30% Drop In Palantir Stock: Time To Invest?

Table of Contents

Understanding the 30% Palantir Stock Price Decline

The recent 30% plunge in Palantir's stock price is a complex issue stemming from a confluence of factors, including broader market conditions, the company's recent financial performance, and prevailing investor sentiment.

Analyzing the Market Conditions

The current market volatility significantly impacts technology stocks, including Palantir. Broader economic concerns are influencing investor sentiment, leading to a sell-off in many growth stocks.

- Rising interest rates: The Federal Reserve's efforts to combat inflation have led to increased interest rates, making borrowing more expensive and reducing the attractiveness of growth stocks like Palantir, which often rely on future earnings projections.

- Inflation concerns: Persistent inflation erodes purchasing power and increases uncertainty, prompting investors to move towards more stable, less volatile investments.

- Geopolitical uncertainty: Ongoing geopolitical tensions contribute to overall market uncertainty, making investors more risk-averse and impacting the valuations of growth-oriented companies.

Palantir's Recent Financial Performance

Palantir's recent financial performance plays a critical role in understanding the stock price drop. While the company has shown growth in certain areas, some aspects have fallen short of expectations.

- Revenue growth: While Palantir has reported revenue growth, the pace might not be as rapid as some investors anticipated, leading to disappointment. Analyzing the breakdown of revenue between government and commercial sectors is crucial. A significant reliance on government contracts can introduce vulnerability to shifts in government spending.

- Profitability: Palantir's profitability remains a key area of focus for investors. Concerns around achieving sustainable profitability in the long term might contribute to the stock price decline.

- Key contract wins or losses: Large contract wins or unexpected losses can significantly influence investor sentiment and the company's overall valuation. Scrutinizing the details of these contracts provides insights into the company's future trajectory.

Investor Sentiment and Market Speculation

Negative investor sentiment and market speculation heavily contributed to the Palantir stock price drop. Analyst downgrades and short-selling activity can amplify negative perceptions.

- Negative press impacting investor confidence: Negative news coverage, whether justified or not, can significantly impact investor confidence and lead to sell-offs.

- Analyst downgrades: Negative analyst ratings and price target reductions can trigger further selling pressure, driving the stock price down.

- Short-selling activity: A surge in short-selling, where investors bet against the stock price, can exacerbate downward pressure.

Is This a Buying Opportunity? Evaluating the Risks and Rewards

The 30% drop in Palantir stock presents a complex investment decision, demanding a careful evaluation of both potential upside and inherent risks.

Potential Upside of Investing in Palantir After the Drop

Despite the recent downturn, Palantir maintains significant long-term growth potential in the rapidly expanding data analytics market.

- Strong potential for growth in the AI and big data sectors: Palantir's technology is well-positioned to benefit from the growing adoption of AI and big data solutions across various industries.

- Government contracts providing stability: A substantial portion of Palantir's revenue comes from government contracts, providing a degree of stability and predictability.

- Potential for disruptive innovation: Palantir's innovative technology continues to offer the potential for disruption within the data analytics and AI sectors.

Assessing the Risks Associated with Palantir Investment

Investing in Palantir, or any stock, involves inherent risk, especially with volatile tech stocks. Several factors contribute to the risk profile of a Palantir investment.

- High valuation compared to competitors: Palantir's valuation relative to its competitors needs careful consideration, as it might be considered overvalued by some investors.

- Dependence on government contracts: Heavy reliance on government contracts exposes Palantir to the risks of shifting government priorities and potential budget cuts.

- Competition in the data analytics market: The data analytics market is fiercely competitive, with established players and emerging startups vying for market share.

Diversification and Risk Management Strategies

Diversification is paramount in any investment portfolio. Investing in Palantir should be part of a broader strategy, not an all-or-nothing bet.

- Don't invest more than you can afford to lose: This fundamental principle applies to all investments, especially those with higher volatility.

- Spread investments across different asset classes: Diversifying across different asset classes, sectors, and geographies mitigates risk.

- Consider dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the impact of volatility.

Conclusion

The 30% drop in Palantir stock presents a complex investment scenario with both substantial risks and potential rewards. While current market conditions and Palantir's recent financial performance contribute to the decline, its long-term growth potential in the burgeoning data analytics and AI sectors remains compelling. A thorough understanding of the company's financial health, competitive landscape, and overall market outlook is crucial before considering any investment in Palantir stock.

Call to Action: Carefully weigh the risks and rewards before making any decisions about buying Palantir (PLTR) stock. Conduct your own in-depth research and consult with a financial advisor before investing in Palantir stock or any other security. Remember, past performance is not indicative of future results.

