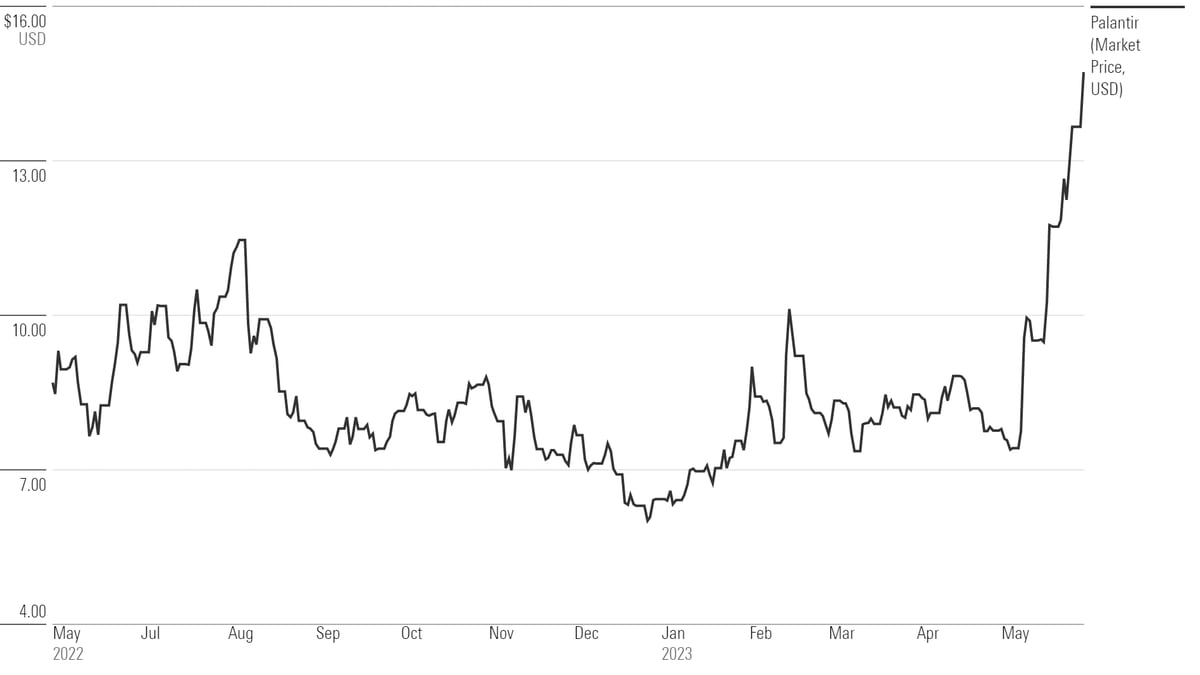

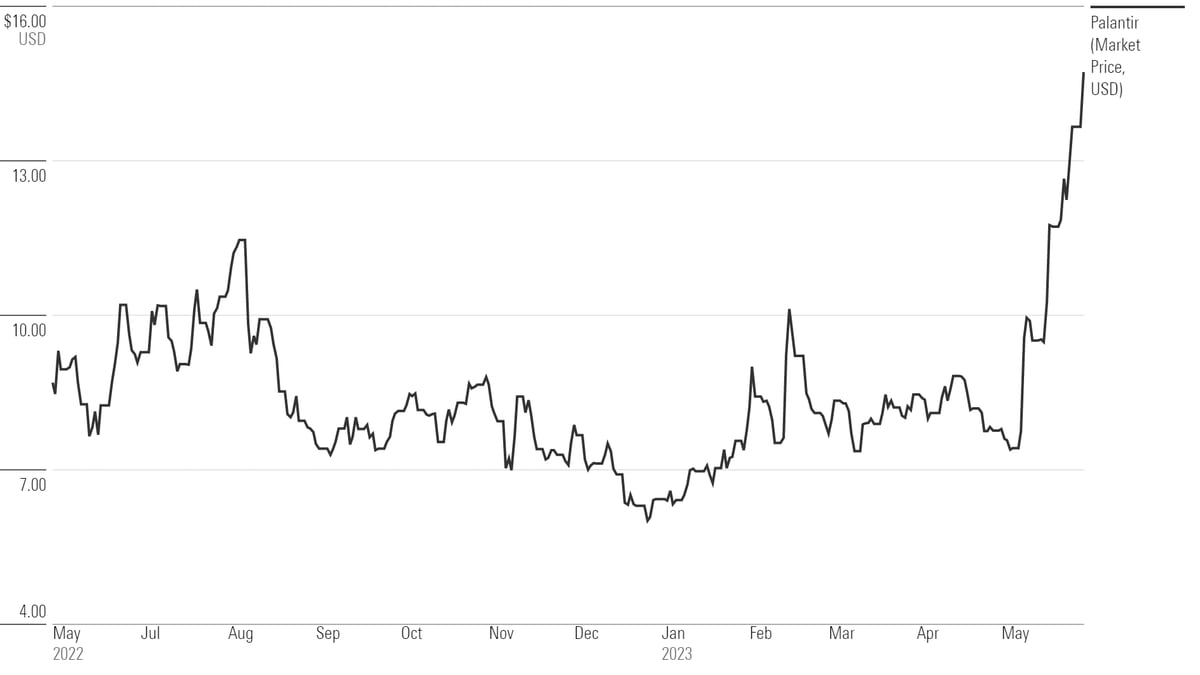

Should You Buy Palantir Stock After A 30% Decline?

