Navigating The Private Credit Boom: 5 Do's And Don'ts For Job Seekers

Table of Contents

DO: Network Strategically in the Private Credit Industry

Landing a coveted role in private credit often relies heavily on networking. Building strong connections within the industry can significantly boost your chances.

Leverage LinkedIn:

Actively engage on LinkedIn. This isn't just about having a profile; it's about using it strategically.

- Pro Tip: Tailor your LinkedIn profile to highlight relevant skills and experience. Use keywords like "private credit analyst," "private equity associate," "credit fund manager," "direct lending," "senior secured loans," "mezzanine financing," "unitranche," "private debt," and "private credit strategies." Quantify your achievements whenever possible, showcasing your impact.

- Keyword Integration: Use keywords relevant to private credit roles you desire, such as "financial modeling," "due diligence," "portfolio management," "credit underwriting," and "risk assessment." Mention specific private credit firms that interest you.

- Actionable Steps: Connect with professionals at target firms, participate in industry discussions, and join relevant LinkedIn groups focused on private credit and finance.

Attend Industry Events:

Conferences, seminars, and workshops are invaluable networking opportunities.

- Pro Tip: Prepare talking points that showcase your understanding of the private credit market and your career ambitions. Practice your elevator pitch.

- Keyword Integration: Research conferences focusing on "private debt," "direct lending," and specific private credit strategies. Look for events hosted by industry associations or leading private credit firms.

- Actionable Steps: Attend at least one relevant industry event each quarter. Prepare questions to engage with speakers and attendees.

Informational Interviews:

Reach out to professionals working in private credit for informational interviews.

- Pro Tip: Prepare thoughtful questions and show genuine interest in their career path and experiences within the private credit sector. Focus on learning, not just job hunting.

- Keyword Integration: Mention specific private credit firms or strategies that interest you during your conversation. Show you've done your research.

- Actionable Steps: Aim for at least one informational interview per month. Follow up with thank-you notes and keep in touch.

DO: Showcase Relevant Skills and Experience

Your resume and cover letter are your first impression. Highlighting the right skills and experiences is crucial.

Highlight Financial Acumen:

Emphasize your skills in financial modeling, valuation, credit analysis, and portfolio management.

- Pro Tip: Quantify your achievements. Instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in X cost savings."

- Keyword Integration: Use keywords such as "financial modeling," "LBO modeling," "credit underwriting," "risk assessment," "DCF analysis," and "cash flow projections."

- Actionable Steps: Review your past work experiences and identify quantifiable achievements that demonstrate your financial skills.

Demonstrate Industry Knowledge:

Demonstrate a deep understanding of private credit strategies, market trends, and the regulatory environment.

- Pro Tip: Stay up-to-date on industry news and publications like Private Debt Investor, PEI Media, and industry reports from consulting firms.

- Keyword Integration: Mention specific private credit strategies like "unitranche," "mezzanine debt," "senior secured loans," and relevant regulatory frameworks.

- Actionable Steps: Subscribe to relevant industry newsletters and publications. Actively follow thought leaders on social media.

Tailor Your Application:

Customize your resume and cover letter for each specific job application.

- Pro Tip: Research the firm and the specific role to understand their investment strategies and target markets.

- Keyword Integration: Use keywords from the job description in your application materials. This shows you've carefully considered their needs.

- Actionable Steps: Create templates for your resume and cover letter, but customize them for each application, highlighting the most relevant skills and experience for that specific role.

DO: Prepare for Behavioral and Technical Interviews

The interview stage is critical. Thorough preparation is key.

Practice Behavioral Questions:

Prepare answers to common behavioral interview questions, focusing on your strengths, weaknesses, and experiences.

- Pro Tip: Use the STAR method (Situation, Task, Action, Result) to structure your answers, providing concrete examples.

- Actionable Steps: Practice answering common interview questions with a friend or career counselor. Record yourself to identify areas for improvement.

Master Technical Skills:

Brush up on your financial modeling, valuation, and credit analysis skills.

- Pro Tip: Practice case studies and work through sample problems. This will build your confidence and speed.

- Actionable Steps: Use online resources and practice problems to hone your technical skills. Consider taking a refresher course.

Research the Firm:

Thoroughly research the firm's investment strategy, portfolio companies, and recent transactions.

- Pro Tip: Demonstrate your understanding of their business model and ask insightful questions during the interview.

- Actionable Steps: Visit the firm's website, read press releases, and look up their investments on databases like PitchBook or Crunchbase.

DON'T: Neglect Your Online Presence

Your digital footprint matters.

