New Deals Team At Deutsche Bank: A Focus On Defense Finance

Table of Contents

The Composition and Expertise of the New Deals Team

Deutsche Bank's newly formed defense finance deals team boasts a unique blend of seasoned professionals with extensive experience in various aspects of financial services. The team's structure is designed for optimal efficiency and collaboration, bringing together experts in mergers and acquisitions (M&A), debt financing, equity offerings, and regulatory compliance within the defense sector. While the exact size and all personnel details may not be publicly disclosed for competitive reasons, the team includes several notable hires and internal promotions, bringing in specialized knowledge of government contracting, military finance, and aerospace finance. Key skills and experiences within the team include:

- Mergers and Acquisitions (M&A) expertise: The team possesses a deep understanding of complex M&A transactions within the defense industry, including cross-border deals.

- Deep understanding of defense regulations and compliance: Navigating the intricate regulatory landscape of defense contracting is crucial, and this team possesses the expertise to ensure full compliance.

- Strong relationships with defense contractors and government agencies: Established networks within the industry are vital for securing deals and fostering long-term partnerships.

- Experience in structuring complex defense finance transactions: The team’s expertise allows them to tailor financial solutions to meet the specific needs of defense clients.

Deutsche Bank's Strategic Focus on Defense Finance

Deutsche Bank's strategic focus on defense finance is driven by several key factors. The global defense landscape presents a significant market opportunity, marked by substantial growth and increasing demand for specialized financial services. This strategic expansion is fueled by:

- Growing defense budgets globally: Increased defense spending worldwide presents a substantial market for financial services tailored to the unique needs of the defense sector.

- Increased privatization and outsourcing in the defense industry: As governments increasingly outsource defense-related projects, the need for sophisticated financing solutions grows.

- Opportunities in emerging defense technologies: The rapid advancements in areas like cybersecurity, artificial intelligence, and space technology create new investment opportunities.

- Desire to diversify investment portfolio: Expanding into defense finance allows Deutsche Bank to diversify its portfolio and mitigate risks associated with economic fluctuations in other sectors. This diversification also expands their reach into the lucrative world of government contracting and military finance.

This strategic move positions Deutsche Bank to capitalize on the growth potential within the defense finance market, leveraging its competitive advantages in global reach, financial expertise, and strong relationships with key players in the industry.

Key Services Offered by the Deals Team

Deutsche Bank's new defense finance deals team offers a comprehensive suite of services designed to cater to the diverse financial needs of defense companies and government agencies. These services include:

- Mergers and acquisitions advisory: Guidance and support throughout the M&A process, including valuation, due diligence, and negotiation.

- Debt financing: Securing funding through syndicated loans, private placements, and other debt instruments tailored to the specific requirements of defense projects.

- Equity financing: Facilitating equity offerings, including initial public offerings (IPOs) and private equity investments, for defense companies.

- Project finance: Providing financial solutions for large-scale defense projects, encompassing infrastructure development and technological advancements.

- Restructuring and refinancing: Assisting defense companies in navigating financial challenges and optimizing their capital structures.

- Risk management and regulatory compliance support: Providing expert guidance to mitigate financial risks and ensure compliance with all applicable regulations.

This wide range of services positions Deutsche Bank as a one-stop shop for defense finance, providing clients with a comprehensive and integrated approach to their financial needs.

Impact and Future Outlook of Deutsche Bank's Defense Finance Initiative

Deutsche Bank's foray into the defense finance sector has the potential to significantly impact the industry. This initiative is expected to:

- Increase competition in the defense finance market: This increased competition will drive innovation and efficiency, ultimately benefiting clients.

- Potential for higher returns on investment: The defense sector offers opportunities for high returns due to its stable and often government-backed nature.

- Contributions to national security and economic growth: By facilitating investments in defense technologies and infrastructure, Deutsche Bank contributes to national security and economic development.

- Potential for innovation and technological advancements: Access to capital can fuel innovation and accelerate the development of cutting-edge defense technologies.

While the initiative presents many opportunities, challenges remain, including navigating the complex regulatory environment and managing potential geopolitical risks. The long-term success of Deutsche Bank's defense finance team will depend on its ability to adapt to evolving market dynamics and maintain its focus on client needs.

