$584 Million: Dubai Holding Expands REIT Initial Public Offering

Table of Contents

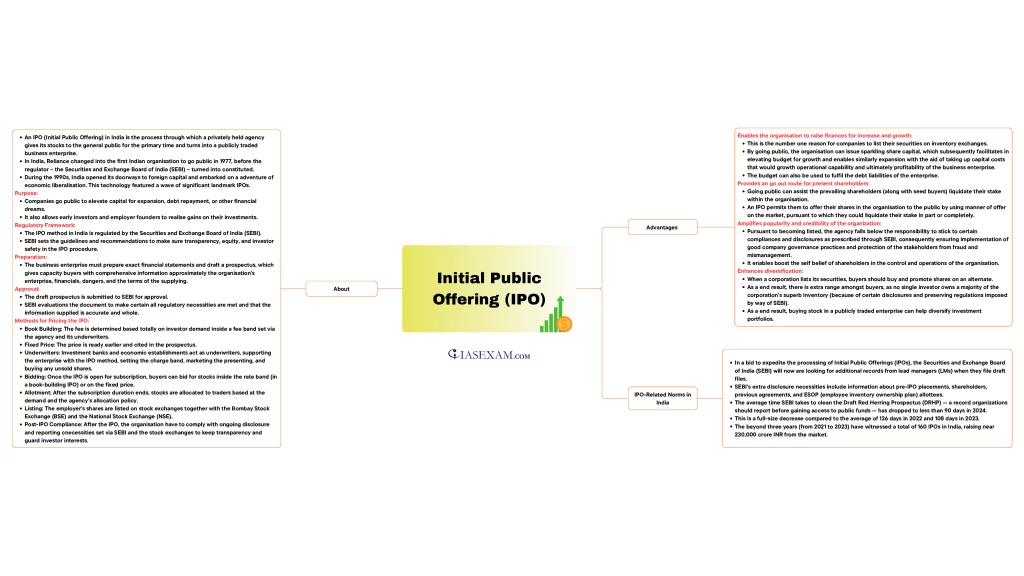

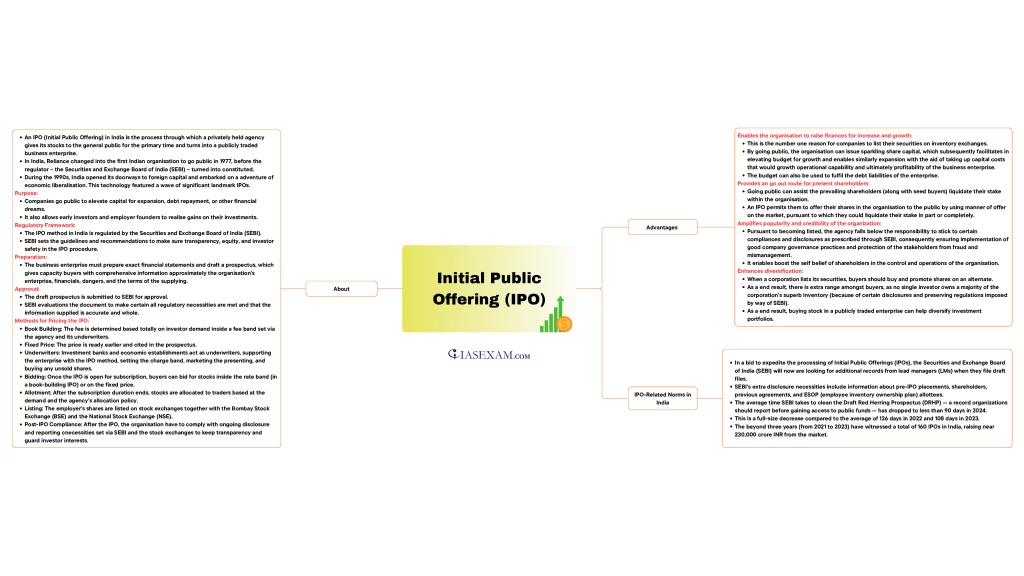

The Significance of the $584 Million Expansion

The initial IPO size for Dubai Holding's REIT was considerably smaller, representing a significant percentage increase with this expansion to $584 million. This substantial growth reflects several key factors. Firstly, there's been overwhelmingly strong investor interest, indicating high confidence in Dubai's real estate market and the potential returns offered by this REIT. Secondly, the positive market outlook for Dubai's real estate, characterized by sustained growth and development, has undoubtedly contributed to the increased valuation. Finally, the strategic goals of Dubai Holding to expand its portfolio and consolidate its position in the market are key drivers behind this ambitious expansion.

- Increased capital: The $584 million influx provides Dubai Holding with substantial capital to further develop its extensive portfolio of real estate projects.

- Enhanced investor confidence: The expansion reinforces investor confidence in Dubai's real estate sector and its long-term growth prospects.

- Higher potential returns: The larger scale of the IPO suggests potential for higher returns for investors participating in the Real Estate Investment Trust.

