Frankfurt Stock Exchange: DAX Remains Stable Post-Record

Table of Contents

Economic Factors Contributing to DAX Stability

The DAX's current strength is intrinsically linked to the health of the German economy and the broader Eurozone. Several key economic factors contribute to its stability.

Inflation and Interest Rate Impacts

Inflation remains a significant global concern, impacting investor confidence and stock market performance. However, the European Central Bank (ECB)'s monetary policy, while aimed at curbing inflation, has been carefully calibrated to avoid significantly harming economic growth. The impact of interest rate adjustments on the DAX remains a subject of ongoing analysis, with some sectors more sensitive than others. Careful monitoring of inflation rates and ECB announcements is crucial for investors.

Robust German Exports

Germany's robust export sector plays a pivotal role in the country's economic resilience and, consequently, the DAX's stability. Strong demand for German manufactured goods, particularly in key sectors like automotive and machinery, continues to bolster economic growth and investor confidence. The strength of the Euro against other currencies also plays a role in maintaining this export strength.

Eurozone Economic Outlook

The overall health of the Eurozone significantly influences the DAX. While challenges persist across the region, the relatively stable economic outlook in the Eurozone supports continued positive sentiment toward the German market. Interconnectedness within the Eurozone means that broader economic trends significantly affect the German economy and its flagship index.

- Recent GDP growth figures for Germany: [Insert latest GDP growth data here]

- Current inflation rate and projections: [Insert latest inflation data and projections here]

- European Central Bank's monetary policy and its impact: [Summarize current ECB policy and its impact on the German economy]

- Key export sectors driving German economic growth: Automotive, machinery, chemicals, and pharmaceuticals are among the key sectors driving German economic growth.

DAX Performance and Key Players

Analyzing the DAX index itself reveals crucial insights into its stability. Examining the performance of key sectors and companies provides a clearer picture.

Top Performing DAX Companies

Several companies within the DAX have demonstrated exceptional performance, contributing significantly to the index's overall stability. [Insert examples of top-performing DAX companies and their key achievements/performance drivers here]. Factors like strong earnings reports, innovative products, and successful expansion strategies are key drivers of their success and contribute significantly to the positive sentiment surrounding the DAX.

Sectoral Analysis

While some sectors within the DAX might exhibit volatility, others show remarkable resilience. [Provide a sector-wise analysis; e.g., the automotive sector’s performance, the technology sector’s trends, and the financial sector's stability/volatility]. A balanced portfolio, diversified across sectors, is crucial to mitigate sector-specific risk.

