Offshore Wind Energy: A Cost-Benefit Analysis For Energy Companies

Table of Contents

Capital Costs of Offshore Wind Energy Projects

Investing in offshore wind energy requires a significant upfront capital expenditure. This makes a robust financial model crucial for success.

Initial Investment and Infrastructure

The initial investment in offshore wind projects is substantial, encompassing various elements:

- Turbine costs and specifications: Turbine size and technology significantly impact costs. Larger turbines generate more power but come with a higher price tag. Technological advancements, like floating offshore wind turbines, present both opportunities and cost considerations.

- Foundation construction: The foundation type – monopiles (single-column structures), jackets (steel frameworks), or floating platforms – depends on water depth and seabed conditions, drastically affecting construction costs.

- Subsea cabling and grid connection expenses: Laying and connecting subsea cables to the onshore grid is a complex and expensive undertaking, requiring specialized vessels and expertise.

- Site preparation and environmental impact assessments: Thorough site surveys, environmental impact studies, and permitting processes add to the initial investment costs. Navigating regulatory hurdles can lead to delays and increased expenses.

Financing and Investment Risks

Securing financing for large-scale offshore wind projects presents significant challenges:

- High initial capital expenditure: The sheer magnitude of upfront investment makes these projects risky for investors, demanding detailed financial projections and risk mitigation strategies.

- Technological risks and uncertainties: New technologies and the harsh marine environment introduce technological uncertainties, potentially leading to cost overruns and delays.

- Regulatory hurdles and permitting processes: Obtaining necessary permits and approvals can be a lengthy and complex process, adding to the overall project timeline and cost.

- Potential for cost overruns: Offshore wind projects are inherently complex, making them susceptible to cost overruns due to unforeseen circumstances, design changes, or supply chain disruptions.

Operational Costs and Maintenance

Beyond the initial capital investment, operating and maintaining an offshore wind farm involves ongoing expenses.

Ongoing Expenses

Recurring operational costs include:

- Routine maintenance and repairs of turbines and subsea infrastructure: Regular inspections, repairs, and component replacements are essential to ensure the long-term efficiency and reliability of the wind farm.

- Crew transportation and accommodation: Maintaining and servicing offshore wind farms requires specialized crews, necessitating costly transportation and accommodation solutions.

- Monitoring and control systems: Sophisticated monitoring and control systems are crucial for optimizing performance, detecting faults, and minimizing downtime.

- Insurance and liability: Comprehensive insurance coverage is vital to protect against potential risks and liabilities associated with operating an offshore wind farm.

Predicting and Managing Operational Costs

Strategies for minimizing operational costs are crucial for profitability:

- Advanced predictive maintenance techniques: Utilizing data analytics and predictive modelling can optimize maintenance schedules, minimizing downtime and reducing repair costs.

- Efficient logistics and supply chain management: Effective logistics and supply chain management are key to ensuring timely delivery of parts and minimizing disruption to operations.

- Automation and remote monitoring technologies: Automation and remote monitoring technologies can improve operational efficiency, reduce labor costs, and enhance safety.

Revenue Generation and Financial Returns

The profitability of offshore wind projects hinges on several factors influencing revenue generation and return on investment.

Electricity Price and Market Dynamics

Electricity prices and market dynamics significantly impact profitability:

- Power Purchase Agreements (PPAs): Long-term PPAs provide price certainty and revenue stability, reducing financial risks.

- Government subsidies and incentives for renewable energy: Government support, including tax credits, feed-in tariffs, and renewable portfolio standards, can significantly improve the financial attractiveness of offshore wind projects.

- Carbon pricing and its effect on offshore wind energy economics: Carbon pricing mechanisms, such as carbon taxes or emissions trading schemes, can increase the competitiveness of offshore wind energy by reflecting its environmental benefits.

Long-Term Profitability and Return on Investment (ROI)

Projecting long-term financial viability requires considering:

- Expected lifespan of turbines and infrastructure: The expected lifespan of turbines and infrastructure directly impacts the project's long-term profitability and return on investment (ROI).