Update Your Resume and LinkedIn Profile:

Ensure your resume and LinkedIn profile are up-to-date and reflect your skills and experience accurately.

- Pro Tip: Use keywords relevant to the private credit industry. Keep your profile professional and engaging.

- Actionable Steps: Regularly review and update your online profiles. Ask a friend to proofread for any errors or inconsistencies.

Ignore Online Reviews:

Research potential employers and look for employee reviews and feedback to gain insight into their work culture.

- Actionable Steps: Use sites like Glassdoor or Indeed to research potential employers.

Neglect Social Media:

Be mindful of your social media presence and ensure it reflects professionally. Clean up any inappropriate content.

DON'T: Underestimate the Importance of Due Diligence

Thorough research is essential throughout the entire job search process.

Thoroughly Research Firms:

Invest time in researching the private credit firms you’re applying to – understand their investment strategies, team, and culture.

- Actionable Steps: Go beyond the company website. Read news articles, industry publications, and look for insights from employee reviews.

Neglect Salary Research:

Research industry salary benchmarks to ensure you’re negotiating a fair compensation package.

- Actionable Steps: Use sites like Glassdoor, Salary.com, and Payscale to research salary ranges for similar roles in your location.

Rush the Process:

Don't rush the job search process – take time to prepare, network, and research.

- Actionable Steps: Create a realistic timeline for your job search and stick to it. Avoid applying for too many jobs at once.

Conclusion:

The private credit job market offers significant opportunities for ambitious professionals. By following these do's and don'ts, and actively focusing on your network, skills, and preparation for interviews, you can significantly increase your chances of landing your dream role in this dynamic sector. Remember to leverage your network, highlight relevant skills, and conduct thorough research on private credit firms to stand out from the competition. Start your journey to securing a coveted private credit job today!