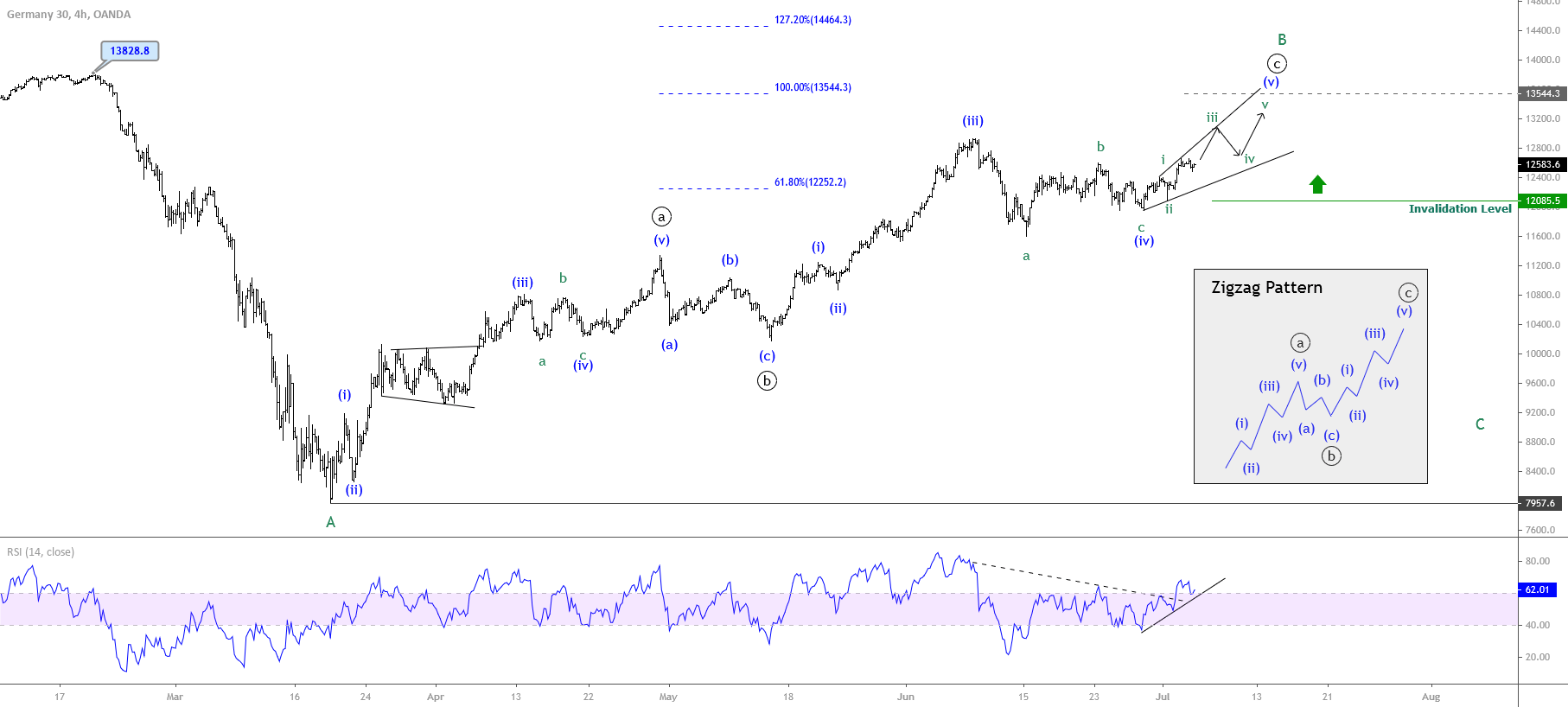

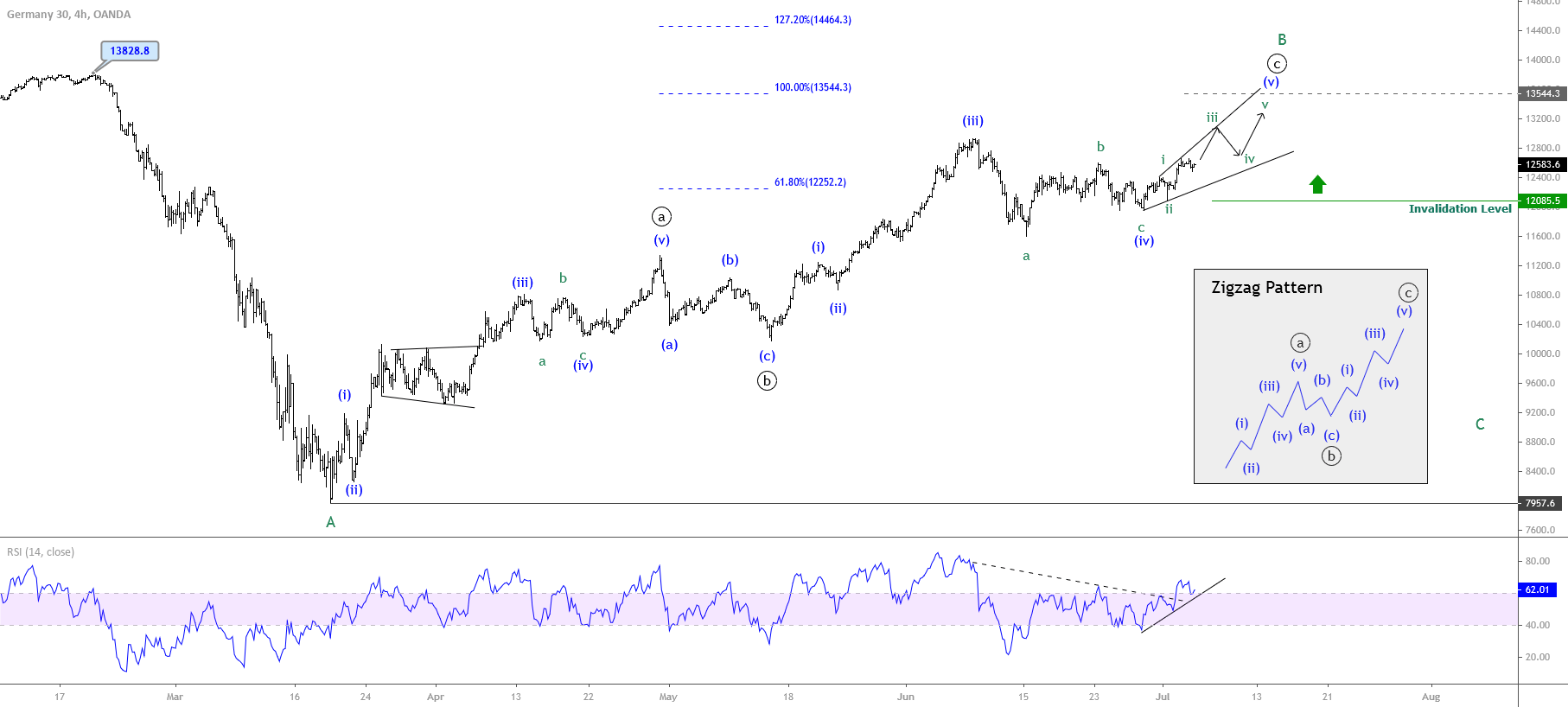

- DAX closing prices for the past month/quarter: [Insert relevant data here]

