Net Asset Value (NAV) Explained: Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the market value of an Exchange-Traded Fund (ETF)'s underlying assets minus its liabilities. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means calculating the total value of all the global stocks and bonds held within the fund, subtracting any expenses or liabilities. The simple formula is: Assets - Liabilities = NAV.

This calculation is performed daily, providing a snapshot of the ETF's value at the close of market trading. The assets in the Amundi MSCI All Country World UCITS ETF USD Acc include a diversified portfolio of global equities and potentially some cash holdings. Liabilities encompass management fees and other operational expenses.

- NAV reflects the market value of the ETF's holdings. This means the NAV fluctuates based on the price movements of the underlying securities.

- NAV is crucial for determining the ETF's share price. While the share price may deviate slightly due to market forces (tracking error), it generally closely follows the NAV.

- Fluctuations in the NAV reflect the performance of the underlying assets. A rising NAV indicates positive performance, while a falling NAV suggests negative performance.

How NAV Impacts Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

The daily NAV changes directly affect your investment returns. If the NAV increases, your investment grows proportionally. Conversely, a decrease in NAV reflects a loss in value. The relationship between NAV and the ETF's share price is vital for understanding your investment's performance. While ideally they should track perfectly, there might be a small difference called tracking error, mainly due to trading costs and other market factors.

To monitor the performance of your Amundi MSCI All Country World UCITS ETF USD Acc, regularly check its NAV. You can usually find this information on Amundi's official website, financial news websites, and many brokerage platforms.

- Monitor NAV for performance tracking. Regularly reviewing the NAV allows you to assess the success of your investment strategy.

- Understand NAV to make informed investment decisions. NAV provides a clear indicator of your investment's value.

- NAV helps to assess the value of your ETF investment. This is crucial for making buy, sell, or hold decisions.

Understanding UCITS ETFs and NAV

The Amundi MSCI All Country World UCITS ETF USD Acc is a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF. This designation signifies that it's compliant with European Union regulations designed to protect investors. These regulations impact the NAV calculation and reporting processes, ensuring transparency and accountability. The regulatory oversight ensures that the NAV is calculated accurately and fairly.

- UCITS ETFs offer investor protection. These regulations provide a high level of security and transparency for investors.

- UCITS regulations ensure transparent NAV calculation. The standards provide increased confidence in the reported NAV.

- Investing in UCITS ETFs provides a regulated investment vehicle. This adds a layer of protection compared to other, less regulated investment options.

The Amundi MSCI All Country World UCITS ETF USD Acc: A Closer Look at its NAV

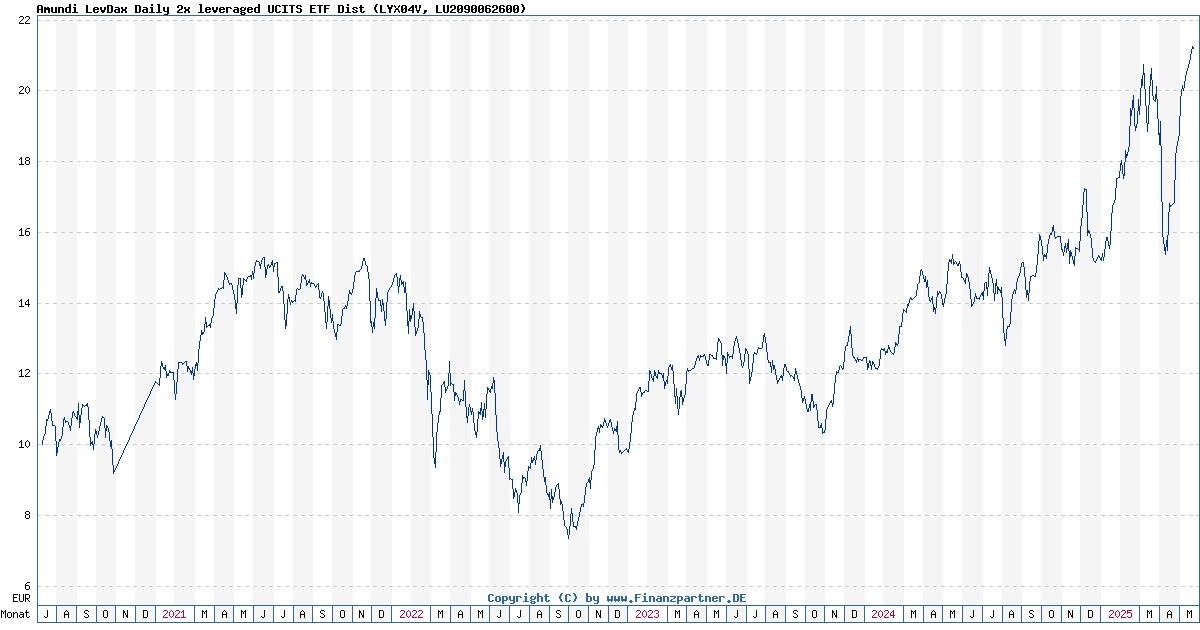

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily by valuing its holdings – a diverse mix of global equities mirroring the MSCI All Country World Index. This diversification across various sectors and geographies mitigates risk and impacts the NAV's volatility compared to a less-diversified ETF. For example, if a significant portion of its holdings were in a single sector experiencing a downturn, the NAV would be more impacted than if the holdings were spread more evenly. (Note: A historical NAV chart would be included here if available and permissible.)

Conclusion: Making Informed Decisions with Net Asset Value

Understanding Net Asset Value is crucial for anyone invested in the Amundi MSCI All Country World UCITS ETF USD Acc or any ETF for that matter. Regularly checking the Net Asset Value of your Amundi MSCI All Country World UCITS ETF USD Acc allows you to monitor its performance, make informed investment decisions, and ensure your investment aligns with your financial goals. Learn more about maximizing your ETF investment strategy through understanding NAV and its role in your overall portfolio.

Featured Posts

-

Konchita Vurst Ee Prognoz Na Chetyrekh Pobediteley Evrovideniya 2025

May 24, 2025

Konchita Vurst Ee Prognoz Na Chetyrekh Pobediteley Evrovideniya 2025

May 24, 2025 -

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 24, 2025 -

Porsche Now Labubu

May 24, 2025

Porsche Now Labubu

May 24, 2025 -

Frankfurt Stock Exchange Dax Remains Stable Post Record

May 24, 2025

Frankfurt Stock Exchange Dax Remains Stable Post Record

May 24, 2025

Latest Posts

-

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

M56 Motorway Closure Latest Traffic Updates And Diversions

May 24, 2025

M56 Motorway Closure Latest Traffic Updates And Diversions

May 24, 2025 -

Serious Crash On M56 Current Traffic And Road Closures

May 24, 2025

Serious Crash On M56 Current Traffic And Road Closures

May 24, 2025 -

M56 Closed Live Traffic Updates Following Serious Accident

May 24, 2025

M56 Closed Live Traffic Updates Following Serious Accident

May 24, 2025 -

M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025