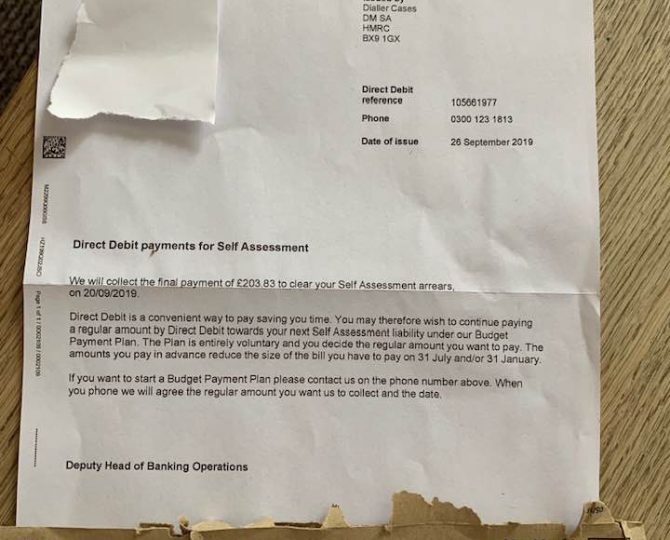

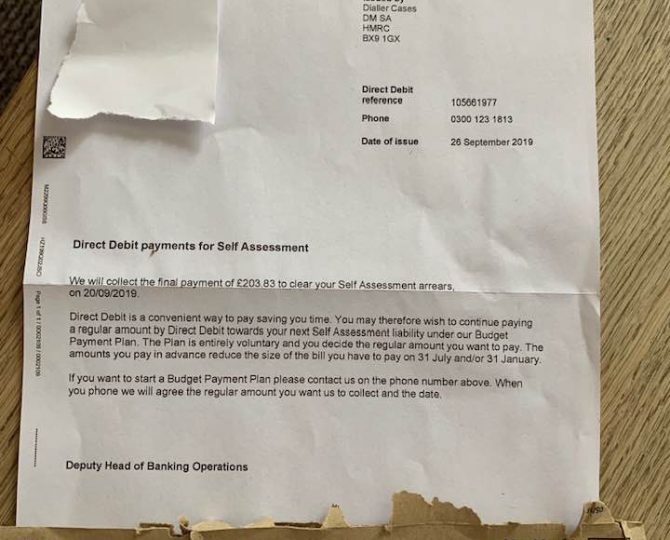

Ignoring HMRC Letters? Potential Consequences For UK Households

Table of Contents

Types of HMRC Letters and Their Significance

Understanding the various types of HMRC letters is the first step in responsible tax management. Ignoring any of these could have serious repercussions. Different letters require different actions and carry varying levels of urgency.

-

Tax return reminders: These letters remind you to submit your Self Assessment tax return by the deadline (usually 31 January). Failing to submit on time automatically incurs penalties. It's vital to understand your obligations and submit your return accurately and on time to avoid an HMRC tax return penalty.

-

Tax assessment notices: These letters detail the amount of tax you owe, based on your submitted return or other information HMRC holds. They clearly state the payment deadline. Understanding your tax assessment and adhering to payment deadlines is crucial to avoid further penalties.

-

Penalty notices: These letters inform you of penalties incurred for late submission, non-payment, or inaccuracies in your tax return. HMRC penalties can range from a relatively small amount to a significant sum, depending on the severity and nature of the infringement. Different types of penalties exist, including those for careless and deliberate errors.

-

Investigation letters: These indicate that HMRC is investigating your tax affairs. These investigations can stem from discrepancies in your tax return, tips, or routine audits. Responding appropriately and fully cooperating with the investigation is critical. Ignoring an HMRC investigation letter only exacerbates the situation and can lead to much more significant penalties. Keywords related to this include: HMRC tax investigation, tax investigation UK.

Financial Penalties for Ignoring HMRC Letters

Ignoring HMRC letters inevitably leads to financial penalties. The longer you delay, the higher the penalties become.