- Strengthened global investment hub status: This expansion further strengthens Dubai's position as a leading global investment hub, attracting both local and international capital.

Details of the Dubai Holding REIT Offering

The Dubai Holding REIT portfolio comprises a diverse range of high-quality properties, encompassing residential, commercial, and mixed-use developments across prime locations in Dubai. These properties are strategically selected to provide a robust and diversified investment opportunity. The REIT offers attractive key investment highlights including projected returns based on solid occupancy rates and rental income streams.

Investing in the Dubai Holding REIT IPO is relatively straightforward, following standard IPO procedures. Further details will be available through the official IPO prospectus.

- Expected dividend yield: Investors can anticipate a competitive dividend yield, providing a steady stream of income.

- Risk assessment: As with any investment, there are inherent risks involved. A thorough risk assessment should be conducted before making any investment decision.

- IPO Timeline: The timeline for the entire IPO process will be clearly outlined in the official documentation.

- Minimum Investment Requirements: The minimum investment amount will be specified in the IPO prospectus.

Impact on the Dubai Real Estate Market

The expanded $584 million Dubai Holding REIT IPO will have a substantial impact on Dubai's real estate market. The influx of capital will likely increase liquidity, potentially leading to growth in property values and rental rates. Moreover, the REIT plays a crucial role in attracting foreign direct investment, further boosting Dubai's economy and strengthening its position in the global real estate landscape.

- Increased Market Liquidity: The IPO will inject significant liquidity into the Dubai real estate market.

- Potential Property Value Growth: This increased capital can lead to growth in the value of properties within the REIT’s portfolio and the broader market.

- Attracting International Investors: The REIT serves as a magnet for international investors seeking exposure to Dubai's thriving real estate sector.

- Economic Growth Stimulus: The positive ripple effect of this investment will undoubtedly boost Dubai's economic growth.

Competition and Market Outlook for Dubai Holding's REIT

While Dubai's REIT market is competitive, Dubai Holding's REIT is well-positioned to succeed due to its diverse portfolio, strong management team, and the overall positive outlook for Dubai's real estate sector. Macroeconomic factors, such as global economic conditions and interest rates, will undoubtedly influence the REIT's performance, but the current forecast remains optimistic.

- Key Competitors: A detailed competitive analysis of other REITs operating in Dubai will be made available through official channels.

- Market Predictions: Market analysis and expert predictions point towards strong performance for the REIT.

- Potential Risks and Challenges: Potential challenges, such as fluctuating interest rates and global economic uncertainty, should be considered.

- Long-Term Growth: The long-term growth prospects for the REIT are positive, given Dubai’s continued economic development.

Conclusion: Investing in the Future with Dubai Holding's Expanded REIT IPO

The expansion of Dubai Holding's REIT IPO to $584 million marks a significant development for Dubai's real estate market. It represents a vote of confidence in Dubai's economic future, offering substantial opportunities for investors seeking exposure to this dynamic sector. The increased capital will fuel further development, attract international investment, and boost economic growth. The Dubai Holding REIT presents a compelling investment opportunity with the potential for strong returns. Learn more about this exciting Dubai Holding REIT investment opportunity and consider becoming a part of Dubai's continued success. For more information and details on how to invest in the $584 million Dubai Holding REIT IPO, please visit [link to relevant resource].

Featured Posts

-

Poslednji Pozdrav Andelki Milivojevic Tadic Milica Milsa U Suzama

May 20, 2025

Poslednji Pozdrav Andelki Milivojevic Tadic Milica Milsa U Suzama

May 20, 2025 -

Was A Schumacher Comeback Realistic The Red Bull Factor

May 20, 2025

Was A Schumacher Comeback Realistic The Red Bull Factor

May 20, 2025 -

Atp Bucharest Cobollis Breakthrough First Title Win

May 20, 2025

Atp Bucharest Cobollis Breakthrough First Title Win

May 20, 2025 -

Highfield Rugby Club Announces New Head Coach James Cronin

May 20, 2025

Highfield Rugby Club Announces New Head Coach James Cronin

May 20, 2025 -

Understanding D Wave Quantums Qbts Thursday Stock Price Decrease

May 20, 2025

Understanding D Wave Quantums Qbts Thursday Stock Price Decrease

May 20, 2025

Latest Posts

-

Your First Alert Strong Winds And Severe Storms Expected

May 20, 2025

Your First Alert Strong Winds And Severe Storms Expected

May 20, 2025 -

Preparing For School Delays A Guide To Winter Weather Advisories

May 20, 2025

Preparing For School Delays A Guide To Winter Weather Advisories

May 20, 2025 -

Understanding Winter Weather Advisories And Their Impact On Schools

May 20, 2025

Understanding Winter Weather Advisories And Their Impact On Schools

May 20, 2025 -

Navigating School Delays During Winter Weather Advisories

May 20, 2025

Navigating School Delays During Winter Weather Advisories

May 20, 2025 -

School Delays And Closures Due To Winter Weather Advisories

May 20, 2025

School Delays And Closures Due To Winter Weather Advisories

May 20, 2025