Musk's SpaceX Holdings: A $43 Billion Increase Over Tesla Investment

Table of Contents

SpaceX's Exponential Growth Trajectory

SpaceX's phenomenal growth is a testament to its innovative approach and consistent success in a rapidly expanding market. The company's valuation isn't just a number; it reflects a confluence of factors driving its incredible trajectory.

-

Lucrative Contracts and Partnerships: SpaceX has secured numerous lucrative contracts with government agencies like NASA, playing a crucial role in resupplying the International Space Station. Furthermore, commercial contracts with private entities for satellite launches are a major revenue stream.

-

Reusable Rocket Technology: The Falcon 9 reusable rocket system is a game-changer. By significantly reducing launch costs through reusability, SpaceX has made space access more affordable and increased launch frequency, accelerating its revenue generation. This contrasts sharply with traditional expendable rockets, making SpaceX a highly competitive player.

-

Starlink's Meteoric Rise: Starlink, SpaceX's satellite internet constellation, is a significant driver of growth. Its rapidly expanding subscriber base and ambitious revenue projections point to a substantial contribution to the overall SpaceX valuation. The global demand for high-speed internet access, especially in underserved areas, is fueling Starlink's success.

-

Significant Milestones: SpaceX consistently achieves remarkable milestones, including successful launches of its Falcon Heavy rocket and advancements in Starship development. These achievements demonstrate technological prowess and solidify investor confidence, further boosting its SpaceX valuation.

Comparison with Tesla Investment

The difference between SpaceX's current valuation and Elon Musk's initial investment is staggering: a $43 billion increase. This substantial growth underscores the remarkable success of SpaceX compared to even Musk's other ventures.

-

Net Worth Implications: This massive increase in SpaceX holdings significantly impacts Musk's overall net worth, solidifying his position as one of the world's wealthiest individuals.

-

Contrasting Investment Strategies: While both SpaceX and Tesla are high-risk ventures, their business models differ significantly. Tesla focuses on the electric vehicle market, while SpaceX targets the space exploration and satellite internet sectors. Musk's investment strategy reflects a diversification across high-growth, albeit high-risk, industries.

-

Differing Growth Trajectories: Tesla's growth, while impressive, shows a different pattern compared to SpaceX's almost exponential rise. The relatively quicker growth of SpaceX highlights the immense potential of the space industry and SpaceX's leading position within it.

Factors Driving SpaceX's Valuation

Several factors contribute to SpaceX's impressive market valuation, reflecting not only its current success but also its immense future potential.

-

Starlink's Market Dominance: The demand for global internet connectivity is driving Starlink's expansion and profitability, solidifying its position as a major contributor to the overall SpaceX valuation. This is a key aspect of SpaceX's investment strategy.

-

Private Space Industry Boom: The increasing participation of private companies in space exploration has opened up new avenues for growth and innovation. SpaceX is at the forefront of this revolution, capitalizing on opportunities previously limited to government agencies.

-

Technological Innovation: SpaceX's commitment to technological innovation, particularly in reusable rocketry and satellite technology, provides a strong competitive advantage. This continuous innovation is a key element in attracting investment and boosting the SpaceX valuation.

-

Government Policy and Regulation: Supportive government policies and regulations, particularly in the United States, have facilitated SpaceX's growth and success. However, future regulations and international policies could impact SpaceX's trajectory.

-

Future Projections: Based on current trends, projections for SpaceX's valuation remain extremely positive. The continuing expansion of Starlink, advancements in Starship technology, and the increasing commercialization of space travel all point to continued growth.

The Future of SpaceX and the Space Industry

SpaceX's long-term ambitions are incredibly ambitious, extending far beyond earth-bound ventures.

-

Long-Term Goals: Mars colonization remains a significant long-term goal, along with the development of space tourism and the expansion of commercial spaceflight. These ambitious projects contribute to the high valuation of the company.

-

Impact on the Space Industry: SpaceX's success has profoundly impacted the broader space industry, spurring innovation and competition. Other private companies are now entering the space, driven by SpaceX's success and demonstrating the immense potential of this sector.

