Election Uncertainty: Impact On The Canadian Dollar's Value

Table of Contents

How Elections Influence Economic Policy and Investor Sentiment

The platforms of different Canadian political parties significantly impact investor confidence and consequently, the CAD. Differing approaches to fiscal and monetary policy create uncertainty that ripples through the market. A party promising significant tax cuts might boost short-term investor optimism, but also raise concerns about long-term debt and inflation. Conversely, a party focused on increased social programs might be viewed favorably by some, but negatively by others concerned about potential economic slowdown.

- Impact of potential tax changes on corporate profits and investment: Changes to corporate tax rates directly influence profitability and investment decisions. Lower taxes may encourage investment, while higher taxes might lead to reduced investment and capital flight.

- Government spending plans and their influence on inflation and interest rates: Increased government spending can stimulate economic growth but also fuel inflation, prompting the Bank of Canada to raise interest rates to control price increases. This can impact the CAD's value relative to other currencies.

- Changes in trade policy and their implications for Canadian exports and imports: A shift in trade agreements or tariffs can significantly affect Canadian exports and imports, impacting the country's trade balance and the overall strength of the CAD. This is particularly true given Canada's reliance on international trade. Keywords related to this section are: fiscal policy, monetary policy, interest rates, inflation, investor confidence, and Canadian economy.

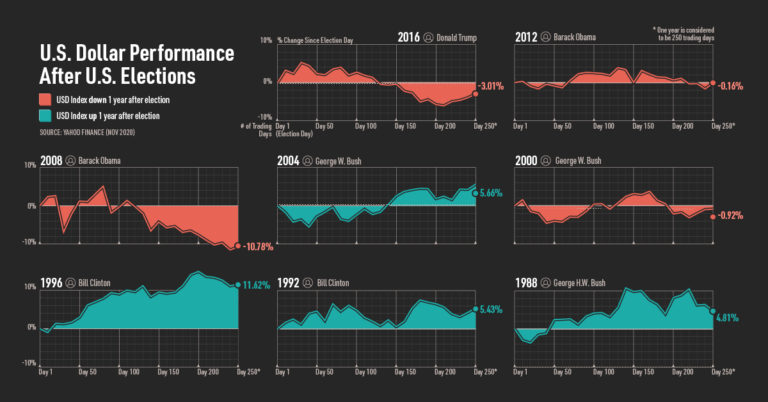

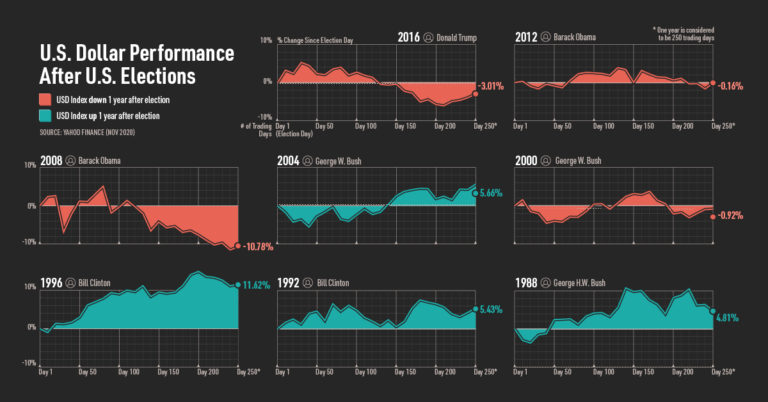

Analyzing Historical Data: Past Elections and CAD Performance

Examining the historical relationship between Canadian elections and the CAD's performance reveals valuable insights. While no two elections are identical, analyzing past trends provides a framework for understanding potential future scenarios. For instance, periods of significant policy uncertainty surrounding elections have often coincided with increased CAD volatility.

- Specific examples of CAD fluctuations during past election periods: Analyzing the CAD's behaviour during the lead-up to and aftermath of previous elections provides concrete data points. For example, periods of heightened uncertainty often lead to a weakening of the CAD as investors adopt a wait-and-see approach.

- Mention any significant economic events that coincided with elections and their impact on the CAD: It's crucial to consider the broader economic context. A global recession coinciding with an election will naturally impact the CAD beyond the election's direct influence.

- Reference credible sources for data (e.g., Bank of Canada, Statistics Canada): Reliable sources such as the Bank of Canada and Statistics Canada provide invaluable data for this analysis, lending credibility to the findings. Relevant keywords here include: historical data, CAD exchange rate history, past elections, currency volatility, and economic indicators.