-

Late filing penalties: These are automatically applied if you submit your Self Assessment tax return after the deadline. The penalty increases the longer you delay, often starting with a relatively small amount but escalating substantially after a few months.

-

Interest charges: You will accrue interest on any unpaid tax. This interest can quickly accumulate, significantly increasing your overall debt. Understanding how interest on tax arrears is calculated is vital.

-

Additional penalties: HMRC can impose further penalties for deliberate or careless mistakes on your tax return. These penalties can be significantly higher than those for simple late filing.

-

Potential for increased scrutiny: Consistent failure to respond to HMRC correspondence increases the likelihood of further investigation and more rigorous scrutiny of your future tax returns.

Legal Consequences of Ignoring HMRC Letters

The consequences of ignoring HMRC letters extend beyond financial penalties. You could face serious legal repercussions.

-

Debt collection agencies: If you fail to pay your tax debt, HMRC may pass your case to a debt collection agency. This can damage your credit rating and make it difficult to borrow money in the future.

-

Court summons and judgments: Unpaid tax debts can result in court summons and potentially a County Court Judgment (CCJ). A CCJ has serious implications for your creditworthiness and can significantly impact your financial future.

-

County Court Judgments (CCJs): A CCJ is a public record of your debt and remains on your credit file for six years, significantly impacting your ability to secure loans, mortgages, or credit cards. Keywords: HMRC debt collection, CCJ, avoiding a CCJ.

-

Criminal prosecution: In cases of serious tax evasion or deliberate fraud, HMRC can pursue criminal prosecution, leading to potentially severe penalties, including imprisonment. This is a particularly serious consequence for ignoring HMRC letters related to suspected fraudulent activity. Keywords: tax evasion, tax fraud, legal consequences of tax evasion.

How to Respond to HMRC Letters Effectively

Dealing with HMRC correspondence requires a methodical and responsible approach.

-

Read the letter carefully: Understand the specific requirements, deadlines, and the action required of you.

-

Gather necessary documents: Collect all relevant documents, such as payslips, bank statements, and previous tax returns, to ensure an accurate and complete response.

-

Contact HMRC directly: If you have any questions or require clarification, contact HMRC using the details provided in the letter.

-

Keep records: Maintain a detailed record of all communication with HMRC, including copies of letters sent and received, and any phone calls or emails.

-

Seek professional advice: If you are unsure how to proceed or need assistance in understanding the complexities of your tax obligations, consult a tax advisor or accountant. Keywords: HMRC contact, tax advisor, tax accountant, responding to HMRC, HMRC guidance.

Conclusion

Ignoring HMRC letters can lead to severe financial and legal consequences, ranging from significant penalties and interest charges to CCJs and even criminal prosecution. Prompt action and responsible tax management are crucial to avoiding these repercussions. Don't ignore those HMRC letters! Understanding your responsibilities and responding promptly is crucial to avoiding serious repercussions. Contact HMRC directly or seek professional advice if you're unsure how to proceed. Properly managing your correspondence with HMRC can save you significant stress and financial hardship.

Featured Posts

-

Tragedia Na Tijuca Incendio Em Escola Comove Comunidade

May 20, 2025

Tragedia Na Tijuca Incendio Em Escola Comove Comunidade

May 20, 2025 -

Your First Solo Trip A Step By Step Guide

May 20, 2025

Your First Solo Trip A Step By Step Guide

May 20, 2025 -

Check Your Payslip Are You Due A Hmrc Refund

May 20, 2025

Check Your Payslip Are You Due A Hmrc Refund

May 20, 2025 -

Le Projet D Adressage D Abidjan Plus De 14 000 Voies Repertoriees

May 20, 2025

Le Projet D Adressage D Abidjan Plus De 14 000 Voies Repertoriees

May 20, 2025 -

Introducing The Richard Mille Rm 72 01 Designed In Partnership With Charles Leclerc

May 20, 2025

Introducing The Richard Mille Rm 72 01 Designed In Partnership With Charles Leclerc

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025