows: Changes in capital flows, including potential capital flight, can disrupt the balance and exert downward pressure on the Hong Kong dollar.

- Market Volatility: Increased volatility in global financial markets can impact the Hong Kong dollar, potentially leading to the need for intervention to maintain the peg within the designated band.

- Exchange Rate Fluctuations: The recent intervention was a direct response to exchange rate fluctuations threatening to push the HKD outside its acceptable range against the USD.

Geopolitical Factors and Global Uncertainty

The global economic climate significantly impacts the Hong Kong dollar.

- US Interest Rate Hikes: Rising US interest rates can attract capital away from Hong Kong, putting downward pressure on the HKD.

- Global Inflation: High global inflation creates uncertainty and can lead to capital flight, impacting the stability of the Hong Kong dollar and increasing the likelihood of HKMA intervention.

- Geopolitical Risks: Geopolitical tensions and uncertainty can also lead to capital flight, requiring intervention to maintain the peg. Hong Kong's unique geopolitical situation makes it particularly susceptible to global events.

- Safe-Haven Currency: The US dollar's status as a safe-haven currency can exacerbate capital flows during times of global uncertainty, influencing the demand for HKD.

Impact and Implications of the Intervention

Short-Term Effects on the Hong Kong Economy

The intervention has immediate consequences for various sectors.

- Interest Rate Impact: The HKMA's actions affect interest rates, influencing borrowing costs for businesses and consumers.

- Capital Inflows: Intervention can attract capital inflows, supporting the HKD and potentially stimulating economic activity.

- Market Confidence: The HKMA's actions can boost market confidence, signaling its commitment to maintaining stability.

- Economic Growth: The short-term effects on economic growth depend on various factors, including the scale and duration of the intervention.

Long-Term Outlook for the Hong Kong Dollar Peg

The sustainability of the peg remains a subject of ongoing debate.

- Peg Sustainability: While the peg has historically proven resilient, global uncertainties pose challenges to its long-term sustainability.

- Long-Term Outlook: The long-term outlook depends on the evolving global economic landscape and the HKMA's ability to effectively manage potential shocks.

- Currency Reform: While unlikely in the near future, discussion around potential currency reforms highlights ongoing considerations of the peg's long-term viability.

- Alternative Exchange Rate Regimes: Alternative exchange rate regimes have been discussed, but a significant shift from the current system would be a monumental decision with far-reaching implications.

Conclusion

The HKMA's recent US dollar intervention underscores the importance of the Hong Kong dollar's peg to the US dollar for maintaining economic stability in Hong Kong. The intervention, driven by market pressures and global uncertainty, highlights the challenges in maintaining the peg in a volatile global environment. While the peg has proven resilient historically, its long-term sustainability remains a key consideration. The short-term impact on the Hong Kong economy will depend on various factors, while the long-term outlook requires careful monitoring of global economic trends and the HKMA’s ongoing management of the linked exchange rate.

To stay informed about the future of Hong Kong's currency, monitor the HKMA's actions and learn more about Hong Kong's linked exchange rate. Stay updated on the Hong Kong dollar's peg and its implications for the Hong Kong economy. Further research into Hong Kong's monetary policy and its implications for investors is highly recommended.

Featured Posts

-

U S Labor Market Report 177 000 Jobs Created In April 4 2 Unemployment

May 04, 2025

U S Labor Market Report 177 000 Jobs Created In April 4 2 Unemployment

May 04, 2025 -

Singapores Upcoming Election The Ruling Party Faces Its Biggest Challenge

May 04, 2025

Singapores Upcoming Election The Ruling Party Faces Its Biggest Challenge

May 04, 2025 -

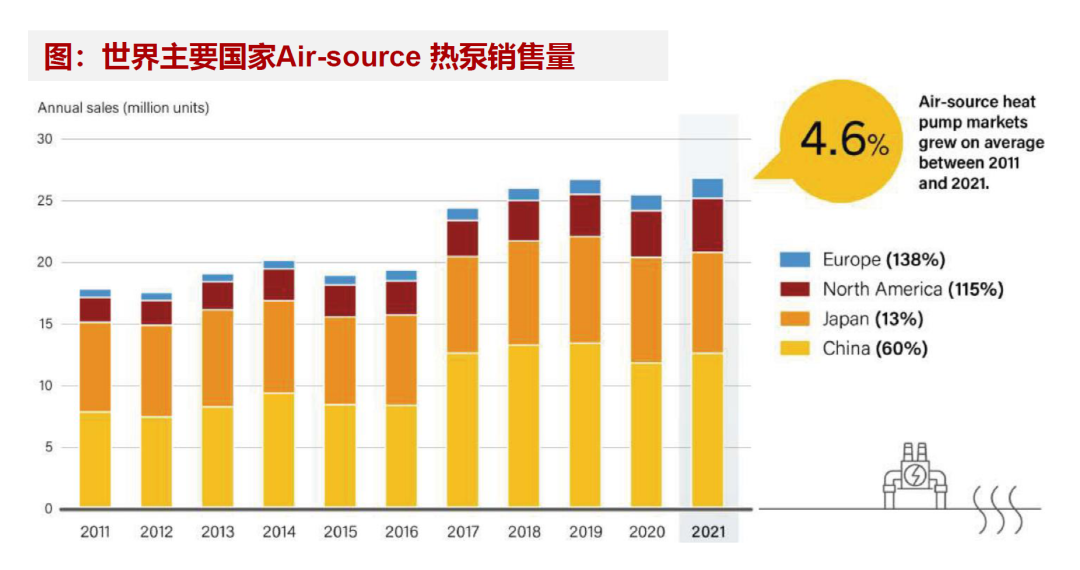

Utrecht Wastewater Plant Netherlands Largest Heat Pump Launched

May 04, 2025

Utrecht Wastewater Plant Netherlands Largest Heat Pump Launched

May 04, 2025 -

Expensive Offshore Wind Farms Falling Out Of Favor With Energy Companies

May 04, 2025

Expensive Offshore Wind Farms Falling Out Of Favor With Energy Companies

May 04, 2025 -

Lizzos Weight Loss A Transformation That Shocked The Internet

May 04, 2025

Lizzos Weight Loss A Transformation That Shocked The Internet

May 04, 2025

Latest Posts

-

Emma Stooyn I Apisteyti Emfanisi Kai To Forema Poy Syzitietai

May 04, 2025

Emma Stooyn I Apisteyti Emfanisi Kai To Forema Poy Syzitietai

May 04, 2025 -

Emma Stoun Vrazila Vsikh Minispidnitseyu Na Premiyi Shou Biznesu

May 04, 2025

Emma Stoun Vrazila Vsikh Minispidnitseyu Na Premiyi Shou Biznesu

May 04, 2025 -

I Anatreptiki Emfanisi Tis Emma Stooyn Ena Forema Poy K Sexorizei

May 04, 2025

I Anatreptiki Emfanisi Tis Emma Stooyn Ena Forema Poy K Sexorizei

May 04, 2025 -

I Emma Stooyn Kai I Anatreptiki Tis Emfanisi To Forema Tis Klevei Tin Parastasi

May 04, 2025

I Emma Stooyn Kai I Anatreptiki Tis Emfanisi To Forema Tis Klevei Tin Parastasi

May 04, 2025 -

Catch Red Wings And Tigers Games Fox 2 Simulcast Announcement

May 04, 2025

Catch Red Wings And Tigers Games Fox 2 Simulcast Announcement

May 04, 2025