The Role of Global Factors in Amplifying Election Uncertainty

The impact of election uncertainty on the CAD is rarely isolated. Global economic conditions can significantly amplify or dampen the effects. For example, fluctuations in oil prices, a major Canadian export, directly affect the Canadian economy and the CAD.

- Impact of oil price fluctuations on the Canadian economy and the CAD: Oil price increases generally strengthen the CAD, while decreases weaken it. This interaction adds another layer of complexity during periods of election uncertainty.

- The influence of US interest rates on the CAD/USD exchange rate: Given the close economic ties between Canada and the US, changes in US interest rates directly affect the CAD/USD exchange rate. Higher US rates often attract investment away from Canada, weakening the CAD.

- The effect of global trade wars or other international events: Global events like trade wars or geopolitical instability can exacerbate the uncertainty surrounding a Canadian election, leading to increased volatility in the CAD. Relevant keywords for this section are: global economy, oil prices, US dollar, international trade, and geopolitical risk.

Strategies for Navigating Election Uncertainty for Investors

For investors, understanding and managing the risk associated with election uncertainty is paramount. Several strategies can help mitigate potential losses.

- Strategies for hedging currency risk: Hedging strategies, such as using forward contracts or options, can help protect against adverse currency movements.

- Importance of diversification in investment portfolios: Diversifying investments across different asset classes and geographies reduces exposure to the risks associated with any single market, including the Canadian market during election periods.

- Recommendations for monitoring relevant economic news and data: Staying informed about economic indicators, political developments, and global events allows investors to make more informed decisions. Keywords in this section include: investment strategies, risk management, currency hedging, portfolio diversification, and economic forecasting.

Conclusion: Understanding Election Uncertainty and Protecting Your Investments in the Canadian Dollar

Canadian elections and their impact on the CAD are inextricably linked. Understanding the interplay of economic policies, investor sentiment, and global factors is crucial for navigating this volatility. Political risk significantly impacts the value of the Canadian dollar, making it essential for investors to monitor the Canadian dollar closely. To effectively manage election uncertainty and protect your CAD investments, stay informed about upcoming elections and their potential implications. Seek professional financial advice to tailor investment strategies that align with your risk tolerance and investment goals. Remember to actively monitor the Canadian dollar and understand the impact of elections on the Canadian dollar to safeguard your financial future.

Featured Posts

-

Cardinale Becciu Sentenza Di Condanna E Risarcimento Danni

May 01, 2025

Cardinale Becciu Sentenza Di Condanna E Risarcimento Danni

May 01, 2025 -

Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km A Velo

May 01, 2025

Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km A Velo

May 01, 2025 -

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Ghry Nzr

May 01, 2025

Shh Rg Kb Tk Zyr Khnjr Ayksprys Ardw Ky Ghry Nzr

May 01, 2025 -

Te Ipukarea Society Contributions To Rare Seabird Conservation

May 01, 2025

Te Ipukarea Society Contributions To Rare Seabird Conservation

May 01, 2025 -

Cay Fest On Film A Splice Spotlight

May 01, 2025

Cay Fest On Film A Splice Spotlight

May 01, 2025

Latest Posts

-

Lempron Tzeims 50 000 Pontoi Mia Parakatathiki Gia Tin Istoria Toy Nba

May 01, 2025

Lempron Tzeims 50 000 Pontoi Mia Parakatathiki Gia Tin Istoria Toy Nba

May 01, 2025 -

I Klironomia Toy Lempron Tzeims 50 000 Pontoi Kai Pera

May 01, 2025

I Klironomia Toy Lempron Tzeims 50 000 Pontoi Kai Pera

May 01, 2025 -

Lempron Tzeims Analyontas Tin Istoriki Epidosi Ton 50 000 Ponton

May 01, 2025

Lempron Tzeims Analyontas Tin Istoriki Epidosi Ton 50 000 Ponton

May 01, 2025 -

O Lempron Tzeims Kai To Orosimo Ton 50 000 Ponton

May 01, 2025

O Lempron Tzeims Kai To Orosimo Ton 50 000 Ponton

May 01, 2025 -

Vaticano Nuova Data Per Il Processo Sul Fratello Di Becciu E I Fondi 8xmille

May 01, 2025

Vaticano Nuova Data Per Il Processo Sul Fratello Di Becciu E I Fondi 8xmille

May 01, 2025