Norway's Nicolai Tangen: Navigating Trump's Tariffs

Table of Contents

The Impact of Trump's Tariffs on Global Markets

Trump's tariffs, implemented between 2018 and 2020, significantly impacted global markets. The policy of imposing tariffs on imported goods, primarily from China, created a ripple effect across the globe. This protectionist approach aimed to bolster domestic industries, but it resulted in:

- Increased uncertainty for global investors: The unpredictable nature of the tariff decisions made long-term investment planning extremely difficult. Businesses struggled to forecast future costs and profitability, leading to reduced investment.

- Disruption to supply chains: Tariffs forced companies to reassess their global supply chains, leading to delays, increased costs, and a search for alternative suppliers. This disruption had a knock-on effect across various industries.

- Price increases for consumers: The added tariffs were frequently passed on to consumers in the form of higher prices for goods, impacting purchasing power and contributing to inflationary pressures.

- Retaliatory tariffs from other countries: Other nations responded to Trump's tariffs with their own retaliatory measures, escalating trade tensions and further disrupting global trade flows.

These effects significantly impacted sectors such as manufacturing, technology, and agriculture – sectors heavily represented in the GPFG's portfolio. Companies like Apple, heavily reliant on Chinese manufacturing, felt the immediate brunt of the tariffs. The uncertainty created by the fluctuating tariff landscape presented a considerable challenge for Tangen's investment strategy.

Tangen's Investment Strategy and Risk Management

Nicolai Tangen's approach to managing the GPFG during this period emphasized proactive risk management and diversification. His strategy focused on:

- Diversification strategies: The GPFG, already known for its diversified portfolio, further refined its strategy, reducing exposure to sectors heavily impacted by the trade war. This involved strategic reallocation of assets across various asset classes and geographies.

- Emphasis on sustainable and responsible investing (SRI): While not a direct response to tariffs, Tangen's emphasis on SRI aligned with a long-term perspective, reducing reliance on potentially volatile, tariff-sensitive industries.

- Focus on long-term value creation: The strategy prioritized long-term value creation over short-term gains. This meant weathering the initial storm caused by the tariffs, understanding that long-term fundamentals would eventually prevail.

- Adjustments to portfolio allocation: The GPFG likely made adjustments to its sector allocations, shifting away from companies heavily exposed to the US-China trade conflict and towards companies with more resilient business models and less direct tariff exposure.

While precise data on specific allocation changes isn't publicly available due to the fund's confidentiality, the GPFG's overall performance during this turbulent period suggests that Tangen's risk management strategies were relatively effective.

Geopolitical Considerations and Norway's Position

Norway, while not directly involved in the US-China trade dispute, maintains a strong economic relationship with the US. This relationship played a significant role in shaping Tangen's decision-making:

- Norway's reliance on trade with the US: Although not as direct as other nations, Norway benefits from trade with the US, making the implications of the global trade war relevant.

- Potential political implications: The tariffs created uncertainty about the future direction of US trade policy and its potential impact on global stability, influencing Norway’s approach to international cooperation.

- Norway's response: Norway engaged in diplomatic efforts to promote free trade and multilateralism, seeking to mitigate the negative consequences of protectionist policies on the global economy.

This geopolitical context, coupled with Norway's commitment to open markets, likely shaped Tangen's strategic approach, influencing his decisions to prioritize diversification and long-term stability.

Long-Term Implications for the GPFG

Trump's tariffs had lasting implications for the GPFG's investment strategy and future planning:

- Changes in investment allocation: The experience reinforced the importance of geographical and sectoral diversification within the portfolio.

- Lessons learned regarding risk management: The episode underscored the significance of proactive risk management in a volatile global environment.

- Adaptation of strategies to future uncertainties: The GPFG likely refined its models for assessing and mitigating geopolitical risks.

The long-term impact on achieving the GPFG's long-term goals is complex. While the tariffs created short-term volatility, the fund's diversified approach and focus on long-term value likely minimized the overall negative impact, demonstrating the effectiveness of a well-defined risk management strategy.

Conclusion

Nicolai Tangen's leadership during the period of Trump's tariffs demonstrated the critical importance of proactive risk management, diversification, and a long-term investment horizon in navigating global economic uncertainty. His emphasis on sustainable and responsible investing further showcased the fund's commitment to both financial returns and broader societal impact. The geopolitical context highlighted the interconnectedness of global markets and the influence of international relations on investment decisions. Understanding how leaders like Nicolai Tangen navigate global economic uncertainty, like the impact of Trump’s tariffs, is crucial for comprehending the complexities of international finance. Further research into the strategies employed by the GPFG under Tangen’s leadership will provide valuable insights into effective management of sovereign wealth funds in a volatile world. Learn more about Nicolai Tangen's response to Trump's Tariffs and their implications for global investment.