Featured Posts

-

Pope Francis His Life His Legacy And His Compassionate Vision

Apr 22, 2025

Pope Francis His Life His Legacy And His Compassionate Vision

Apr 22, 2025 -

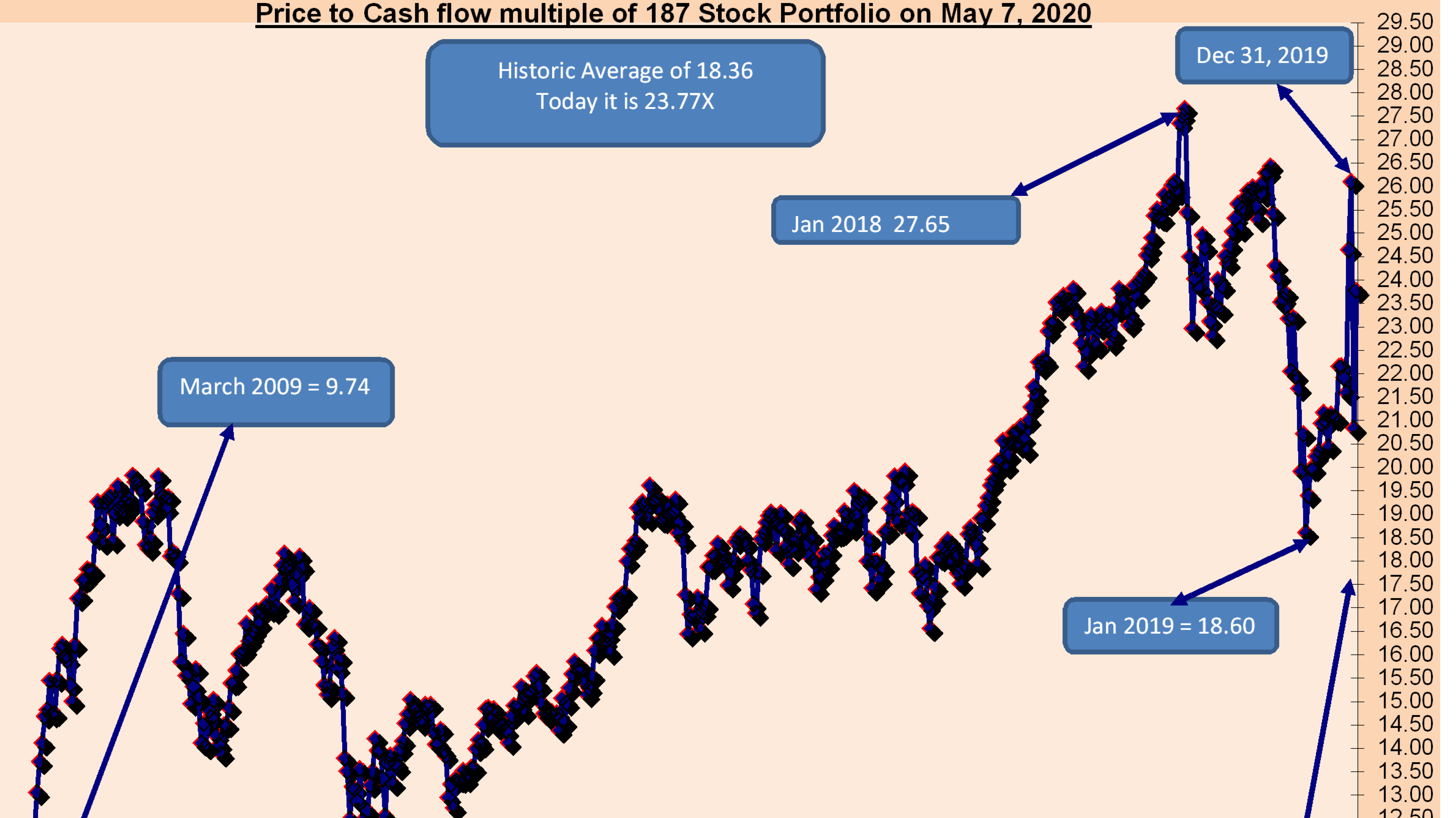

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025 -

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025 -

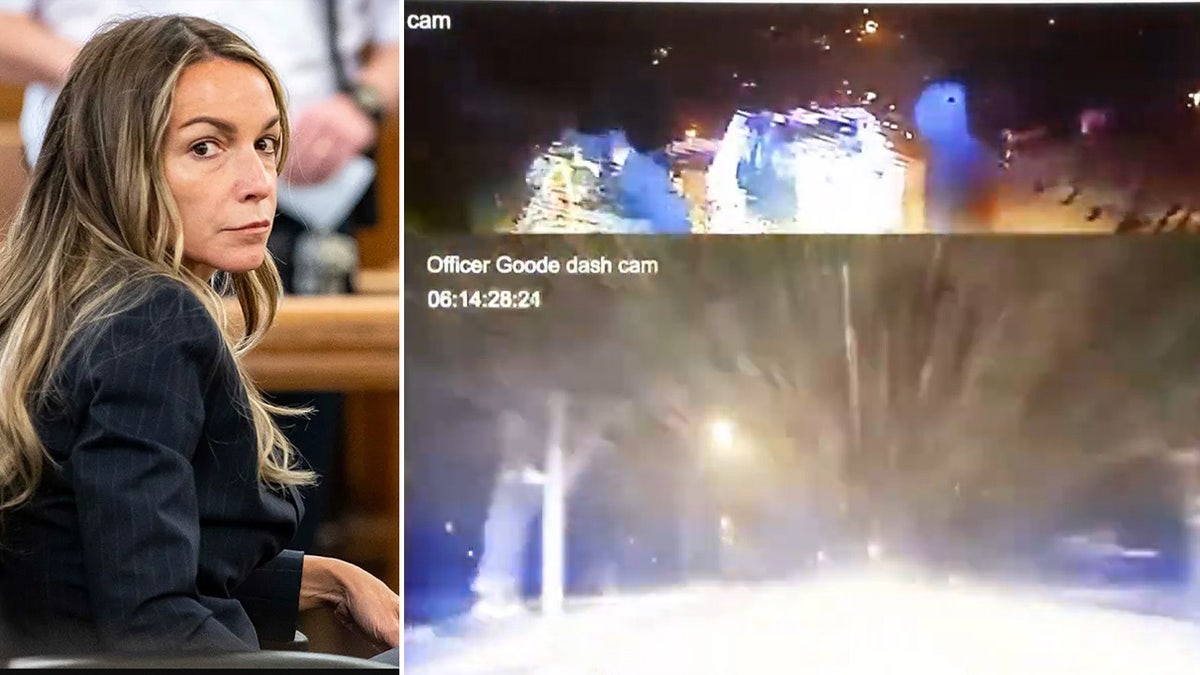

Karen Reads Murder Case A Year By Year Timeline Of Legal Proceedings

Apr 22, 2025

Karen Reads Murder Case A Year By Year Timeline Of Legal Proceedings

Apr 22, 2025 -

Understanding Papal Conclaves Secrecy Tradition And The Election Of The Pope

Apr 22, 2025

Understanding Papal Conclaves Secrecy Tradition And The Election Of The Pope

Apr 22, 2025