- Notable gains or losses by specific DAX companies: [Provide examples of companies showing significant gains or losses and their reasons]

- Performance of key sectors within the DAX: [Analyze the performance of various sectors within the DAX, e.g., technology, automotive, financials]

- Comparison to other major European indices: [Compare the DAX's performance to other major European indices, like the CAC 40 or FTSE 100]

Future Outlook and Investment Strategies

While the DAX has shown remarkable stability, understanding potential future trends and risks is crucial for informed investment decisions.

Predicting Future DAX Performance

Predicting the future performance of the DAX is complex and depends on various interacting factors, including global economic conditions, geopolitical events, and industry-specific trends. While a continued period of stability is plausible given the current economic indicators, investors should remain vigilant and monitor for potential shifts in the economic landscape.

Investment Strategies for the DAX

Investors considering exposure to the German stock market can employ various strategies. Diversification across different sectors and asset classes is crucial for mitigating risk. Index funds tracking the DAX can provide broad market exposure, while actively managed funds offer a more targeted approach. Careful consideration of risk tolerance and investment goals is essential.

- Potential risks to DAX stability (e.g., geopolitical events, economic downturns): Geopolitical instability, unexpected economic downturns, and significant shifts in global trade patterns pose potential risks to DAX stability.

- Recommendations for diversification within a DAX-focused portfolio: Diversification across sectors, asset classes (e.g., bonds, real estate), and geographical regions is recommended to reduce risk.

- Potential long-term growth prospects for the DAX: The long-term growth prospects for the DAX remain positive, given Germany's robust economy and its position as a major player in the global market.

Conclusion

The DAX's stability following recent record highs on the Frankfurt Stock Exchange reflects the strength of the German economy and the broader Eurozone. Factors like robust exports, managed inflation, and a relatively stable Eurozone outlook contribute to this positive performance. While the future is inherently uncertain, understanding the key economic factors and employing diversified investment strategies will enable investors to navigate the dynamic Frankfurt Stock Exchange and the DAX. Stay informed about the dynamic Frankfurt Stock Exchange and the DAX index. Continue your research on the DAX and make well-informed decisions about your investment strategy. Learn more about investing in the DAX and the German market for opportunities to enhance your portfolio.

Featured Posts

-

I 10 Uomini Piu Ricchi Del Mondo Nel 2025 La Classifica Forbes Aggiornata

May 24, 2025

I 10 Uomini Piu Ricchi Del Mondo Nel 2025 La Classifica Forbes Aggiornata

May 24, 2025 -

New R And B Music Leon Thomas And Flos Latest Releases And More

May 24, 2025

New R And B Music Leon Thomas And Flos Latest Releases And More

May 24, 2025 -

Pomnite Li Konchita Vurst Transformatsiyata Y Sled Evroviziya

May 24, 2025

Pomnite Li Konchita Vurst Transformatsiyata Y Sled Evroviziya

May 24, 2025 -

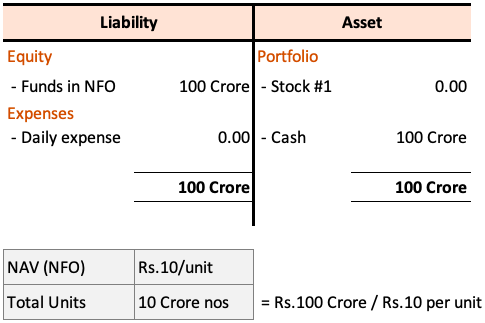

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

Latest Posts

-

Discover Local And Global Destinations The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Discover Local And Global Destinations The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

England Airpark And Alexandria International Airport Ae Xplore Campaign Details And Launch Information

May 24, 2025

England Airpark And Alexandria International Airport Ae Xplore Campaign Details And Launch Information

May 24, 2025 -

New Ae Xplore Campaign Encourages Local Flights And Global Exploration From England Airpark And Alexandria International Airport

May 24, 2025

New Ae Xplore Campaign Encourages Local Flights And Global Exploration From England Airpark And Alexandria International Airport

May 24, 2025 -

Boosting Regional Travel England Airpark And Alexandria International Airports Ae Xplore Initiative

May 24, 2025

Boosting Regional Travel England Airpark And Alexandria International Airports Ae Xplore Initiative

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025