- Potential for technological advancements and cost reductions: Technological advancements can lead to cost reductions and improved efficiency, enhancing the long-term ROI.

- Depreciation and tax implications: Proper accounting for depreciation and tax implications is crucial for accurately assessing the financial performance of offshore wind projects.

Environmental and Social Benefits

While financial viability is paramount, the environmental and social benefits of offshore wind energy should not be overlooked.

Reduced Carbon Emissions

Offshore wind energy contributes significantly to reducing greenhouse gas emissions, playing a crucial role in combating climate change. The amount of CO2 avoided depends on the project scale and the energy source it replaces.

Job Creation and Economic Development

Offshore wind projects create numerous jobs across the entire value chain, from manufacturing and construction to operation and maintenance, stimulating local and regional economies.

Environmental Impact Mitigation

While generally environmentally friendly, potential impacts like noise pollution, visual impact, and effects on marine life need careful mitigation through responsible planning and implementation.

Conclusion

The cost-benefit analysis of offshore wind energy projects requires a careful evaluation of significant upfront capital investments, ongoing operational costs, and long-term revenue streams. While initial investment is substantial and carries inherent risks, the potential for long-term profitability, driven by increasing electricity prices, government incentives, and carbon pricing mechanisms, makes offshore wind a compelling investment. Furthermore, the substantial environmental and social benefits solidify its position as a crucial component of a sustainable energy future. Energy companies should carefully consider the cost-benefit analysis of offshore wind energy projects and explore the potential for sustainable, profitable investments in this growing sector. Further research and collaboration with industry experts are crucial for making informed decisions regarding offshore wind energy investments, considering offshore wind power as part of a diversified renewable energy portfolio.

Featured Posts

-

Predicting The First Round Key Factors In The Nhl Stanley Cup Playoffs

May 04, 2025

Predicting The First Round Key Factors In The Nhl Stanley Cup Playoffs

May 04, 2025 -

Carneys Plan Reshaping The Economy For A Generation

May 04, 2025

Carneys Plan Reshaping The Economy For A Generation

May 04, 2025 -

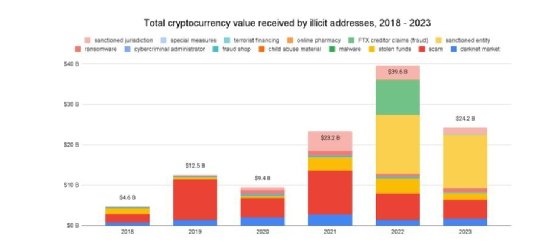

How Chainalysis Acquisition Of Alterya Will Shape The Future Of Blockchain Security And Ai

May 04, 2025

How Chainalysis Acquisition Of Alterya Will Shape The Future Of Blockchain Security And Ai

May 04, 2025 -

Is Darjeeling Teas Production In Crisis

May 04, 2025

Is Darjeeling Teas Production In Crisis

May 04, 2025 -

2024 Stanley Cup Are The Vegas Golden Knights The Team To Beat

May 04, 2025

2024 Stanley Cup Are The Vegas Golden Knights The Team To Beat

May 04, 2025

Latest Posts

-

Cult Members Face Prison For Reckless Gambling Endangering Children

May 04, 2025

Cult Members Face Prison For Reckless Gambling Endangering Children

May 04, 2025 -

Seventh Wonders Fleetwood Mac Tribute Concert Perth Mandurah Albany Dates

May 04, 2025

Seventh Wonders Fleetwood Mac Tribute Concert Perth Mandurah Albany Dates

May 04, 2025 -

Conviction Of Cult Members For Gambling Related Child Abuse

May 04, 2025

Conviction Of Cult Members For Gambling Related Child Abuse

May 04, 2025 -

Experience Fleetwood Mac Live Seventh Wonders Perth Mandurah Albany Tour

May 04, 2025

Experience Fleetwood Mac Live Seventh Wonders Perth Mandurah Albany Tour

May 04, 2025 -

Gambling Ring Cult Members Imprisoned For Endangering Children

May 04, 2025

Gambling Ring Cult Members Imprisoned For Endangering Children

May 04, 2025