-

Competitive Landscape and Challenges: While SpaceX currently dominates many sectors, it faces potential future challenges from emerging competitors and evolving market dynamics. Maintaining its leading position will require continuous innovation and adaptation.

Conclusion

Elon Musk's SpaceX holdings have experienced an astounding surge in value, surpassing his Tesla investment by a remarkable $43 billion. This phenomenal growth is fueled by a combination of successful contracts, innovative technologies, and the booming demand for space-based services. The future of SpaceX and the wider space industry looks exceptionally promising, driven by continuous innovation and ambitious long-term goals.

Call to Action: Stay informed about the latest developments in the world of space exploration and the continued growth of SpaceX holdings. Follow our updates for more insights into Elon Musk's SpaceX investment and the future of the private space industry.

Featured Posts

-

Stricter Uk Visa Rules How Will It Affect Students From Pakistan And Asylum Applications

May 09, 2025

Stricter Uk Visa Rules How Will It Affect Students From Pakistan And Asylum Applications

May 09, 2025 -

Harry Styles On Snl Impression His Devastated Response

May 09, 2025

Harry Styles On Snl Impression His Devastated Response

May 09, 2025 -

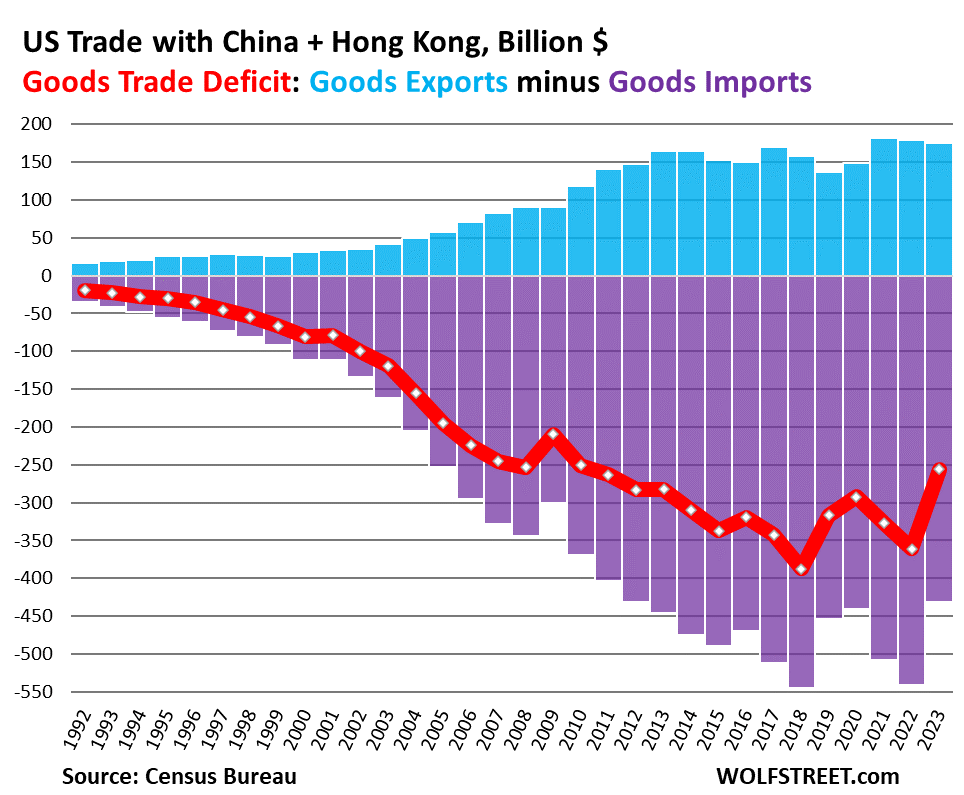

U S And China Seek Trade War De Escalation Key Developments This Week

May 09, 2025

U S And China Seek Trade War De Escalation Key Developments This Week

May 09, 2025 -

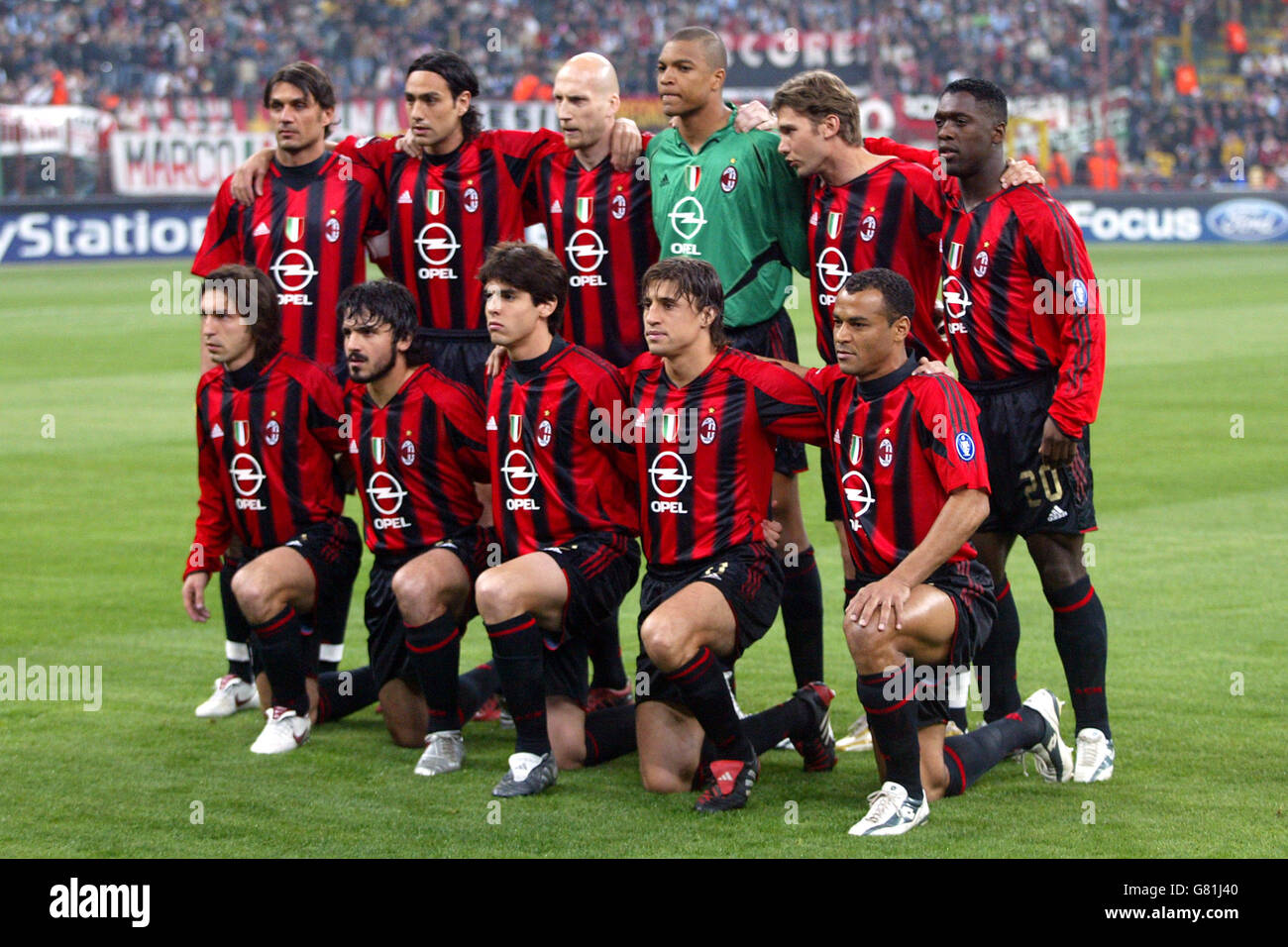

Bayern Munichs Champions League Loss To Inter Milan First Leg Analysis

May 09, 2025

Bayern Munichs Champions League Loss To Inter Milan First Leg Analysis

May 09, 2025 -

30 Drop In Palantir Stock Time To Invest

May 09, 2025

30 Drop In Palantir Stock Time To Invest

May 09, 2025