Market Reaction: Dow Futures And Dollar After Moody's US Downgrade

Table of Contents

Immediate Impact on Dow Futures

Sharp Decline in Futures

The announcement of Moody's downgrade triggered a sharp decline in Dow futures. Within minutes of the news breaking at [insert time], Dow futures plummeted by [insert percentage]%, signaling immediate investor concern and risk aversion. This dramatic drop reflected the market's immediate assessment of the increased uncertainty surrounding the US economy and its future prospects.

-

Correlation with US Economic Stability: The downgrade highlighted concerns about the US government's increasing debt burden and its potential impact on the nation's economic stability. Investors, interpreting this as a significant risk, reacted by selling off assets, leading to the sharp decline in Dow futures.

-

Increased Risk Aversion: The Moody's downgrade fueled a significant "risk-off" trade, where investors moved away from riskier assets like stocks and into safer havens like government bonds. This widespread risk aversion directly contributed to the substantial drop in Dow Jones Industrial Average futures contracts.

-

Disproportionately Affected Sectors: The financial sector, particularly sensitive to credit ratings and economic stability, experienced a disproportionately sharp decline in its futures contracts following the Moody's announcement. Other sectors reliant on borrowing and economic confidence also felt the impact.

The Dollar's Response to the Downgrade

Initial Dollar Strength, Followed by Volatility

Initially, the US dollar experienced a surge in value against major currencies, acting as a safe-haven asset amidst the market turmoil. However, this initial strength was followed by increased volatility as the market digested the implications of the downgrade.

-

Safe-Haven Asset: During times of economic uncertainty, the US dollar often serves as a safe-haven currency. Investors seeking stability moved towards the dollar, temporarily boosting its value.

-

Impact of Higher US Interest Rates: To counter the negative effects of the downgrade, the Federal Reserve might consider raising interest rates. Higher interest rates generally increase the demand for the dollar, potentially bolstering its value against other currencies in the long term.

-

Currency Trading Pair Volatility: The EUR/USD and USD/JPY currency pairs, among others, witnessed significant volatility following the downgrade. This underscores the global impact of the Moody's announcement on foreign exchange markets.

Broader Market Reactions and Implications

Bond Yields and Government Debt

The Moody's downgrade had a significant impact on US Treasury bond yields. The increased perceived risk associated with US government debt pushed yields higher, reflecting increased borrowing costs for the US government.

-

Relationship Between Credit Ratings and Bond Yields: A credit rating downgrade signals increased risk, making bonds issued by the downgraded entity less attractive. This reduces demand and pushes yields upward.

-

Potential for Increased Inflation: Higher borrowing costs for the US government could translate into increased government spending, potentially contributing to higher inflation rates. This is a significant concern for policymakers and investors alike.

-

Ripple Effect on Global Financial Markets: The impact extends beyond US borders. Global financial markets are interconnected, and a downgrade of the US credit rating creates uncertainty and ripple effects throughout the world, impacting everything from emerging market debt to global equity markets.

Analyzing Investor Sentiment and Future Outlook

Uncertainty and Market Volatility

The prevailing sentiment among investors is one of uncertainty and apprehension. This translates into increased market volatility and unpredictable price swings in the short term.

-

Divergent Investor Strategies: Following the downgrade, investors are adopting diverse strategies. Some are opting for defensive positions, while others may see opportunities in the market downturn, engaging in contrarian investment approaches.

-

Potential Long-Term Effects on US Economic Growth: The long-term impact on US economic growth remains uncertain. The downgrade could negatively affect investor confidence, investment decisions, and overall economic activity.

-

Role of Central Banks and Government Responses: Central banks and governments will play a crucial role in managing the fallout from the downgrade. Their actions – through monetary and fiscal policies – will greatly influence the market's response and the broader economic outlook.

Conclusion

The Moody's downgrade of the US credit rating has triggered immediate and significant market reactions. Dow futures experienced a sharp decline, reflecting investor concern and risk aversion. The US dollar initially strengthened as a safe-haven asset, but subsequently faced increased volatility. Furthermore, US Treasury bond yields increased, signaling higher borrowing costs for the government and a potential for inflationary pressures. The uncertainty surrounding the future economic outlook is high, and continued market volatility is likely.

Call to Action: Stay informed about the ongoing market reaction to Moody's US credit rating downgrade. Continue monitoring Dow futures, dollar movements, and broader market trends for a comprehensive understanding of this evolving situation and its potential long-term effects. Understanding the intricacies of the Moody's downgrade and its effects on Dow futures and the dollar is crucial for informed investment decisions.

Featured Posts

-

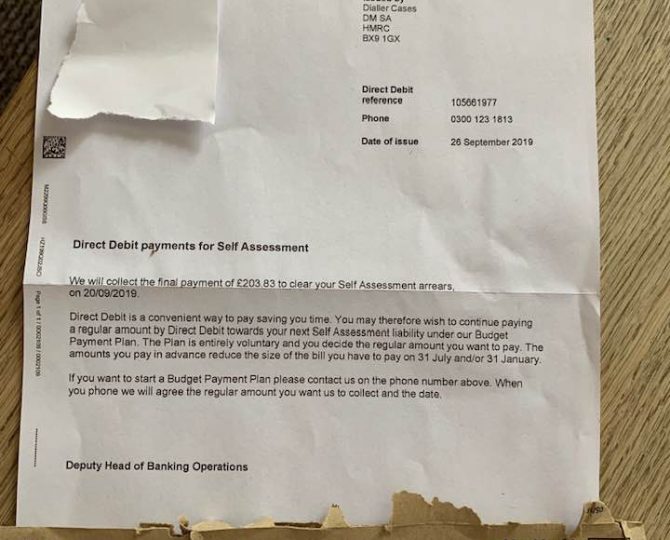

Ignoring Hmrc Letters Potential Consequences For Uk Households

May 20, 2025

Ignoring Hmrc Letters Potential Consequences For Uk Households

May 20, 2025 -

Prima Nepoata A Lui Michael Schumacher Gina Schumacher A Devenit Mama

May 20, 2025

Prima Nepoata A Lui Michael Schumacher Gina Schumacher A Devenit Mama

May 20, 2025 -

Nyt Mini Crossword Answers March 18 2024

May 20, 2025

Nyt Mini Crossword Answers March 18 2024

May 20, 2025 -

Tyler Bates Wwe Raw Return Date Match And What To Expect

May 20, 2025

Tyler Bates Wwe Raw Return Date Match And What To Expect

May 20, 2025 -

The Tony Hinchcliffe Wwe Segment A Backstage Account Of A Disappointing Performance

May 20, 2025

The Tony Hinchcliffe Wwe Segment A Backstage Account Of A Disappointing Performance

May 20, 2025

Latest Posts

-

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Interview Barry Ward On Playing Cops And Casting

May 21, 2025 -

Barry Ward Discusses His Career From Cop Roles To Diverse Characters

May 21, 2025

Barry Ward Discusses His Career From Cop Roles To Diverse Characters

May 21, 2025 -

Irish Actor Barry Ward A Candid Conversation On His Career

May 21, 2025

Irish Actor Barry Ward A Candid Conversation On His Career

May 21, 2025 -

Barry Ward Interview The Irish Actor On Roles And Stereotypes

May 21, 2025

Barry Ward Interview The Irish Actor On Roles And Stereotypes

May 21, 2025 -

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025