NCLH Stock Soars: Strong Earnings And Upbeat Guidance

Table of Contents

Stellar Q3 Earnings Report Exceeds Expectations

Norwegian Cruise Line Holdings (NCLH) delivered a Q3 earnings report that far surpassed analyst predictions, sending positive ripples throughout the market. The report showcased significant improvements across key financial metrics, solidifying the company's position and boosting investor confidence in the NCLH stock.

-

Revenue significantly above analyst estimates: NCLH reported a revenue surge of X% (replace X with actual percentage), considerably outperforming the anticipated Y% (replace Y with actual percentage) growth forecast by analysts. This substantial increase is a clear indicator of the cruise industry's resurgence and strong demand for NCLH's services. This strong NCLH revenue performance demonstrates the effectiveness of the company's strategies in a recovering market.

-

Strong booking trends for future cruises: The company reported robust booking trends for upcoming cruises, signaling continued strong demand and a positive outlook for future quarters. Advance bookings are significantly higher than pre-pandemic levels, further bolstering investor confidence in the NCLH stock price.

-

Improved operational efficiency leading to higher profit margins: NCLH showcased improved operational efficiency, resulting in higher profit margins compared to the same period last year. This demonstrates the company's ability to manage costs effectively while maintaining a high level of service. Improved NCLH profit margin is a key factor contributing to the stock's rise.

-

Positive cash flow generation: The company reported positive cash flow generation, demonstrating financial strength and stability. This positive NCLH cash flow provides a strong foundation for future investments and growth initiatives. The strong financial health reflected in the NCLH earnings clearly contributed to the positive market reaction. The combination of strong NCLH revenue and improved efficiency significantly boosted the NCLH profit margin.

Upbeat Guidance Fuels Investor Confidence

NCLH's Q3 earnings report wasn't the only catalyst for the stock's surge. The company's equally impressive guidance for the coming quarters further fueled investor confidence and propelled the NCLH stock price higher.

-

Increased booking volume projections: The company projected a substantial increase in booking volume for the coming quarters, building on the strong momentum seen in Q3. This positive NCLH outlook suggests sustained growth and strong future performance.

-

Expectations for sustained revenue growth: NCLH's guidance anticipates continued revenue growth, reflecting a positive outlook for the cruise industry's recovery and the company's market share. The expectation of continued NCLH revenue growth is a key driver of investor optimism.

-

Optimistic outlook for the cruise industry's overall recovery: The company expressed optimism regarding the overall recovery of the cruise industry, suggesting a positive outlook for the sector as a whole. This positive NCLH outlook is shared by many industry analysts, further supporting the bullish sentiment surrounding the stock. The positive NCLH guidance reinforces the belief in the continued recovery of the cruise industry.

Market Reaction and Analyst Sentiment

The market reacted swiftly and positively to NCLH's strong earnings report and upbeat guidance.

-

Stock price increase percentage: NCLH stock experienced a significant price increase of X% (replace X with actual percentage) following the release of the report.

-

Increased trading volume: Trading volume for NCLH stock surged significantly, indicating strong investor interest and activity. The increased NCLH trading volume is a clear indication of the market's excitement surrounding the company's positive news.

-

Positive analyst ratings and price target adjustments: Several reputable analysts upgraded their ratings on NCLH stock and adjusted their price targets upwards, reflecting a positive outlook on the company's future performance. Positive analyst ratings and increased NCLH price target further amplified the positive market sentiment.

Conclusion

The surge in NCLH stock price is a direct result of the company's stellar Q3 earnings report, its upbeat guidance for future quarters, and the overwhelmingly positive market reaction and analyst sentiment. The strong NCLH revenue growth, improved NCLH profit margin, and positive NCLH cash flow, combined with the optimistic NCLH outlook and projections, paint a picture of a company well-positioned for continued success. With strong earnings and a positive outlook, NCLH stock presents a compelling opportunity for investors. Conduct your own thorough research and consider adding NCLH to your portfolio. Stay tuned for more updates on NCLH stock performance. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

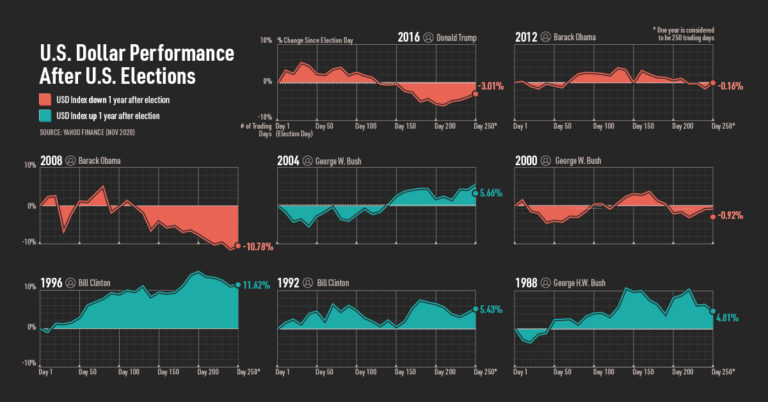

Election Uncertainty Impact On The Canadian Dollars Value

May 01, 2025

Election Uncertainty Impact On The Canadian Dollars Value

May 01, 2025 -

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025

Dragon Den Businessman Rejects Investors Accepts Risky Offer

May 01, 2025 -

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomnetaansluiting

May 01, 2025

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomnetaansluiting

May 01, 2025 -

Amn Ke Lye Kshmyrywn Ke Hqwq Ky Pasdary Drwry He

May 01, 2025

Amn Ke Lye Kshmyrywn Ke Hqwq Ky Pasdary Drwry He

May 01, 2025 -

String Of Nfl Heists Chilean Migrants Indicted In Multi Million Dollar Crime Ring

May 01, 2025

String Of Nfl Heists Chilean Migrants Indicted In Multi Million Dollar Crime Ring

May 01, 2025

Latest Posts

-

Bestu Deildin I Dag Dagskra Og Urslitaspa

May 01, 2025

Bestu Deildin I Dag Dagskra Og Urslitaspa

May 01, 2025 -

String Of Nfl Heists Chilean Migrants Indicted In Multi Million Dollar Crime Ring

May 01, 2025

String Of Nfl Heists Chilean Migrants Indicted In Multi Million Dollar Crime Ring

May 01, 2025 -

Valur Leikir I Dag Moegulegt 2 0 Forskot I Bestu Deildinni

May 01, 2025

Valur Leikir I Dag Moegulegt 2 0 Forskot I Bestu Deildinni

May 01, 2025 -

Chilean Migrant Group Charged In Series Of Nfl Player Heists

May 01, 2025

Chilean Migrant Group Charged In Series Of Nfl Player Heists

May 01, 2025 -

Islensk Fotboltadagskra T Hrir Leikir I Bestu Deildinni

May 01, 2025

Islensk Fotboltadagskra T Hrir Leikir I Bestu Deildinni

May 01, 2025