Table of Contents

Analyzing Palantir's Recent Performance and the Reasons Behind the Decline

The 30% drop in Palantir stock price wasn't an isolated event; it reflected a broader tech stock decline and negative market sentiment. Several factors contributed to this downturn:

-

Broader Market Sell-Off: The overall stock market volatility, particularly affecting growth stocks, significantly impacted Palantir's valuation. Concerns about inflation, rising interest rates, and a potential recession weighed heavily on investor confidence.

-

Concerns About Growth Rate: While Palantir has shown consistent revenue growth, some analysts expressed concerns about the sustainability of its high growth rate, especially in the commercial sector.

-

Earnings Reports and Guidance: Recent earnings reports, while showing revenue growth, might have fallen short of some analysts' expectations, triggering sell-offs. Future guidance might also have contributed to investor hesitancy.

-

Increased Competition: The big data analytics market is increasingly competitive. The emergence of new players and the expansion of established tech giants into this space poses a threat to Palantir's market share.

Let's look at some key financial metrics:

-

Revenue Growth: While Palantir has consistently demonstrated revenue growth, the rate of growth has been a focus of market scrutiny in recent quarters. Analyzing the year-over-year and quarter-over-quarter revenue changes provides crucial insights into the company's trajectory.

-

Profitability: Palantir's path to profitability remains a key area of investor focus. Examining metrics like operating margins and net income reveals the company's financial health and its progress towards achieving sustainable profitability. (A relevant chart or graph illustrating revenue and profit trends would be inserted here).

Evaluating Palantir's Long-Term Growth Potential and Market Position

Despite the recent downturn, Palantir boasts significant long-term growth potential. Its innovative data analytics platforms cater to a rapidly expanding market. Key factors supporting long-term growth include:

-

Increasing Demand for Data Analytics: The need for advanced data analytics solutions across various industries is continuously growing, creating a favorable market environment for Palantir.

-

Government Contracts: Palantir's strong position in government contracts provides a stable revenue stream and offers opportunities for future expansion within the public sector.

-

Commercial Applications: The expansion into the commercial sector presents significant growth opportunities, although this market segment remains more competitive.

-

Strategic Partnerships: Collaborations with other technology companies can further expand Palantir's reach and enhance its product offerings.

-

Technological Innovation: Continued investment in research and development will ensure Palantir remains at the forefront of data analytics innovation, maintaining a strong competitive advantage. Its unique approach to data integration and analysis positions it for continued success.

Assessing the Risks Associated with Investing in Palantir Stock

Investing in Palantir, like any growth stock, involves significant risks:

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's financial performance.

-

High Valuation: Even after the recent decline, Palantir's valuation remains relatively high compared to its peers. This makes the stock susceptible to further declines if growth expectations aren't met.

-

Competition: The intense competition in the big data analytics space presents a considerable challenge to Palantir's market dominance.

Considering Alternative Investment Strategies

Investors hesitant about the risks associated with Palantir stock might consider alternative investment strategies, such as:

-

Diversification: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price, mitigating the risk of buying high.

Conclusion: Should You Buy Palantir Stock After a 30% Decline? A Final Verdict

The decision of whether to buy Palantir stock after its recent decline requires careful consideration. While the 30% drop presents a potentially attractive entry point for long-term investors, the inherent risks associated with growth stocks, particularly in a volatile market, cannot be ignored. Palantir's strong long-term growth potential, driven by the increasing demand for data analytics and its unique platform capabilities, is counterbalanced by concerns about its high valuation, competition, and dependence on government contracts.

Thorough due diligence is paramount before making any investment decision. Analyze the company's financial statements, understand the competitive landscape, and assess your own risk tolerance. Considering alternative investment strategies to diversify your portfolio is also prudent.

Based on the analysis presented, while the significant decline makes Palantir more attractive than it was before, it remains a high-risk, high-reward investment. Therefore, our recommendation is a cautious approach: further research is crucial before investing in Palantir. Consider diversifying your portfolio to mitigate risk. Should you invest in Palantir? The answer depends entirely on your individual risk tolerance and investment goals. Conduct your own research and make an informed decision about investing in Palantir stock (PLTR).

Featured Posts

-

Unlocking Potential The Impact Of Strong Middle Management On Company Culture And Productivity

May 10, 2025

Unlocking Potential The Impact Of Strong Middle Management On Company Culture And Productivity

May 10, 2025 -

Elizabeth City Road Fatal Accident Leaves Two Dead

May 10, 2025

Elizabeth City Road Fatal Accident Leaves Two Dead

May 10, 2025 -

El Arresto De Una Estudiante Transgenero Implicaciones Legales Y Sociales Del Uso De Banos

May 10, 2025

El Arresto De Una Estudiante Transgenero Implicaciones Legales Y Sociales Del Uso De Banos

May 10, 2025 -

Beyond The Monkey Anticipation Builds For Stephen Kings Upcoming Films In 2024

May 10, 2025

Beyond The Monkey Anticipation Builds For Stephen Kings Upcoming Films In 2024

May 10, 2025 -

Seattle Businesses Woo Canadian Sports Fans With Par Exchange Rates

May 10, 2025

Seattle Businesses Woo Canadian Sports Fans With Par Exchange Rates

May 10, 2025