Featured Posts

-

Australian Election Albaneses Labor Party Favored As Voting Commences

May 04, 2025

Australian Election Albaneses Labor Party Favored As Voting Commences

May 04, 2025 -

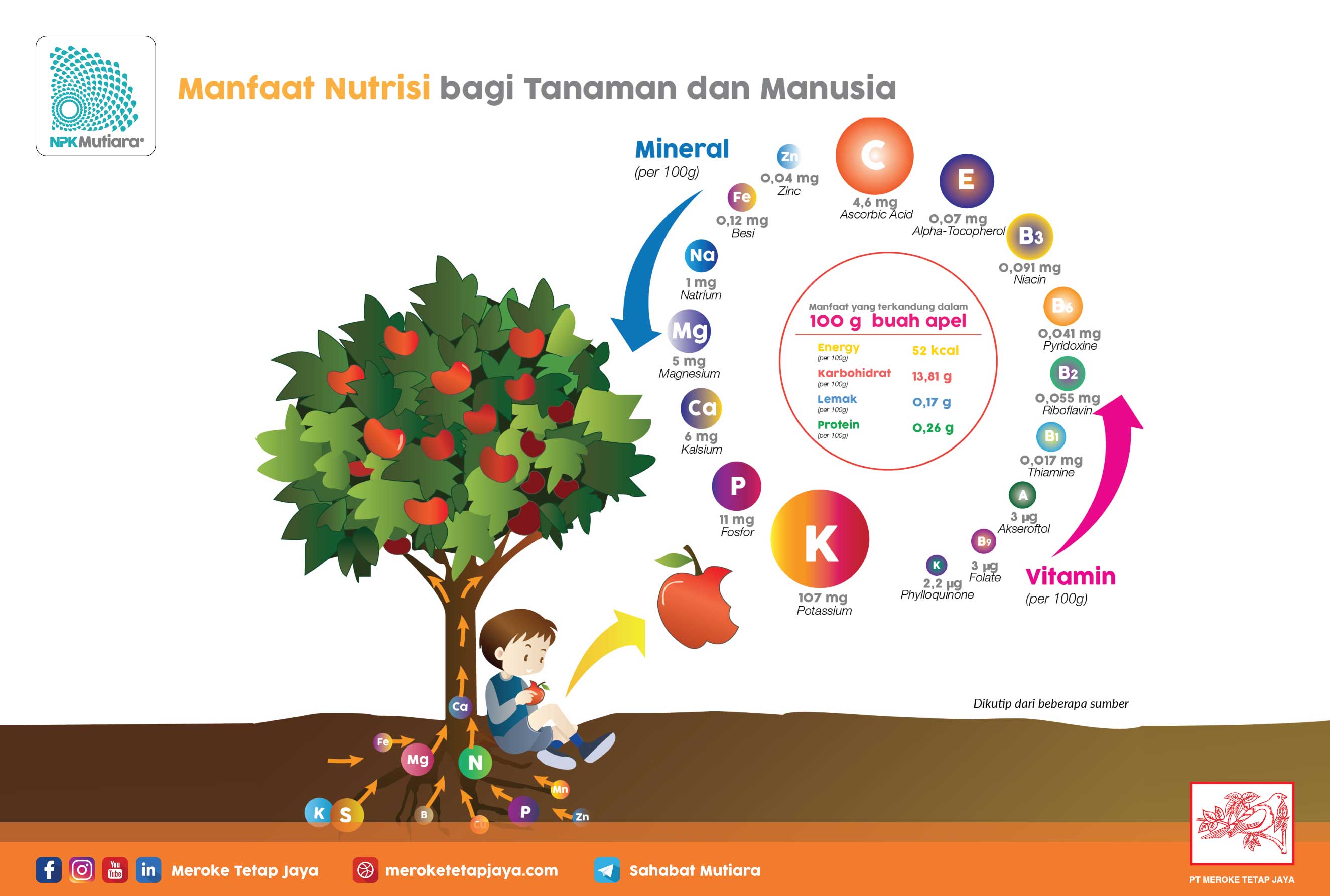

Bukan Sekadar Sampah Cangkang Telur Sumber Nutrisi Untuk Tanaman And Hewan

May 04, 2025

Bukan Sekadar Sampah Cangkang Telur Sumber Nutrisi Untuk Tanaman And Hewan

May 04, 2025 -

Carneys Meeting With Trump The Future Of Cusma

May 04, 2025

Carneys Meeting With Trump The Future Of Cusma

May 04, 2025 -

The Cusma Negotiations Carneys Crucial Meeting With Trump

May 04, 2025

The Cusma Negotiations Carneys Crucial Meeting With Trump

May 04, 2025 -

Offshore Wind Energy A Cost Benefit Analysis For Energy Companies

May 04, 2025

Offshore Wind Energy A Cost Benefit Analysis For Energy Companies

May 04, 2025

Latest Posts

-

Nhl Standings And Showdown Saturday Key Matchups To Watch

May 04, 2025

Nhl Standings And Showdown Saturday Key Matchups To Watch

May 04, 2025 -

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 04, 2025

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 04, 2025 -

Nhl Playoffs Showdown Saturday A Look At The Standings

May 04, 2025

Nhl Playoffs Showdown Saturday A Look At The Standings

May 04, 2025 -

Johnston And Rantanen Lead Avalanche To Victory Over Panthers In High Scoring Affair

May 04, 2025

Johnston And Rantanen Lead Avalanche To Victory Over Panthers In High Scoring Affair

May 04, 2025 -

Showdown Saturday A Look At The Tight Nhl Playoff Standings Race

May 04, 2025

Showdown Saturday A Look At The Tight Nhl Playoff Standings Race

May 04, 2025