Netflix's Resilience Amidst Big Tech Downturn: A Wall Street Tariff Haven?

Table of Contents

Netflix's Diversification Strategy as a Protective Measure

Netflix's success isn't solely reliant on its streaming service; its strategic diversification acts as a significant buffer against market fluctuations. This multifaceted approach reduces its vulnerability compared to companies heavily reliant on a single revenue stream.

Beyond Streaming: Exploring Netflix's Expansion into Gaming and Advertising

- Gaming Initiatives: Netflix has invested heavily in mobile gaming, offering a diverse range of titles directly integrated into its platform. This expansion taps into a lucrative market and diversifies its revenue sources beyond subscriptions.

- Ad-Supported Tier: The introduction of a cheaper, ad-supported subscription tier opens Netflix to a broader audience and generates additional revenue streams, mitigating reliance solely on premium subscriptions.

- Competitor Analysis: Unlike some streaming rivals heavily reliant on subscriber growth, Netflix's diversification strategy positions it more favorably during economic downturns. Its expansion beyond core streaming services offers a safety net against subscription fatigue.

Geographic Expansion and International Market Penetration

- Global Reach: Netflix boasts a vast global subscriber base, spanning numerous countries and regions. This broad reach reduces the impact of economic downturns in specific geographical areas.

- New Market Penetration: Netflix continues to strategically expand into new international markets, further diversifying its revenue base and mitigating risk associated with dependence on any single region.

- Global Subscriber Growth: Consistent global subscriber growth signifies the strength of its brand and the resilience of its business model, even amidst economic uncertainties. This sustained growth contributes significantly to overall company stability.

Content Strategy and its Role in Maintaining Subscriber Base

Netflix's content strategy is a cornerstone of its resilience. The company's focus on original programming and strategic acquisitions creates a competitive advantage and safeguards its subscriber base.

Original Content as a Competitive Advantage

- Investment in Originals: Netflix's massive investment in original movies and series provides exclusive content that attracts and retains subscribers. This is crucial in a competitive streaming landscape.

- Exclusive Content Retention: The exclusivity of Netflix's original content acts as a powerful magnet, reducing subscriber churn and encouraging loyalty.

- Competitive Comparison: Compared to platforms relying heavily on licensed content, Netflix's commitment to originals gives it a more sustainable competitive edge. This reduces dependence on external content providers and potential licensing issues.

Strategic Licensing and Acquisition Deals

- Successful Licensing Agreements: Netflix secures licensing agreements for popular content, supplementing its original programming and providing diverse viewing options for its subscribers.

- Strategic Acquisitions: Acquisitions of production companies and studios further strengthen Netflix's content creation capabilities and expand its content library.

- Risk Mitigation: This dual approach—originals and licensed/acquired content—mitigates the risk associated with relying solely on internal content creation, ensuring a consistent stream of engaging material for its audience.

Netflix's Financial Health and Investor Confidence

Netflix's strong financial performance and investor confidence contribute to its perceived resilience in the current market climate.

Analyzing Netflix's Recent Financial Performance

- Revenue Growth: Despite market fluctuations, Netflix has demonstrated consistent revenue growth, showcasing the strength of its business model.

- Subscriber Numbers: While subscriber growth may fluctuate, Netflix maintains a substantial and growing subscriber base globally.

- Profitability: While profitability has been a subject of scrutiny, Netflix's overall financial health remains relatively strong compared to many other Big Tech companies experiencing significant losses. [Include relevant charts and financial data here.]

Wall Street's Perception of Netflix as a Safe Haven

- Analyst Opinions: Many analysts view Netflix as a relatively safer investment compared to other Big Tech companies facing more significant challenges.

- Investor Confidence: Despite market volatility, investor confidence in Netflix remains relatively high due to its diversified revenue streams and strong content library.

- Potential Safe Haven: The combination of these factors contributes to Netflix's potential to become a preferred investment destination during periods of economic uncertainty.

Conclusion

In summary, Netflix's diversified revenue streams, robust content strategy, and relatively strong financial performance contribute to its resilience amidst the Big Tech downturn. Its strategic moves, including expansion into gaming and advertising, along with a focus on original content and international markets, suggest that it could be viewed as a more stable investment compared to other tech giants. We've seen how Netflix's resilience amidst Big Tech downturn is a testament to its adaptability and strategic foresight. This reinforces our argument that Netflix's unique characteristics position it as a potential Wall Street tariff haven during periods of economic instability. Consider Investing in Netflix's Resilience – further research into its financial performance may reveal it to be a smart investment strategy for the long term. Explore Netflix's resilience: a smart investment strategy? and see if it aligns with your portfolio goals.