Featured Posts

-

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

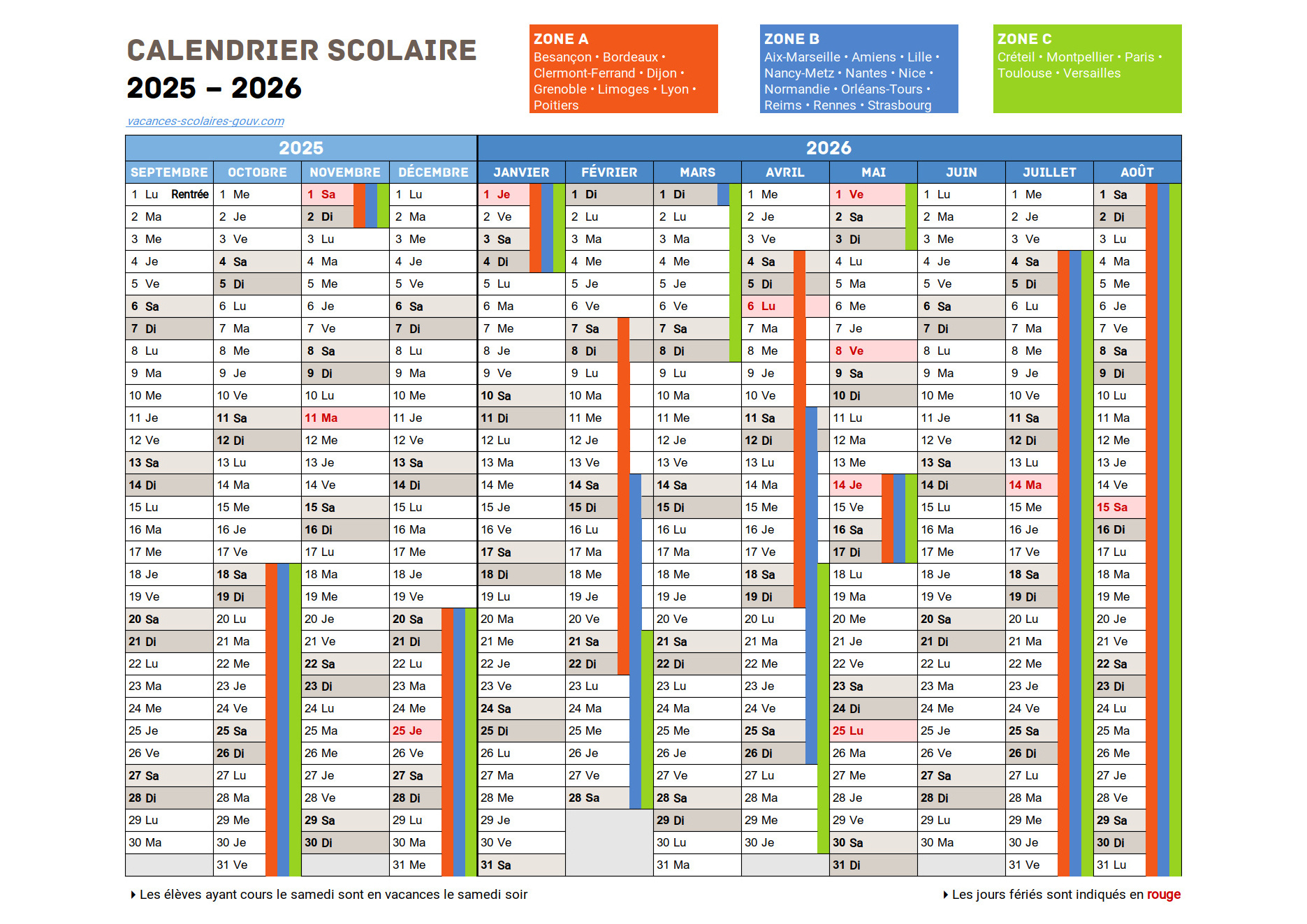

Dijon 2026 Le Projet Ecologiste Pour Les Municipales

May 09, 2025

Dijon 2026 Le Projet Ecologiste Pour Les Municipales

May 09, 2025 -

Edmonton Oilers Star Leon Draisaitl Hart Trophy Contender

May 09, 2025

Edmonton Oilers Star Leon Draisaitl Hart Trophy Contender

May 09, 2025 -

Inside The Reimagined Queen Elizabeth 2 A 2 000 Guest Cruise Ship

May 09, 2025

Inside The Reimagined Queen Elizabeth 2 A 2 000 Guest Cruise Ship

May 09, 2025 -

Bert Kreischers Netflix Specials His Wifes Reaction To His Sex Jokes

May 09, 2025

Bert Kreischers Netflix Specials His Wifes Reaction To His Sex Jokes

May 09, 2025