Conclusion: Deutsche Bank's Commitment to Defense Finance – A Promising Future

Deutsche Bank's establishment of a dedicated defense finance deals team marks a significant commitment to this specialized sector. The team's expertise in M&A, debt and equity financing, and regulatory compliance, combined with Deutsche Bank's global reach, positions the bank to become a key player in the defense finance market. The potential impact on the industry is substantial, promising increased competition, higher returns on investment, and advancements in defense technology. Learn more about how Deutsche Bank's expertise in defense finance can benefit your organization. Contact our new deals team today to discuss your needs and explore the opportunities within the dynamic world of defense finance.

Featured Posts

-

Unexpected Daycare Costs Learning From A 3 000 Babysitting Bill

May 09, 2025

Unexpected Daycare Costs Learning From A 3 000 Babysitting Bill

May 09, 2025 -

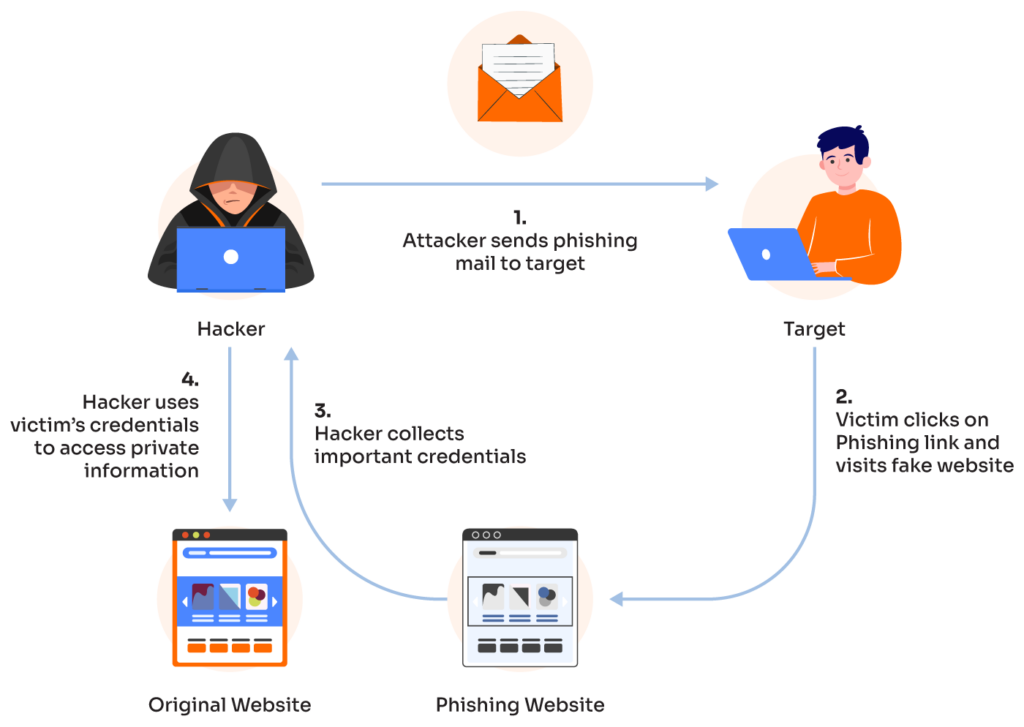

Federal Investigation Hacker Made Millions Targeting Executive Office365 Accounts

May 09, 2025

Federal Investigation Hacker Made Millions Targeting Executive Office365 Accounts

May 09, 2025 -

10 Film Noir Movies Guaranteed To Grip You

May 09, 2025

10 Film Noir Movies Guaranteed To Grip You

May 09, 2025 -

New Canola Suppliers For China The Impact Of The Canada Trade Dispute

May 09, 2025

New Canola Suppliers For China The Impact Of The Canada Trade Dispute

May 09, 2025 -

2025 Could The Monkey Be Stephen Kings Worst Movie Adaptation Yet

May 09, 2025

2025 Could The Monkey Be Stephen Kings Worst Movie Adaptation Yet

May 09, 2025