Featured Posts

-

Strengthening Bilateral Security China And Indonesia

Apr 22, 2025

Strengthening Bilateral Security China And Indonesia

Apr 22, 2025 -

Trumps Economic Agenda Winners And Losers

Apr 22, 2025

Trumps Economic Agenda Winners And Losers

Apr 22, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 22, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 22, 2025 -

Trumps Aggressive Trade Tactics Risks To Us Financial Primacy

Apr 22, 2025

Trumps Aggressive Trade Tactics Risks To Us Financial Primacy

Apr 22, 2025

Latest Posts

-

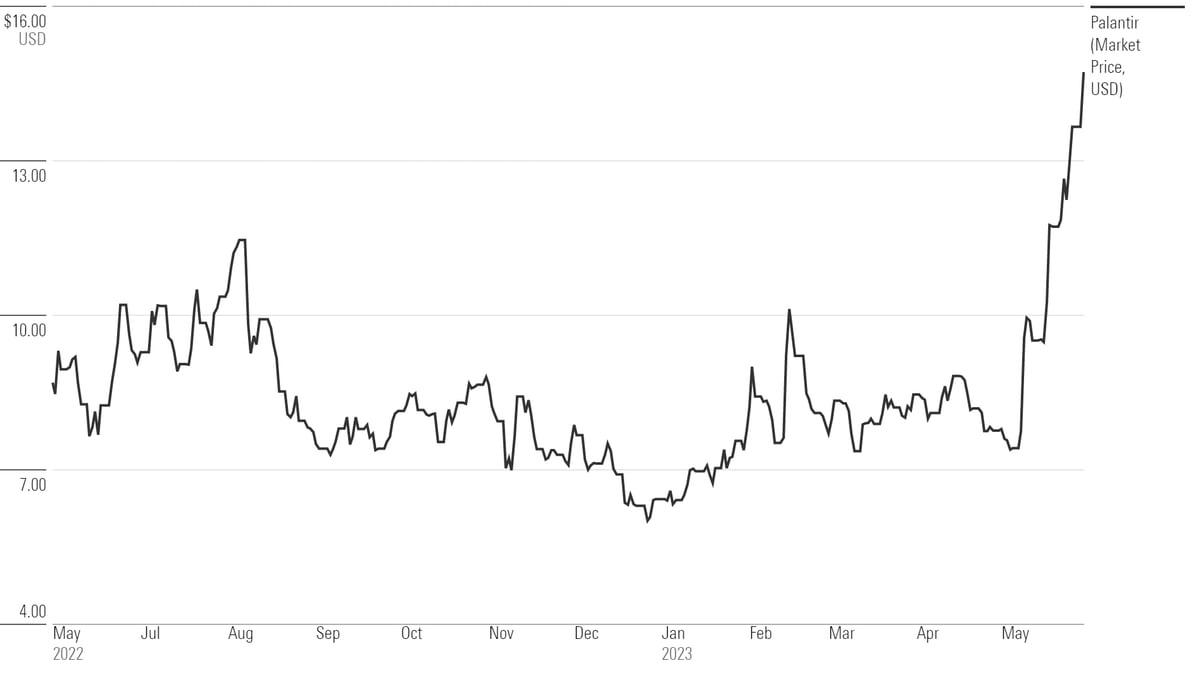

30 Drop In Palantir Is It A Good Time To Invest

May 10, 2025

30 Drop In Palantir Is It A Good Time To Invest

May 10, 2025 -

Palantir Stock Plunges 30 A Dip Buyers Analysis

May 10, 2025

Palantir Stock Plunges 30 A Dip Buyers Analysis

May 10, 2025 -

Should You Buy Palantir Stock After A 30 Decline

May 10, 2025

Should You Buy Palantir Stock After A 30 Decline

May 10, 2025 -

Palantirs 30 Drop Time To Buy The Dip

May 10, 2025

Palantirs 30 Drop Time To Buy The Dip

May 10, 2025 -

Palantir Stock Outlook Investment Advice Before May 5th

May 10, 2025

Palantir Stock Outlook Investment Advice Before May 5th

May 10, 2025